Il Form 1065

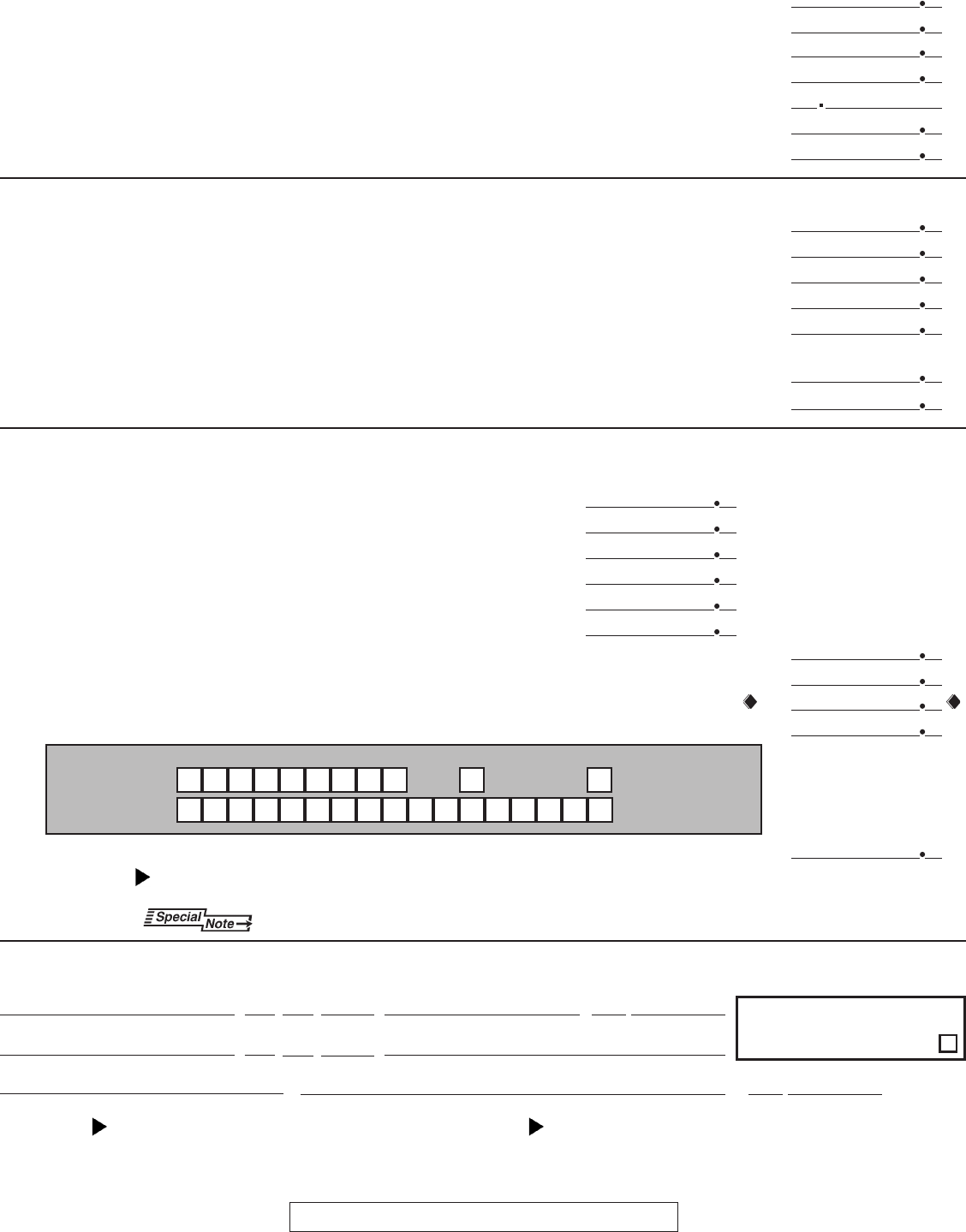

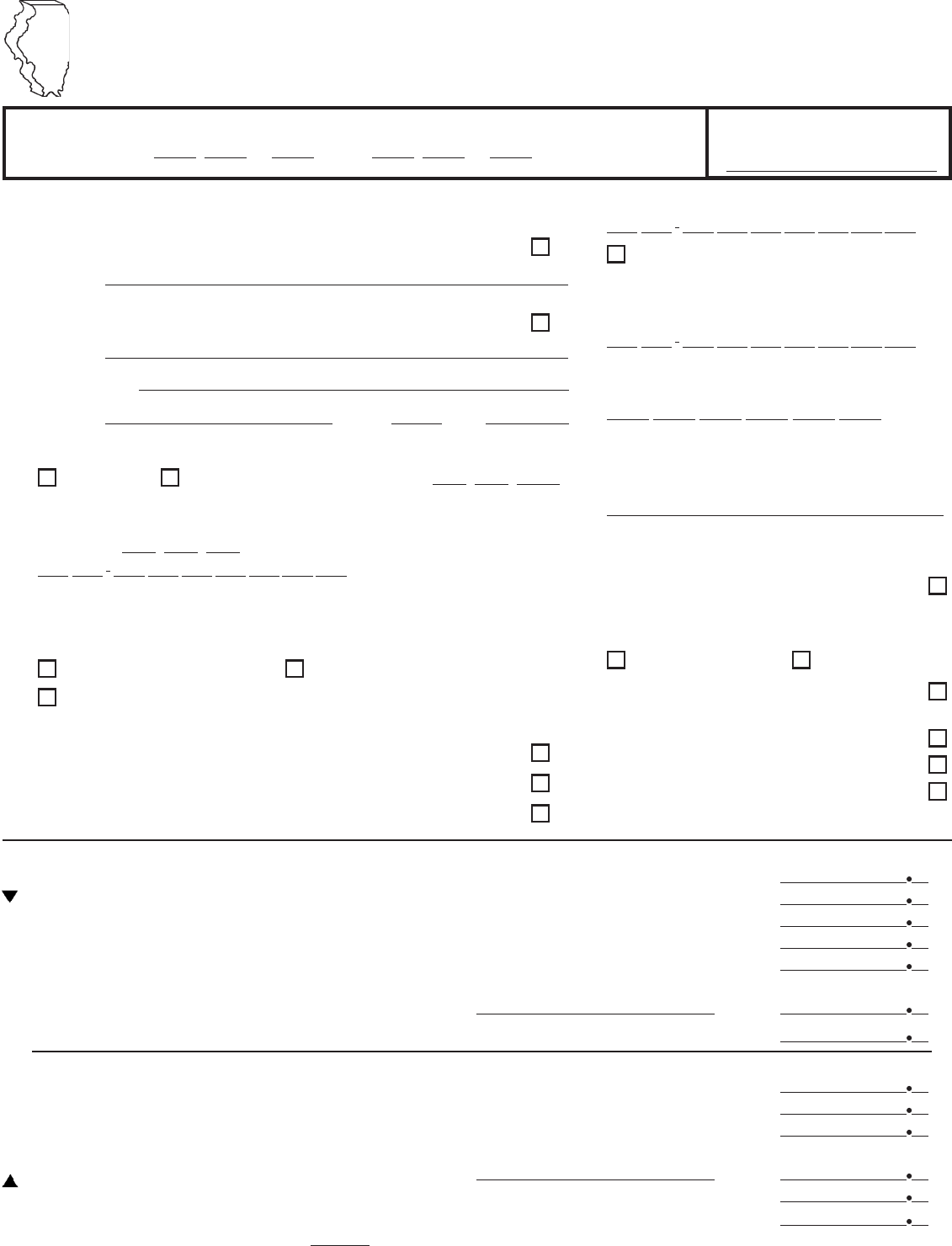

Il Form 1065 - And the total assets at the end of the tax year are: Use the following internal revenue service center address: If this return is not for calendar year 2022, enter your fiscal tax year here. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If the partnership's principal business, office, or agency is located in: Enter your federal employer identification number (fein). Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Your change can occur from a state Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Web where to file your taxes for form 1065.

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. And the total assets at the end of the tax year are: If this return is not for calendar year 2022, enter your fiscal tax year here. Use the following internal revenue service center address: Your change can occur from a state Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Or getting income from u.s. Year ending month year il attachment no. Web where to file your taxes for form 1065. Enter your federal employer identification number (fein).

If the partnership's principal business, office, or agency is located in: If this return is not for calendar year 2022, enter your fiscal tax year here. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Year ending month year il attachment no. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Month day year month day year. And the total assets at the end of the tax year are: Your change can occur from a state This form is for tax years ending on or after december 31, 2022, and before december 31, 2023.

Download Instructions for Form IL1065 Partnership Replacement Tax

Use the following internal revenue service center address: Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. And the total assets at the end of the tax year are: Web where to file your taxes for form 1065. Month day year month day year.

2014 Form Il1065, Partnership Replacement Tax Return Edit, Fill

Use the following internal revenue service center address: And the total assets at the end of the tax year are: If this return is not for calendar year 2022, enter your fiscal tax year here. If the partnership's principal business, office, or agency is located in: Web where to file your taxes for form 1065.

