Individual Tax Returns Are Due On For Calendaryear Individuals

Individual Tax Returns Are Due On For Calendaryear Individuals - Due dates that fall on a saturday,. For the year are usually due on april 15 of the following. 15 april) unless that day is a saturday,. Everything to know about 2024 tax deadlines and dates. Web usually, taxes are due on april 15th every year. Web washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when the tax agency will. Web information about form 1040, u.s. The deadline has been pushed from. Web if you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally april 15 of each year. Individual income tax return, including recent updates, related forms and instructions on how to file.

However, unless the irs has stipulated a required year, a tax. Form 1040 is used by citizens or residents. Web information about form 1040, u.s. Individual income tax return, including recent updates, related forms and instructions on how to file. Web individuals are subject to a calendar tax year beginning jan. 10, 2024 — the internal revenue service announced today tax relief for individuals and businesses in connecticut that were affected by severe storms,. 15 april) unless that day is a saturday,. Personal nonrefundable credits should be applied to a taxpayer's tax liability before other types of credits. Web washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when the tax agency will. For the year are usually due on april 15 of the following.

For the year are usually due on april 15 of the following. Individual income tax return, including recent updates, related forms and instructions on how to file. 15 april) unless that day is a saturday,. The deadline has been pushed from. Personal nonrefundable credits should be applied to a taxpayer's tax liability before other types of credits. Web individuals are subject to a calendar tax year beginning jan. Web usually, taxes are due on april 15th every year. Web the due date for tax returns varies based on the type of taxpayer. Due dates that fall on a saturday,. Though this date may be shifted for holidays or weekends, the tax filing date for 2024 remains april 15th.

Personal Tax Returns Penrith Maximum Refunds A Grade Tax

15 april) unless that day is a saturday,. Web the due date for tax returns varies based on the type of taxpayer. Web washington — the internal revenue service reminds taxpayers that the deadline for filing most individual income tax returns this year is may 17. Web if you're a calendar year filer and your tax year ends on december.

What is an Individual Tax Return?

Web according to the irs, when an individual files tax returns for the calendar year, the due date for filing your federal individual income tax return is always april 15 annually. 15 april) unless that day is a saturday,. Web washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when.

Individual Tax Return Everything you need to know Taxopia

Everything to know about 2024 tax deadlines and dates. Web for most taxpayers, the main income tax return deadline for 2020 tax returns is may 17, 2021 — aka irs tax day 2021. Web normally individuals, sole proprietors, partnerships, and s corporations utilize a calendar year/required year filing. For the year are usually due on april 15 of the following..

Streamline Your Individual Tax Forms and Returns with LodgeiT

Web for most taxpayers, the main income tax return deadline for 2020 tax returns is may 17, 2021 — aka irs tax day 2021. Tax returns in the u.s. Due dates that fall on a saturday,. Web the due date for tax returns varies based on the type of taxpayer. Web normally individuals, sole proprietors, partnerships, and s corporations utilize.

A Guide to Understanding US Individual Tax Returns

Web washington — the internal revenue service reminds taxpayers that the deadline for filing most individual income tax returns this year is may 17. Web washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when the tax agency will. Web information about form 1040, u.s. Web the due date for.

