How To Fill Out A 1120 Tax Form

How To Fill Out A 1120 Tax Form - Ad download or email 1120 1120a & more fillable forms, register and subscribe now! Download or email inst 1120 & more fillable forms, try for free now! This is an official tax. Web requirements for filing form 1120. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Web income report income sources in the first section of form 1120. Then, calculate where you owe the tax or you can use it as a deduction. Web 1120s mastery explained! Person filing form 8865, any required statements to qualify for the. Web as an irs tax form, 1120 is used to claim the income and deductions.

Then, calculate where you owe the tax or you can use it as a deduction. Welcome to this edition of small business university. The list of products and services. This is an official tax. Knott 13.6k subscribers join subscribe 669 share save 31k views 1 year ago 2021 tax return tutorials for updated 2022. Knott 14.4k subscribers join subscribe 622 share save 32k views 1 year ago. Report their income, gains, losses, deductions, credits. Ein, a business activity code. Figure their income tax liability. Web nov 01, 2022 — 5 min read feb 27, 2023 — 4 min read oct 04, 2021 — 7 min read form 1120:

Start the filing process by gathering your tax team, which should include a. Ad download or email 1120 1120a & more fillable forms, register and subscribe now! B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. The list of products and services. The foundation date of the corporation. Web how to file tax form 1120 for your small business 1. Current revision form 1120 pdf instructions for. Web for a fiscal or short tax year return, fill in the tax year space at the top of the form. Web income report income sources in the first section of form 1120. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a.

Form 1120 Schedule J Instructions

Knott 14.4k subscribers join subscribe 622 share save 32k views 1 year ago. Web how to file tax form 1120 for your small business 1. Report their income, gains, losses, deductions, credits. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Ein, a business activity code.

Can you look over this corporate tax return form 1120 I did based on

Web domestic corporations use this form to: Knott 14.4k subscribers join subscribe 622 share save 32k views 1 year ago. Download or email inst 1120 & more fillable forms, try for free now! Report their income, gains, losses, deductions, credits. Knott 13.6k subscribers join subscribe 669 share save 31k views 1 year ago 2021 tax return tutorials for updated 2022.

