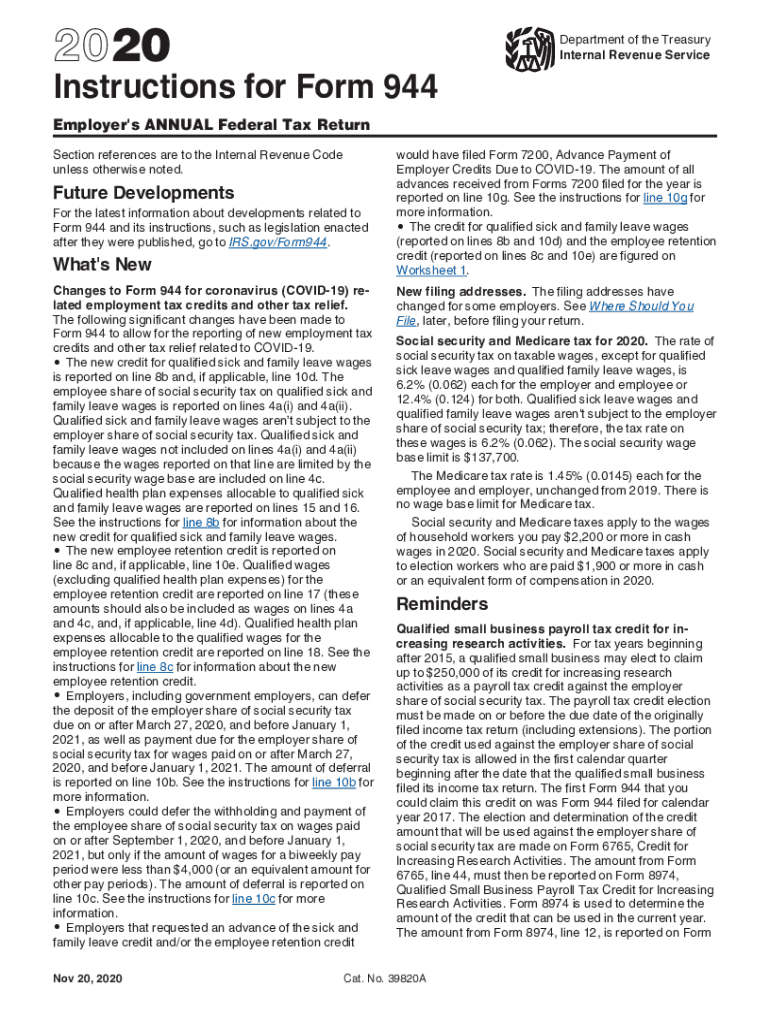

Instructions For Form 944

Instructions For Form 944 - Ad access irs tax forms. The form is divided into five different. The form is used instead of form 941. Web form 944 for 2022: Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. All employers are required to hold their employee’s fica (medicare and social security) and income. Or claim for refund, to replace form 941c, supporting statement to correct information. Get ready for tax season deadlines by completing any required tax forms today. Finalized versions of the 2020 form 944 and its instructions are available. If you are a child,.

