How To File Form 7004 Electronically

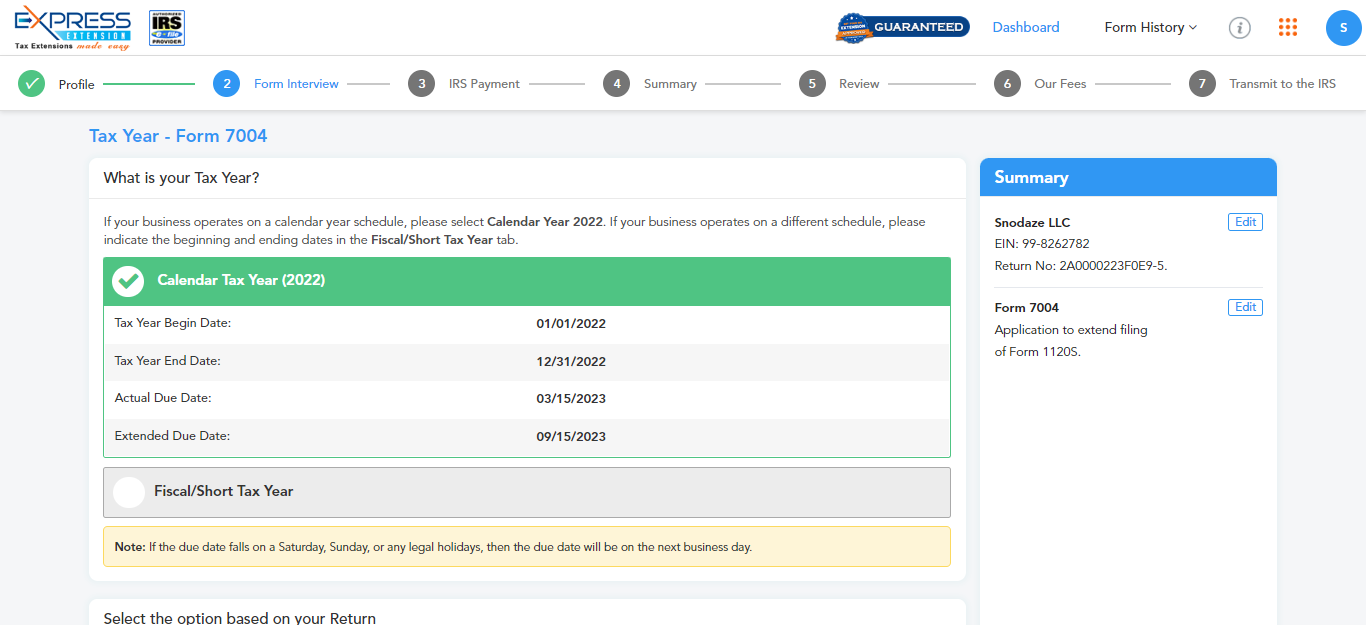

How To File Form 7004 Electronically - See the form 7004 instructions for a list of the exceptions. Form 7004 can be filed electronically for most returns. Get ready for tax season deadlines by completing any required tax forms today. Web 1 min read you can extend filing form 1120s when you file form 7004. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web to file form 7004 extension online, the taxpayers must gather all documents such as: Select the tax year step 4: Make an appropriate estimate of the taxes owed by the irs. Last updated june 04, 2019 11:29 pm.

This might result in a. Web follow these steps to print a 7004 in turbotax business: Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Web complete and file form 7004 online properly. Business details such as name,. Web to file form 7004 extension online, the taxpayers must gather all documents such as: Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns: File form 7004 on or before the deadline of the tax form. Web get your taxes done. Web you can file an irs form 7004 electronically for most returns.

