Indiana Form 103 Long Instructions

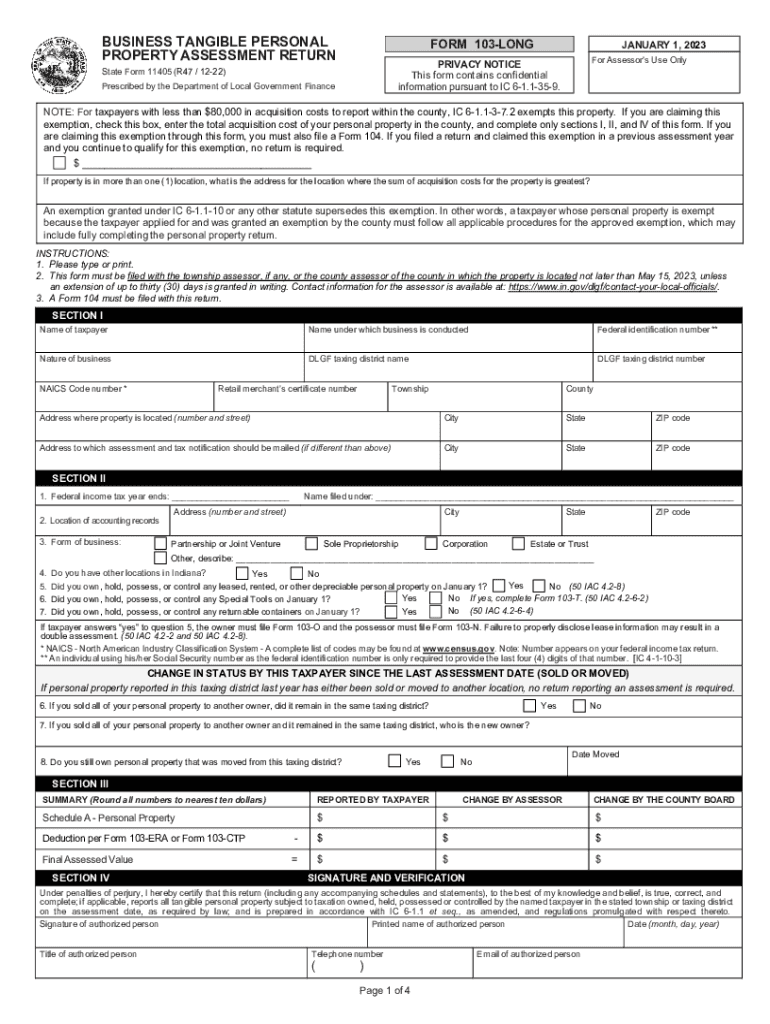

Indiana Form 103 Long Instructions - A separate schedule must be completed and attached to. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds. Download / view document file. Open it right away and start making it your. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not. Web 5 rows we last updated the business tangible personal property assessment return in january 2023, so this. Web date of record:07/06/18 13:47. Download this form print this form more about the. Web start on page 2 of theform 103—short.

This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than. Open it right away and start making it your. A separate schedule must be completed and attached to. Web business tangible personal property assessment return. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not. Download / view document file. Indiana’s tax reporting yearfor personal property coversthose items you purchased frommarch 2, 2010until march1, 2011. Web 5 rows we last updated the business tangible personal property assessment return in january 2023, so this. Download this form print this form more about the.

This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not. Download this form print this form more about the. Download / view document file. Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds. Open it right away and start making it your. Web start on page 2 of theform 103—short. Web claim for exemption of air or water pollution control facilities. Web business tangible personal property assessment return. A separate schedule must be completed and attached to.

Indiana State Form St 103 Form Resume Examples 023dQOVL8N

Indiana’s tax reporting yearfor personal property coversthose items you purchased frommarch 2, 2010until march1, 2011. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than. Web up to $40 cash back over 25 million fillable forms are available on our website, and you.

Indiana Form St 103 Instructions Form Resume Examples 91mDynMGp0

Web date of record:07/06/18 13:47. Download / view document file. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds. Web start on page 2 of theform 103—short. Download this form print this form more about the.