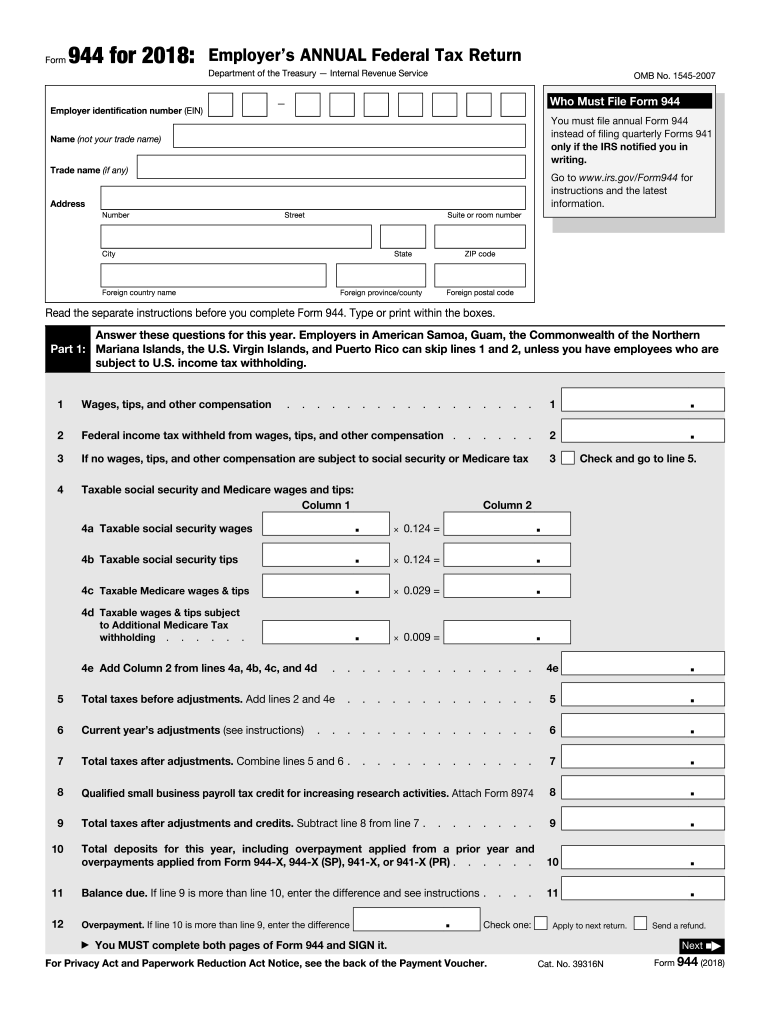

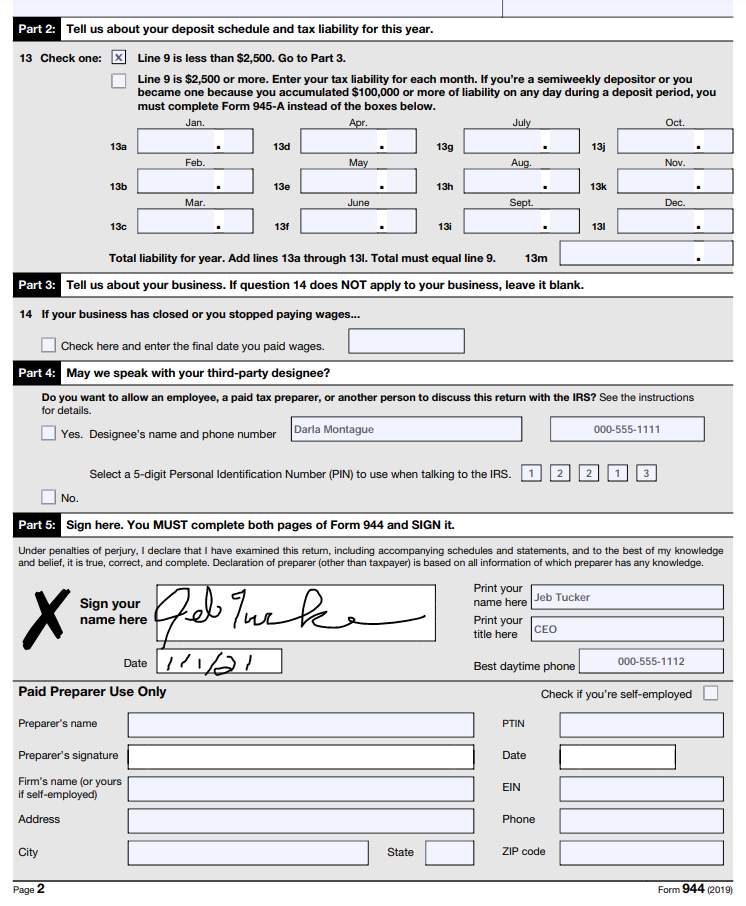

Web the total should equal line 1 on form 944. Who must file form 944. Web irs form 944 is an annual filing. Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. The deadline for filing the form is feb. For filing the employer's annual federal tax return, employers must know the. Or claim for refund, to replace form 941c, supporting statement to correct information. How should you complete form 944? Web though the form has instructions to guide you through filling it out, make sure you take your time to do it accurately. Double click the payroll item in question.