Get ready for tax season deadlines by completing any required tax forms today. The following links provide information on the companies that have passed the internal revenue service (irs). Select the tax year step 4: Ad get ready for tax season deadlines by completing any required tax forms today. With your return open, select search and enter extend; Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Complete, edit or print tax forms instantly. Enter tax payment details step 5:. Web if the business files form 7004 on paper and file their returns electronically, then their return will be processed before granting the extension. Select business entity & form step 3:

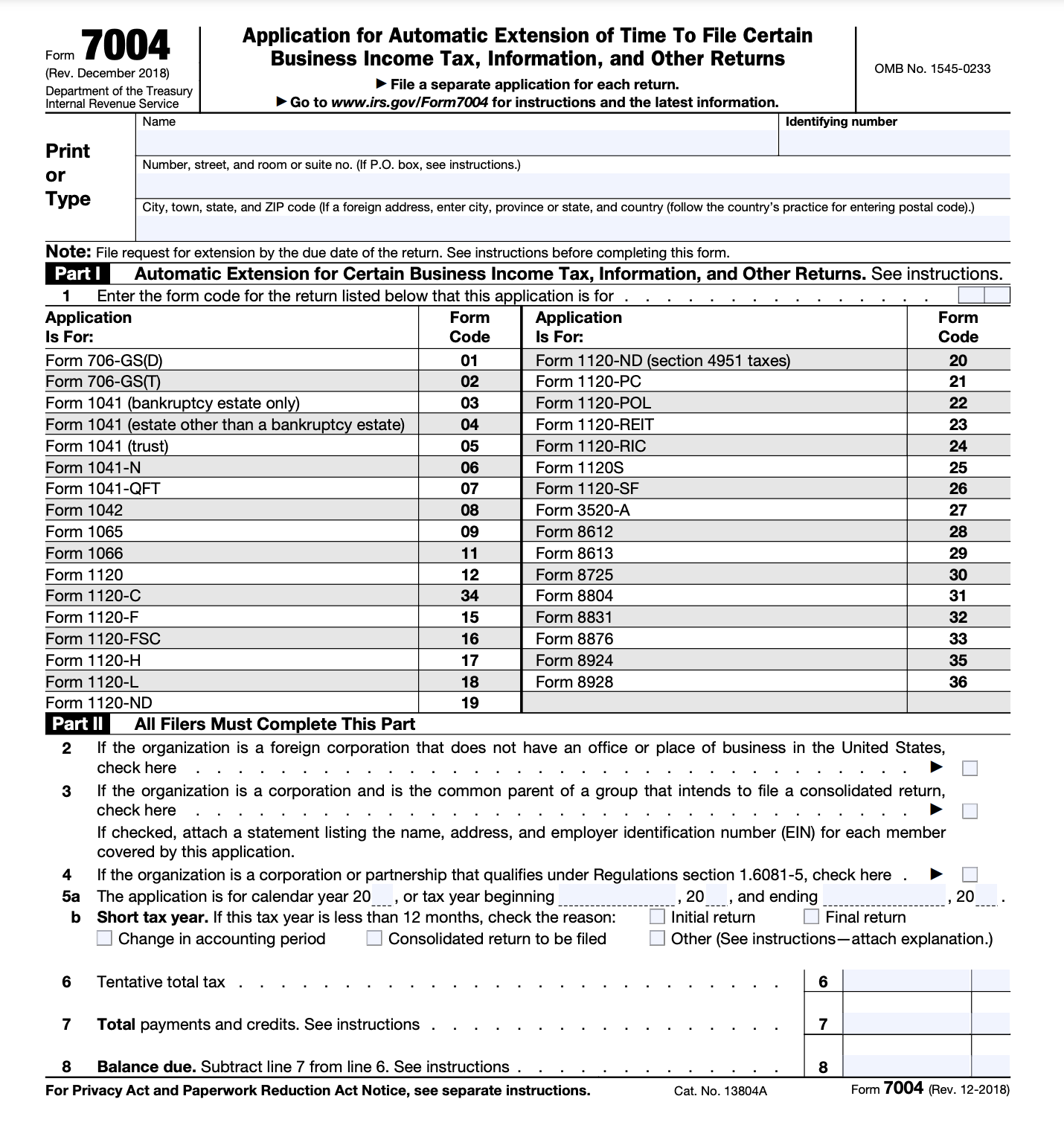

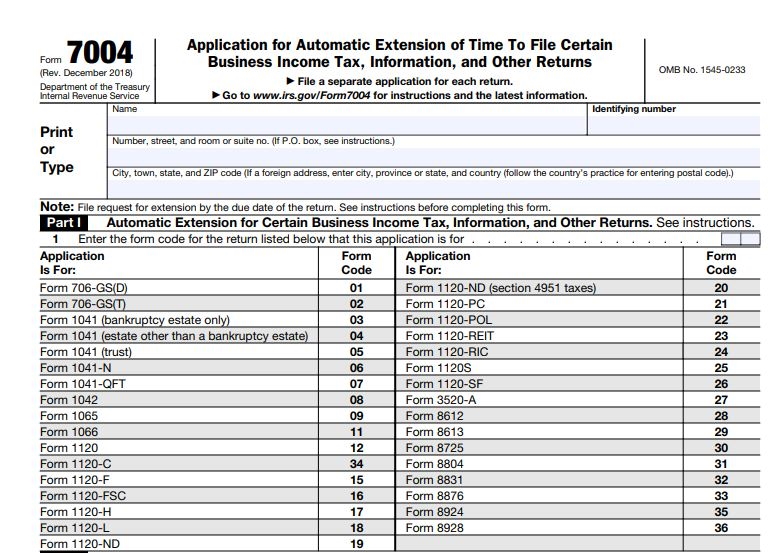

How to Fill Out Tax Form 7004 Tax forms, Irs tax forms,

Web use the chart to determine where to file form 7004 based on the tax form you complete. Get your maximum refund fast However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,. Business details such as name,. Complete, edit or print tax forms instantly.

E File Tax Form 7004 Universal Network

Complete, edit or print tax forms instantly. Business information (name, ein, address) type of business (exp. Select the appropriate form from the table below to determine where to. Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns: See the form 7004 instructions for a list of the.

Can I Electronically File Form 7004 Paul Johnson's Templates

File form 7004 on or before the deadline of the tax form. Web use the chart to determine where to file form 7004 based on the tax form you complete. Enter business details step 2: Select the tax year step 4: Make an appropriate estimate of the taxes owed by the irs.

7004 Form 2023 IRS Forms Zrivo

Select the appropriate form from the table below to determine where to. Last updated june 04, 2019 11:29 pm. Get your maximum refund fast This might result in a. Web to file form 7004 extension online, the taxpayers must gather all documents such as:

Efile Form 7004 & get extension up to 6 months. in 2021 Business tax

Enter code 25 in the box on form 7004, line 1. Web 1 min read you can extend filing form 1120s when you file form 7004. Web use the chart to determine where to file form 7004 based on the tax form you complete. Enter tax payment details step 5:. Web get your taxes done.

What is Form 7004 and How to Fill it Out Bench Accounting