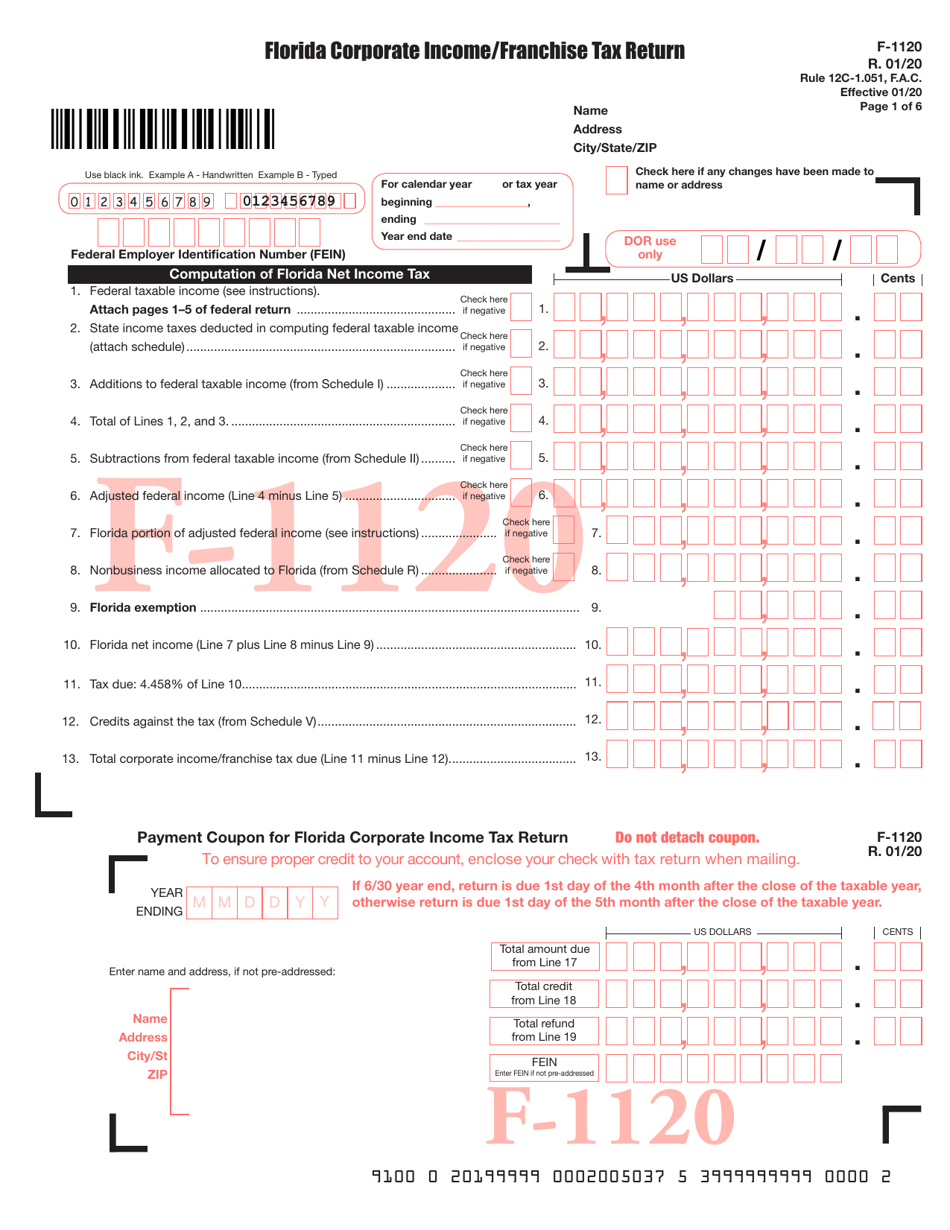

Form F1120 Download Printable PDF or Fill Online Florida Corporate

Report their income, gains, losses, deductions, credits. Download or email inst 1120 & more fillable forms, try for free now! Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Upload, modify or create forms. Enter the amount of your gross receipts or sales on line 1a, but leave out those reported on.