2013 Form Il1065, Partnership Replacement Tax Return Edit, Fill

And the total assets at the end of the tax year are: Web where to file your taxes for form 1065. If this return is not for calendar year 2022, enter your fiscal tax year here. Month day year month day year. Your change can occur from a state

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Month day year month day year. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Year ending month year il attachment no. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If this return is not for calendar.

2008 Form 1065 Edit, Fill, Sign Online Handypdf

Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Month day year month day year. Use the following internal revenue service center address: Enter your federal employer identification number (fein). If this return is not for calendar year 2022, enter your fiscal tax year here.

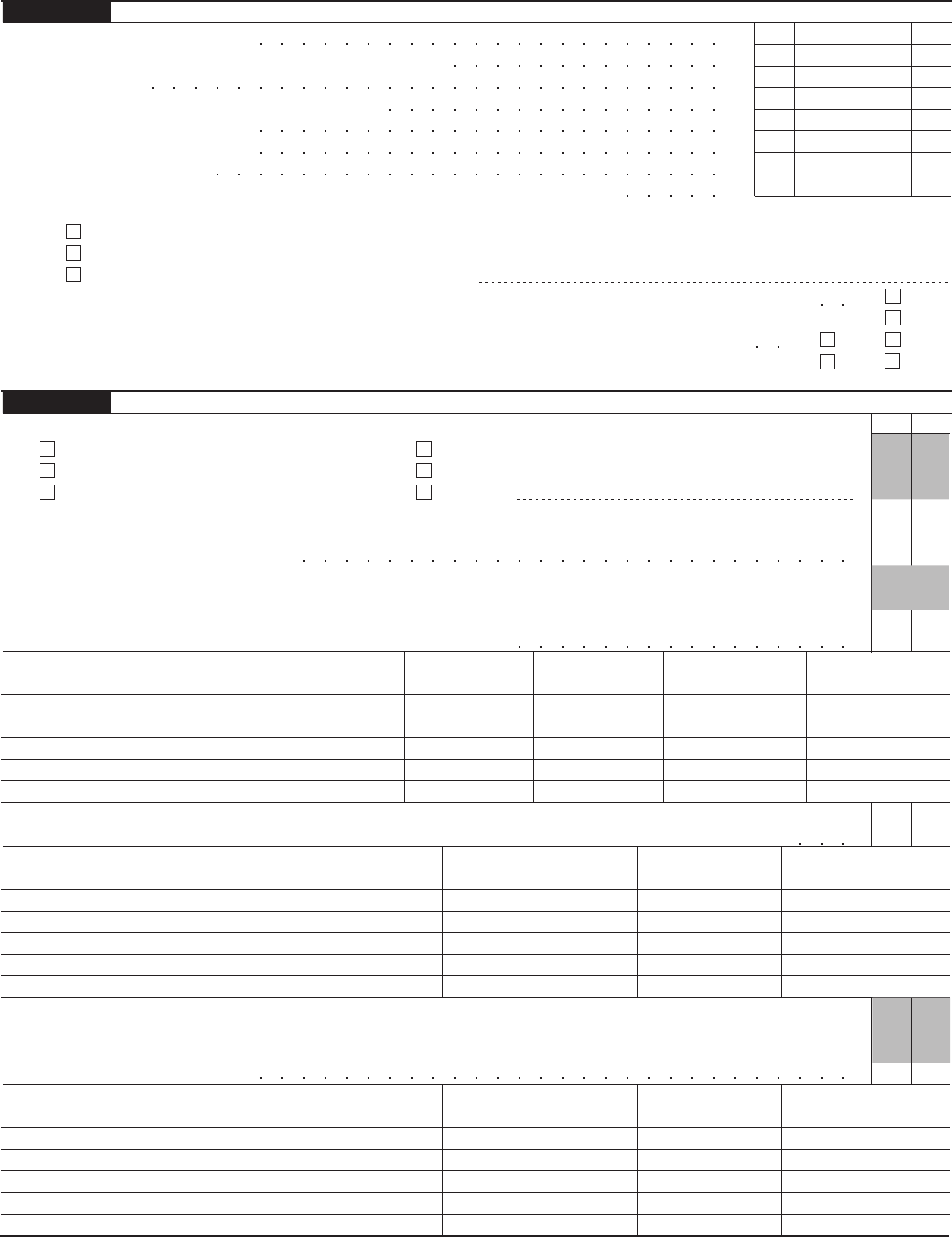

Fillable Form Il1065X Amended Partnership Replacement Tax Return

Year ending month year il attachment no. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If the partnership's principal business, office, or agency is located in: Web where to file your taxes for form 1065. Month day year month day year.