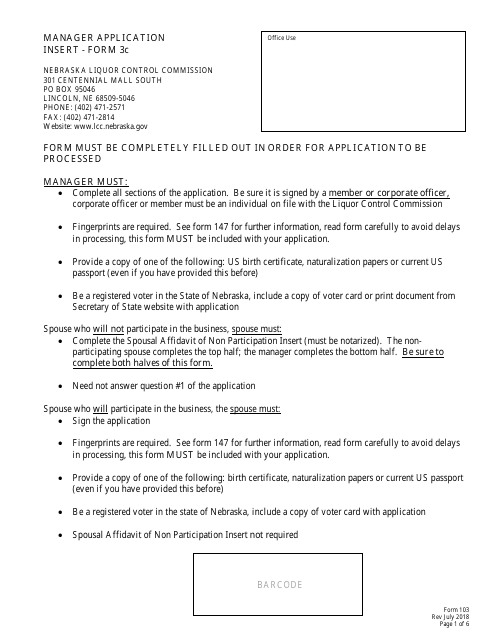

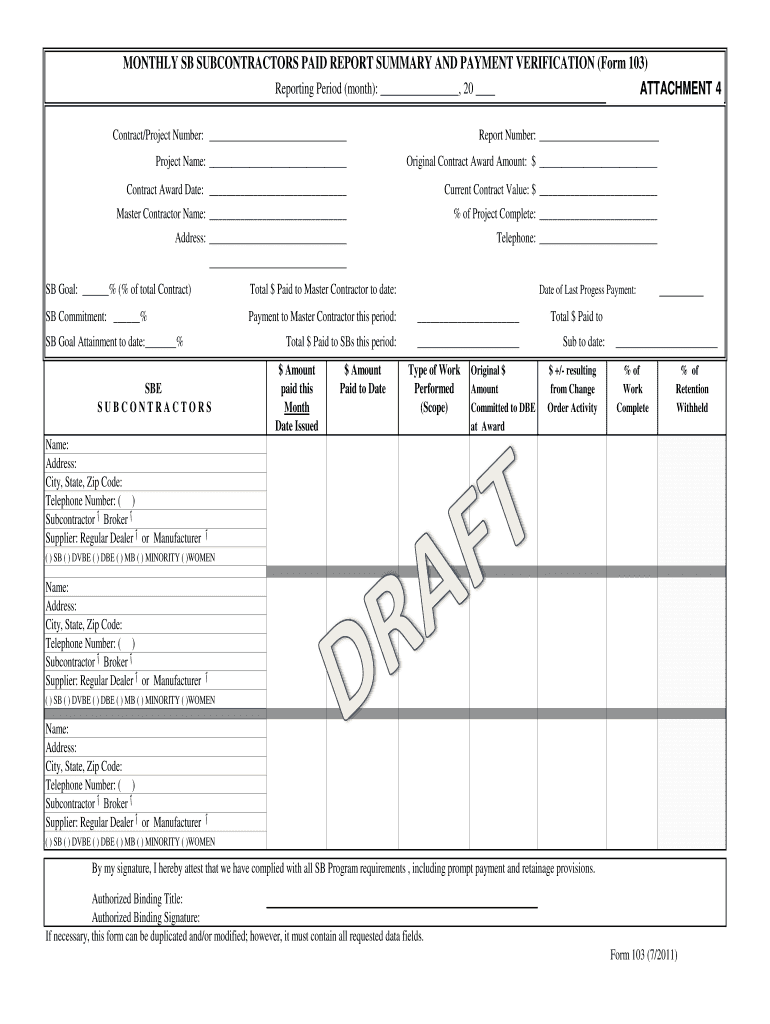

Form 103 (3C) Download Fillable PDF or Fill Online Manager Application

Open it right away and start making it your. Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. Web date of record:07/06/18 13:47. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a.

