How Do I File Form 990 Electronically

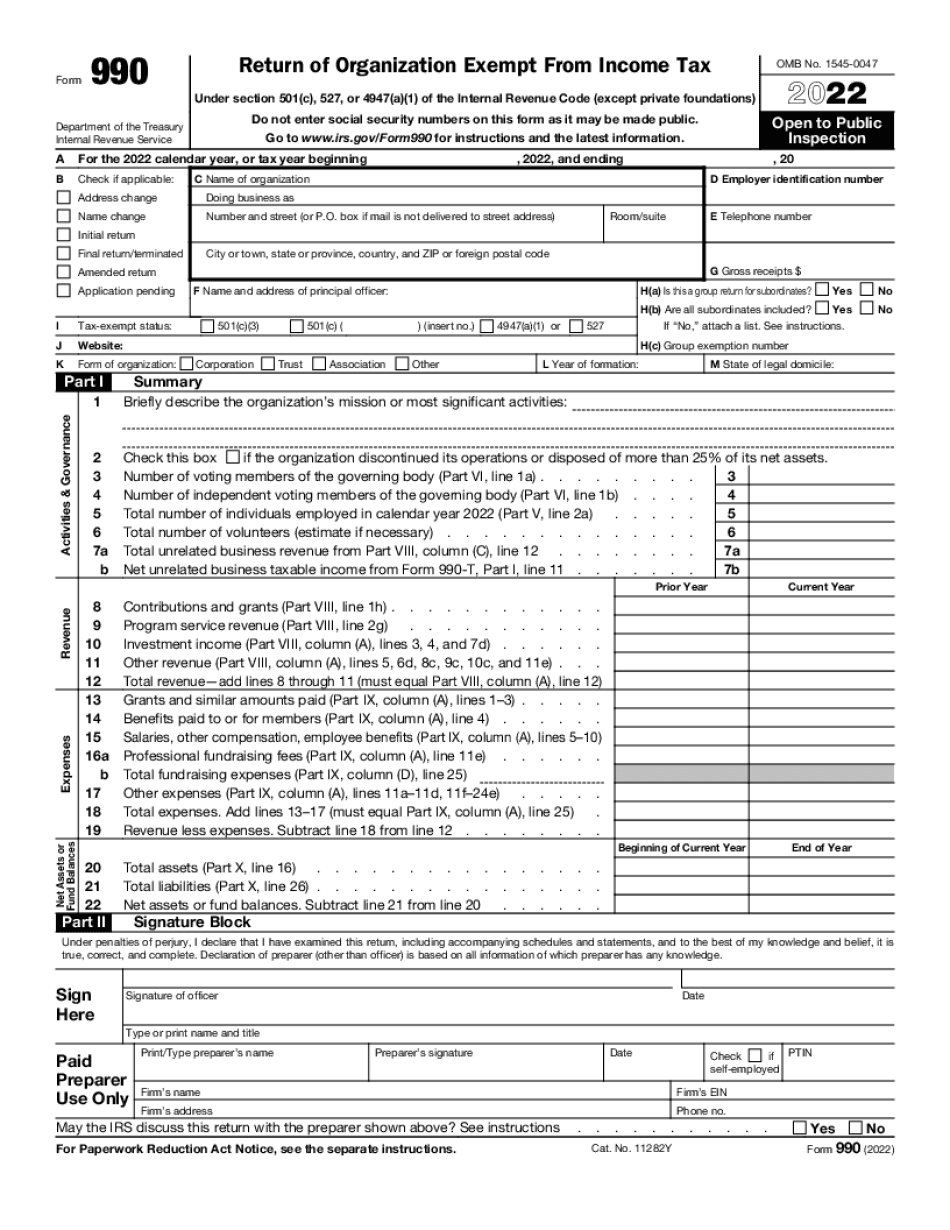

How Do I File Form 990 Electronically - Web what are the new electronic 990 filing requirements? Complete, edit or print tax forms instantly. To help you through the process, here’s six steps to take. What are the costs associated. Web 21 rows charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to. Web organizations can file electronically using the irs website at irs.gov/polorgs. Web what are the steps for filing the irs form 990 and form char500 to the irs and new york's charities bureau at the same time? Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web electronic filing only form 990 return of organization exempt from income tax omb no.

