Irs 433D Form

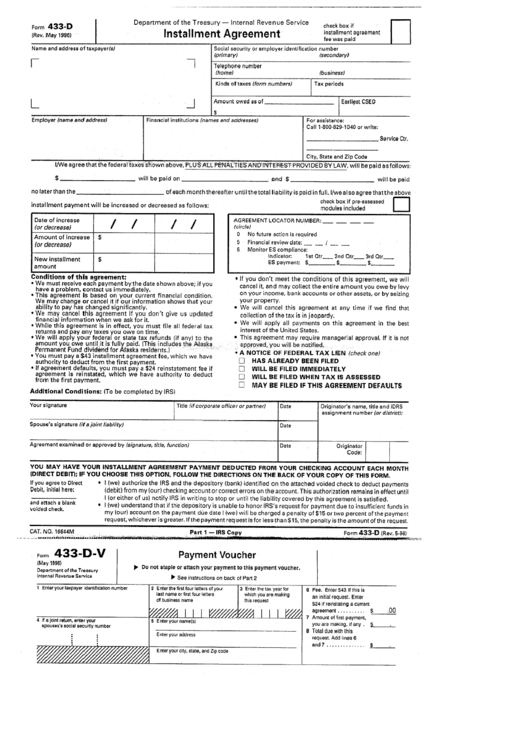

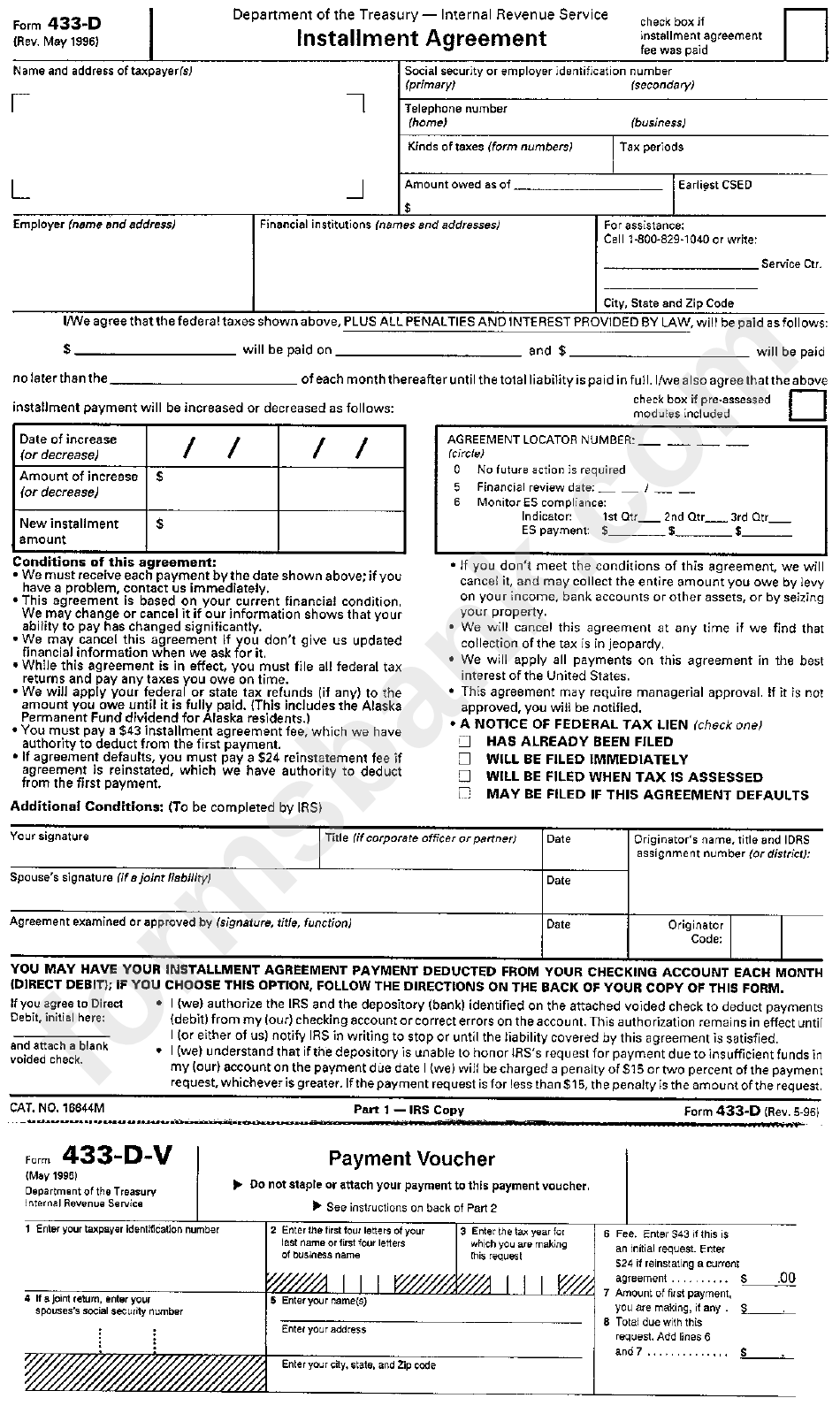

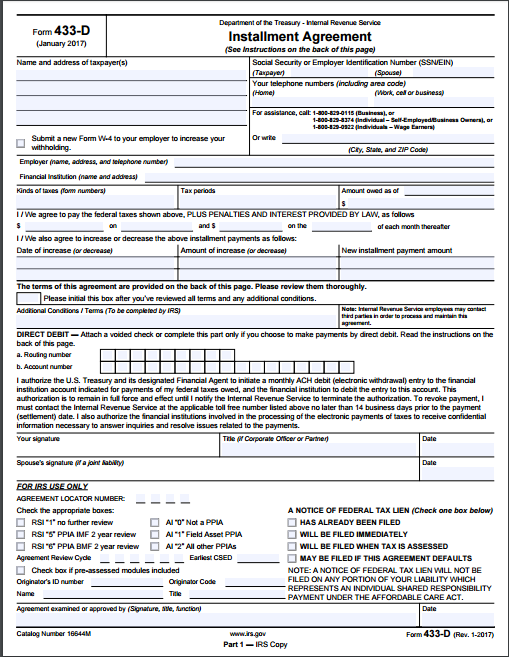

Irs 433D Form - This form is used by the united states internal revenue service. Web what is an irs form 433d? This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. You may not have the adobe reader installed or your viewing environment may not be properly. It shows the amount of your initial payment plus. Answer all questions or write n/a if the question is not. It is a form taxpayers can submit to authorize a direct debit payment method. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito.

