How To Fill Out 8879 Form

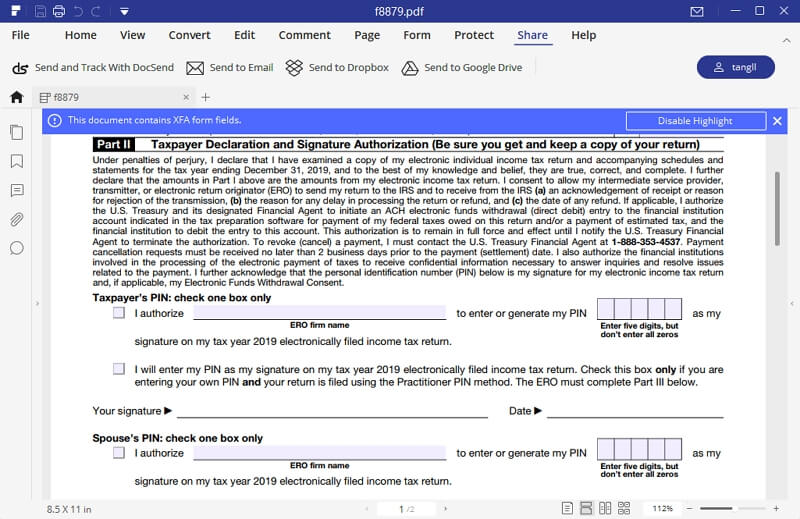

How To Fill Out 8879 Form - Complete form 8879 when the practitioner pin. Web form 8879 instructions direct the ero to do the following: Complete, edit or print tax forms instantly. Web a person filling out an 8879 form either declares on the form that he will enter the personal identification number on an electronically filed tax return or authorizes another party, an. Web 1 best answer. Web access the pdfliner website. Ad get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Sign online button or tick the preview image of the. Web form 8879 is generally included in the print options under the view results menu, but to print the form by itself from the main menu of the tax return (form 1040).

Easily fill out pdf blank, edit, and sign them. Ad get ready for tax season deadlines by completing any required tax forms today. Sign online button or tick the preview image of the. However, it must be kept in accordance with. Web a person filling out an 8879 form either declares on the form that he will enter the personal identification number on an electronically filed tax return or authorizes another party, an. If you have a spouse, enter their. Web filing the copy can be done in various ways. Complete, edit or print tax forms instantly. If form 9325 is used to provide the sid, it is not required to be physically attached to form 8879. Find and get a copy of the irs form 8879.

Ad get ready for tax season deadlines by completing any required tax forms today. Web how to complete irs form 8879: Web form 8879 is generally included in the print options under the view results menu, but to print the form by itself from the main menu of the tax return (form 1040). If you have a spouse, enter their. One of the most traditional methods is obtaining a sample of the 8879 form, which can be printed and filled out manually. Sign online button or tick the preview image of the. Do not enter all zeros certify that the above numeric entry is my. Enter the tax year you are filing and select the tax return form you are authorizing. Form 8879 is not included in turbotax because it is never used when you file your tax return yourself with turbotax. Form 8879 is used only to.

IRS Form 8879 Instructions on How to Fill it Right

Click on the button get form to open it and start editing. Web 1 best answer. Do not send form 8879 to the irs unless requested to do so. Easily fill out pdf blank, edit, and sign them. Form 8879 is not included in turbotax because it is never used when you file your tax return yourself with turbotax.

