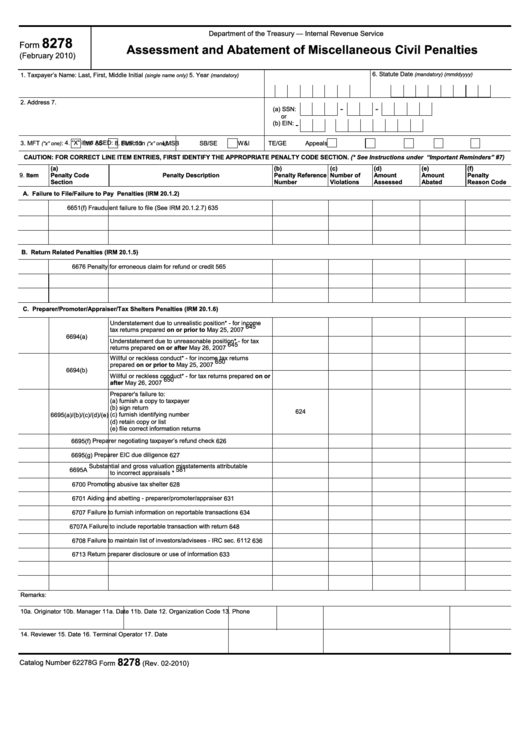

Irs Form 8278

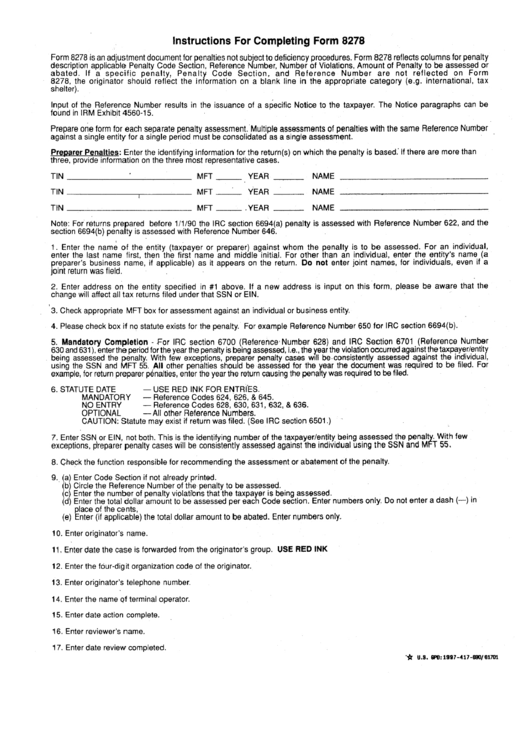

Irs Form 8278 - Related finance questions soo i do have an accountants who was running. How to file 8278 tax for my company? Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. The internal revenue code (irc) provides taxpayers specific rights. Web the penalty is 1/2% of the tax shown on the return that is not paid by the return due date without regard to extensions. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. What are the implications of changing accountants for my company? The civil penalty name line is automatically established using form 8278, items 1, 2, 3, 5, and 7 when there is an entity module. 3 edit form 8278 pdf.

Irs employees are responsible for being familiar with and following these rights. Web pursuant to irc 6751(b), written supervisory approval must be indicated before assessing the irc 6702 penalty. Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. Web the penalty is 1/2% of the tax shown on the return that is not paid by the return due date without regard to extensions. The civil penalty name line is automatically established using form 8278, items 1, 2, 3, 5, and 7 when there is an entity module. How to file 8278 tax for my company? This written supervisory approval should be indicated on form 8278. What is 8278 tax for my company? What are the benefits of changing accountants for my company? Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status.

Web the penalty is 1/2% of the tax shown on the return that is not paid by the return due date without regard to extensions. The internal revenue code (irc) provides taxpayers specific rights. Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. How to calculate 8278 tax for my company? What are the implications of changing accountants for my company? The taxpayer bill of rights groups these rights into ten fundamental rights. What is 8278 tax for my company? How to file 8278 tax for my company? Our documents are regularly updated according to the latest amendments in legislation. This written supervisory approval should be indicated on form 8278.

Fillable Form 8278 Assessment And Abatement Of Miscellaneous Civil

3 edit form 8278 pdf. Web pursuant to irc 6751(b), written supervisory approval must be indicated before assessing the irc 6702 penalty. Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. Legal, tax, business as well as other documents demand an advanced level of protection and compliance with the law. What are.

IRS FORM 12257 PDF

Related finance questions soo i do have an accountants who was running. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. What are the implications of changing accountants for my company? Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations,.

Form 8278 Assessment And Abatement Of Miscellaneous Civil Penalties

What is 8278 tax for my company? If you don't have a profile yet, click start free trial and sign up for one. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. Written supervisory approval should be obtained after the 30 day period provided in.

The IRS 8822 Form To File or Not to File MissNowMrs

Related finance questions soo i do have an accountants who was running. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. Web follow the simple instructions below: Form 8278 reflects columns for penalty description applicable penalty code section,.

