Idaho Form 41Es

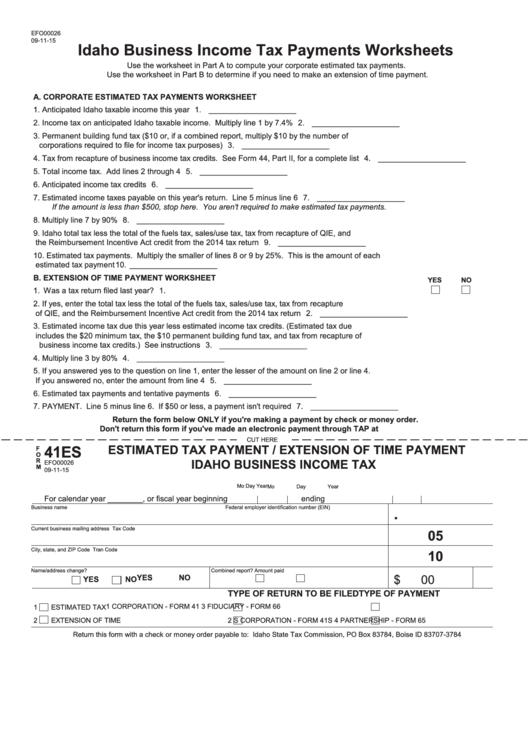

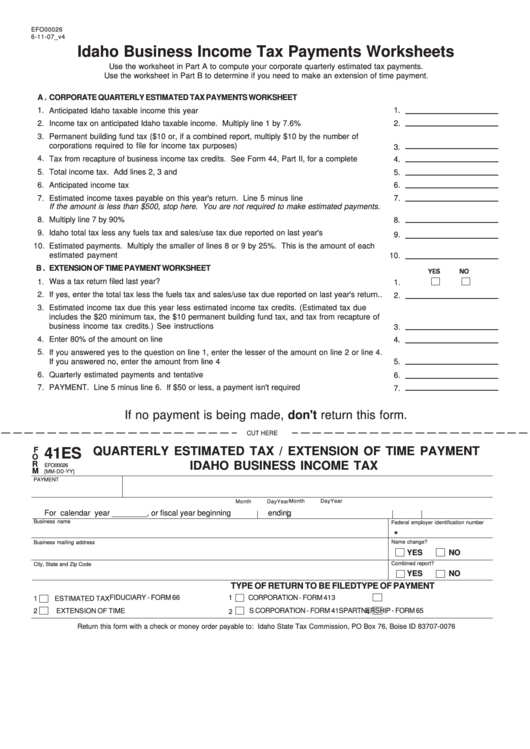

Idaho Form 41Es - Web if you owe state tax and you want to make an extension payment, use idaho form 41es (estimated tax payment / extension of time payment, idaho business income tax). Income for the period and deducting any prior installments. It must be made by the original filing due date (the 15th day of the fourth month following the close of the taxable year) in order to be applied to the owner’s tax return filed for the same year. Use the cross or check marks in the top toolbar to select your answers in the list boxes. New hire reporting form idaho department of labor new hire reporting. Supplemental schedule of affiliated entities. Use get form or simply click on the template preview to open it in the editor. You can make the estimated payment electronically using the quick pay option on our website. Use the smaller of the two amounts to determine the estimated tax payment for each period. Estimated tax payments each estimated tax payment must be 25% of the lesser of the corporation's income tax for the prior year or 90% of its income tax for the current tax year.

Include a copy of form 49er. For more information, visit our e‑pay page at tax.idaho.gov/epay. Save or instantly send your ready documents. • 100% of the corporation’s income tax for 2020 • 90% of its income tax for 2021 don’t include: Web a preprinted form, use the form 41es, available at tax.idaho.gov. Overpayments will be applied to any prior year tax liabilities before carryovers or refunds are allowed. For calendar year 2022 or fiscal year beginning state use only mo day year mo day year 22ending income 13 don’t staple 13. Last name social security number. Currently, taxslayer pro does not support electronic signatures on idaho forms. Web form 41 corporation income tax return2022 amended return?