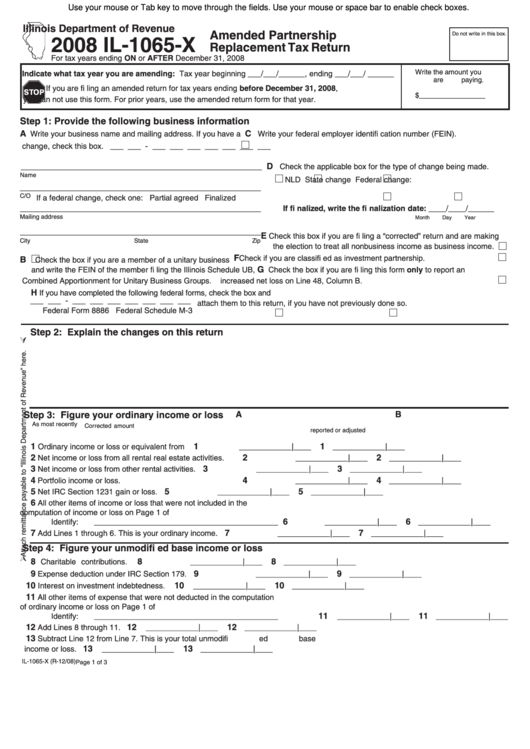

Download Instructions for Form IL1065X Amended Partnership

If the partnership's principal business, office, or agency is located in: Enter your federal employer identification number (fein). Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Or getting income from u.s.