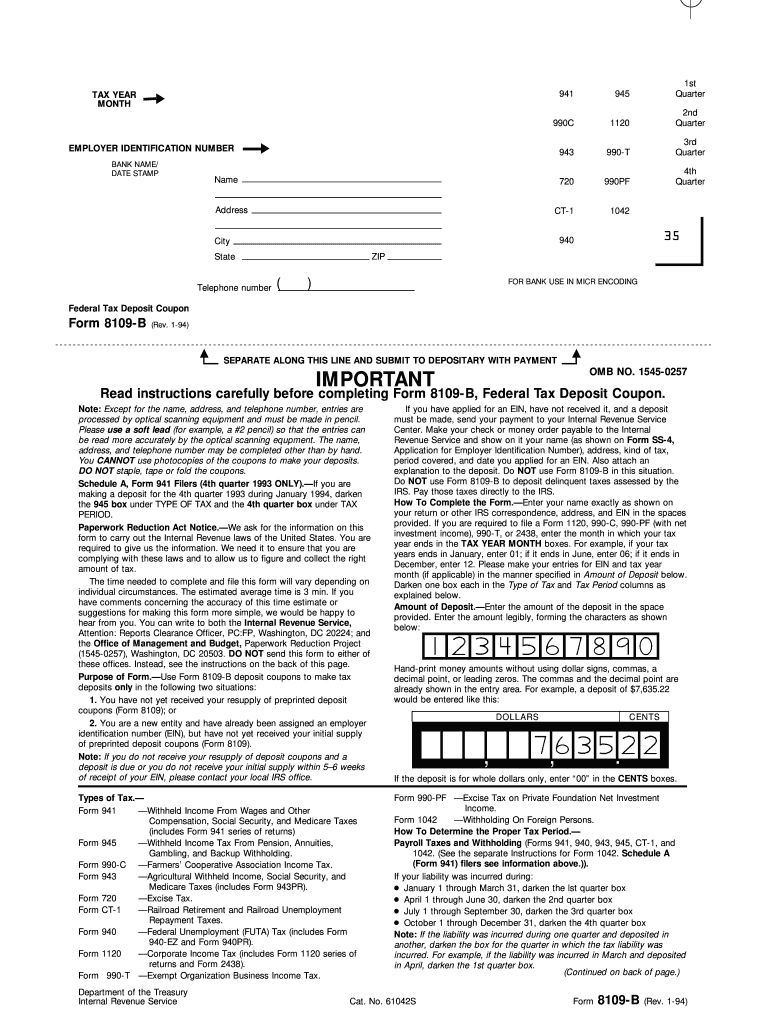

1994 Form IRS 8109B Fill Online, Printable, Fillable, Blank pdfFiller

Retain the completed form 8879 for 3 years from the. If form 9325 is used to provide the sid, it is not required to be physically attached to form 8879. Form 8879 is used only to. Web form 8879 instructions direct the ero to do the following: Complete, edit or print tax forms instantly.