Web a preprinted form, use the form 41es, available at tax.idaho.gov. Web choose the tax type. Web 2022 amended return? Use the smaller of the two amounts to determine the estimated tax payment for each period. Last name social security number. Start completing the fillable fields and carefully type in required information. Web your corporation’s estimated idaho tax liability is $500 or more. Include a copy of form 49er. Web report error it appears you don't have a pdf plugin for this browser. It must be made by the original filing due date (the 15th day of the fourth month following the close of the taxable year) in order to be applied to the owner’s tax return filed for the same year.

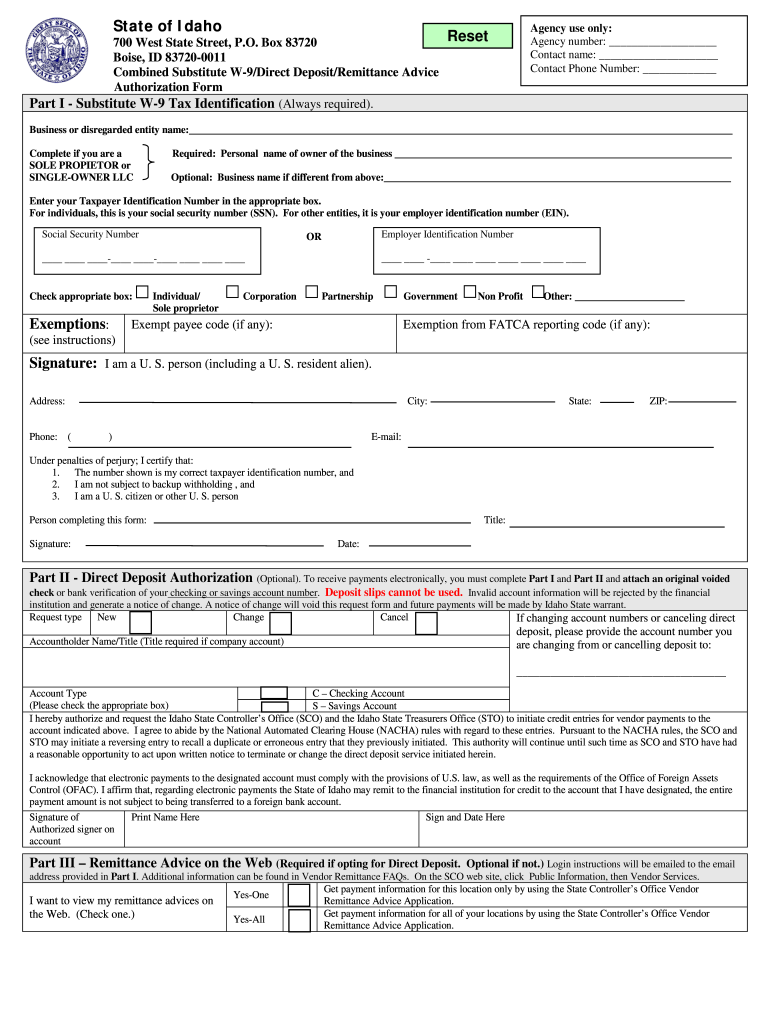

W9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

You can print other idaho tax forms here. Web a preprinted form, use the form 41es, available at tax.idaho.gov. Web form, use the form 41es, available at tax.idaho.gov. Estimated tax payments each estimated tax payment must be 25% of the lesser of: • fuels tax due • sales/use tax due • fuels tax refunds

Idaho Probate Forms Form Resume Examples l6YN7yy5V3

Web form 41es may also be used to make payments of qie recapture when you. Web form, use the form 41es, available at tax.idaho.gov. Web report error it appears you don't have a pdf plugin for this browser. Web the taxslayer pro desktop program supports the following idaho business forms. For calendar year 2022 or fiscal year beginning state use.

