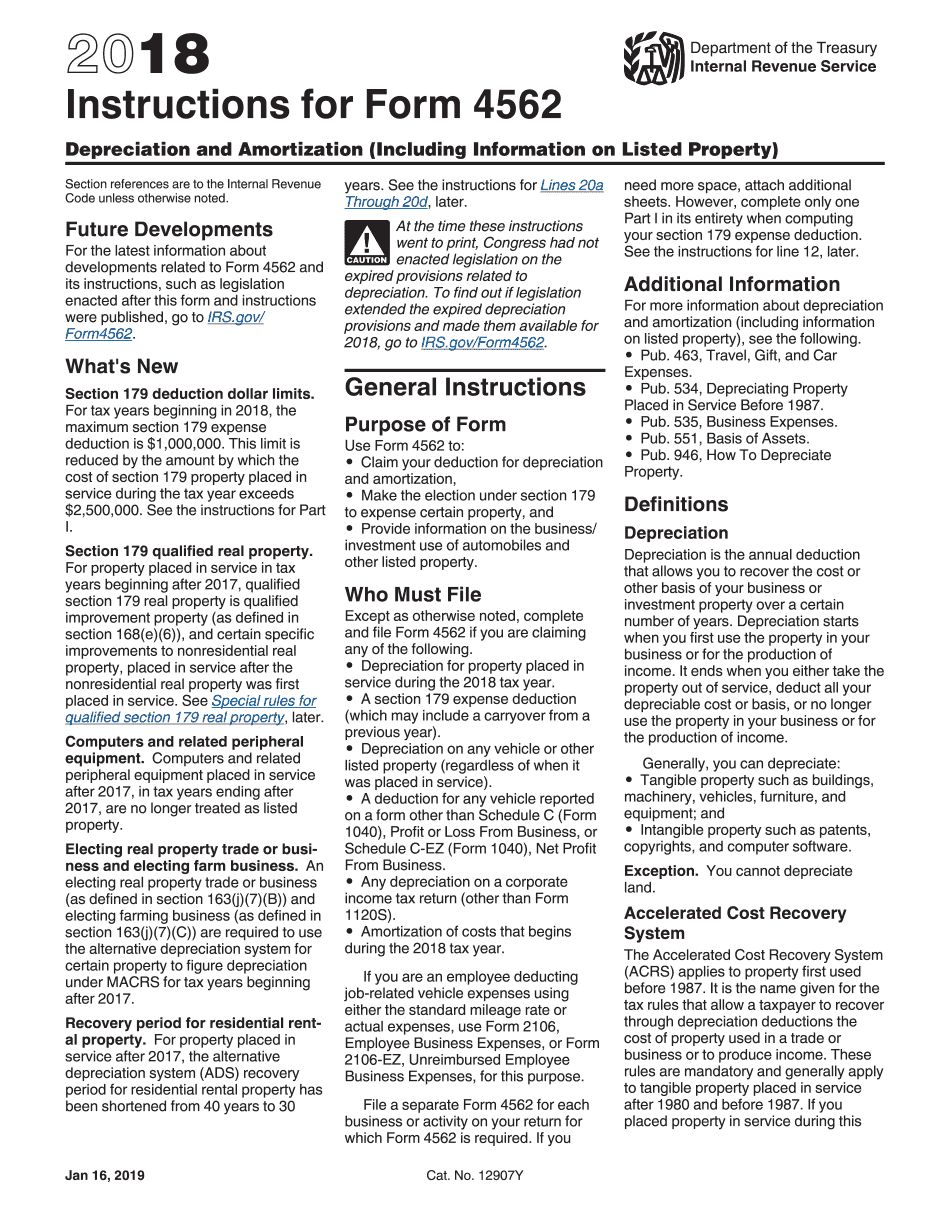

Instructions Form 4562

Instructions Form 4562 - Something you’ll need to consider is that the amount you can deduct depends on the amount of business income that’s taxable. Complete, edit or print tax forms instantly. Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the irs whenever. Total income you are reporting in the. Web what information do you need for form 4562? Department of the treasury 2002 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000. If you need more placed in service after october 3, 2008, (b) • certain machinery or equipment used in a space, attach additional sheets. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. Do not enter less than $25,000.

Web general instructions purpose of form use form 4562 to: 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years beginning on or after january 1, 2008. Web the instructions for form 4562 include a worksheet that you can use to complete part i. To properly fill out form 4562, you’ll need the following information: “2021 instructions for form 4562. Web what information do you need for form 4562? See the instructions for lines 20a through 20d, later. Try it for free now! Who must file except as otherwise noted, complete This form is for income earned in tax year 2022, with tax returns due in april 2023.

Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years beginning on or after january 1, 2008. First, you’ll need to gather all the financial records regarding your asset. Date of which your asset is put to use; Web the instructions for form 4562 include a worksheet that you can use to complete part i. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000. See the instructions for lines 20a through 20d, later. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted.

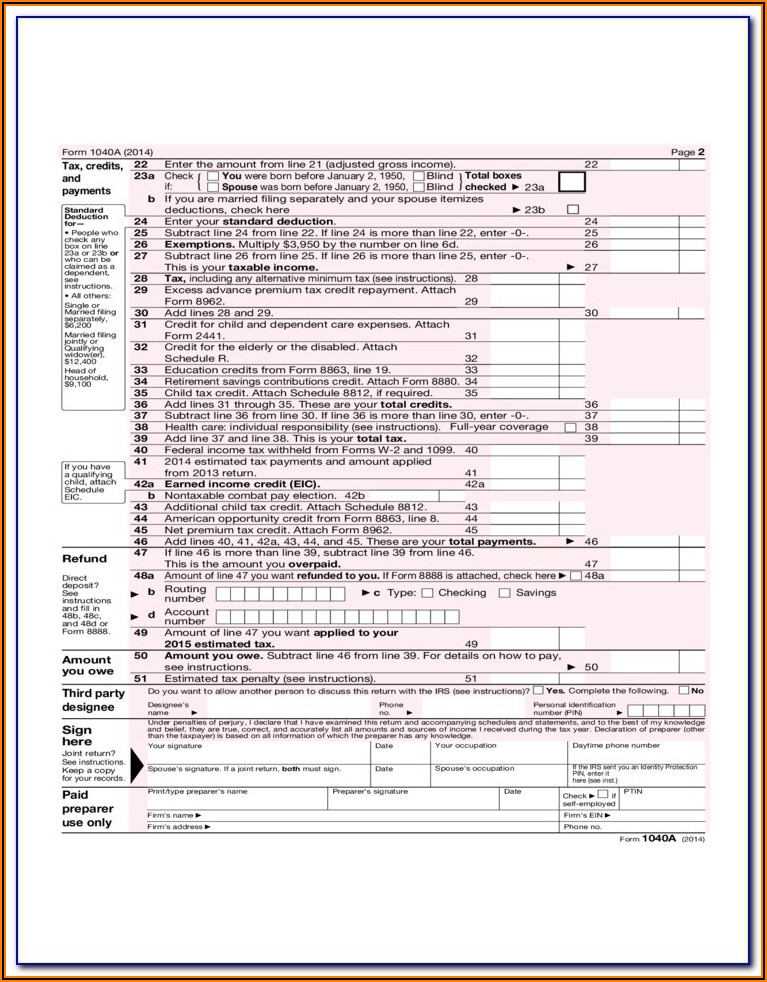

Pa Form W2 S Instructions Universal Network

Date of which your asset is put to use; Web the first part of irs form 4562 deals with the section 179 deduction. Here’s what each line should look like as outlined in the irs form 4562 instructions, along with a. Web general instructions purpose of form use form 4562 to: Try it for free now!

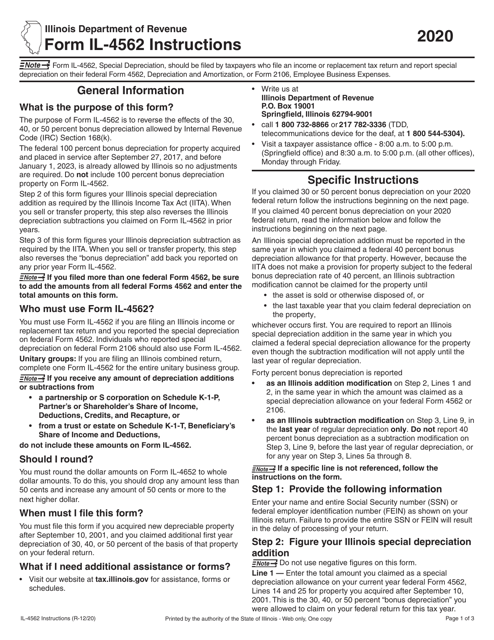

Download Instructions for Form IL4562 Special Depreciation PDF, 2020

Web the first part of irs form 4562 deals with the section 179 deduction. General instructions purpose of form use form 4562 to: Web total amounts on this form. Do not enter less than $25,000. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562.

Irs Form 1040x Instructions 2014 Form Resume Examples nO9bk6AY4D

Read and follow the directions for every section, by recording the value as directed on the form 4562. Date of which your asset is put to use; “2021 instructions for form 4562. Complete, edit or print tax forms instantly. Must be removed before printing.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in april 2023. Complete, edit or print tax forms instantly. Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000. Ad get ready for tax season deadlines by completing any required tax forms today. Web information about form.

