How Long Does It Take To Form A 501C3

How Long Does It Take To Form A 501C3 - Applications are processed as quickly as possible. Sometimes it takes a little less; See the top ten reasons for delay in processing applications. By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. Web updated june 30, 2023 reviewed by lea d. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. Web how long does it take to process an application for exemption? This documentation often makes 501c3 applications 100 pages or longer. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. How long does it take for a 501c3 to be approved?

How long does it take for a 501c3 to be approved? By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. Web updated june 30, 2023 reviewed by lea d. Sometimes it takes a little less; The process can be delayed, however, for reasons ranging from simple errors on the application to issues concerning the qualification of the organization for exemption. Applications are processed as quickly as possible. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. See the top ten reasons for delay in processing applications. Web how long does it take for a 501(c)(3) to be approved?

How long does it take for a 501c3 to be approved? The process can be delayed, however, for reasons ranging from simple errors on the application to issues concerning the qualification of the organization for exemption. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. This documentation often makes 501c3 applications 100 pages or longer. Web how long does it take for a 501(c)(3) to be approved? Web applications for nonprofit status must be submitted online to the irs. Web how long does it take to process an application for exemption? Applications are processed as quickly as possible. See the top ten reasons for delay in processing applications. Sometimes it takes a little less;

How To Form A 501c3 In Illinois Form Resume Examples Dp3OwwL30Q

By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. See the top ten reasons for delay in processing applications. Web applications for nonprofit status must be submitted online to the irs. Web how long does it take to process an application for exemption? As you might suspect, form.

How To Form A 501c3 In Pa Form Resume Examples

Sometimes it takes a little less; Web updated june 30, 2023 reviewed by lea d. Web how long does it take for a 501(c)(3) to be approved? Applications are processed as quickly as possible. This documentation often makes 501c3 applications 100 pages or longer.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

How long does it take for a 501c3 to be approved? Web updated june 30, 2023 reviewed by lea d. Sometimes it takes a little less; Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from.