Form 41es Estimated Tax Payment / Extension Of Time Payment Idaho

Use the smaller of the two amounts to determine the estimated tax payment for each period. Web complete idaho form 41es online with us legal forms. See page 1 of the instructions for reasons to amend and enter the number that applies. Download this form print this form more about the idaho form 41 corporate income tax tax return ty.

Idaho W9 Form Fill Out and Sign Printable PDF Template signNow

Estimated tax payments each estimated tax payment must be 25% of the lesser of: Use get form or simply click on the template preview to open it in the editor. Income for the period and deducting any prior installments. Allocation of estimated tax payments to beneficiaries You can make the estimated payment electronically using the quick pay option on our.

Form Efo00026 Draft Idaho Business Tax Payments Worksheets

Download this form print this form more about the idaho form 41 corporate income tax tax return ty 2022 Web your corporation’s estimated idaho tax liability is $500 or more. Web the form 41es worksheet allows you to compare the income tax on last year's return with the anticipated income tax for the current year. For calendar year 2022 or.

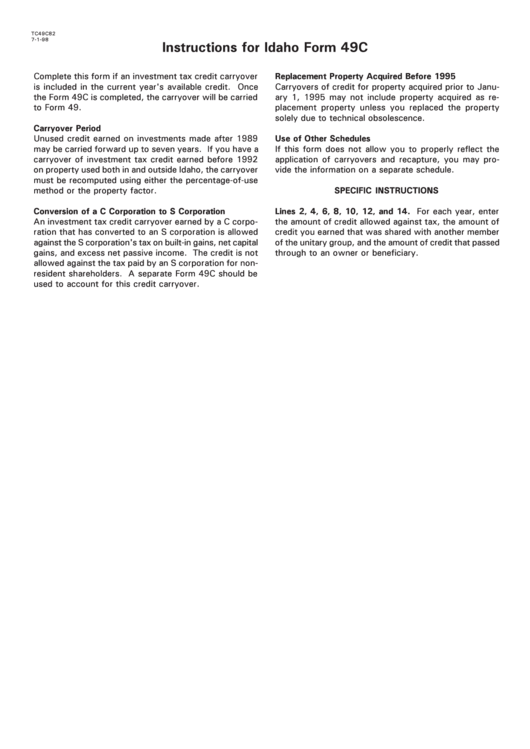

Instructions For Idaho Form 49c Idaho Investment Tax Credit Carryover

Don't include fuels tax due, sales/use tax due, fuels New hire reporting form idaho department of labor new hire reporting. Currently, taxslayer pro does not support electronic signatures on idaho forms. Web 2022 amended return? You will be notified if your overpayment is applied to an existing liability or is used to reduce your refund or carryover.