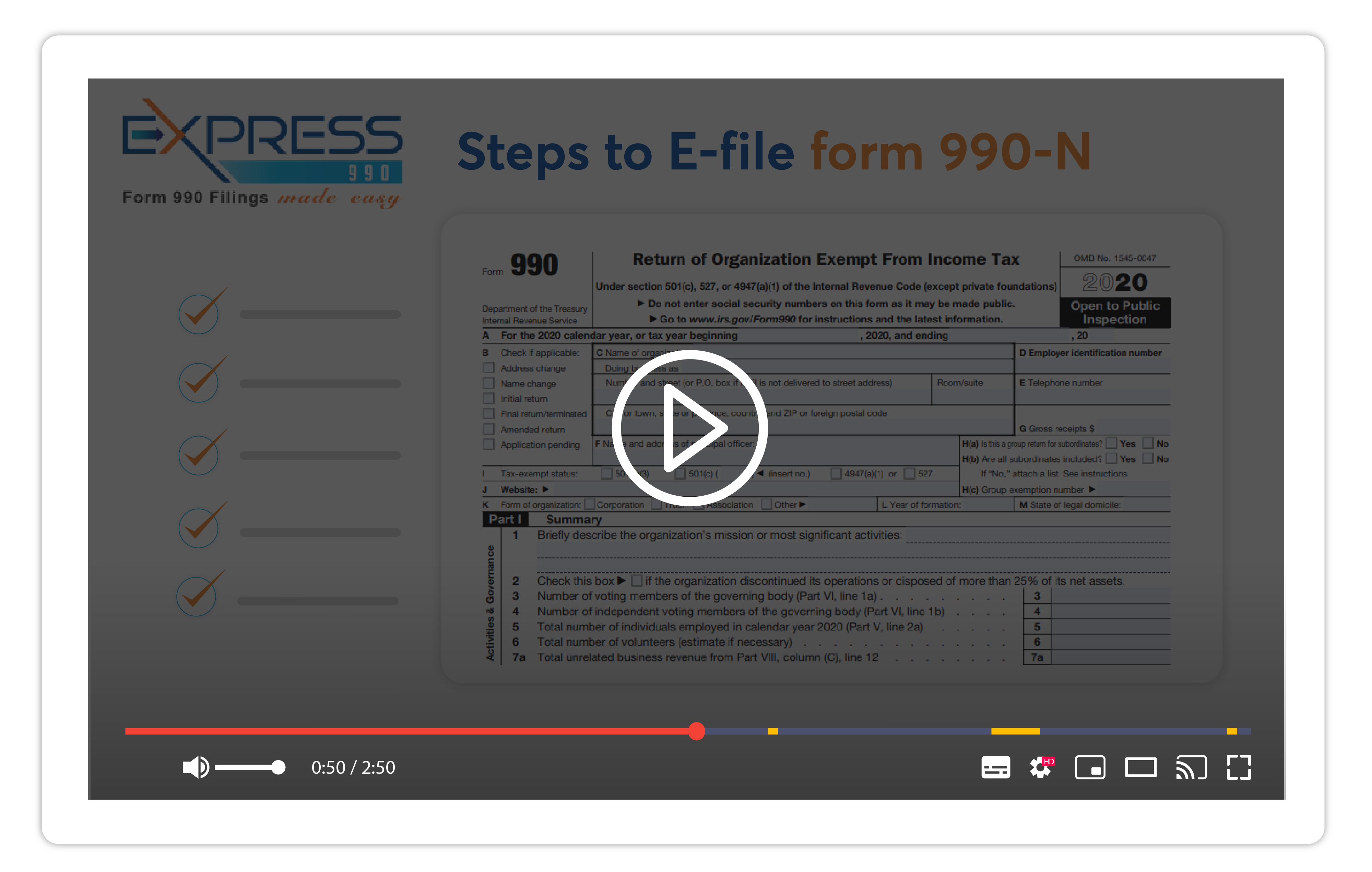

No worries, tax 990 is. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web what are the steps for filing the irs form 990 and form char500 to the irs and new york's charities bureau at the same time? To help you through the process, here’s six steps to take. Web 1 add organization details 2 choose tax year 3 enter form data 4 review your form summary 5 transmit it to the irs search for your ein, and our system will import your. What are the costs associated. Upload, modify or create forms. Web electronic filing only form 990 return of organization exempt from income tax omb no. Web organizations can file electronically using the irs website at irs.gov/polorgs. Ad download or email irs 990ez & more fillable forms, register and subscribe now!