File form 7004 on or before the deadline of the tax form. Web follow these steps to print a 7004 in turbotax business: With your return open, select search and enter extend; Form 7004 can be filed electronically for most returns. Get ready for tax season deadlines by completing any required tax forms today.

EFile IRS Form 7004 How to file 7004 Extension Online

Web how and where to file. Web you can file an irs form 7004 electronically for most returns. Ad get ready for tax season deadlines by completing any required tax forms today. June 4, 2019 11:29 pm. Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns:

Last Minute Tips To Help You File Your Form 7004 Blog

Enter code 25 in the box on form 7004, line 1. Web how and where to file. Make the drop list selection 09 form 1065 in the line 1a box. Get ready for tax season deadlines by completing any required tax forms today. Web kurtl1 expert alumni form 7004 is the extension form for businesses and not for individuals.

Where to file Form 7004 Federal Tax TaxUni

Web open the 7004 screen (other forms tab > 7004 extension) check the box generate an extension. Go to other > extensions. Web to electronically file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns: Web use the chart to determine where to file form 7004 based on the tax form.

To File Form 7004 Using Taxact.

Web how and where to file. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725,. Federal tax extension form 7004, the “application for automatic extension of time to file certain business income tax,. Web kurtl1 expert alumni form 7004 is the extension form for businesses and not for individuals.

Web Use The Chart To Determine Where To File Form 7004 Based On The Tax Form You Complete.

File form 7004 on or before the deadline of the tax form. Business details such as name,. The following links provide information on the companies that have passed the internal revenue service (irs). Web to file form 7004 extension online, the taxpayers must gather all documents such as:

Web To Electronically File Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns:

Enter business details step 2: With your return open, select search and enter extend; Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Web Generally, Form 7004 Must Be Filed On Or Before The Regular Due Date Of The Applicable Tax Return And Can Be Filed Electronically For Most Returns.

Enter tax payment details step 5:. Web 1 min read you can extend filing form 1120s when you file form 7004. Last updated june 04, 2019 11:29 pm. This might result in a.