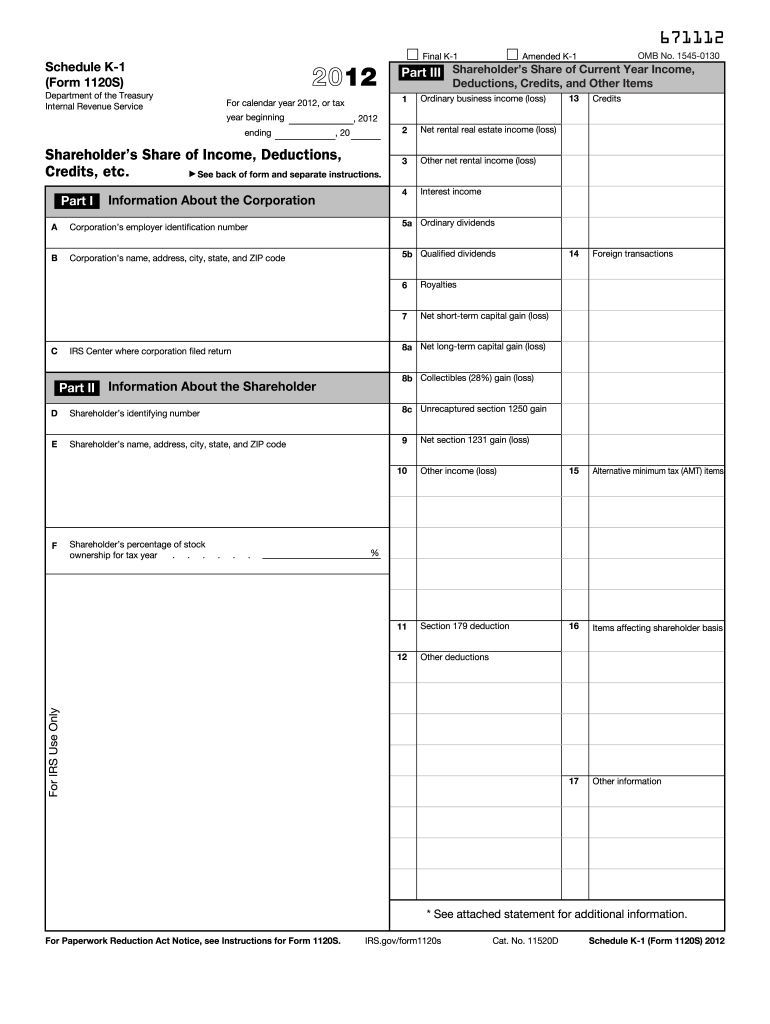

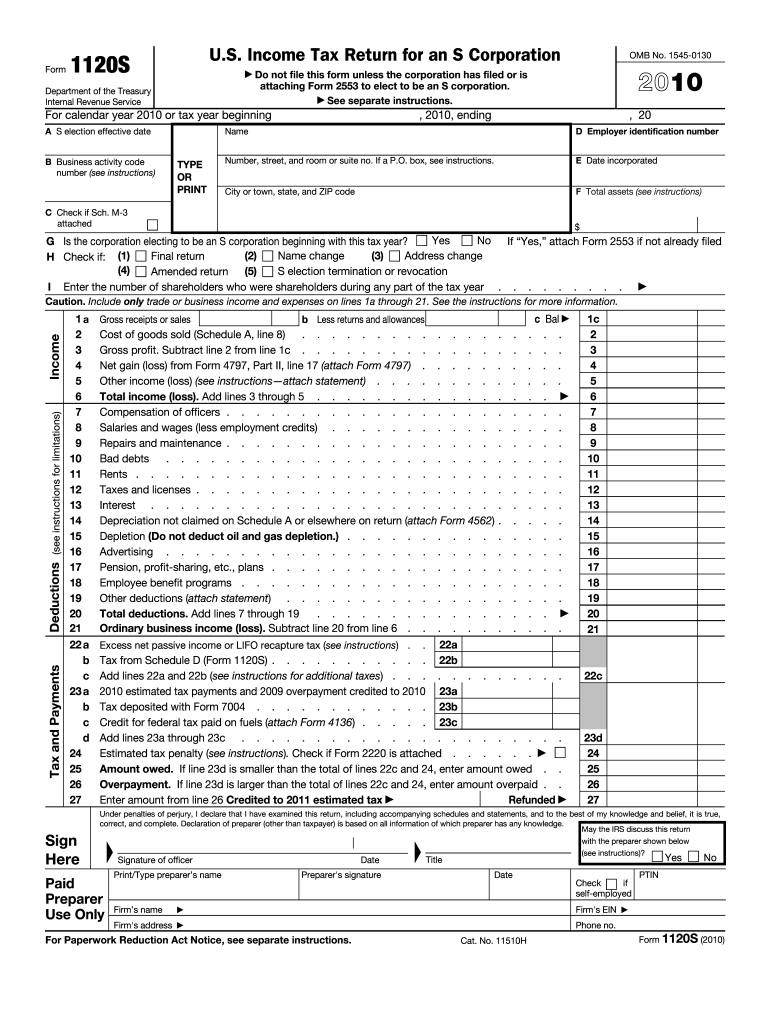

1120s Form Fill Out and Sign Printable PDF Template signNow

Web requirements for filing form 1120. Web as an irs tax form, 1120 is used to claim the income and deductions. Person filing form 8865, any required statements to qualify for the. Form 1120 must be filed by the 15th day of the third month after the end of your corporation's tax year. You would file by march 31.