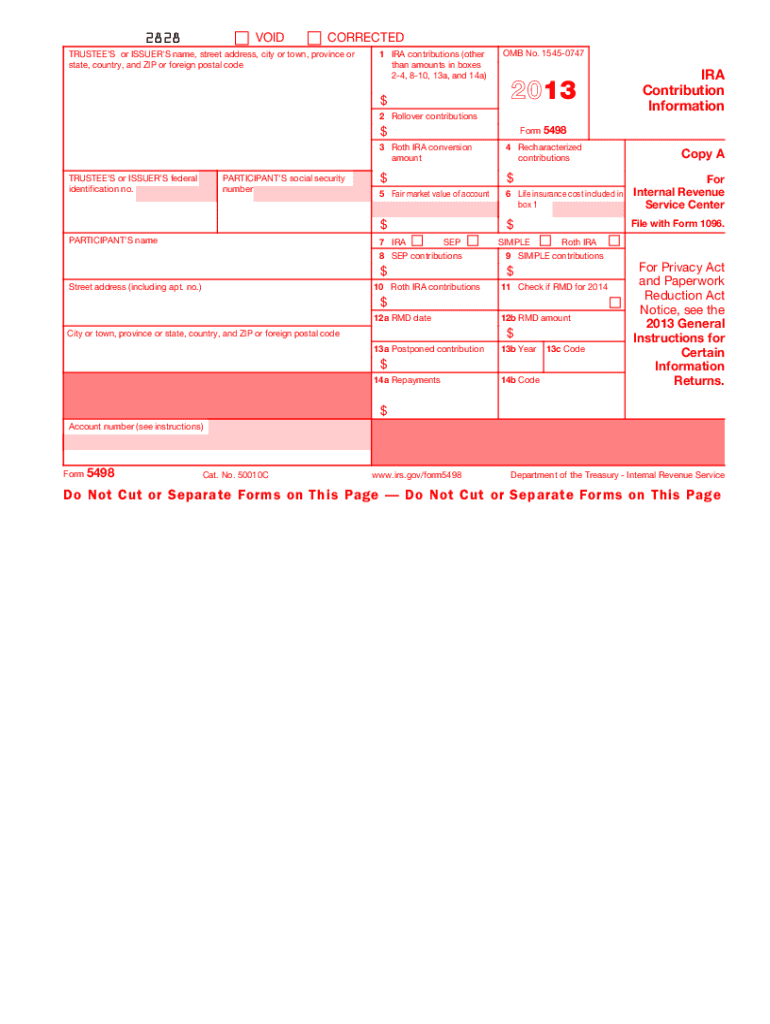

Download IRS Form 5498 for Free FormTemplate

Web pursuant to irc 6751(b), written supervisory approval must be indicated before assessing the irc 6702 penalty. Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. The taxpayer bill of rights groups these rights into ten fundamental rights. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number.

IRS Form 941 Mistakes What Happens If You Mess Up?

Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Our documents are regularly updated according to the latest amendments in legislation. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an.

Irs Form 1090 T Universal Network

Related finance questions soo i do have an accountants who was running. How to file 8278 tax for my company? Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. Our documents are regularly updated according to the latest.

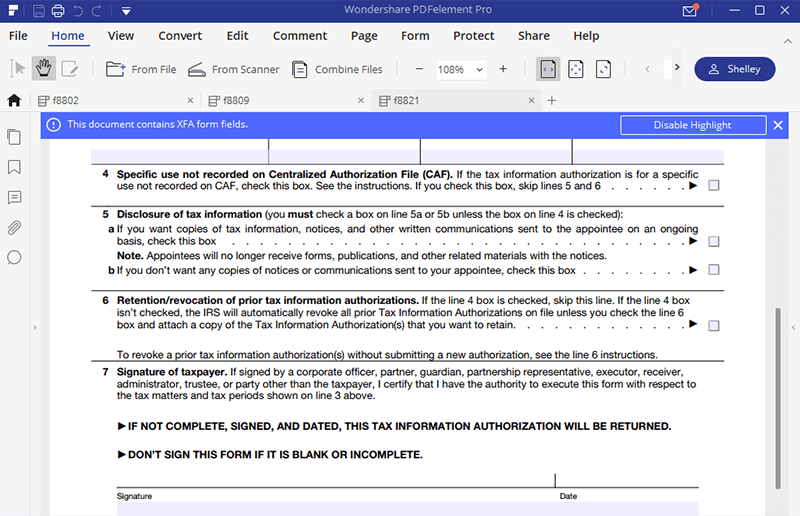

IRS Form 8821 Fill it out with the Best Program

The civil penalty name line is automatically established using form 8278, items 1, 2, 3, 5, and 7 when there is an entity module. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. How to file 8278 tax.

A Frivolous Return Penalty Fraud

Web follow the simple instructions below: What are the implications of changing accountants for my company? Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. How to calculate 8278 tax for my company?

2013 Form IRS 5498 Fill Online, Printable, Fillable, Blank PDFfiller

Web 1 log into your account. Our documents are regularly updated according to the latest amendments in legislation. Use the add new button. Web pursuant to irc 6751(b), written supervisory approval must be indicated before assessing the irc 6702 penalty. The internal revenue code (irc) provides taxpayers specific rights.

The Civil Penalty Name Line Is Automatically Established Using Form 8278, Items 1, 2, 3, 5, And 7 When There Is An Entity Module.

The taxpayer bill of rights groups these rights into ten fundamental rights. Web follow the simple instructions below: Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. How to file 8278 tax for my company?

Web 1 Log Into Your Account.

3 edit form 8278 pdf. Irs employees are responsible for being familiar with and following these rights. If you don't have a profile yet, click start free trial and sign up for one. Our documents are regularly updated according to the latest amendments in legislation.

Web Pursuant To Irc 6751(B), Written Supervisory Approval Must Be Indicated Before Assessing The Irc 6702 Penalty.

Web the penalty is 1/2% of the tax shown on the return that is not paid by the return due date without regard to extensions. Related finance questions soo i do have an accountants who was running. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated.

What Are The Implications Of Changing Accountants For My Company?

The internal revenue code (irc) provides taxpayers specific rights. What is 8278 tax for my company? This written supervisory approval should be indicated on form 8278. How to calculate 8278 tax for my company?

.jpg)