Editable IRS Instructions 4562 2018 2019 Create A Digital Sample in PDF

You’ll need to list the property you’re claiming as the section 179 deduction, the price, and the amount you’re deducting. • enter the amount from line 2 of federal form 4562 on line 2 of minnesota form 4562. Web what information do you need for form 4562? Date of which your asset is put to use; Web information about form.

√ダウンロード example 60 hour driving log filled out 339415How to fill out

Get ready for tax season deadlines by completing any required tax forms today. Web form 4562 and the following modifications: Web what information do you need for form 4562? In order to write off eligible property in the first year it was purchased, you must include form 4562 with your taxes and elect the section 179 deduction. Web instructions for.

Irs Instructions Form 4562 Fill Out and Sign Printable PDF Template

Web the first part of irs form 4562 deals with the section 179 deduction. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web the instructions for form 4562 include a worksheet that you can use to complete part i. Try it for free now! Web what information do you.

Fillable IRS Form 4562 Depreciation and Amortization Printable

Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the irs whenever. Must be removed before printing. In order to write off eligible property in the first year it was purchased, you must include form 4562 with your taxes and elect the section 179 deduction. Web instructions for form.

Form Boc 3 Instructions Universal Network

• enter the amount from line 2 of federal form 4562 on line 2 of minnesota form 4562. Read and follow the directions for every section, by recording the value as directed on the form 4562. Department of the treasury 2002 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) Upload, modify or create.

Form 4562 Do I Need to File Form 4562? (with Instructions)

First, you’ll need to gather all the financial records regarding your asset. Web instructions for form 4562. Web form 4562 is required. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web we last updated federal form 4562 in december 2022 from the federal internal revenue service.

Web We Last Updated Federal Form 4562 In December 2022 From The Federal Internal Revenue Service.

Web instructions for form 4562. 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years beginning on or after january 1, 2008. Try it for free now! • enter the amount from line 2 of federal form 4562 on line 2 of minnesota form 4562.

Web The First Part Of Irs Form 4562 Deals With The Section 179 Deduction.

Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Total income you are reporting in the. Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the irs whenever. Fortunately, you may be able to carry over part of the deduction and claim it when filing taxes for the next tax year.

• Claim Your Deduction For Depreciation And Amortization, • Make The Election Under Section 179 To Expense Certain Property, And • Provide Information On The Business/ Investment Use Of Automobiles And Other Listed Property.

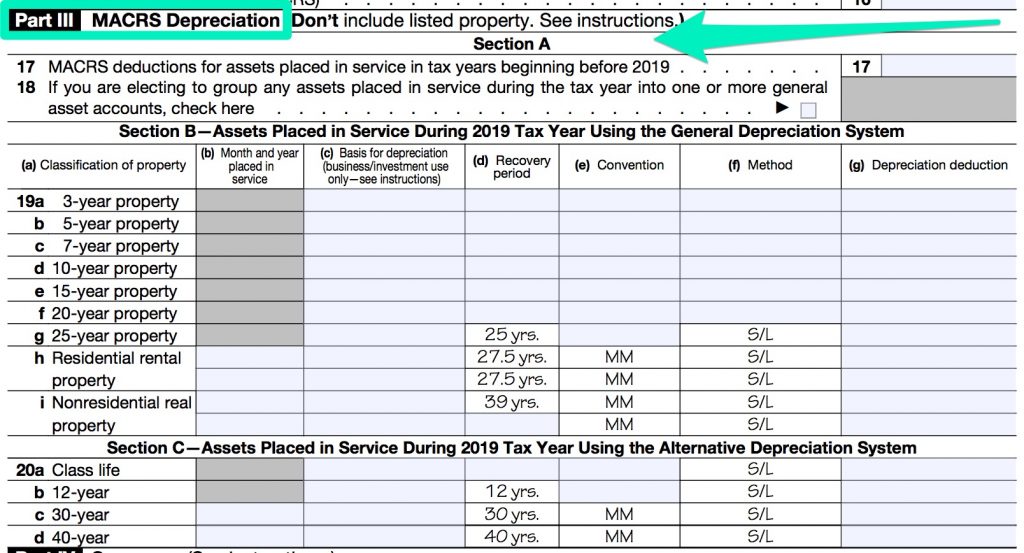

Get ready for tax season deadlines by completing any required tax forms today. Do not use part iii for automobiles and other listed property. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. General instructions purpose of form use form 4562 to:

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Federal Government.

Date of which your asset is put to use; Web the instructions for form 4562 include a worksheet that you can use to complete part i. Read and follow the directions for every section, by recording the value as directed on the form 4562. You’ll need to list the property you’re claiming as the section 179 deduction, the price, and the amount you’re deducting.