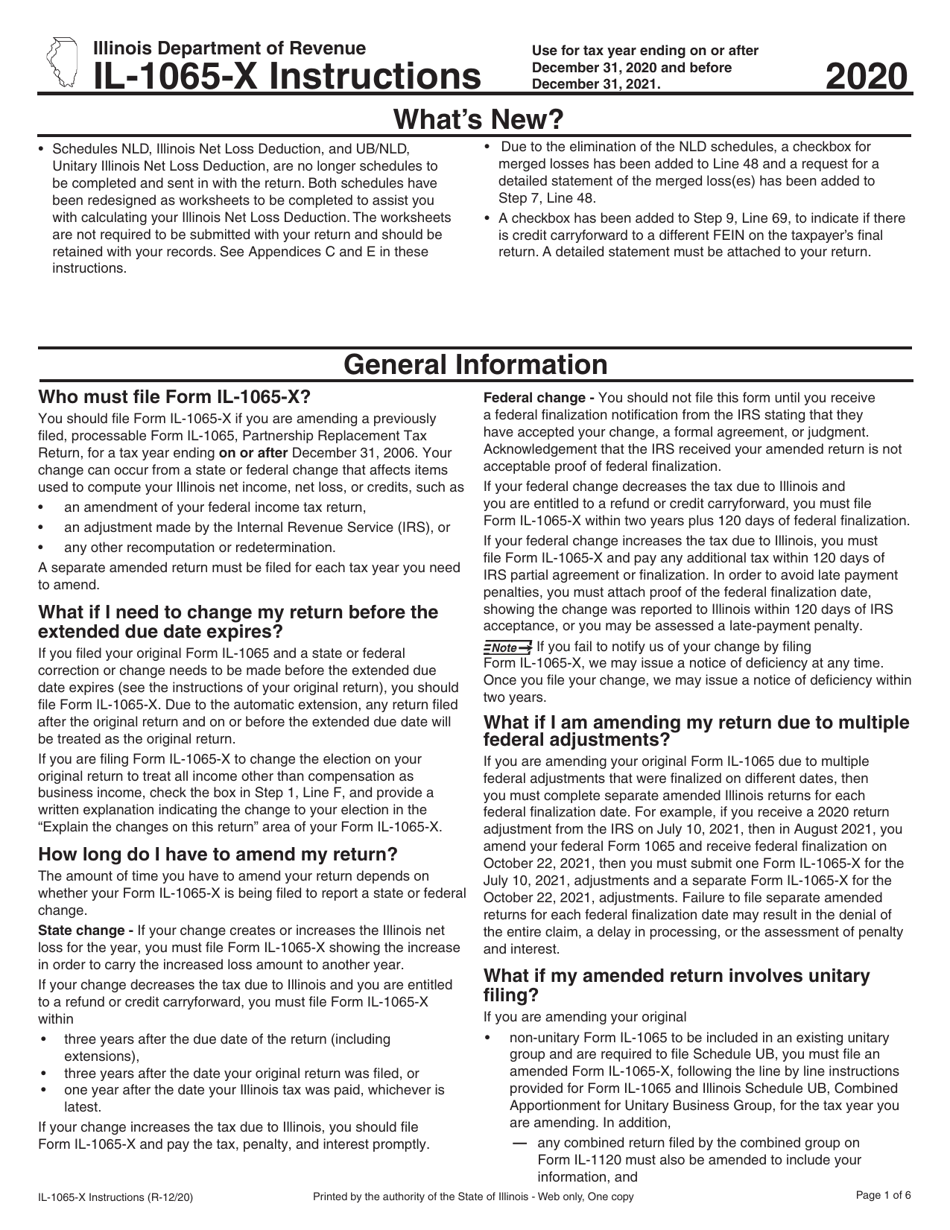

Form IL1065 Schedule F Download Fillable PDF or Fill Online Gains From

Enter your federal employer identification number (fein). Month day year month day year. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Your change can occur from a state If the partnership's principal business, office, or agency is located in:

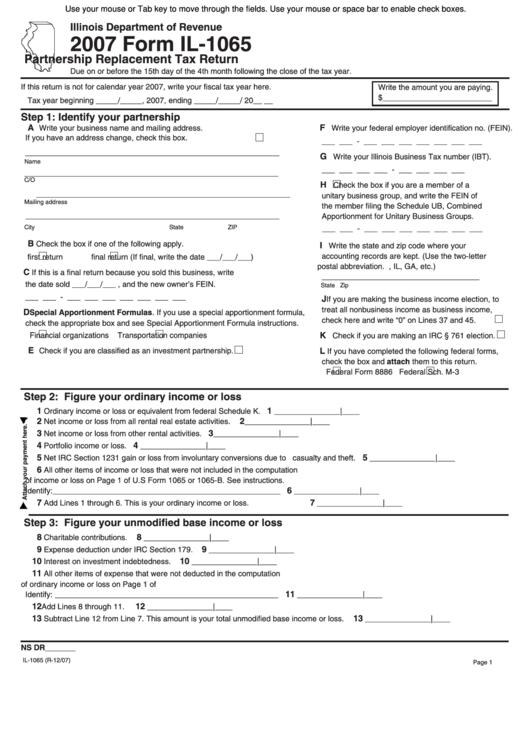

Fillable Form Il1065 Partnership Replacement Tax Return 2007

Year ending month year il attachment no. And the total assets at the end of the tax year are: If the partnership's principal business, office, or agency is located in: Your change can occur from a state Partnerships file an information return to report their income, gains, losses, deductions, credits, etc.

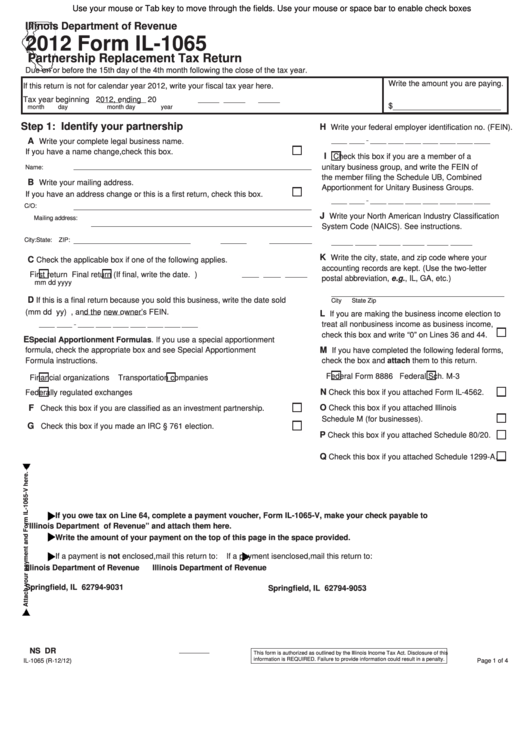

Fillable Form Il1065, Partnership Replacement Tax Return 2012

If this return is not for calendar year 2022, enter your fiscal tax year here. If the partnership's principal business, office, or agency is located in: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Use the following internal revenue service center address: Your change can occur from a state

Or Getting Income From U.s.

Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. If the partnership's principal business, office, or agency is located in: Use the following internal revenue service center address: Your change can occur from a state

Enter Your Federal Employer Identification Number (Fein).

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. If this return is not for calendar year 2022, enter your fiscal tax year here. Year ending month year il attachment no. Month day year month day year.

Partnerships File An Information Return To Report Their Income, Gains, Losses, Deductions, Credits, Etc.

Web where to file your taxes for form 1065. And the total assets at the end of the tax year are: This form is for tax years ending on or after december 31, 2022, and before december 31, 2023.