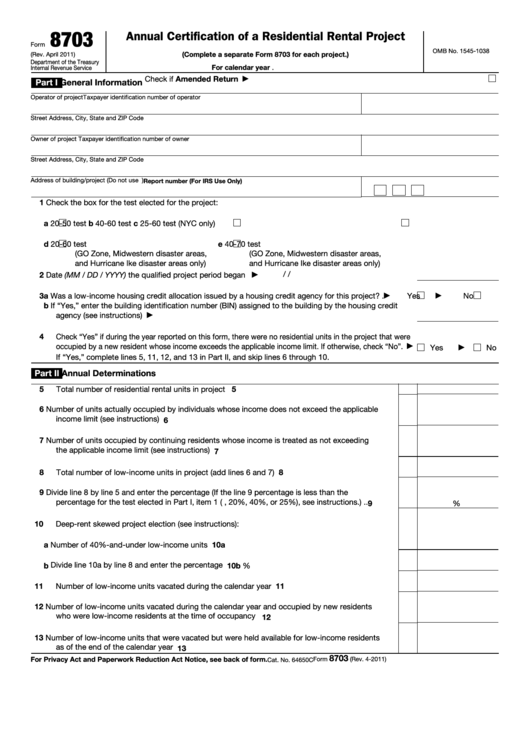

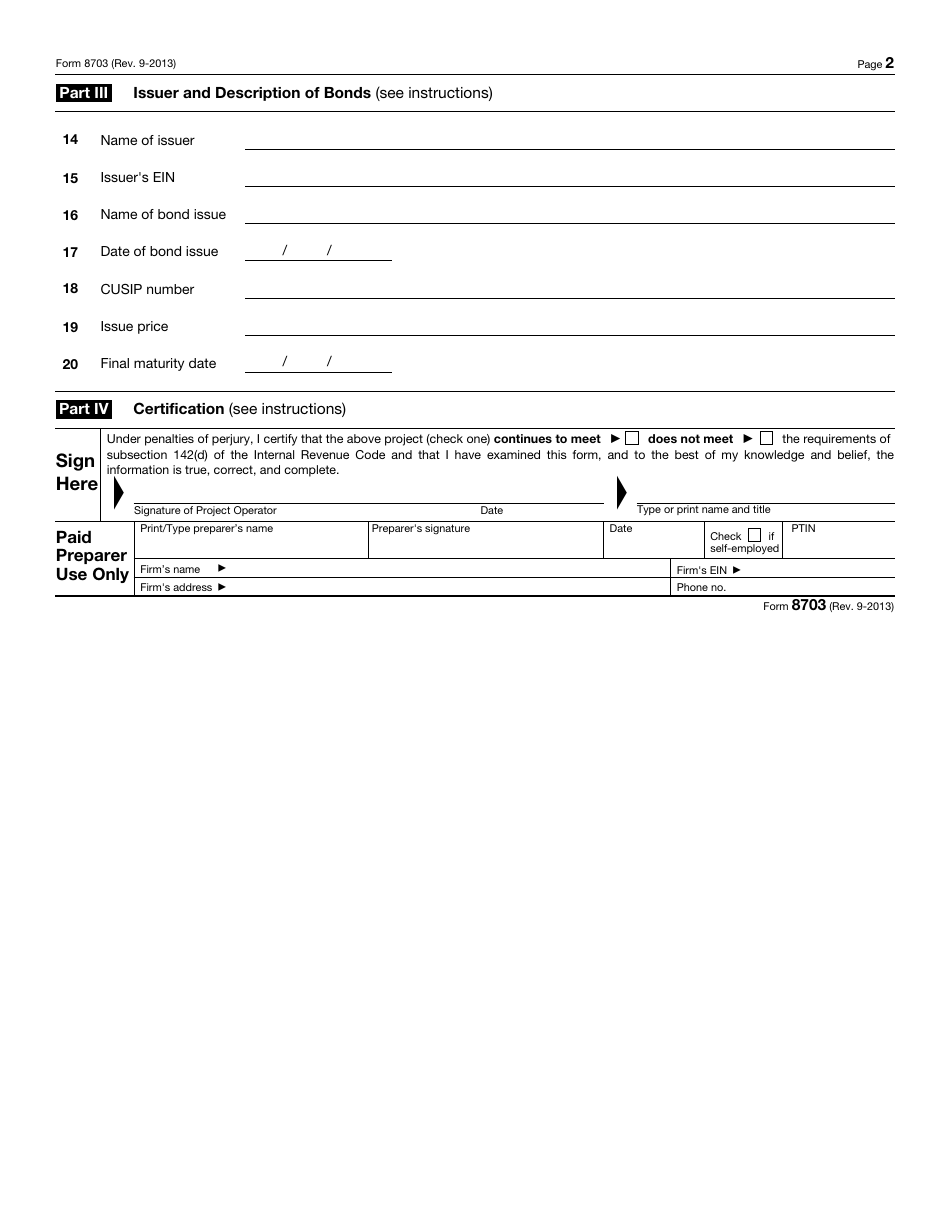

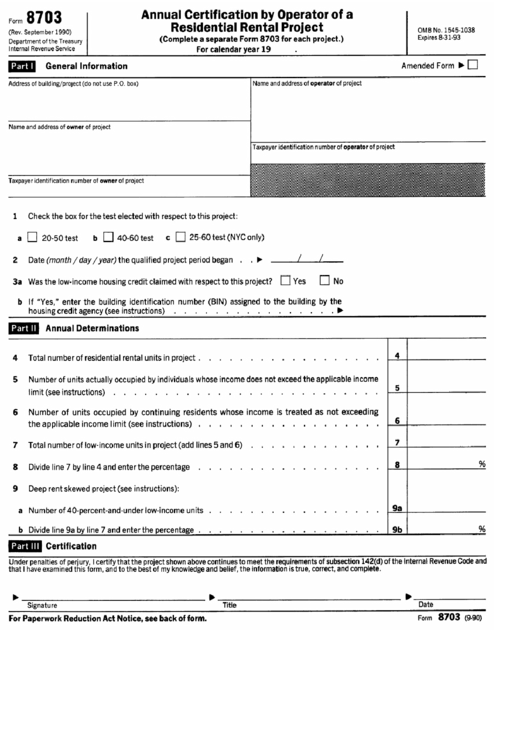

Irs Form 8703

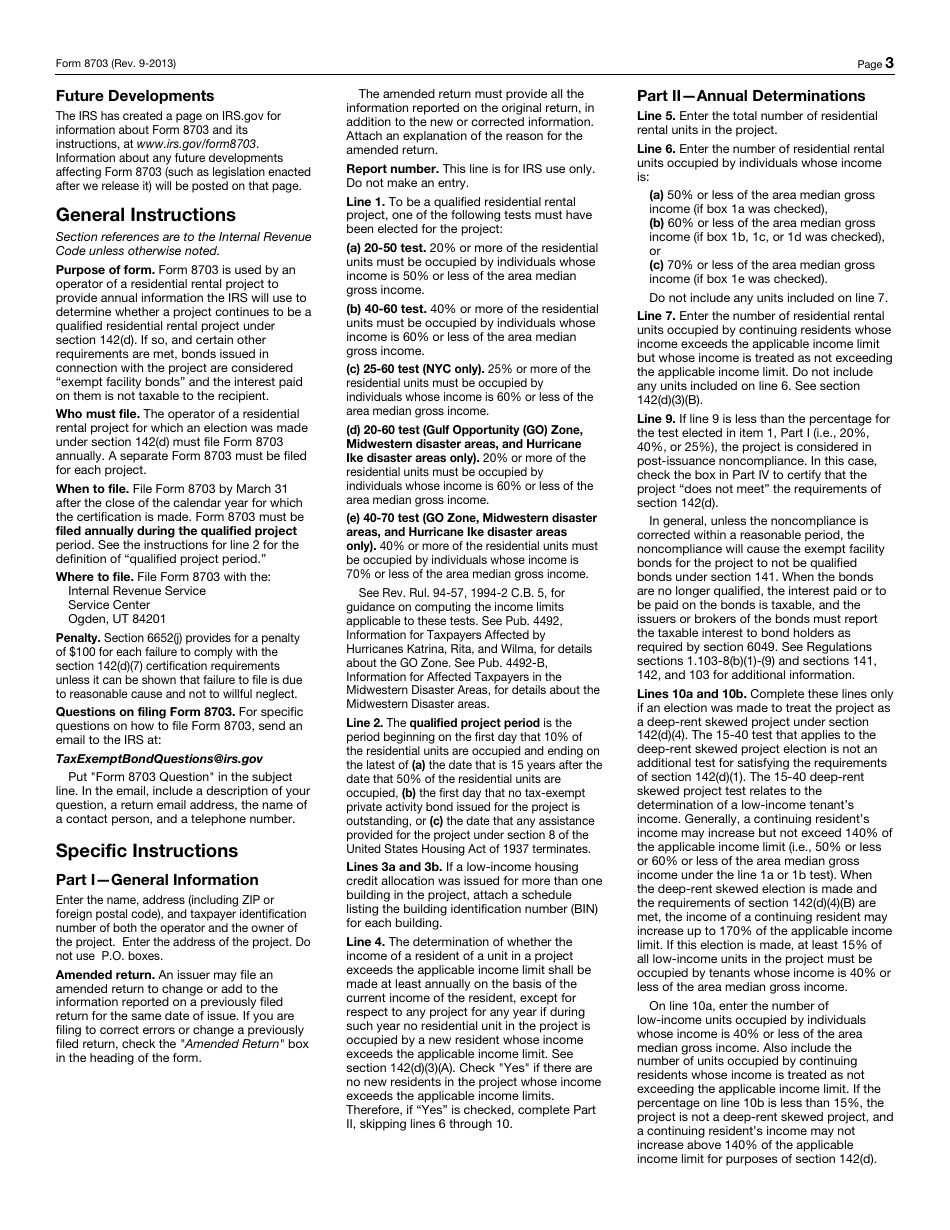

Irs Form 8703 - This form must be filed by march 31 after the close of the. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986. Web 8703 is, and for the certification period was, true, correct and is based upon a review of the records kept by the project owner pursuant to the irs regulations and hdc’s monitoring. December 2021) department of the treasury internal revenue service. File form 8703 with the:. Irs form 8703 must be filed annually during. Web get federal tax return forms and file by mail. For specific questions on how to file form 8703, send an email to the irs at: Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues to be a.

Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio. File form 8703 with the:. For specific questions on how to file form 8703, send an email to the irs at: Web form 8703 residential rental project (rev. Web employer's quarterly federal tax return. December 2021) department of the treasury internal revenue service. Web questions on filing form 8703. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web all reports are due by friday, april 30, 2021. Get the current filing year’s forms, instructions, and publications for free from the irs.

Web all reports are due by friday, april 30, 2021. Web get federal tax forms. Irs form 8703 must be filed annually during. Web questions on filing form 8703. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues to be a. Taxexemptbondquestions@irs.gov put form 8703 question in. Impact of rising utility costs on residents of multifamily housing programs ii. Web get federal tax return forms and file by mail. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio.

IRS FORM 12257 PDF

Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. This form must be filed by march 31 after the close of the calendar year for.

Irs Form 8379 File Online Universal Network

Web form 8703 residential rental project (rev. Get the current filing year’s forms, instructions, and publications for free from the irs. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986. This form must be filed by march 31 after.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Web get federal tax return forms and file by mail. Get the current filing year’s forms, instructions, and publications for free from the irs. Web of the internal revenue code must file form 8703 annually during the qualified project period. Taxexemptbondquestions@irs.gov put form 8703 question in. Web irs form 8703 must be filed with the irs by march 31st after.

