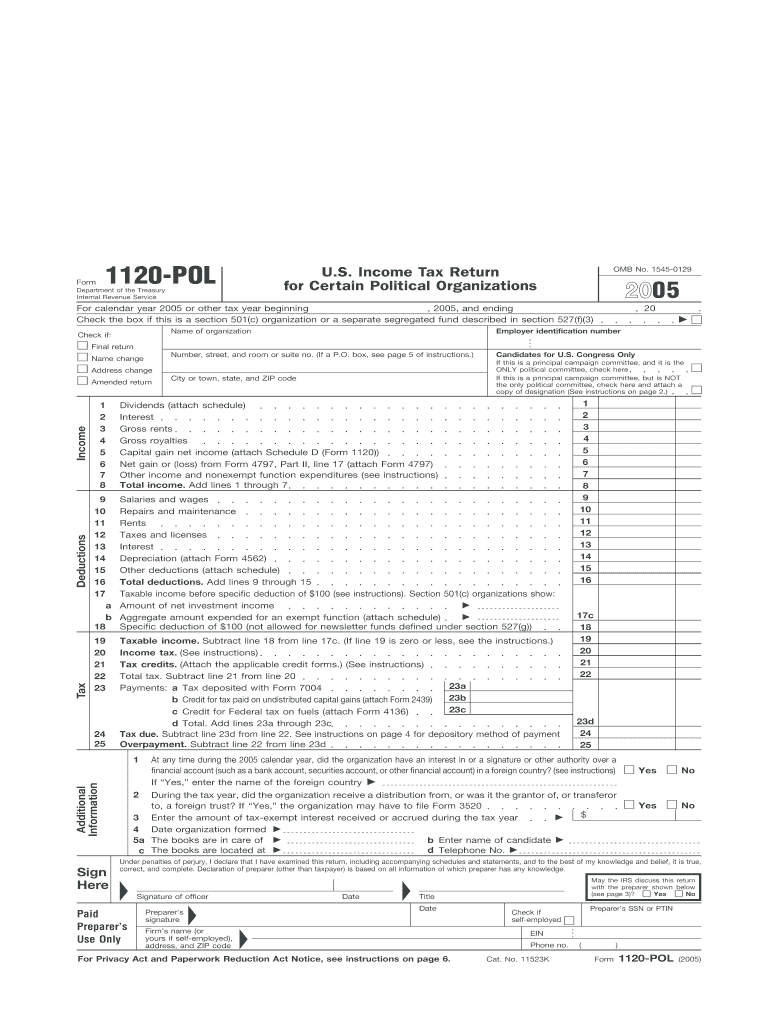

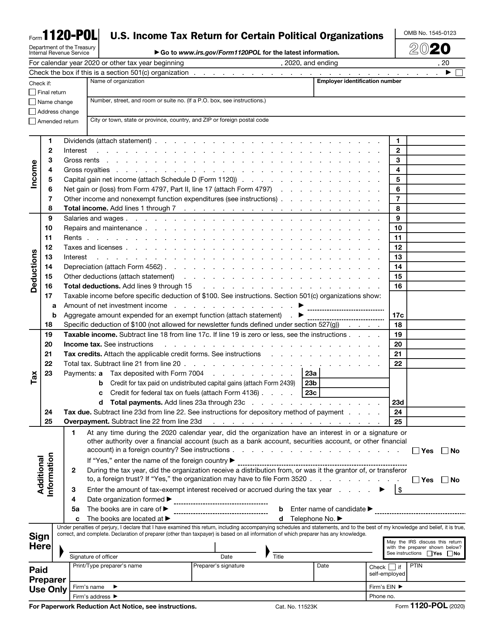

Irs Form 1120 Pol

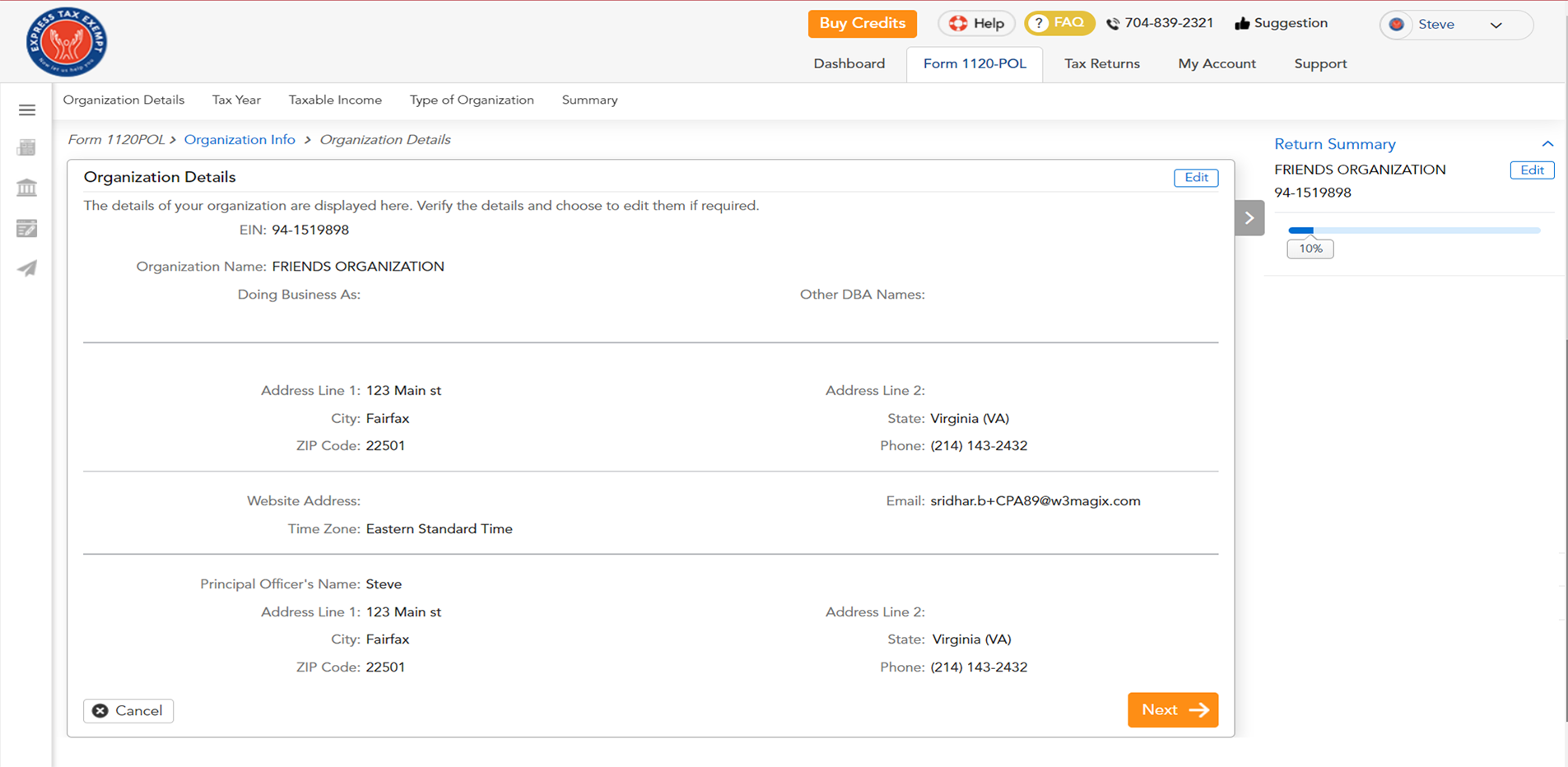

Irs Form 1120 Pol - Ad access irs tax forms. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. Use this form to report the income,. Income tax return for certain political organizations pdf , is the annual income tax return for political organizations. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Complete, edit or print tax forms instantly. Ad easy guidance & tools for c corporation tax returns. What’s new increase in penalty for failure to file. Political organizations and certain exempt organizations file this form to. Web enter your ein and provide all the basic information about your organization, such as name, address, and principal officer details.

Income tax return for certain political organizations. Ad access irs tax forms. Web enter your ein and provide all the basic information about your organization, such as name, address, and principal officer details. Corporation income tax return, including recent updates, related forms and instructions on how to file. Annual information returns on form 990,. Get ready for tax season deadlines by completing any required tax forms today. For calendar year 2022 or tax year beginning, 2022, ending. Use this form to report the income,. Complete, edit or print tax forms instantly. Income tax return for certain political organizations pdf;

For organizations on a calendar year, form 1120. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. Choose tax year and form provide required. Income tax return for certain political organizations pdf; Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. An organization exempt under section 501 (c) of the code that spends any amount for an exempt function (within the. Political organizations and certain exempt organizations file this form to. Congress, the tax is calculated using the graduated rates specified in §11(b). Use this form to report the income,. What’s new increase in penalty for failure to file.