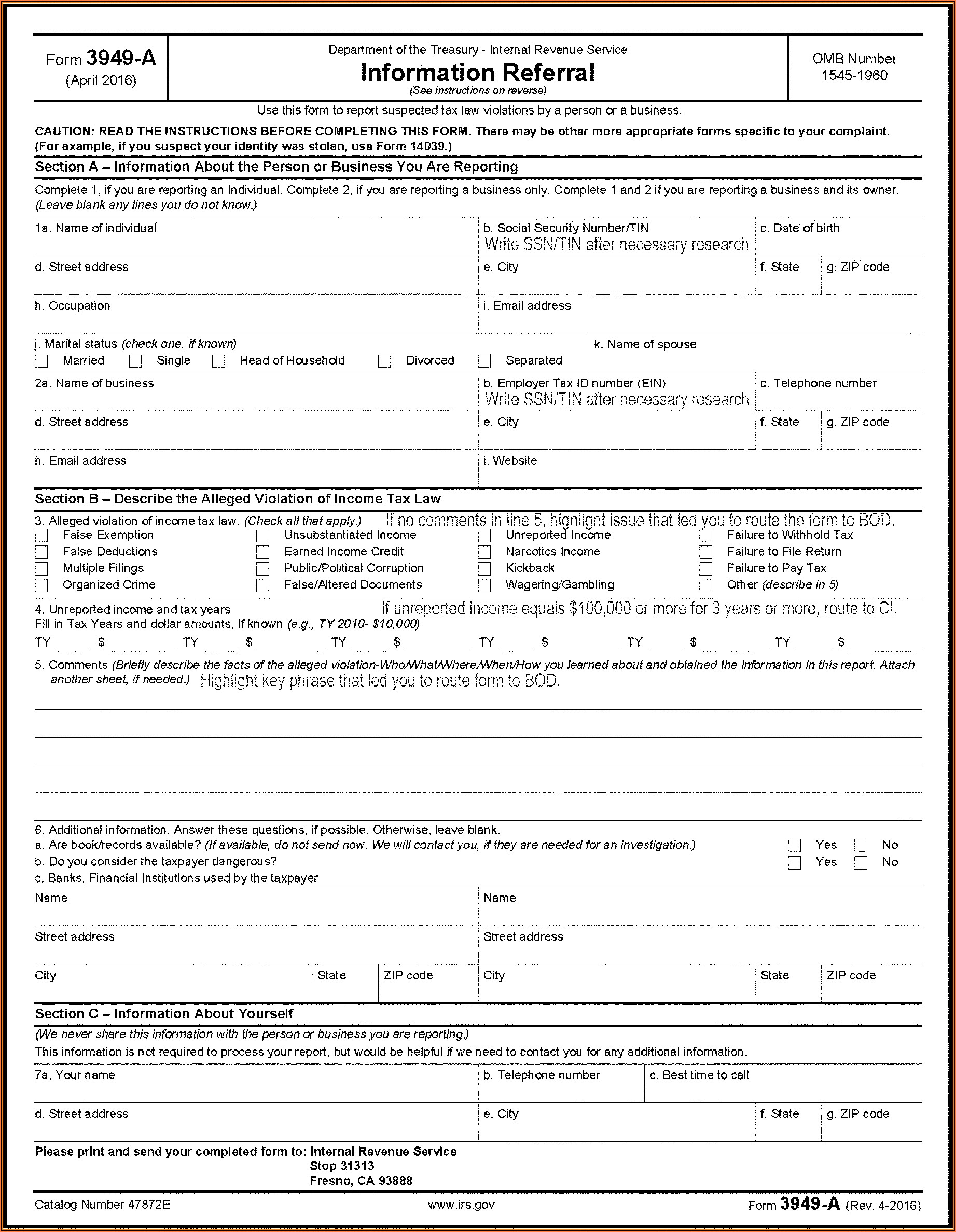

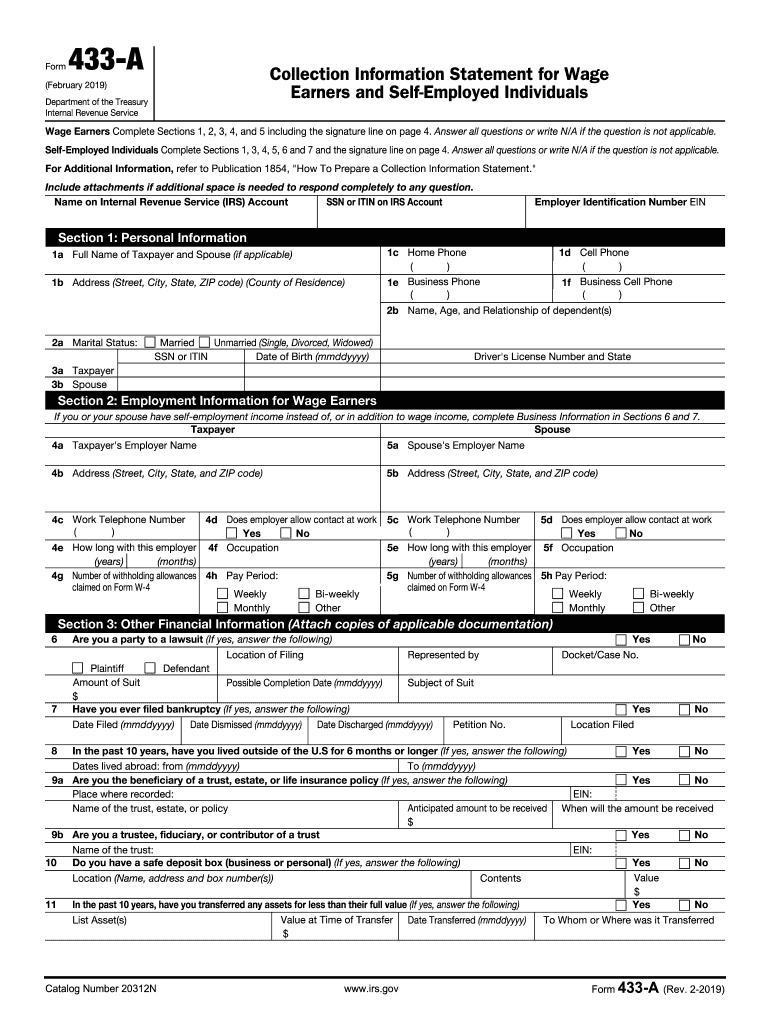

Answer all questions or write n/a if the question is not. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. This form is used by the united states internal revenue service. Web what is an irs form 433d? Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web the document you are trying to load requires adobe reader 8 or higher. You may not have the adobe reader installed or your viewing environment may not be properly. It shows the amount of your initial payment plus.

Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. El cargo de restauración reducido se eliminará si usted acepta realizar pagos electrónicos través de un instrumento de débito. Answer all questions or write n/a if the question is not. This form is used by the united states internal revenue service. It is a form taxpayers can submit to authorize a direct debit payment method. It shows the amount of your initial payment plus. Web what is an irs form 433d? This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Web the document you are trying to load requires adobe reader 8 or higher.