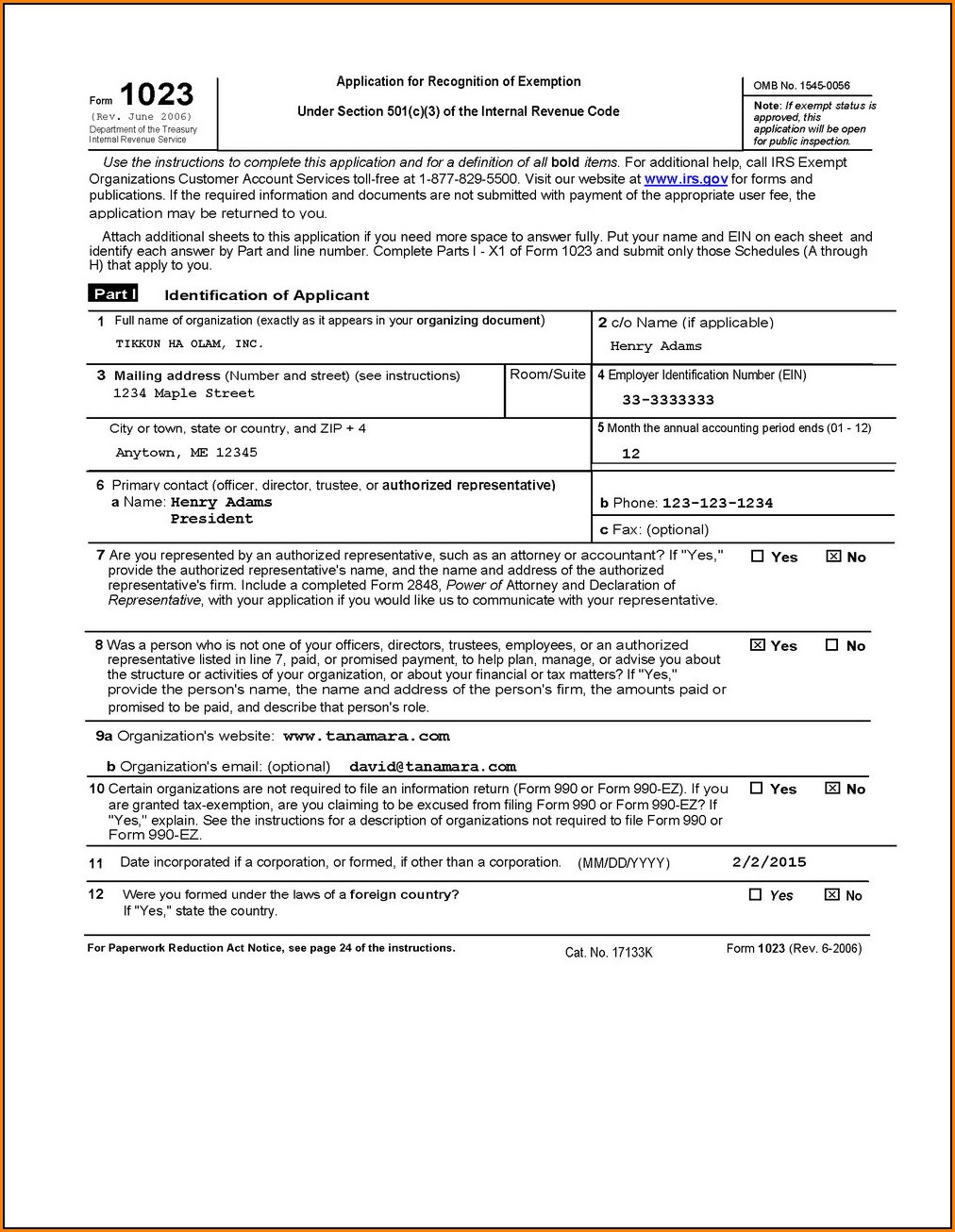

501C3 APPLICATION FORM

How long does it take for a 501c3 to be approved? This documentation often makes 501c3 applications 100 pages or longer. By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. Sometimes it takes a little less; Applications are processed as quickly as possible.

How To Form A 501c3 In New Jersey Form Resume Examples

How long does it take for a 501c3 to be approved? Applications are processed as quickly as possible. Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. By contrast, form 1023 can.

Irs Form 501c3 Ez Universal Network

See the top ten reasons for delay in processing applications. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. How long does it take for a 501c3 to be approved? Web how long does it take to process an application for exemption? Sometimes it.

501c3onestop 501c3 Where To Get Started?

As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. Applications are processed as quickly as possible. Web updated june 30, 2023 reviewed by lea d. Web how long does it take to process an application for exemption? Sometimes it takes a little less;

Irs 501c3 Form 1023 Form Resume Examples EvkBMrPO2d

Web how long does it take for a 501(c)(3) to be approved? Web updated june 30, 2023 reviewed by lea d. Applications are processed as quickly as possible. Sometimes it takes a little less; Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated.

Forming A 501c3 In Florida Form Resume Examples vq1Pq5rKkR

Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed. Sometimes it takes a little less; Web how long does it take for a 501(c)(3) to be approved? By contrast, form 1023 can.

N 400 Form Sample Form Resume Examples ojYqb6JOVz

Web how long does it take for a 501(c)(3) to be approved? Web applications for nonprofit status must be submitted online to the irs. Web updated june 30, 2023 reviewed by lea d. As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. This documentation.

Web How Long Does It Take To Process An Application For Exemption?

Web how long does it take for a 501(c)(3) to be approved? By contrast, form 1023 can take between 3 and 6 months for processing, and it could take up to a year. The process can be delayed, however, for reasons ranging from simple errors on the application to issues concerning the qualification of the organization for exemption. Web updated june 30, 2023 reviewed by lea d.

This Documentation Often Makes 501C3 Applications 100 Pages Or Longer.

How long does it take for a 501c3 to be approved? As you might suspect, form 1023 is appropriate for large or highly complex organizations and the irs scrutinizes these applications carefully before sending out a. Sometimes it takes a little less; Web generally, organizations required to apply for recognition of exemption must notify the service within 27 months from the date of their formation to be treated as described in section 501 (c) (3) from the date formed.

See The Top Ten Reasons For Delay In Processing Applications.

Applications are processed as quickly as possible. Web applications for nonprofit status must be submitted online to the irs.