EFile 1120POL IRS Form 1120POL Online Political Organization

Web enter your ein and provide all the basic information about your organization, such as name, address, and principal officer details. Income tax return for certain political organizations pdf; Choose tax year and form provide required. Use this form to report the income,. Get ready for tax season deadlines by completing any required tax forms today.

Form 1120POL U.S. Tax Return for Certain Political

Ad easy guidance & tools for c corporation tax returns. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. Web political activities of exempt organizations. Web enter your ein and provide all the basic information about your organization, such as name, address, and principal officer details. Income.

Irs Form 1120 Pol Fill Out and Sign Printable PDF Template signNow

Annual information returns on form 990,. Choose tax year and form provide required. Ad easy guidance & tools for c corporation tax returns. Income tax return for certain political organizations pdf , is the annual income tax return for political organizations. An organization exempt under section 501 (c) of the code that spends any amount for an exempt function (within.

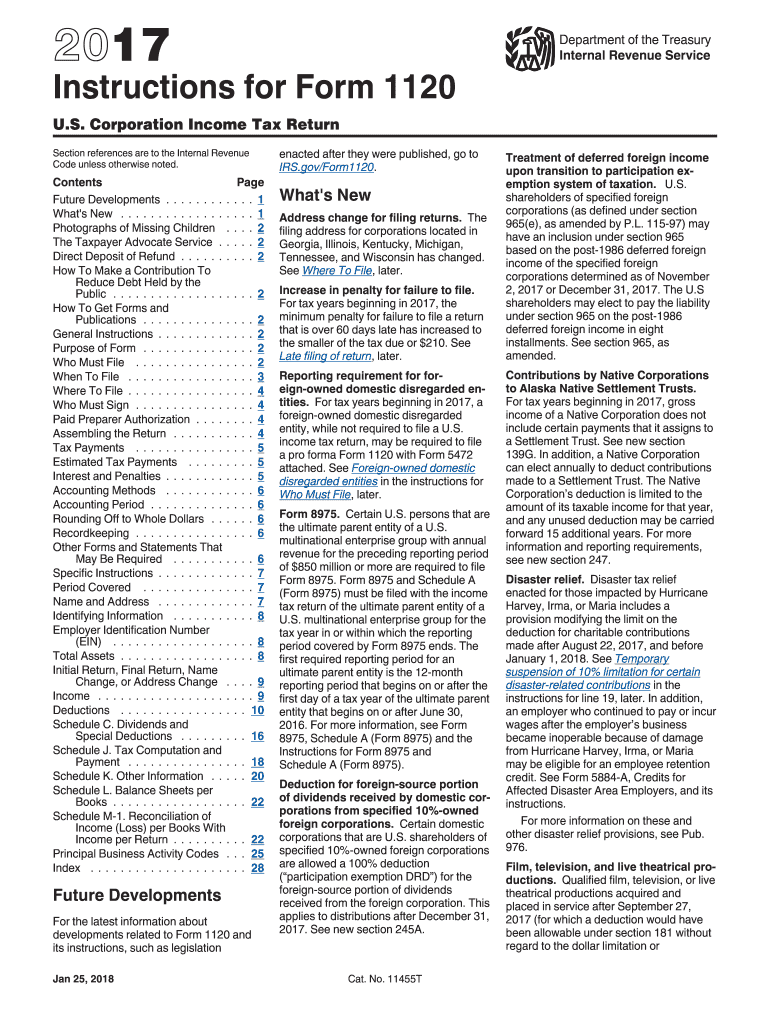

IRS Instructions 1120 2017 Fill out Tax Template Online US Legal Forms

Income tax return for certain political organizations pdf; For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. For organizations on a calendar year, form 1120. Choose tax year and form provide required. Annual information returns on form 990,.