That means employers eligible to file form 944 are only required to complete and submit it once per year. To modify tax tracking for any payroll item: Employer’s annual federal tax return department of the treasury — internal revenue service. Ad access irs tax forms. For filing the employer's annual federal tax return, employers must know the. Who must file form 944? Web this 944 form is designed for small businesses with a tax liability of $1,000 or less. Web the irs form 944 takes the place of form 941 if a small business qualifies. Web “form 944,” and “2020” on your check or money order. Get ready for tax season deadlines by completing any required tax forms today.

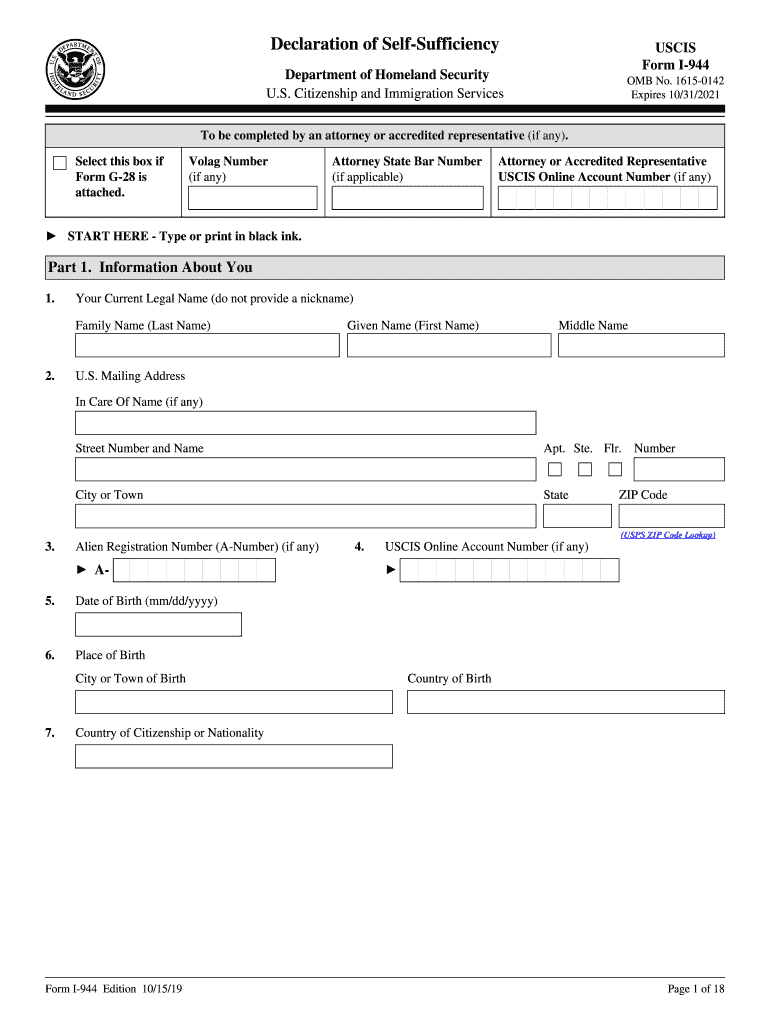

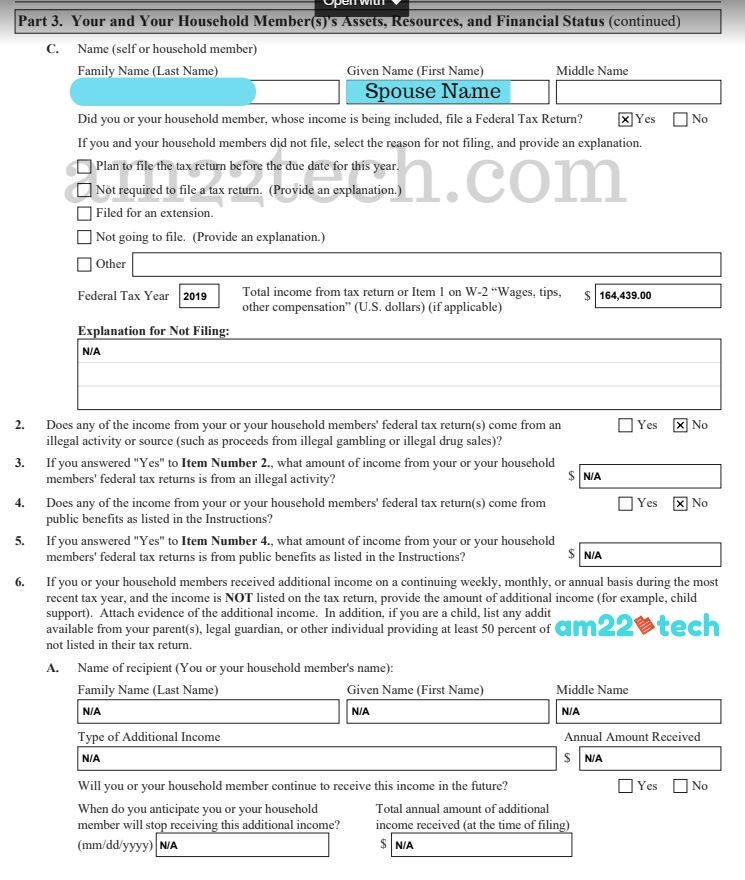

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

The form is used instead of form 941. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. Who must file form 944? However, if you made deposits on time in full payment of the.

