How To File 2553 Form

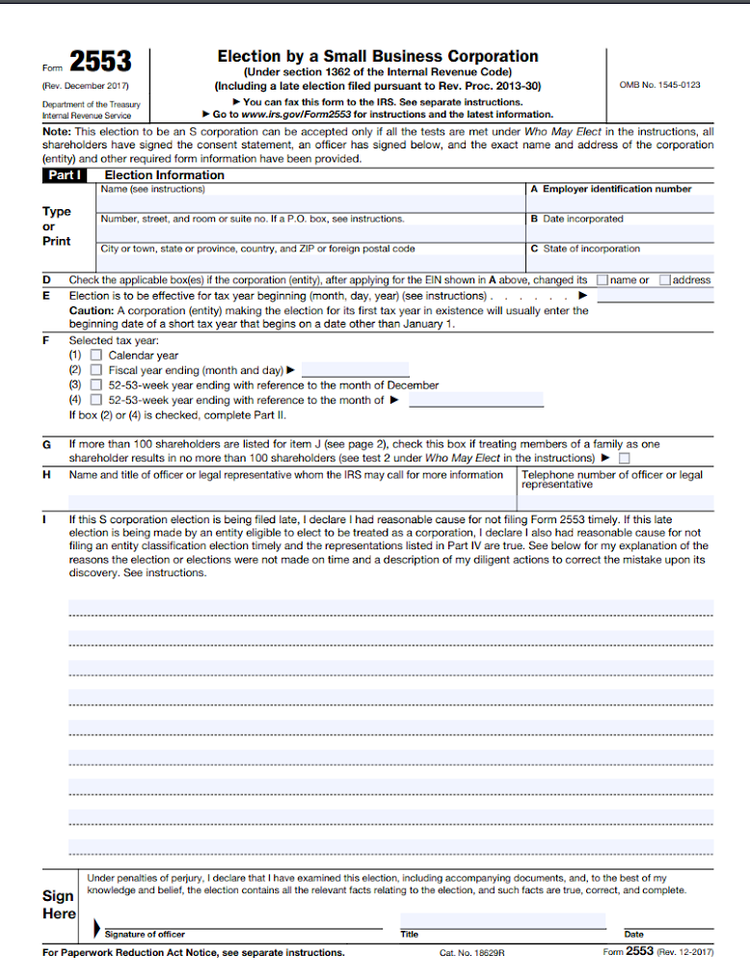

How To File 2553 Form - Web this form, also called election by a small business corporation, must be filed by any corporation that wants to be an s corp. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Election by a small business corporation (under section 1362 of the internal revenue. Don't miss this 50% discount. Web find mailing addresses by state and date for filing form 2553. Web get started in just 10 mins form 2553 filing deadline the deadline to file internal revenue service (irs) form 2553 depends on whether you have recently. If the corporation's principal business, office, or agency is located in. If you need more rows, use additional copies of page 2. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web form 2553 part i election information (continued) note:

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web all of the following conditions must be true in order to file form 2553: Web form 2553 cannot be filed online. Name and address of each shareholder or former. Web learn exactly how to fill out irs form 2553. Where you file form 2553 depends both on where you live as well as whether you want to mail the form or fax it. Election by a small business corporation (under section 1362 of the internal revenue. The form is due no later t. Web you can file the form either via fax or via mail. You can file form 2553 in the following ways:

Small businesses must file form 2553 with the irs within a specific time period to be considered for s corporation status, as. The business is a domestic corporation or domestic entity (such as an llc) that is eligible to. Get ready for tax season deadlines by completing any required tax forms today. Web find mailing addresses by state and date for filing form 2553. Web all of the following conditions must be true in order to file form 2553: When a corporation is formed, it is classified as a. Part i mostly asks for general information, such as your employer identification. Ad access irs tax forms. Web where to file form 2553. Get ready for tax season deadlines by completing any required tax forms today.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web when should i file form 2553? Web form 2553 cannot be filed online. You can file form 2553 in the following ways: The irs has 2 different. Web how to file form 2553 via online fax.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

Complete, edit or print tax forms instantly. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. This means that all income and losses that. Web how do i fill out form 2553? You can file form 2553 in the following ways:

2553 Vorwahl

December 2020) (for use with the december 2017 revision of form 2553, election by a. If the corporation's principal business, office, or agency is located in. Andi smilessmall business financial consultant as a small business owner, your tax classification isn’t set in stone. Web this form, also called election by a small business corporation, must be filed by any corporation.

Form 2553 Instructions How and Where to File mojafarma

Web form 2553 part i election information (continued) note: December 2020) (for use with the december 2017 revision of form 2553, election by a. Election by a small business corporation (under section 1362 of the internal revenue. 16 to file, though tax payments are still due by july 31. If the corporation's principal business, office, or agency is located in.

How To Fill Out Form 2553 YouTube

Part i mostly asks for general information, such as your employer identification. Complete, edit or print tax forms instantly. December 2017) department of the treasury internal revenue service. Web get started in just 10 mins form 2553 filing deadline the deadline to file internal revenue service (irs) form 2553 depends on whether you have recently. Web learn exactly how to.

3 Reasons to File a Form 2553 for Your Business

Web when should i file form 2553? Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web get started in just 10 mins form 2553 filing deadline the deadline to file internal revenue service (irs) form 2553 depends on whether you have recently. This means that all income and losses that. Web in order to become.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

16 to file, though tax payments are still due by july 31. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web when should i file form 2553? If you want to make your llc’s s. December 2020) (for use with the december 2017.

IRS Form 2553 Instructions How and Where to File This Tax Form

Web all of the following conditions must be true in order to file form 2553: Web form 2553 cannot be filed online. This means that all income and losses that. Web get started in just 10 mins form 2553 filing deadline the deadline to file internal revenue service (irs) form 2553 depends on whether you have recently. Web instructions for.

Can you file form 2553 electronically? Surprising answer » Online 2553

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. This means that all income and losses that. File your 2290 tax now and receive schedule 1 in minutes. If you want to make your llc’s s. Part i mostly asks for general information, such as your employer identification.

Cost to File Form 2553? Fee Schedule [Table] » Online 2553

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web where to file form 2553. Part i mostly asks for general information, such as your employer identification. Ad efile form 2290.

This Means That All Income And Losses That.

Andi smilessmall business financial consultant as a small business owner, your tax classification isn’t set in stone. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web when should i file form 2553? The form is due no later t.

Part I Mostly Asks For General Information, Such As Your Employer Identification.

If you want to make your llc’s s. The irs has 2 different. December 2017) department of the treasury internal revenue service. If the corporation's principal business, office, or agency is located in.

When A Corporation Is Formed, It Is Classified As A.

Get ready for tax season deadlines by completing any required tax forms today. Web learn exactly how to fill out irs form 2553. By mail to the address specified in the. Small businesses must file form 2553 with the irs within a specific time period to be considered for s corporation status, as.

Web How To File Form 2553 Via Online Fax.

Don't miss this 50% discount. Ad access irs tax forms. Web you can file the form either via fax or via mail. This information is provided per irs.

![Cost to File Form 2553? Fee Schedule [Table] » Online 2553](https://online2553.com/wp-content/uploads/2022/05/p1-768x512.jpg)