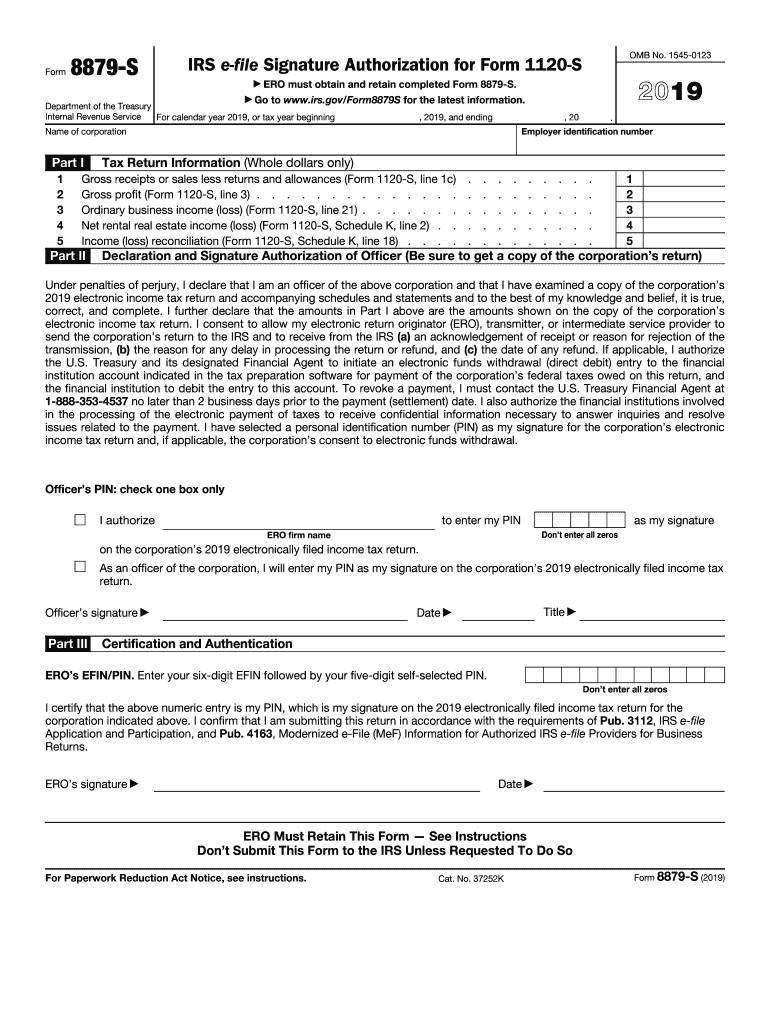

2019 Irs Form 8879 Fill Out and Sign Printable PDF Template signNow

Form 8879 is used only to. If form 9325 is used to provide the sid, it is not required to be physically attached to form 8879. Complete form 8879 when the practitioner pin. Web how to complete irs form 8879: Web form 8879 instructions direct the ero to do the following:

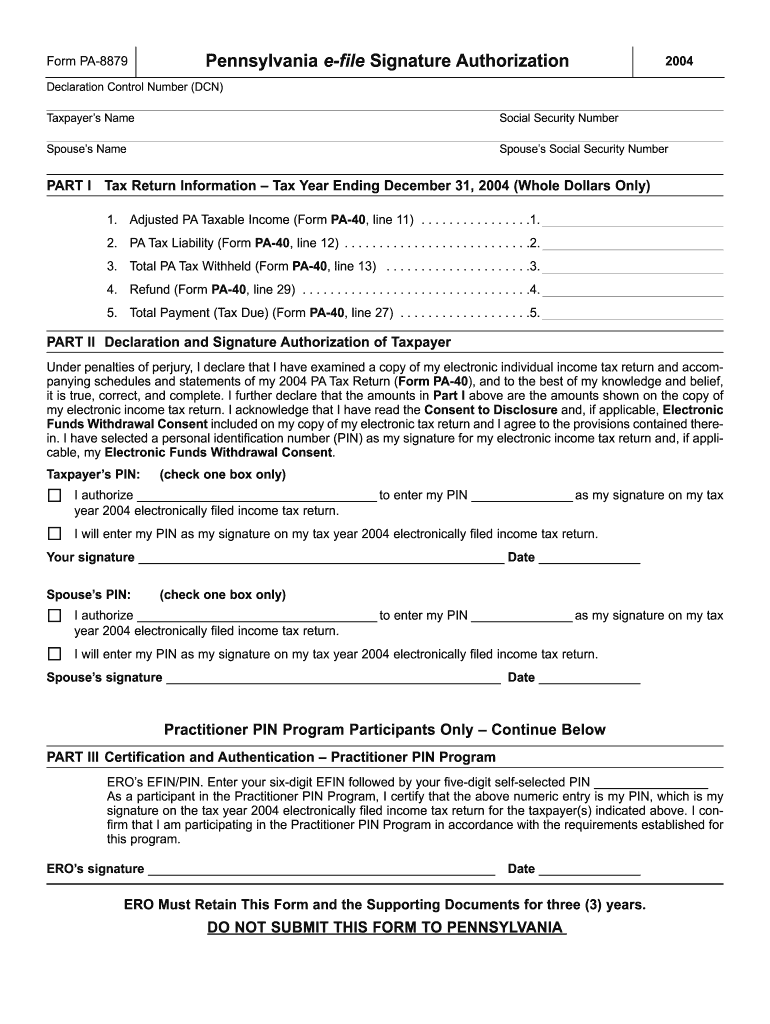

Pa 8879 Fill Out and Sign Printable PDF Template signNow

If form 9325 is used to provide the sid, it is not required to be physically attached to form 8879. Web form 8879 is generally included in the print options under the view results menu, but to print the form by itself from the main menu of the tax return (form 1040). One of the most traditional methods is obtaining.

