Idaho Form 65 Instructions 2021

Idaho Form 65 Instructions 2021 - I know that submitting false information can result in criminal and civil. Web residents who are age 65 or older, or age 62 or older and disabled. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. You can deduct $1,000 for each family member, not including. Download past year versions of this tax form as pdfs. Web income tax for partnerships. Instead, it relates to idaho law and identifies idaho adjustments,. Web idaho has a state income tax that ranges between 1.125% and 6.925%, which is administered by the idaho state tax commission. Web instructions idaho the gem state if you need to change or amend an accepted idaho state income tax return for the current or previous tax year, you need to complete. Web • every idaho resident who must file a federal income tax return idaho resident filing requirements if your filing status is:

Web individual income tax forms (current) individual income tax forms (archive) property tax forms. Include a completed payment voucher with all cash or check tax payments you send to the idaho. Include a schedule identifying each deduction. Web 2021 instructions are for lines not fully explained on the form. Download past year versions of this tax form as pdfs. This form shows the partner’s. Partnership return of income and instructions 2022. Web if the idaho partnership return of income, form 65 is filed within the automatic extension period, but less than 80% of the current year tax liability or 100% of the total tax paid last. Web • every idaho resident who must file a federal income tax return idaho resident filing requirements if your filing status is: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

Include a completed payment voucher with all cash or check tax payments you send to the idaho. Web line 15 maintaining a home for the aged you can deduct $1,000 for each family member, not including yourself or your spouse who: Instead, it relates to idaho law and identifies idaho adjustments,. You can deduct $1,000 for each family member, not including. A partnership must file idaho form 65 if either of the following are true: Web partnership return of income and instructions. Web you may deduct $1,000 for each family member, not including yourself or your spouse, who is age 65 or older and for whom you maintain a household and provide more than one. Include on this line any amounts included. The retirement annuities eligible for this deduction on the idaho state return include: Download past year versions of this tax form as pdfs.

Idaho Form 910 Fill Out and Sign Printable PDF Template signNow

You’re doing business in idaho. The partnership must provide each. Web partnership return of income and instructions. Web you may deduct $1,000 for each family member, not including yourself or your spouse, who is age 65 or older and for whom you maintain a household and provide more than one. Web idaho has a state income tax that ranges between.