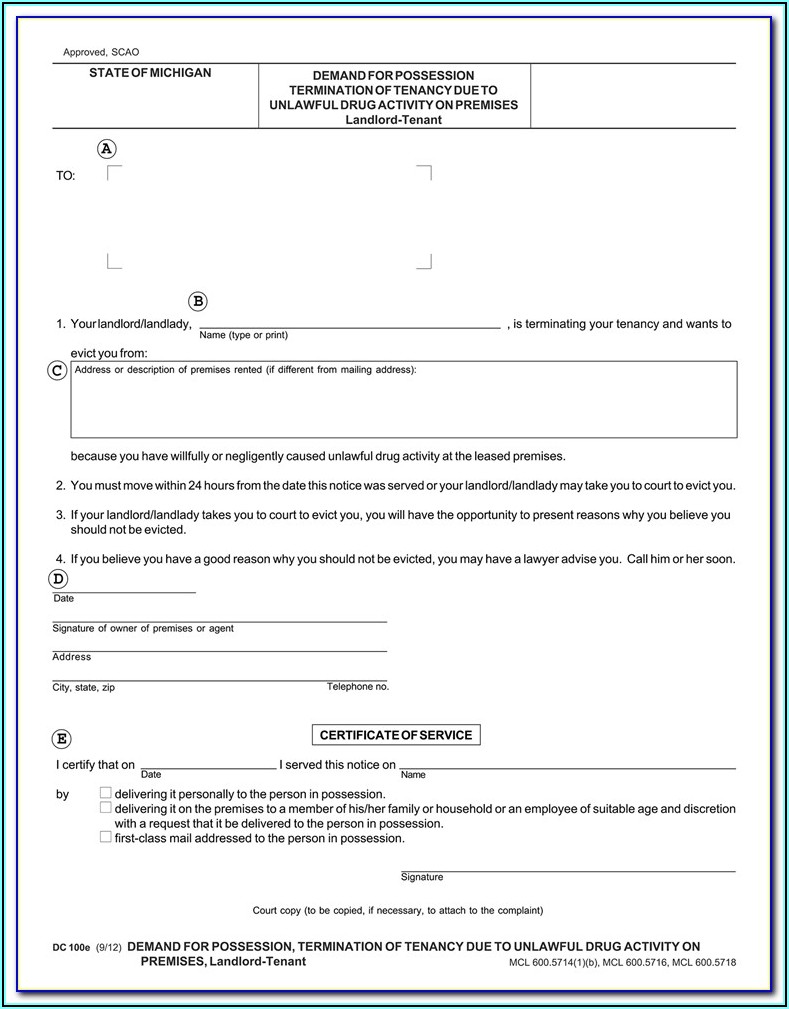

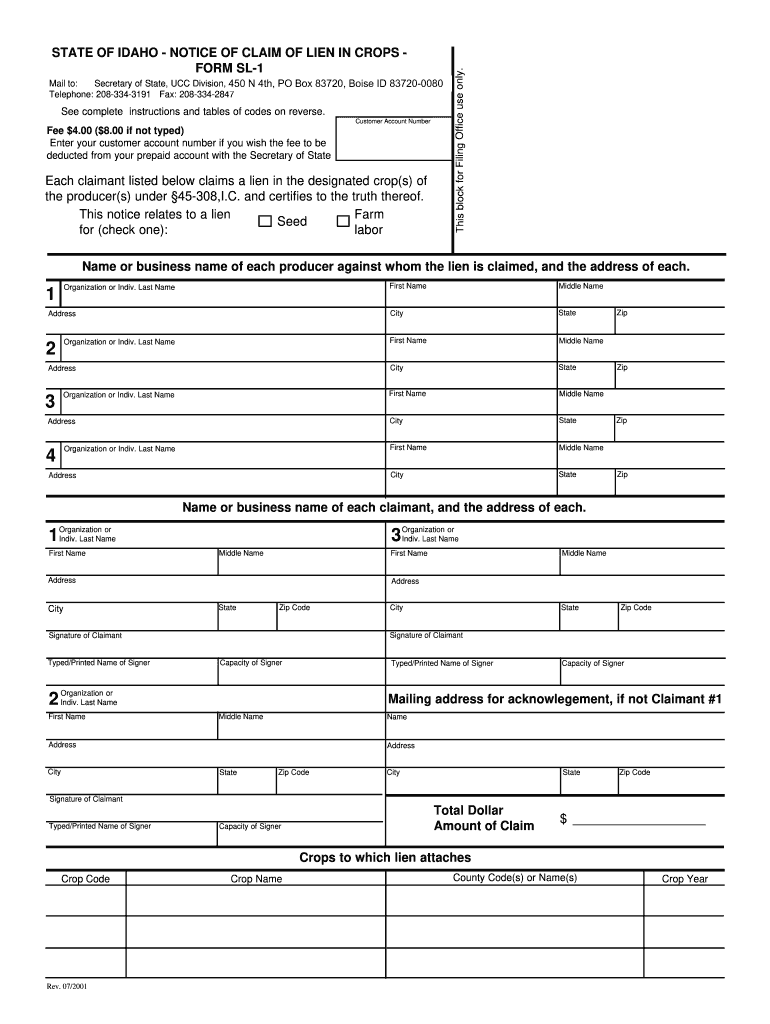

Mechanics Lien Pdf Fill Out and Sign Printable PDF Template signNow

Easily fill out pdf blank, edit, and sign them. See page 1 of the instructions for reasons to amend and enter the number that applies. Web complete idaho form 41es online with us legal forms. Currently, taxslayer pro does not support electronic signatures on idaho forms. Web full year's tax on the annualizedform, use the form 41es, available at tax.idaho.gov.