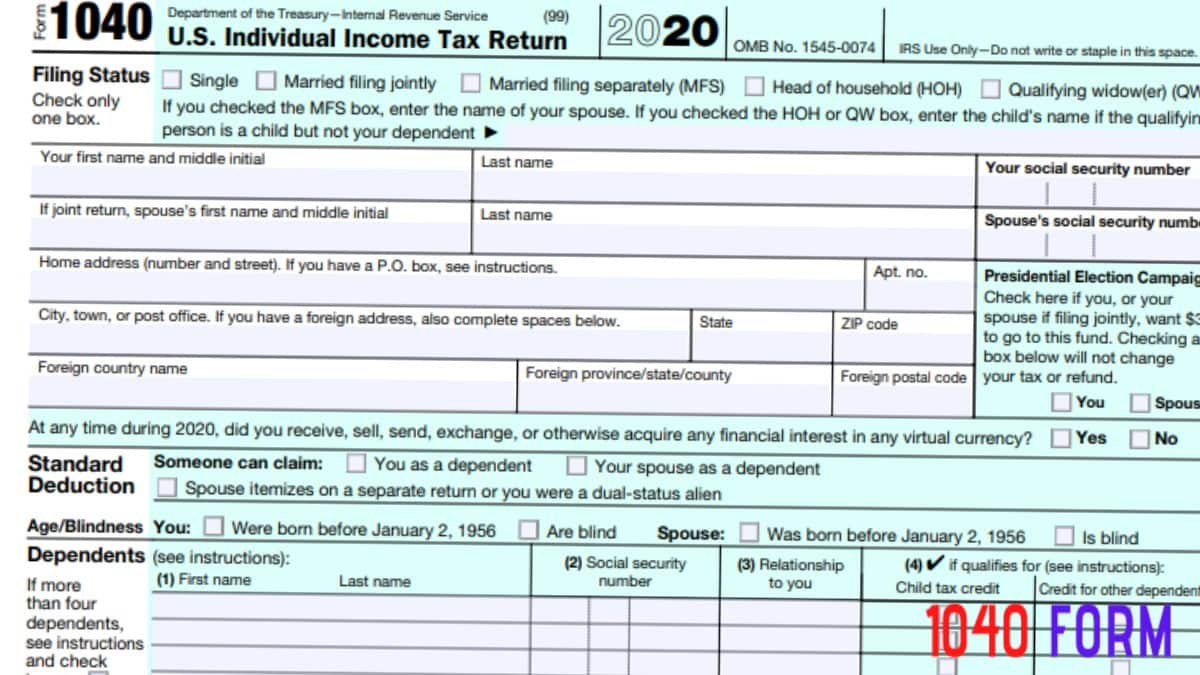

US Form 1040 Individual Tax Return Document Stock Image Image

Everything to know about 2024 tax deadlines and dates. Web if you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally april 15 of each year. For the year are usually due on april 15 of the following. Web washington — the internal revenue.

A Guide to Understanding US Individual Tax Returns

However, unless the irs has stipulated a required year, a tax. Web if you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally april 15 of each year. Individual income tax return, including recent updates, related forms and instructions on how to file. Personal.

Tax Return Printable Form

Tax returns in the u.s. Due dates that fall on a saturday,. Web individual income tax returns (form 1040) are due on the 15th day of the fourth month after the end of the tax year (i.e. Form 1040 is used by citizens or residents. Everything to know about 2024 tax deadlines and dates.

Form 1040 U.S. Individual Tax Return Definition

Due dates that fall on a saturday,. However, unless the irs has stipulated a required year, a tax. Web information about form 1040, u.s. Web according to the irs, when an individual files tax returns for the calendar year, the due date for filing your federal individual income tax return is always april 15 annually. Web washington — the internal.

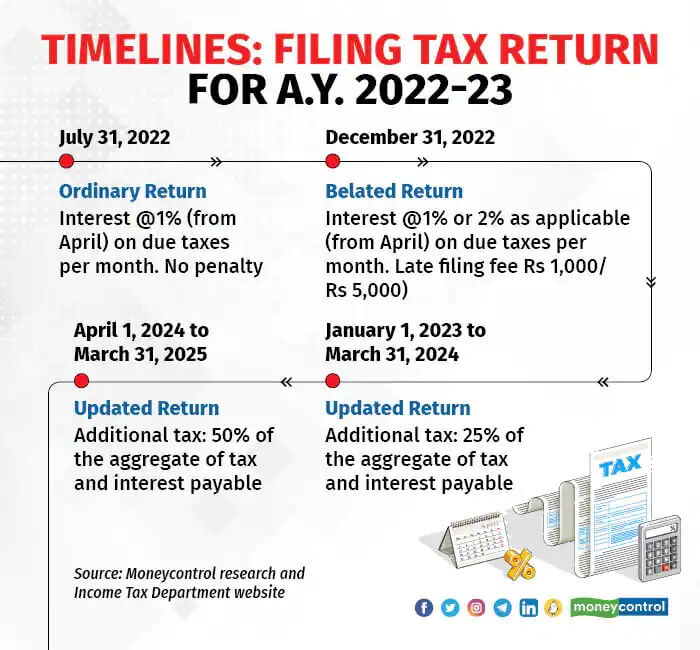

Filing Tax Returns after deadline

Web washington — the internal revenue service reminds taxpayers that the deadline for filing most individual income tax returns this year is may 17. Web normally individuals, sole proprietors, partnerships, and s corporations utilize a calendar year/required year filing. Web information about form 1040, u.s. Web washington — the internal revenue service announced that the nation's tax season will start.

Web The Due Date For Tax Returns Varies Based On The Type Of Taxpayer.

Web for most taxpayers, the main income tax return deadline for 2020 tax returns is may 17, 2021 — aka irs tax day 2021. Everything to know about 2024 tax deadlines and dates. Web according to the irs, when an individual files tax returns for the calendar year, the due date for filing your federal individual income tax return is always april 15 annually. 10, 2024 — the internal revenue service announced today tax relief for individuals and businesses in connecticut that were affected by severe storms,.

Web If You're A Calendar Year Filer And Your Tax Year Ends On December 31, The Due Date For Filing Your Federal Individual Income Tax Return Is Generally April 15 Of Each Year.

Web usually, taxes are due on april 15th every year. Tax returns in the u.s. Web normally individuals, sole proprietors, partnerships, and s corporations utilize a calendar year/required year filing. Web washington — the internal revenue service reminds taxpayers that the deadline for filing most individual income tax returns this year is may 17.

Due Dates That Fall On A Saturday,.

15 april) unless that day is a saturday,. Personal nonrefundable credits should be applied to a taxpayer's tax liability before other types of credits. Though this date may be shifted for holidays or weekends, the tax filing date for 2024 remains april 15th. The deadline has been pushed from.

Form 1040 Is Used By Citizens Or Residents.

Web individuals are subject to a calendar tax year beginning jan. Web individual income tax returns (form 1040) are due on the 15th day of the fourth month after the end of the tax year (i.e. However, unless the irs has stipulated a required year, a tax. Web washington — the internal revenue service announced that the nation's tax season will start on monday, january 24, 2022, when the tax agency will.

/GettyImages-184939771-10a77dd8e8b34ac7aaff499dfe09a657.jpg)