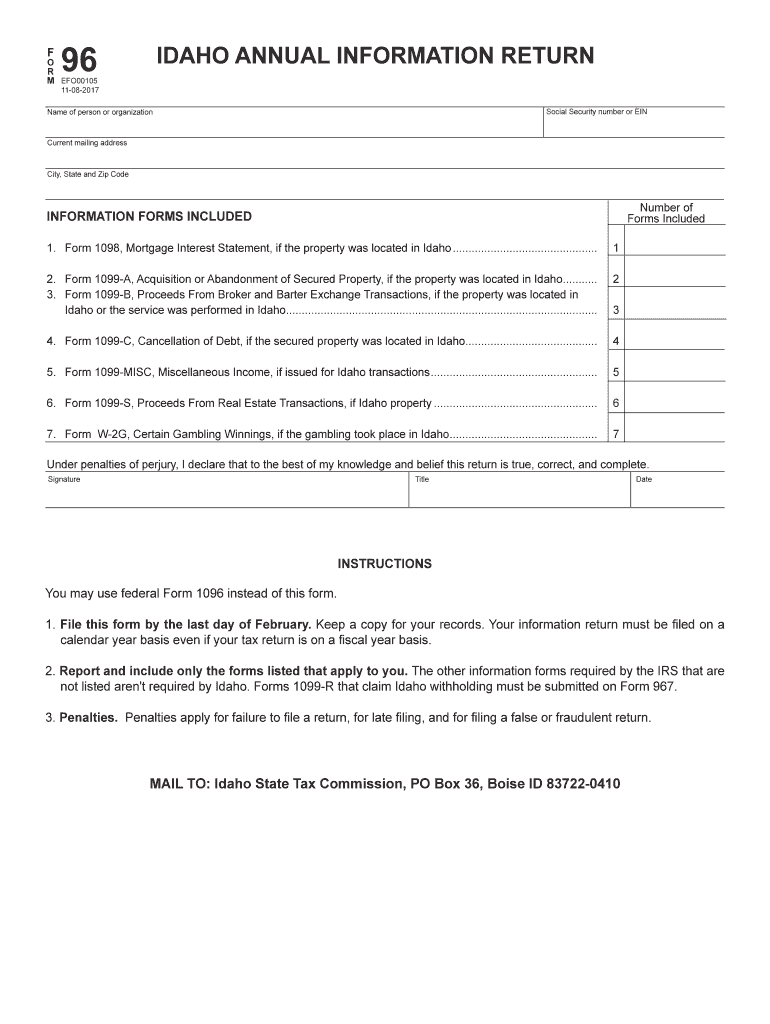

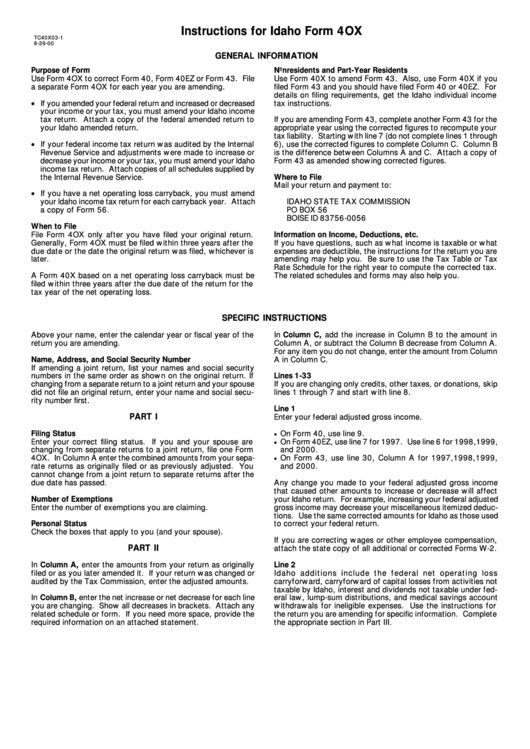

Instructions For Idaho Form 4ox printable pdf download

Web you may deduct $1,000 for each family member, not including yourself or your spouse, who is age 65 or older and for whom you maintain a household and provide more than one. Web individual income tax forms (current) individual income tax forms (archive) property tax forms. Web this rule implements the following statutes passed by the idaho legislature: Instead,.

Idaho Property Disclosure Form 20202021 Fill and Sign Printable

The partnership must provide each. Web if the idaho partnership return of income, form 65 is filed within the automatic extension period, but less than 80% of the current year tax liability or 100% of the total tax paid last. Web idaho has a state income tax that ranges between 1.125% and 6.925%, which is administered by the idaho state.

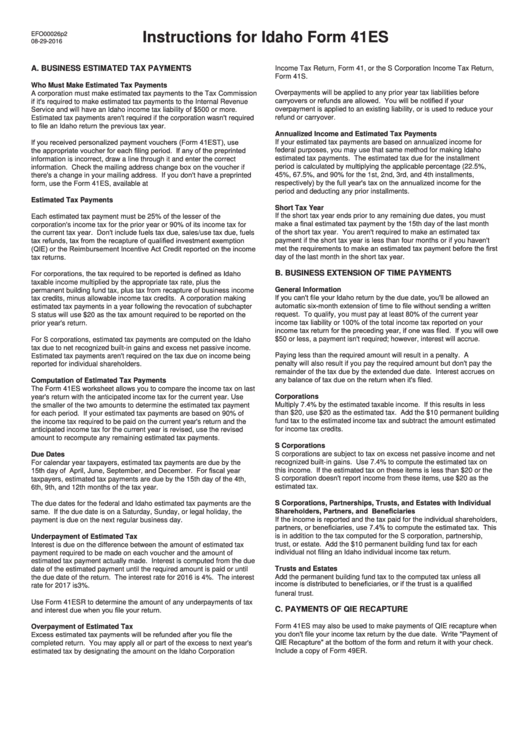

Instructions For Idaho Form 41es printable pdf download

Web instructions idaho the gem state if you need to change or amend an accepted idaho state income tax return for the current or previous tax year, you need to complete. Web partnership return of income and instructions. Web residents who are age 65 or older, or age 62 or older and disabled. Instead, it relates to idaho law and.