2018 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

To modify tax tracking for any payroll item: Web the total should equal line 1 on form 944. The form is divided into five different. The deadline for filing the form is feb. The finalized versions of the.

Form 944 Internal Revenue Code Simplified

Get ready for tax season deadlines by completing any required tax forms today. Employer’s annual federal tax return department of the treasury — internal revenue service. Ad complete irs tax forms online or print government tax documents. Web the irs form 944 takes the place of form 941 if a small business qualifies. Double click the payroll item in question.

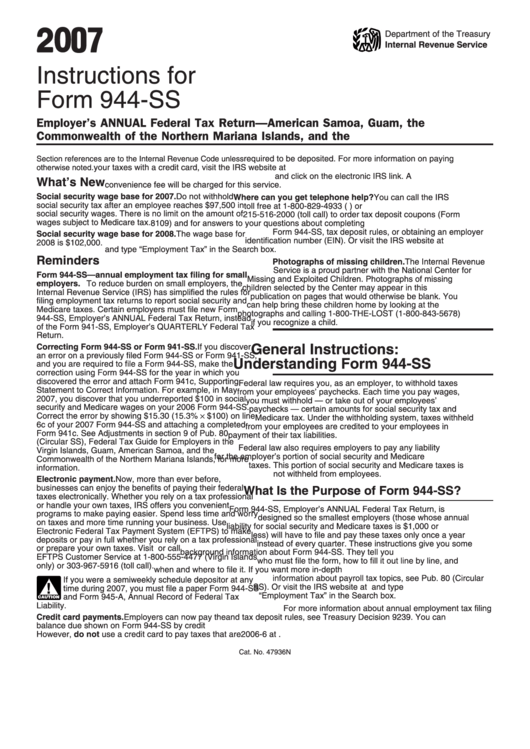

Instructions For Form 944Ss Employer'S Annual Federal Tax Return

Get ready for tax season deadlines by completing any required tax forms today. Who must file form 944. The finalized versions of the. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). The form is used instead of form 941.