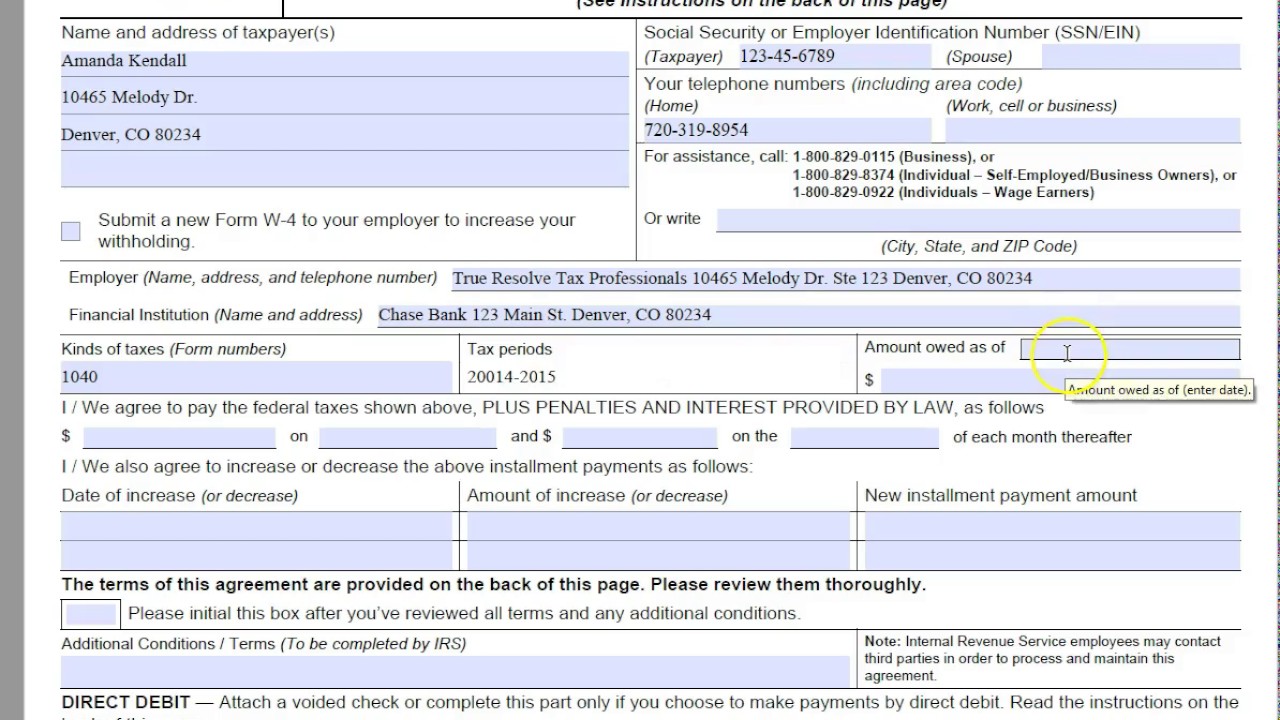

2007 Form IRS 433D Fill Online, Printable, Fillable, Blank pdfFiller

Web the document you are trying to load requires adobe reader 8 or higher. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. It shows the amount of your initial payment plus. It is a form taxpayers can submit to authorize a direct debit payment method. Web para los contribuyentes.

Where To Fax Tax Form 433 D Form Resume Examples N8VZlmO9we

It is a form taxpayers can submit to authorize a direct debit payment method. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. It shows the amount of your initial payment plus. This form is used by the united states internal revenue service..

How to Complete Form 433D Direct Debit Installment Agreement YouTube

This form is used by the united states internal revenue service. It is a form taxpayers can submit to authorize a direct debit payment method. Web the document you are trying to load requires adobe reader 8 or higher. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de.