Web filing a 990 form can be an overwhelming and confusing process, especially if it’s your first time. To help you through the process, here’s six steps to take. What are the costs associated. Web 1 add organization details 2 choose tax year 3 enter form data 4 review your form summary 5 transmit it to the irs search for your ein, and our system will import your. Web what are the new electronic 990 filing requirements? Two voting councilors are married. Web what are the steps for filing the irs form 990 and form char500 to the irs and new york's charities bureau at the same time? Web electronic filing only form 990 return of organization exempt from income tax omb no. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Verification routines ensure your return is accurate and complete.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

Ad download or email form 990 sb & more fillable forms, try for free now! What are the costs associated. Two voting councilors are married. To help you through the process, here’s six steps to take. Ad get ready for tax season deadlines by completing any required tax forms today.

Irs Form 990 ez 2023 Fill online, Printable, Fillable Blank

Ad download or email form 990 sb & more fillable forms, try for free now! Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. No worries, tax 990 is. To help you through the process, here’s six steps to take. Complete, edit or.

Form 990T Filing Instructions for 2020

Try it for free now! Ad download or email form 990 sb & more fillable forms, try for free now! Verification routines ensure your return is accurate and complete. Web 21 rows charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to. Complete the form.

What is IRS Form 990?

Web electronic filing only form 990 return of organization exempt from income tax omb no. Upload, modify or create forms. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. No worries, tax 990 is. Web 1 add organization details 2 choose tax year.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Try it for free now! Web 1 add organization details 2 choose tax year 3 enter form data 4 review your form summary 5 transmit it to the irs search for your ein, and our system will import your. What are the costs associated. Web electronic filing only form 990 return of organization exempt from income tax omb no. Ad.

Form 990N ePostcard

When, where, and how to file, later, for. Web electronic filing only form 990 return of organization exempt from income tax omb no. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web filing a 990 form can be an overwhelming and confusing process, especially if it’s your first time. To help you through the.

The Best Form 990 Software for Tax Professionals What You Need to Know

Web electronic filing only form 990 return of organization exempt from income tax omb no. No worries, tax 990 is. To help you through the process, here’s six steps to take. Try it for free now! Verification routines ensure your return is accurate and complete.

Efile Form 990N 2020 IRS Form 990N Online Filing

Web filing a 990 form can be an overwhelming and confusing process, especially if it’s your first time. Web 1 add organization details 2 choose tax year 3 enter form data 4 review your form summary 5 transmit it to the irs search for your ein, and our system will import your. Complete the form as indicated, paying special attention.

IRS Form 990 You Can Do This Secure Nonprofit Tax Efiling 990EZ

Complete the form as indicated, paying special attention to the checklist of required schedules, which explains what portion of. No worries, tax 990 is. To help you through the process, here’s six steps to take. Web what are the new electronic 990 filing requirements? Electronic federal tax payment system (eftps) popular.

Who Must File Form 990, 990EZ or 990N YouTube

Electronic federal tax payment system (eftps) popular. Ad download or email irs 990ez & more fillable forms, register and subscribe now! To help you through the process, here’s six steps to take. Two voting councilors are married. Web what are the steps for filing the irs form 990 and form char500 to the irs and new york's charities bureau at.

Web Electronic Filing Only Form 990 Return Of Organization Exempt From Income Tax Omb No.

Try it for free now! Two voting councilors are married. Web what are the steps for filing the irs form 990 and form char500 to the irs and new york's charities bureau at the same time? Ad get ready for tax season deadlines by completing any required tax forms today.

Ad Download Or Email Form 990 Sb & More Fillable Forms, Try For Free Now!

What are the costs associated. Web 1 add organization details 2 choose tax year 3 enter form data 4 review your form summary 5 transmit it to the irs search for your ein, and our system will import your. To help you through the process, here’s six steps to take. Ad download or email irs 990ez & more fillable forms, register and subscribe now!

No Worries, Tax 990 Is.

Complete, edit or print tax forms instantly. Web what are the new electronic 990 filing requirements? Complete the form as indicated, paying special attention to the checklist of required schedules, which explains what portion of. Verification routines ensure your return is accurate and complete.

Web Filing A 990 Form Can Be An Overwhelming And Confusing Process, Especially If It’s Your First Time.

Electronic federal tax payment system (eftps) popular. Web organizations can file electronically using the irs website at irs.gov/polorgs. Web 21 rows charities and nonprofits annual filing and forms required filing (form 990 series) required filing (form 990 series) see the form 990 filing thresholds page to. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.