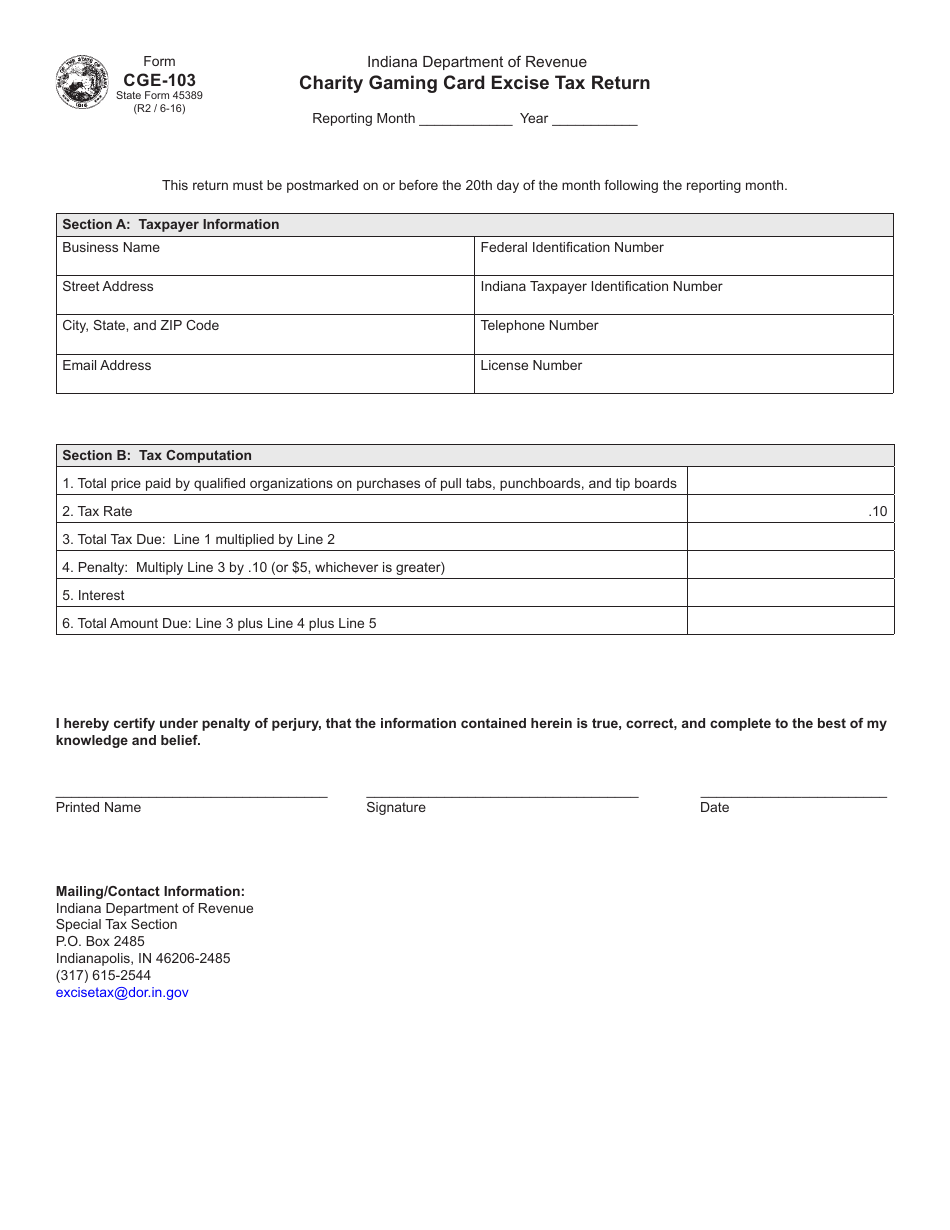

Form CGE103 (State Form 45389) Download Fillable PDF or Fill Online

Download this form print this form more about the. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds. Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. This form.

Form 103 Indiana Fill Out and Sign Printable PDF Template signNow

A separate schedule must be completed and attached to. Download / view document file. Web 5 rows we last updated the business tangible personal property assessment return in january 2023, so this. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than. Yes.

Indiana St 103 Fill Online, Printable, Fillable, Blank pdfFiller

Web start on page 2 of theform 103—short. Indiana’s tax reporting yearfor personal property coversthose items you purchased frommarch 2, 2010until march1, 2011. Download this form print this form more about the. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not. Web claim for.