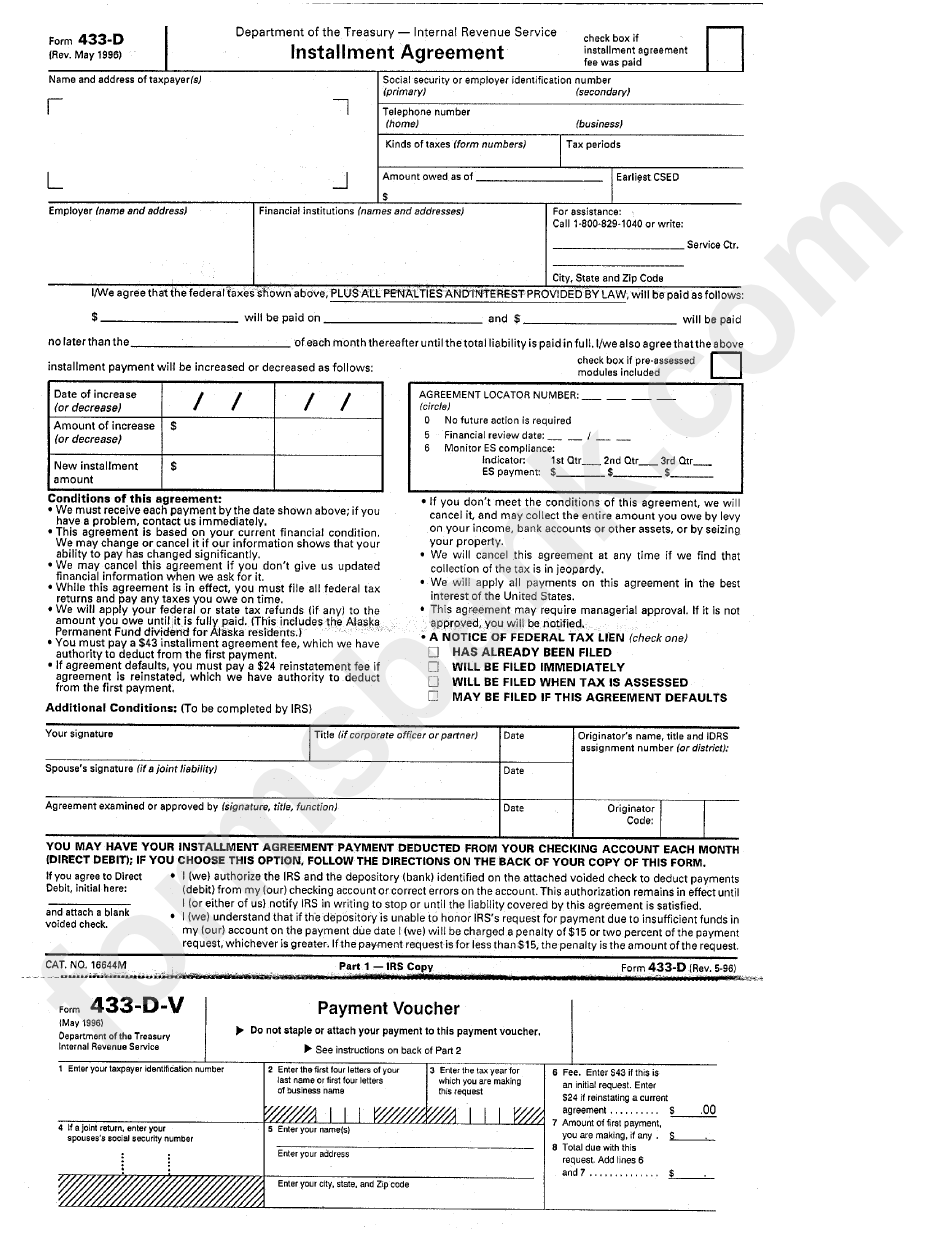

Form 433D Installment Agreement printable pdf download

Web what is an irs form 433d? Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Web the document you are trying to load requires adobe reader 8 or higher. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Answer all questions or write.

20182020 Form IRS 433D Fill Online, Printable, Fillable, Blank

Web what is an irs form 433d? Web the document you are trying to load requires adobe reader 8 or higher. It shows the amount of your initial payment plus. This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. El cargo de restauración reducido se eliminará si usted acepta realizar.

How to Complete an IRS Form 433D Installment Agreement

It shows the amount of your initial payment plus. Answer all questions or write n/a if the question is not. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Web the document you are trying to load requires adobe reader 8 or higher. Web what is an irs form 433d?

Form 433D Installment Agreement printable pdf download

Web the document you are trying to load requires adobe reader 8 or higher. This form is used by the united states internal revenue service. Web what is an irs form 433d? Answer all questions or write n/a if the question is not. This form will be used to help formulate and finalize payment plans and installments for people who.

Form 433D Installment Agreement printable pdf download

You may not have the adobe reader installed or your viewing environment may not be properly. It is a form taxpayers can submit to authorize a direct debit payment method. This form is used by the united states internal revenue service. It shows the amount of your initial payment plus. Complete sections 1, 2, 3, 4, and 5 including the.

433D (2017) Edit Forms Online PDFFormPro

Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. Web the document you are trying to load requires adobe reader 8 or higher. It is a form taxpayers can submit to authorize a direct debit payment method. Complete sections 1, 2, 3, 4,.

2019 Form IRS 433A Fill Online, Printable, Fillable, Blank pdfFiller

This form will be used to help formulate and finalize payment plans and installments for people who owe taxes. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. Web the document you are trying to load requires adobe reader 8 or higher. This.

It Is A Form Taxpayers Can Submit To Authorize A Direct Debit Payment Method.

Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Web para los contribuyentes de bajos ingresos (igual o inferior al 250% de las guías federales de pobreza), el cargo de restauración se reduce a $43. Web the document you are trying to load requires adobe reader 8 or higher. Web what is an irs form 433d?

El Cargo De Restauración Reducido Se Eliminará Si Usted Acepta Realizar Pagos Electrónicos Través De Un Instrumento De Débito.

This form is used by the united states internal revenue service. It shows the amount of your initial payment plus. You may not have the adobe reader installed or your viewing environment may not be properly. Answer all questions or write n/a if the question is not.