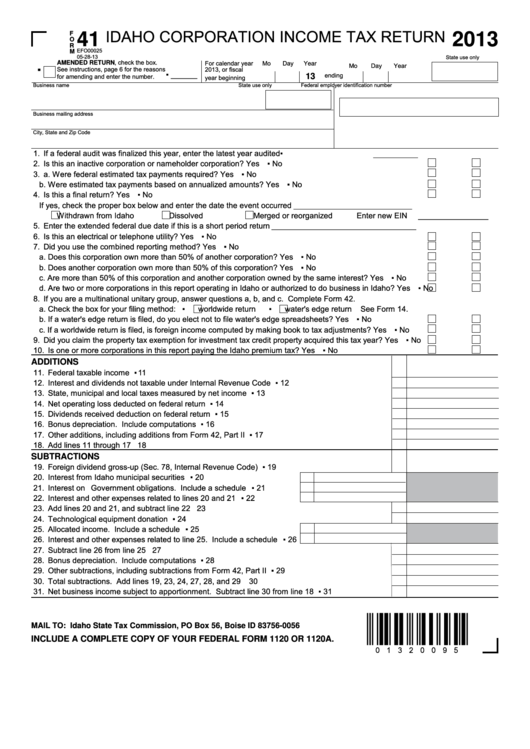

Fillable Form 41 Idaho Corporation Tax Return 2013 printable

Web if you owe state tax and you want to make an extension payment, use idaho form 41es (estimated tax payment / extension of time payment, idaho business income tax). • fuels tax due • sales/use tax due • fuels tax refunds S corporation income tax return and instructions 2020. Include a copy of form 49er. Start completing the fillable.

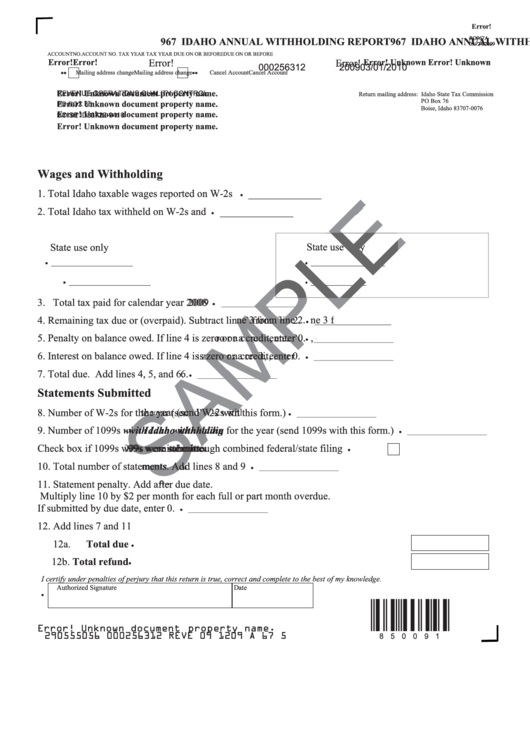

Form Ro967a 967 Idaho Annual Withholding Report 2009 printable pdf

Web full year's tax on the annualizedform, use the form 41es, available at tax.idaho.gov. Web your corporation’s estimated idaho tax liability is $500 or more. Supplemental schedule of affiliated entities. • fuels tax due • sales/use tax due • fuels tax refunds S corporation income tax return and instructions 2021.