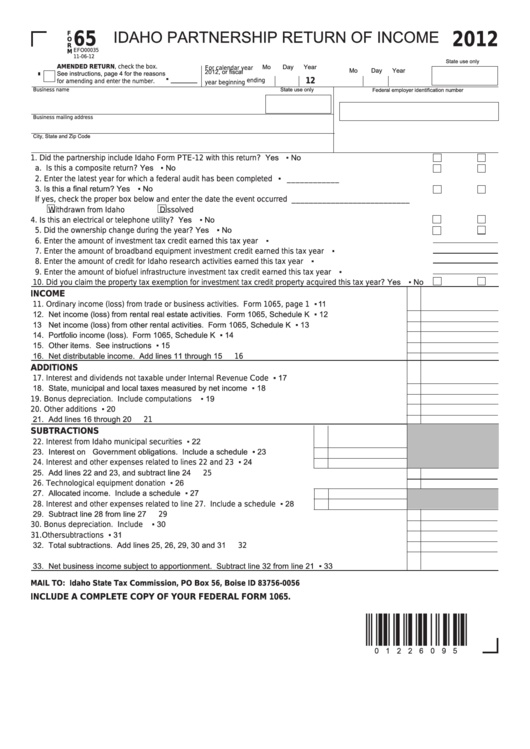

Fillable Form 65 Idaho Partnership Return Of 2012 printable

Web if the idaho partnership return of income, form 65 is filed within the automatic extension period, but less than 80% of the current year tax liability or 100% of the total tax paid last. Web partnership return of income and instructions. Line 15 maintaining a home for the aged. Web form 65 — instructions partnership return of income 2022.

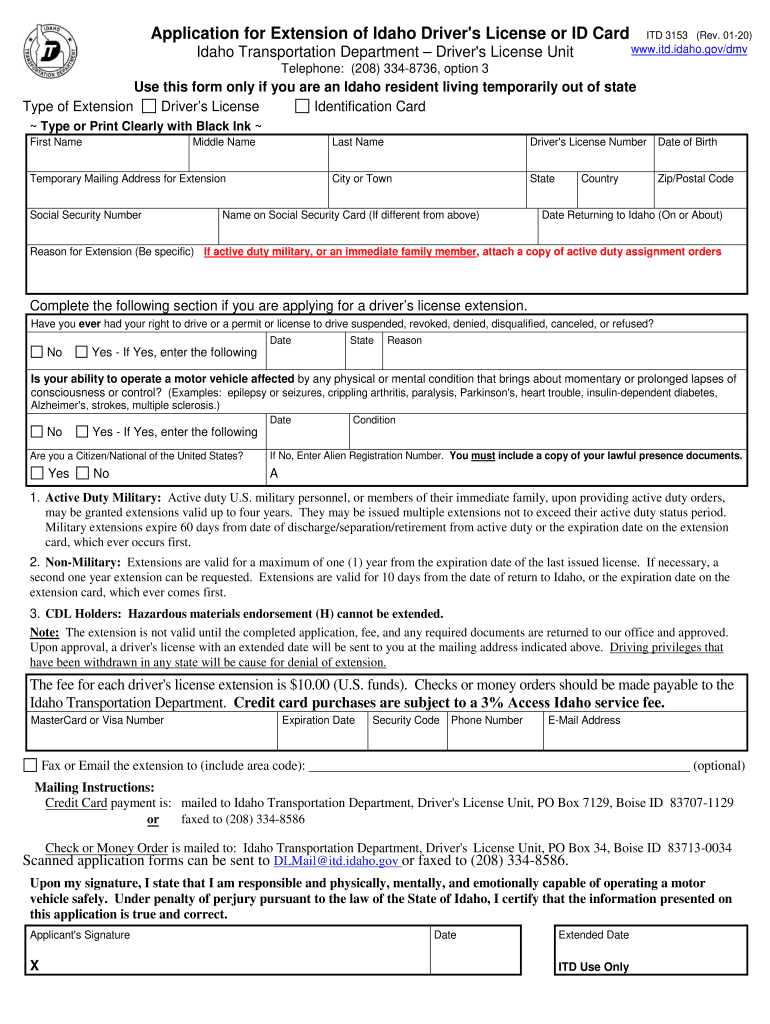

Itd3153 Fill Out and Sign Printable PDF Template signNow

03/12/2023 question what are some common. Web line 15 maintaining a home for the aged you can deduct $1,000 for each family member, not including yourself or your spouse who: Instead, it relates to idaho law and identifies idaho adjustments,. Partnership return of income and instructions 2022. Include on this line any amounts included.