Form 941, Employer's Quarterly Federal Tax Return Workful

Easily fill out pdf blank, edit, and sign them. Web form 8879 instructions direct the ero to do the following: Web form 8879 is generally included in the print options under the view results menu, but to print the form by itself from the main menu of the tax return (form 1040). Retain the completed form 8879 for 3 years.

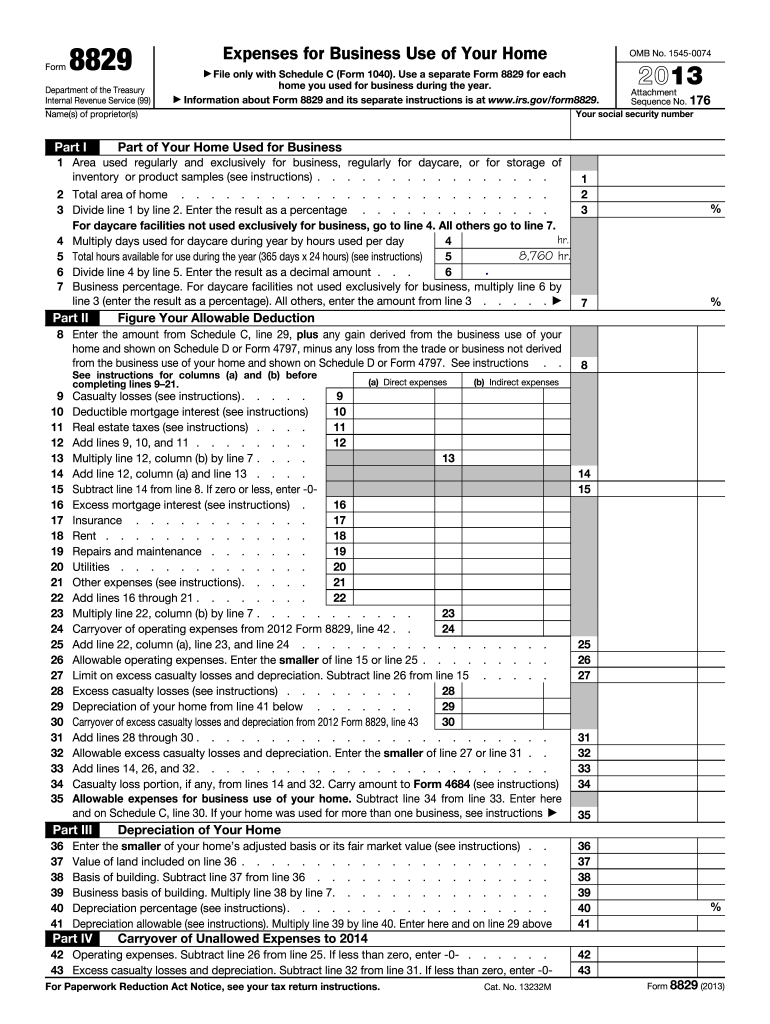

2013 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

Save or instantly send your ready documents. Enter the tax year you are filing and select the tax return form you are authorizing. Web a person filling out an 8879 form either declares on the form that he will enter the personal identification number on an electronically filed tax return or authorizes another party, an. Form 8879 is used only.