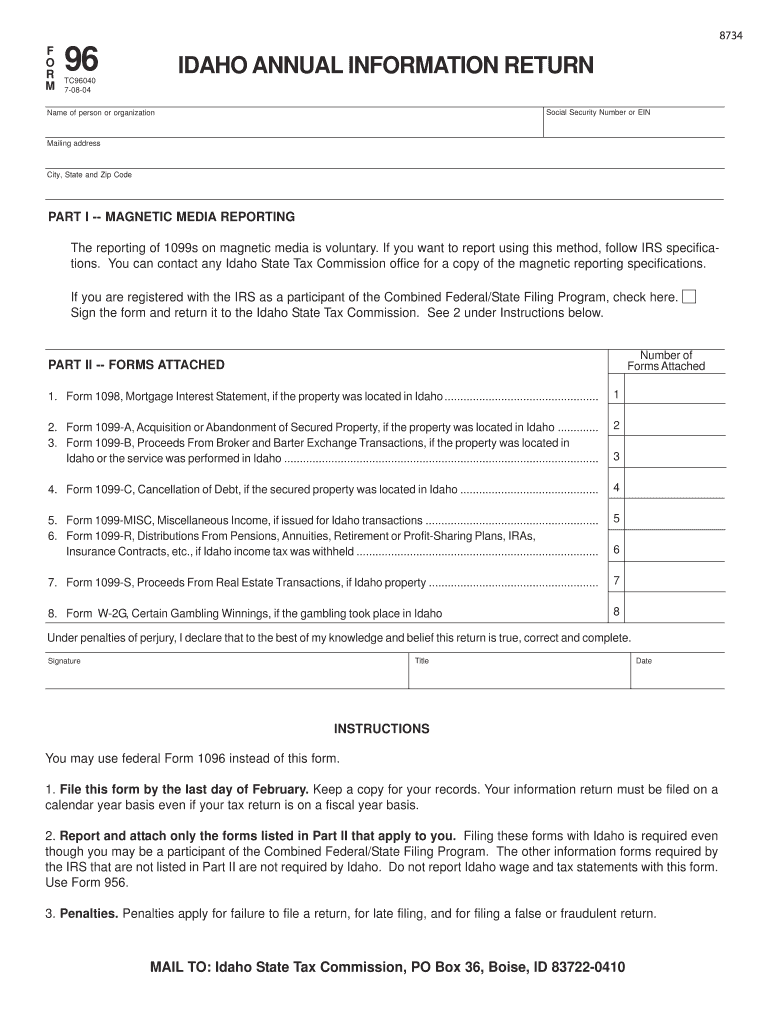

Idaho Form 96 Fill Out and Sign Printable PDF Template signNow

Web choose the tax type. Web to mark an idaho form 40 as an amended return, from the main menu of the idaho return select id amended return and indicate the reason for making the amendment. For calendar year 2022 or fiscal year beginning state use only mo day year mo day year 22ending income 13 don’t staple 13. Web.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web full year's tax on the annualizedform, use the form 41es, available at tax.idaho.gov. Web complete idaho form 41es online with us legal forms. For calendar year 2022 or fiscal year beginning state use only mo day year mo day year ending additions 11 don’t staple 11. See page 1 of the instructions for reasons to amend, and enter the number that applies.

Supplemental Schedule Of Affiliated Entities.

Web payments can be made using the idaho state tax commission’s quickpay, a business’ existing tap account, or by mailing in a check with idaho form 41es. Web form, use the form 41es, available at tax.idaho.gov. S corporation income tax return and instructions 2022. Download this form print this form more about the idaho form 41 corporate income tax tax return ty 2022

Save Or Instantly Send Your Ready Documents.

Forms 41, 41s, 65, or 66. It must be made by the original filing due date (the 15th day of the fourth month following the close of the taxable year) in order to be applied to the owner’s tax return filed for the same year. You can print other idaho tax forms here. • 100% of the corporation’s income tax for 2020 • 90% of its income tax for 2021 don’t include:

Web Federal Employer Identification Number (Fein) Idaho Unemployment Insurance Number (Suta) Name Contact Phone Number Street Address Contact Name City State 8 Zip Fax Employee Information First Name M.i.

Include a copy of form 49er. Web report error it appears you don't have a pdf plugin for this browser. • fuels tax due • sales/use tax due • fuels tax refunds Web 2022 amended return?