Form i944 Self Sufficiency US Green Card (Documents Required) USA

Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. Or claim for refund, to replace form 941c, supporting statement to correct information. Web the total should equal line 1 on form 944. Complete, edit or print tax forms instantly. Web this 944 form is designed for small businesses with.

IRS 944 Instructions 2015 Fill out Tax Template Online US Legal Forms

Complete, edit or print tax forms instantly. Web though the form has instructions to guide you through filling it out, make sure you take your time to do it accurately. Employer’s annual federal tax return department of the treasury — internal revenue service. To modify tax tracking for any payroll item: Web form 944 for 2022:

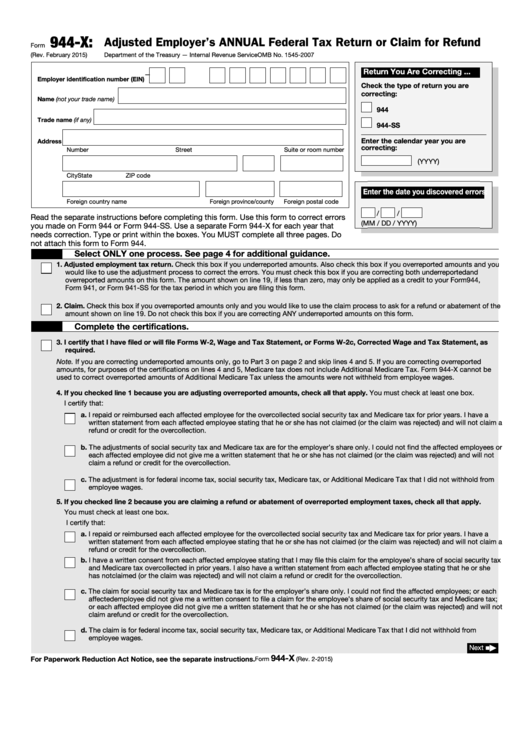

Fillable Form 944X Adjusted Employer'S Annual Federal Tax Return Or

For filing the employer's annual federal tax return, employers must know the. Web the irs form 944 takes the place of form 941 if a small business qualifies. However, if you made deposits on time in full payment of the. That means employers eligible to file form 944 are only required to complete and submit it once per year. Or.

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

Employer’s annual federal tax return department of the treasury — internal revenue service. All employers are required to hold their employee’s fica (medicare and social security) and income. Web this 944 form is designed for small businesses with a tax liability of $1,000 or less. Who must file form 944? Ad complete irs tax forms online or print government tax.

What Is Form 944? Plus Instructions

All employers are required to hold their employee’s fica (medicare and social security) and income. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. For filing the employer's annual federal tax return, employers must know the. Web irs form 944 is an annual filing.

IRS Form 944 LinebyLine Instructions 2022 Employer's Annual Federal

For the vast majority of these. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). For filing the employer's annual federal tax return, employers must know the. Complete, edit or print tax forms instantly. However, if you made deposits on time in full payment of the.

Web The Total Should Equal Line 1 On Form 944.

Web this 944 form is designed for small businesses with a tax liability of $1,000 or less. Web “form 944,” and “2020” on your check or money order. How should you complete form 944? The form is divided into five different.

Double Click The Payroll Item In Question.

Employer’s annual federal tax return department of the treasury — internal revenue service. The form is used instead of form 941. The deadline for filing the form is feb. All employers are required to hold their employee’s fica (medicare and social security) and income.

For Filing The Employer's Annual Federal Tax Return, Employers Must Know The.

Finalized versions of the 2020 form 944 and its instructions are available. Who must file form 944. Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. Web the irs form 944 takes the place of form 941 if a small business qualifies.

Web Irs Form 944 Is An Annual Filing.

That means employers eligible to file form 944 are only required to complete and submit it once per year. If you are a child,. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.