Form 8703 Annual Certification By Operator Of A Residential Rental

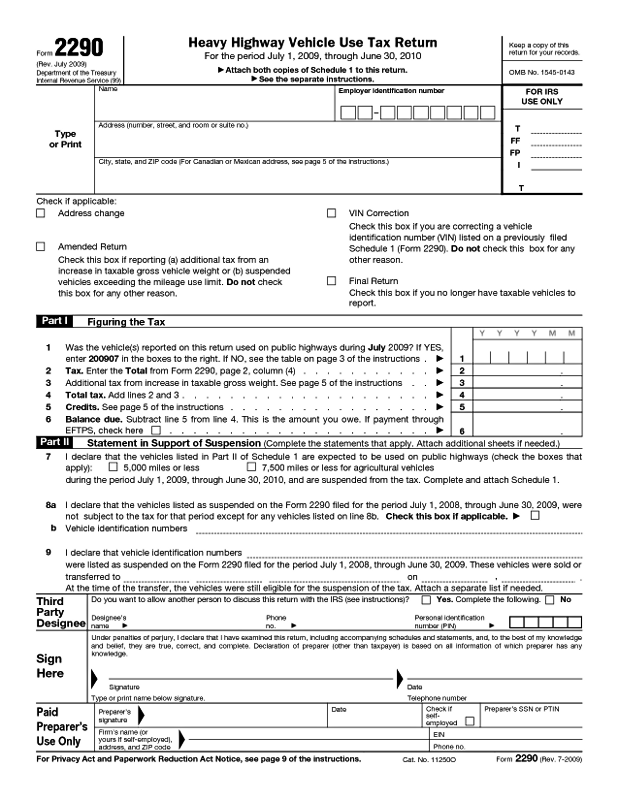

Web employer's quarterly federal tax return. Web of the internal revenue code must file form 8703 annually during the qualified project period. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Section references are to the internal revenue code unless otherwise noted. Annual certification of a residential rental project (complete a.

IRS Form 8703 Download Fillable PDF or Fill Online Annual Certification

December 2021) department of the treasury internal revenue service. Web 8703 is, and for the certification period was, true, correct and is based upon a review of the records kept by the project owner pursuant to the irs regulations and hdc’s monitoring. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Taxexemptbondquestions@irs.gov.

709 Form 2005 Sample 3B4

This form must be filed by march 31 after the close of the calendar year for which. Web form 8703 residential rental project (rev. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Irs form 8703 must be filed annually during. Hdc works closely with our development and property management partners.

Fillable Form 8703 Annual Certification Of A Residential Rental

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web 8703 is, and for the certification period was, true, correct and is based upon a review of the records kept by the project owner pursuant to the irs regulations and hdc’s monitoring. Web we last updated the annual certification of a residential.

Irs Form 8379 Electronically Universal Network

Web get federal tax return forms and file by mail. December 2021) department of the treasury internal revenue service. This form must be filed by march 31 after the close of the calendar year for which. Web of the internal revenue code must file form 8703 annually during the qualified project period. Form 8703 is used by the operator of.

IRS Form 8703 Download Fillable PDF or Fill Online Annual Certification

Web get federal tax forms. Web get federal tax return forms and file by mail. For specific questions on how to file form 8703, send an email to the irs at: Irs form 8703 must be filed annually during. Taxexemptbondquestions@irs.gov put form 8703 question in.

14 Form Irs Seven Signs You’re In Love With 14 Form Irs AH STUDIO Blog

Web get federal tax return forms and file by mail. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio. Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made. Get paper.

Get The Current Filing Year’s Forms, Instructions, And Publications For Free From The Irs.

Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web all reports are due by friday, april 30, 2021. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986.

Annual Certification Of A Residential Rental Project (Complete A Separate Form 8703 For.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. This form must be filed by march 31 after the close of the calendar year for which. Web employer's quarterly federal tax return. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio.

File Form 8703 With The:.

Web we last updated the annual certification of a residential rental project in february 2023, so this is the latest version of form 8703, fully updated for tax year 2022. Web of the internal revenue code must file form 8703 annually during the qualified project period. Irs form 8703 must be filed annually during. Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues to be a.

For Specific Questions On How To File Form 8703, Send An Email To The Irs At:

Web get federal tax forms. Web questions on filing form 8703. Taxexemptbondquestions@irs.gov put form 8703 question in. Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine.

.jpg)

:max_bytes(150000):strip_icc()/Screenshot17-2d147df3078d4785ab879aac9d4b8f61.png)