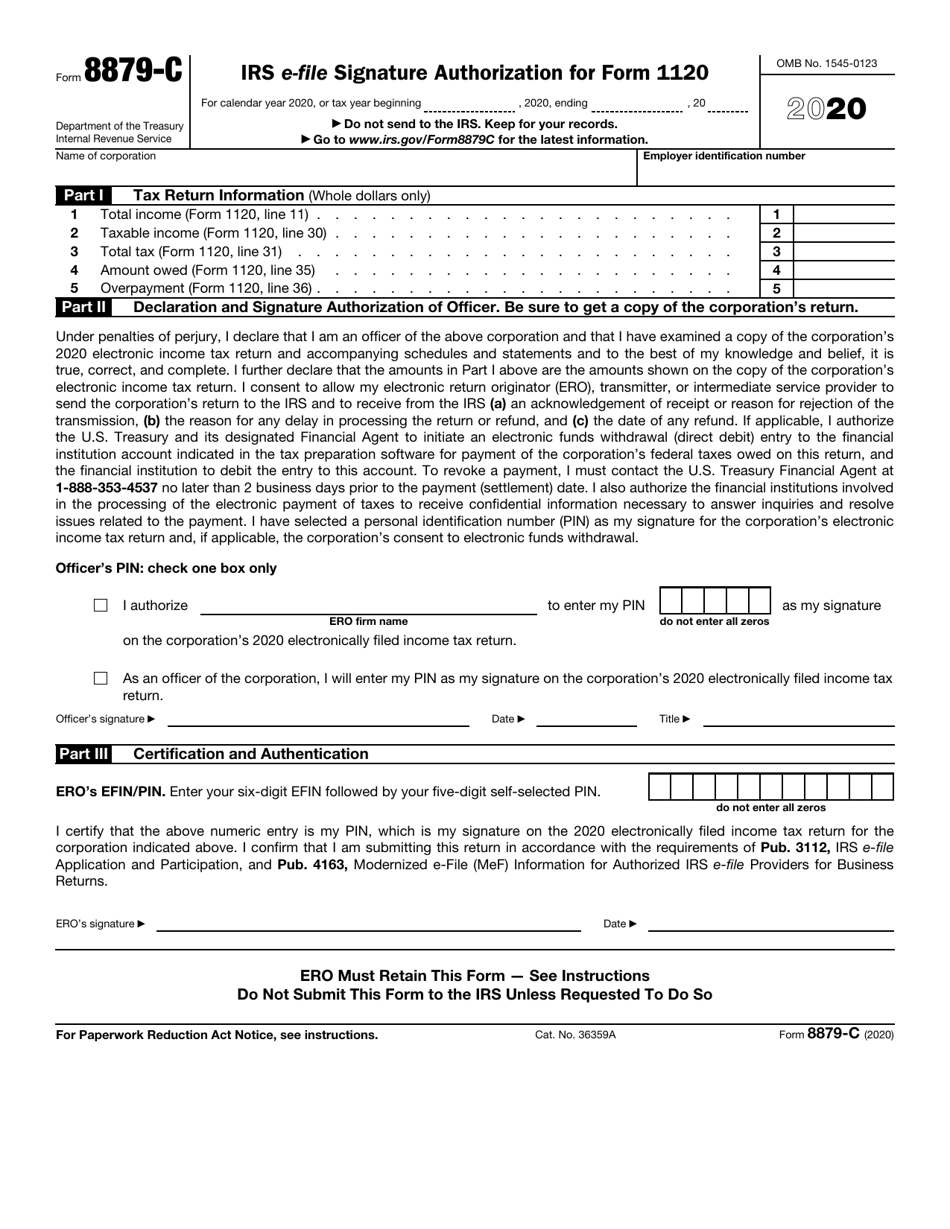

IRS Form 8879C Download Fillable PDF or Fill Online IRS EFile

You can easily access this document. Form 8879 is not included in turbotax because it is never used when you file your tax return yourself with turbotax. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Enter the tax year you are filing and select the tax return.

Form 8821 2018 2019 Blank Sample to Fill out Online in PDF

Web access the pdfliner website. Ad get ready for tax season deadlines by completing any required tax forms today. If form 9325 is used to provide the sid, it is not required to be physically attached to form 8879. Web how to complete irs form 8879: Web a person filling out an 8879 form either declares on the form that.