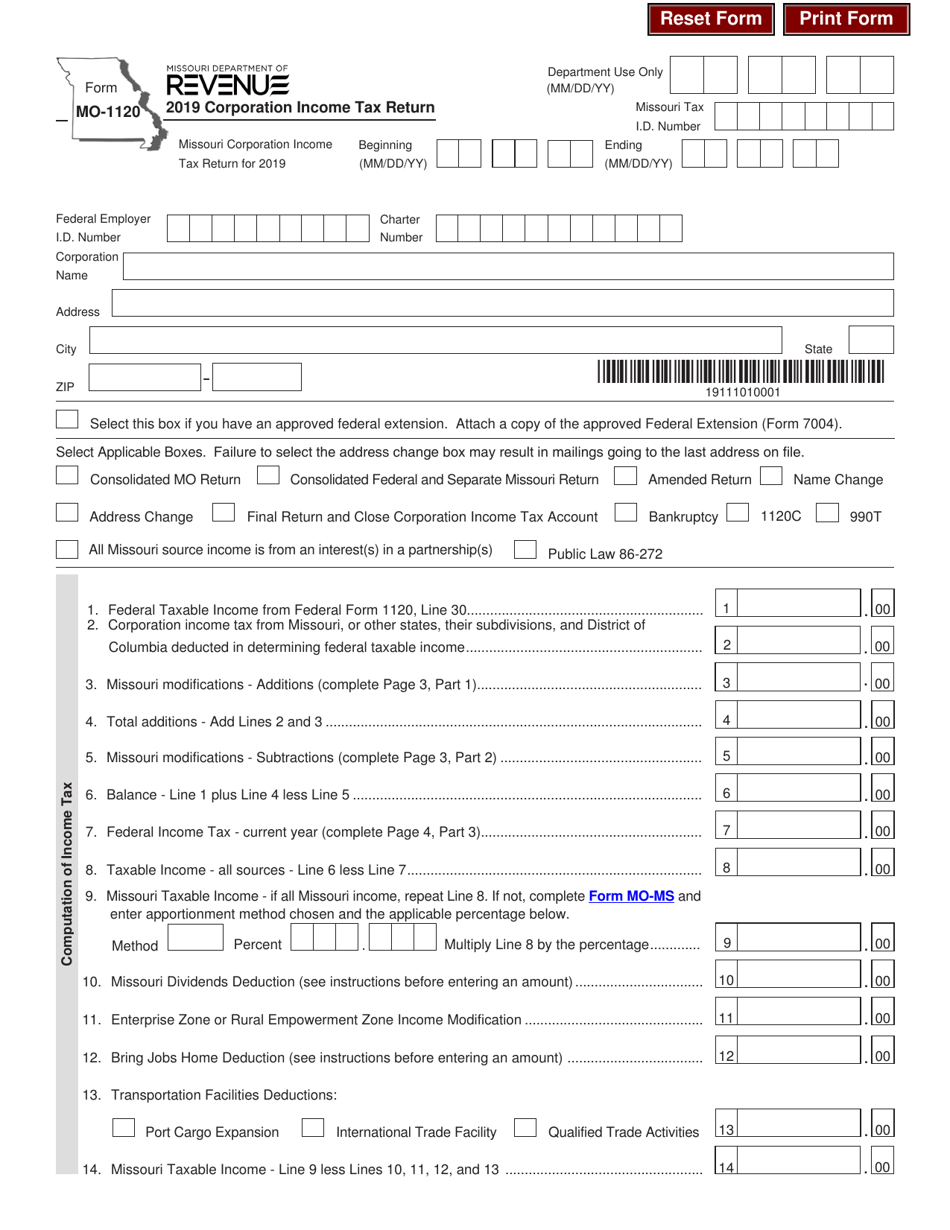

Form MO1120 Download Fillable PDF or Fill Online Corporation

Web how to file tax form 1120 for your small business 1. Web introduction how to fill out form 1120 for 2021. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Try it for free now! The corporation has a tax year of less than 12.

What is Tax Form 1120? EPGD Business Law

Report their income, gains, losses, deductions, credits. Form 1120 must be filed by the 15th day of the third month after the end of your corporation's tax year. Knott 13.6k subscribers join subscribe 669 share save 31k views 1 year ago 2021 tax return tutorials for updated 2022. Knott 14.4k subscribers join subscribe 622 share save 32k views 1 year.

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

Report their income, gains, losses, deductions, credits. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Figure their income tax liability. Web 1120s mastery explained! Web as an irs tax form, 1120 is used to claim the income and deductions.