Indiana Dot Cdl Physical Form Form Resume Examples goVLdXJgVv

Download / view document file. Web start on page 2 of theform 103—short. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds. Web 5 rows we last updated the business tangible personal property assessment return in january 2023, so this..

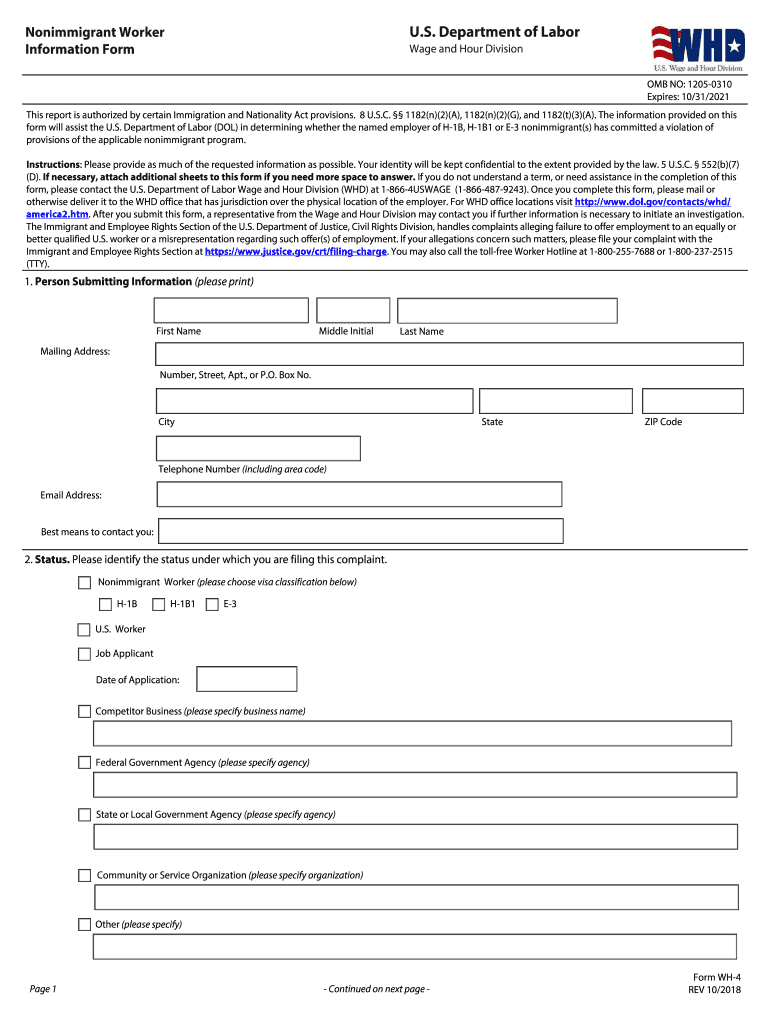

Form Wh 4 Fill Out and Sign Printable PDF Template signNow

Web start on page 2 of theform 103—short. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter.

Form 103 Fill Out and Sign Printable PDF Template signNow

Download / view document file. Web business tangible personal property assessment return. Web date of record:07/06/18 13:47. A separate schedule must be completed and attached to. Download this form print this form more about the.

Hawaii R Duty Reserve Fill Online, Printable, Fillable, Blank pdfFiller

A separate schedule must be completed and attached to. Open it right away and start making it your. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than. Web business tangible personal property assessment return. Download / view document file.

Web Start On Page 2 Of Theform 103—Short.

Open it right away and start making it your. Yes no if you answered “no”, round the true tax value above to the nearest $10 and enter that amount. Web business tangible personal property assessment return. Web up to $40 cash back over 25 million fillable forms are available on our website, and you can find the 103 form indiana in a matter of seconds.

Web 5 Rows We Last Updated The Business Tangible Personal Property Assessment Return In January 2023, So This.

Download this form print this form more about the. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not later than. Download / view document file. Web date of record:07/06/18 13:47.

Indiana’s Tax Reporting Yearfor Personal Property Coversthose Items You Purchased Frommarch 2, 2010Until March1, 2011.

Web claim for exemption of air or water pollution control facilities. This form must be filed with the township assessor, if any, or the county assessor of the county in which the property is located not. A separate schedule must be completed and attached to.