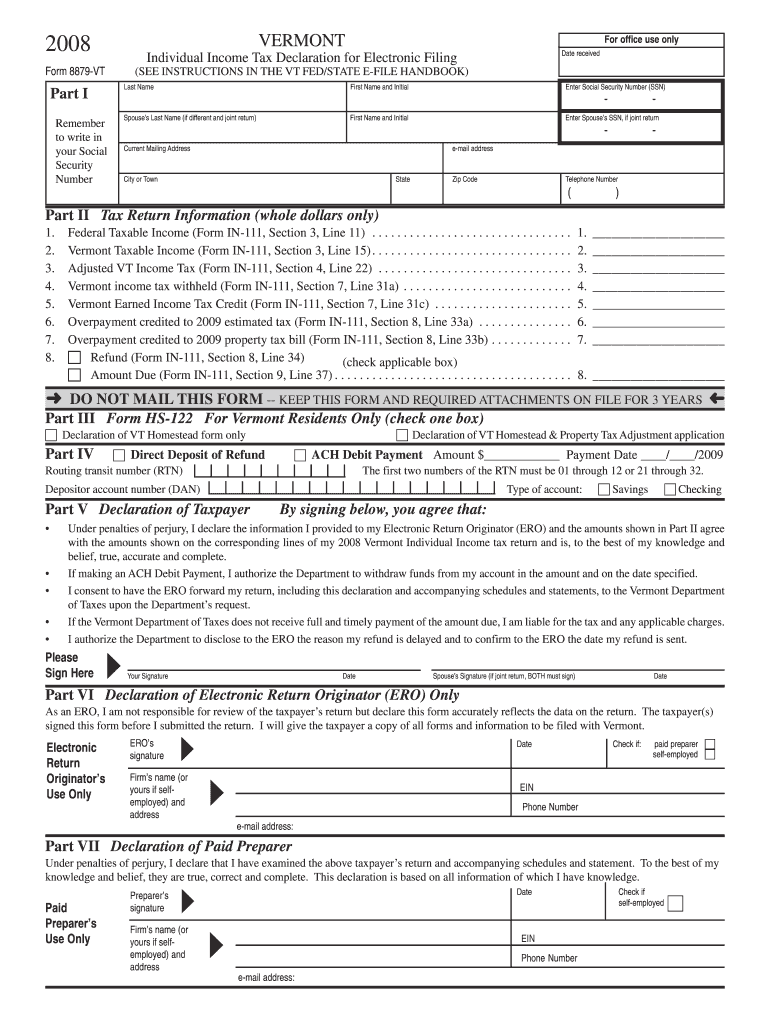

Vt Form 8879 Fill Out and Sign Printable PDF Template signNow

However, it must be kept in accordance with. Web how to complete irs form 8879: Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

2014 Form IRS 8453EO Fill Online, Printable, Fillable, Blank pdfFiller

Ad get ready for tax season deadlines by completing any required tax forms today. Form 8879 is not included in turbotax because it is never used when you file your tax return yourself with turbotax. If form 9325 is used to provide the sid, it is not required to be physically attached to form 8879. To get started on the.

Sign Online Button Or Tick The Preview Image Of The.

Form 8879 is used only to. Complete, edit or print tax forms instantly. Find and get a copy of the irs form 8879. Web a person filling out an 8879 form either declares on the form that he will enter the personal identification number on an electronically filed tax return or authorizes another party, an.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

To get started on the document, use the fill camp; Web filing the copy can be done in various ways. Form 8879 is not included in turbotax because it is never used when you file your tax return yourself with turbotax. Web access the pdfliner website.

Save Or Instantly Send Your Ready Documents.

Complete, edit or print tax forms instantly. Retain the completed form 8879 for 3 years from the. You can easily access this document. Web 1 best answer.

Complete, Edit Or Print Tax Forms Instantly.

Ad get ready for tax season deadlines by completing any required tax forms today. Do not send form 8879 to the irs unless requested to do so. Click on the button get form to open it and start editing. However, it must be kept in accordance with.