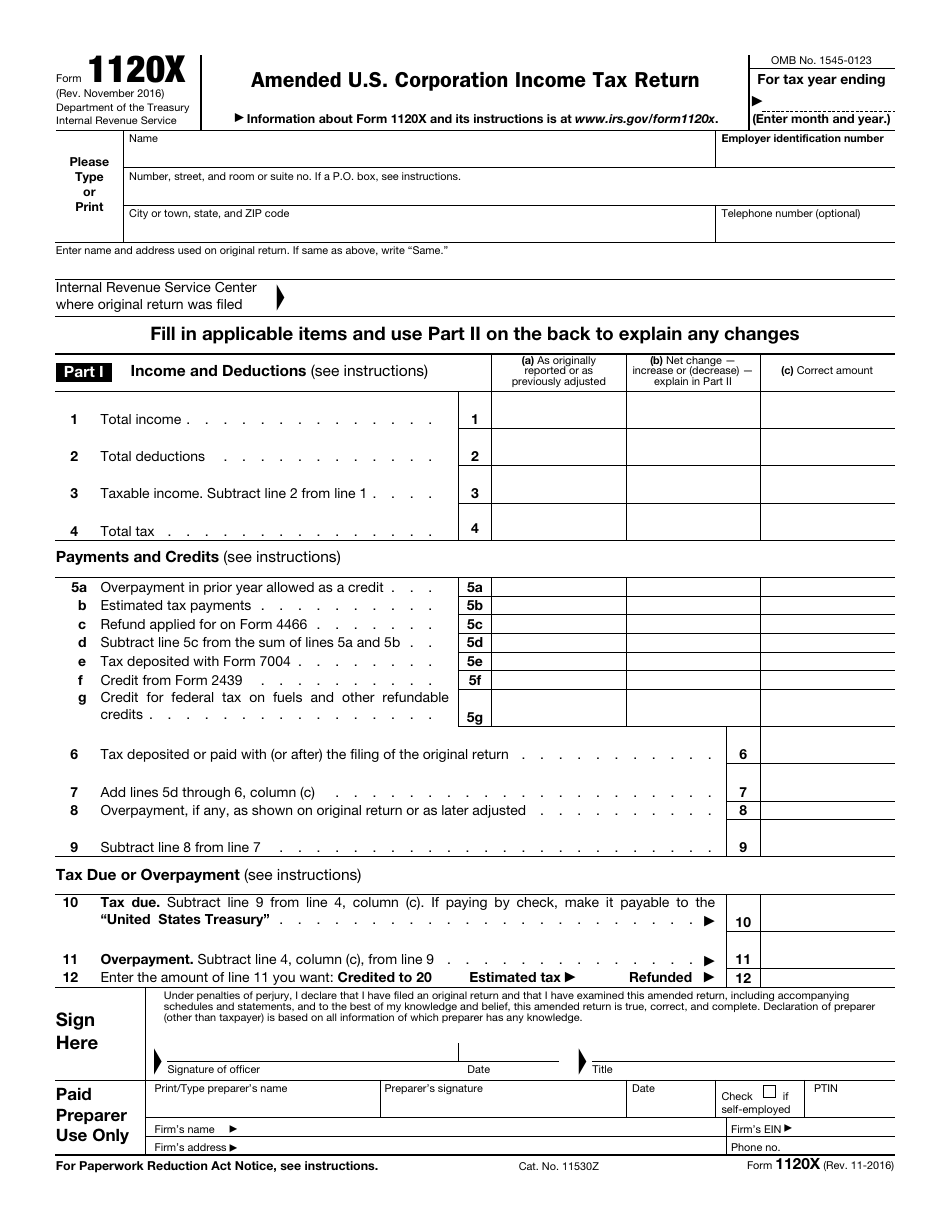

IRS Form 1120X Download Fillable PDF or Fill Online Amended U.S

Person filing form 8865, any required statements to qualify for the. The list of products and services. Ein, a business activity code. The corporation has a tax year of less than 12. Try it for free now!