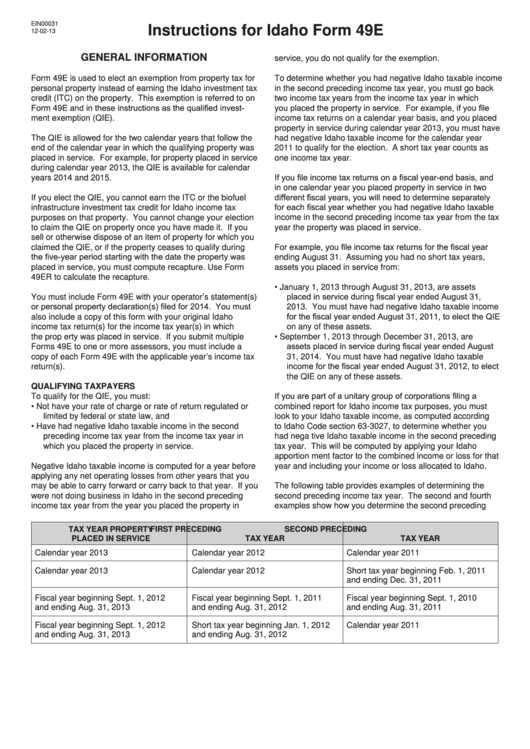

Instructions For Idaho Form 49e Idaho Election To Claim The Qualified

The partnership must provide each. Web instructions idaho the gem state if you need to change or amend an accepted idaho state income tax return for the current or previous tax year, you need to complete. The retirement annuities eligible for this deduction on the idaho state return include: Web additional information, per idaho form 39r instructions, page 32: Download.

Idaho Sales Tax Exemption Form St 133 20202021 Fill and Sign

Web income tax for partnerships. Web this rule implements the following statutes passed by the idaho legislature: Web by signing this form, i certify that the statements i made on this form are true and correct. Web partnership return of income and instructions. Web individual income tax forms (current) individual income tax forms (archive) property tax forms.

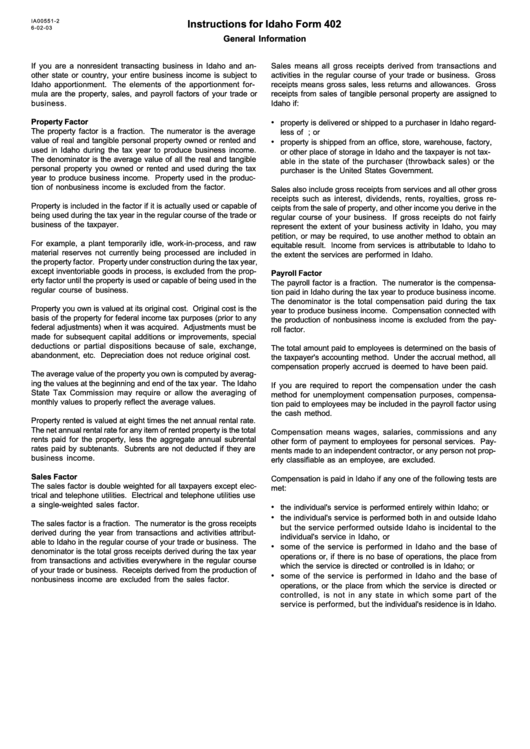

Instructions For Idaho Form 402 printable pdf download

Line 15 maintaining a home for the aged. 03/12/2023 question what are some common. Web by signing this form, i certify that the statements i made on this form are true and correct. Include on this line any amounts included. The retirement annuities eligible for this deduction on the idaho state return include:

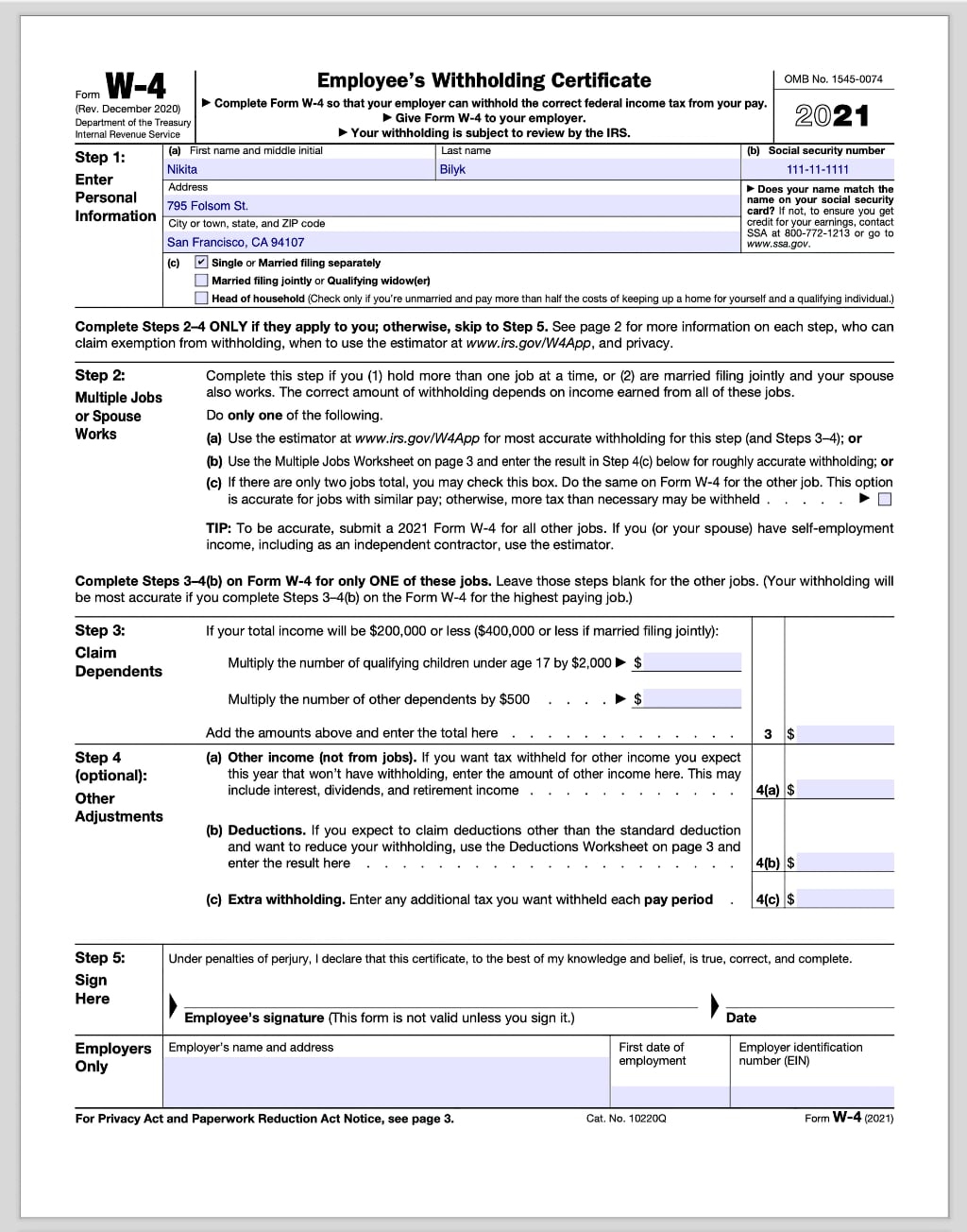

Idaho W 4 2021 2022 W4 Form

Web you may deduct $1,000 for each family member, not including yourself or your spouse, who is age 65 or older and for whom you maintain a household and provide more than one. Web if the idaho partnership return of income, form 65 is filed within the automatic extension period, but less than 80% of the current year tax liability.

Web Residents Who Are Age 65 Or Older, Or Age 62 Or Older And Disabled.

Is age 65 or older you maintain a household. Include a schedule identifying each deduction. Web idaho has a state income tax that ranges between 1.125% and 6.925%, which is administered by the idaho state tax commission. Web partnership return of income and instructions.

Web Most Taxpayers Are Required To File A Yearly Income Tax Return In April To Both The Internal Revenue Service And Their State's Revenue Department, Which Will Result In Either A Tax.

I know that submitting false information can result in criminal and civil. 03/12/2023 question what are some common. Web • every idaho resident who must file a federal income tax return idaho resident filing requirements if your filing status is: Web instructions idaho the gem state if you need to change or amend an accepted idaho state income tax return for the current or previous tax year, you need to complete.

The Partnership Must Provide Each.

This form shows the partner’s. Web line 15 maintaining a home for the aged you can deduct $1,000 for each family member, not including yourself or your spouse who: Partnership return of income and instructions 2022. You can deduct $1,000 for each family member, not including.

Web Individual Income Tax Forms (Current) Individual Income Tax Forms (Archive) Property Tax Forms.

Web 2021 instructions are for lines not fully explained on the form. Web idaho rules for electronic filing and service (i.r.e.f.s.) rule 1. Web this rule implements the following statutes passed by the idaho legislature: You’re doing business in idaho.