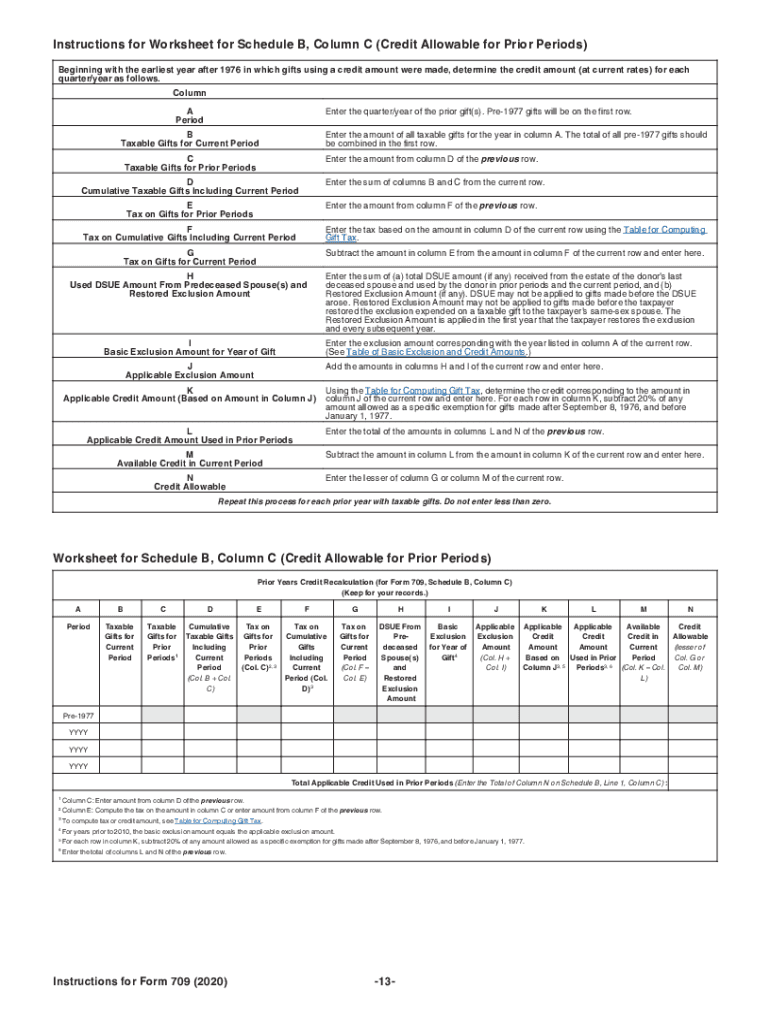

IRS 709 Instructions 20202022 Fill out Tax Template Online US

Use this form to report the income,. Web enter your ein and provide all the basic information about your organization, such as name, address, and principal officer details. Choose tax year and form provide required. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. Ad access irs.

irs form 1120 schedule g 2022 Fill Online, Printable, Fillable Blank

Corporation income tax return, including recent updates, related forms and instructions on how to file. Web political activities of exempt organizations. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Income tax return for certain political organizations pdf;

IRS Form 1120POL Download Fillable PDF or Fill Online U.S. Tax

What’s new increase in penalty for failure to file. Choose tax year and form provide required. Web information about form 1120, u.s. Income tax return for certain political organizations pdf; For calendar year 2022 or tax year beginning, 2022, ending.

IRS 1120 2020 Fill out Tax Template Online US Legal Forms

Use this form to report the income,. Annual information returns on form 990,. Ad easy guidance & tools for c corporation tax returns. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. An organization exempt under section 501 (c) of the code that spends any amount for.

IRS 656 2019 Fill and Sign Printable Template Online US Legal Forms

Use this form to report the income,. For organizations on a calendar year, form 1120. For calendar year 2022 or tax year beginning, 2022, ending. Web political activities of exempt organizations. Annual information returns on form 990,.