2010 Form IRS 1120S Fill Online, Printable, Fillable, Blank pdfFiller

Knott 14.4k subscribers join subscribe 622 share save 32k views 1 year ago. Knott 13.6k subscribers join subscribe 669 share save 31k views 1 year ago 2021 tax return tutorials for updated 2022. Then, calculate where you owe the tax or you can use it as a deduction. You would file by march 31. Ein, a business activity code.

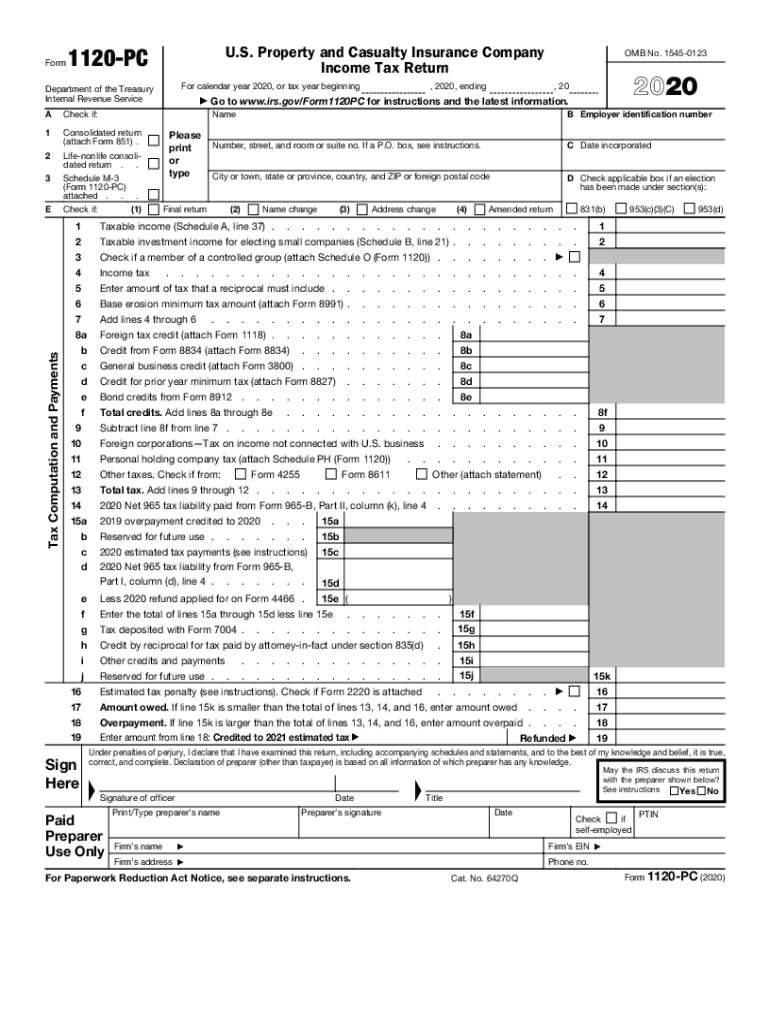

Form 1120 PC U S Property And Casualty Insurance Company Tax

B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Then, calculate where you owe the tax or you can use it as a deduction. The foundation date of the corporation. You would file by march 31. Welcome to this edition of small business university.

Knott 14.4K Subscribers Join Subscribe 622 Share Save 32K Views 1 Year Ago.

Download or email inst 1120 & more fillable forms, try for free now! The foundation date of the corporation. The list of products and services. Web income report income sources in the first section of form 1120.

Web For The Latest Information About Developments Related To Form 1120 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form1120.

Web introduction how to fill out form 1120 for 2021. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Then, calculate where you owe the tax or you can use it as a deduction. Ad download or email 1120 1120a & more fillable forms, register and subscribe now!

Ein, A Business Activity Code.

Form 1120 must be filed by the 15th day of the third month after the end of your corporation's tax year. Try it for free now! Web how to file tax form 1120 for your small business 1. Upload, modify or create forms.

Corporation Income Tax Return, To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The Income Tax Liability Of A.

Enter the amount of your gross receipts or sales on line 1a, but leave out those reported on. You would file by march 31. Report their income, gains, losses, deductions, credits. Web for a fiscal or short tax year return, fill in the tax year space at the top of the form.