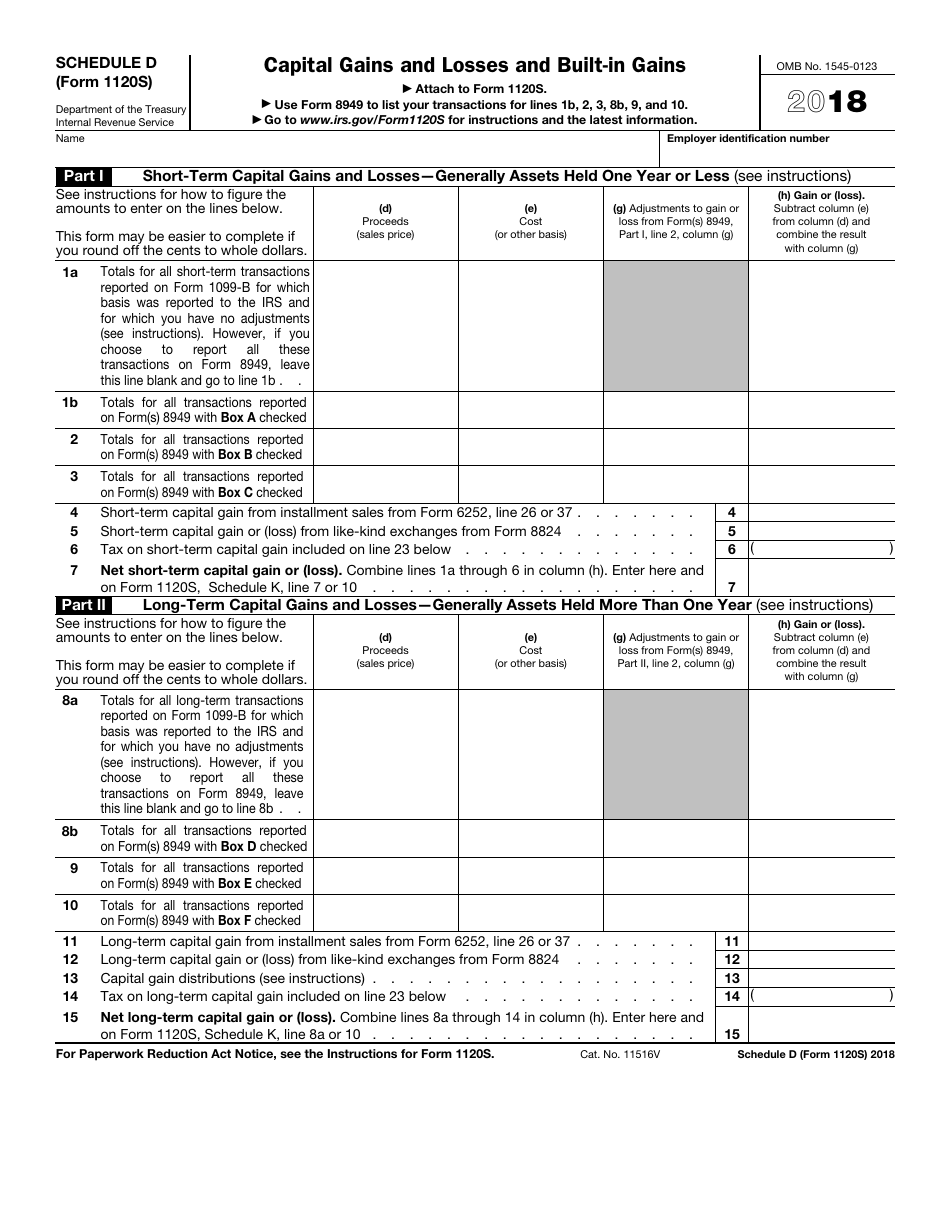

IRS Form 1120S Schedule D Download Fillable PDF or Fill Online Capital

Get ready for tax season deadlines by completing any required tax forms today. Annual information returns on form 990,. For returns due in 2023, the minimum penalty for failure to file a return that is more than 60 days late has. Ad access irs tax forms. Complete, edit or print tax forms instantly.

Political Organizations And Certain Exempt Organizations File This Form To.

Web enter your ein and provide all the basic information about your organization, such as name, address, and principal officer details. Department of the treasury internal revenue service. Web political activities of exempt organizations. Annual information returns on form 990,.

Choose Tax Year And Form Provide Required.

Ad easy guidance & tools for c corporation tax returns. Web information about form 1120, u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Congress, the tax is calculated using the graduated rates specified in §11(b).

Web If The Organization Is The Principal Campaign Committee Of A Candidate For U.s.

Use this form to report the income,. What’s new increase in penalty for failure to file. Income tax return for certain political organizations. An organization exempt under section 501 (c) of the code that spends any amount for an exempt function (within the.

For Organizations On A Calendar Year, Form 1120.

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. For calendar year 2022 or tax year beginning, 2022, ending. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.