Irs Form 8854

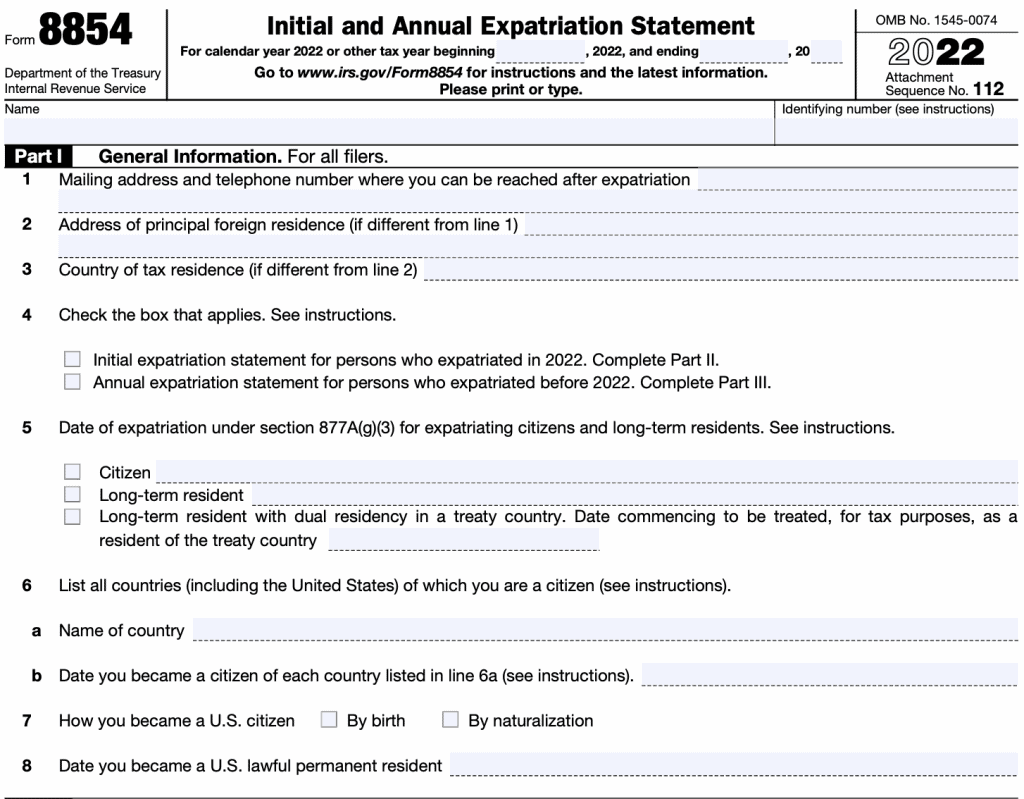

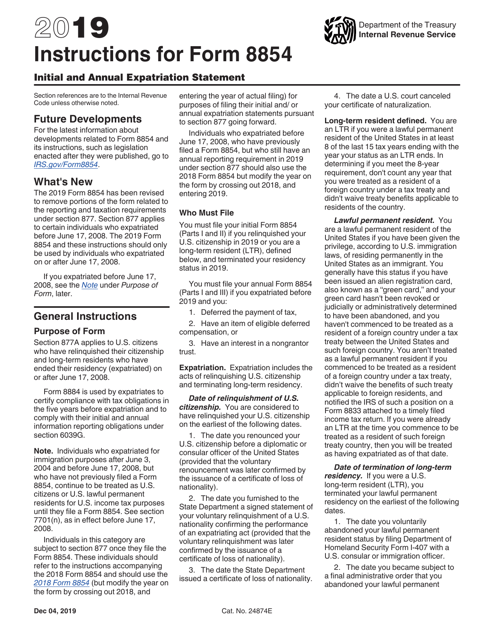

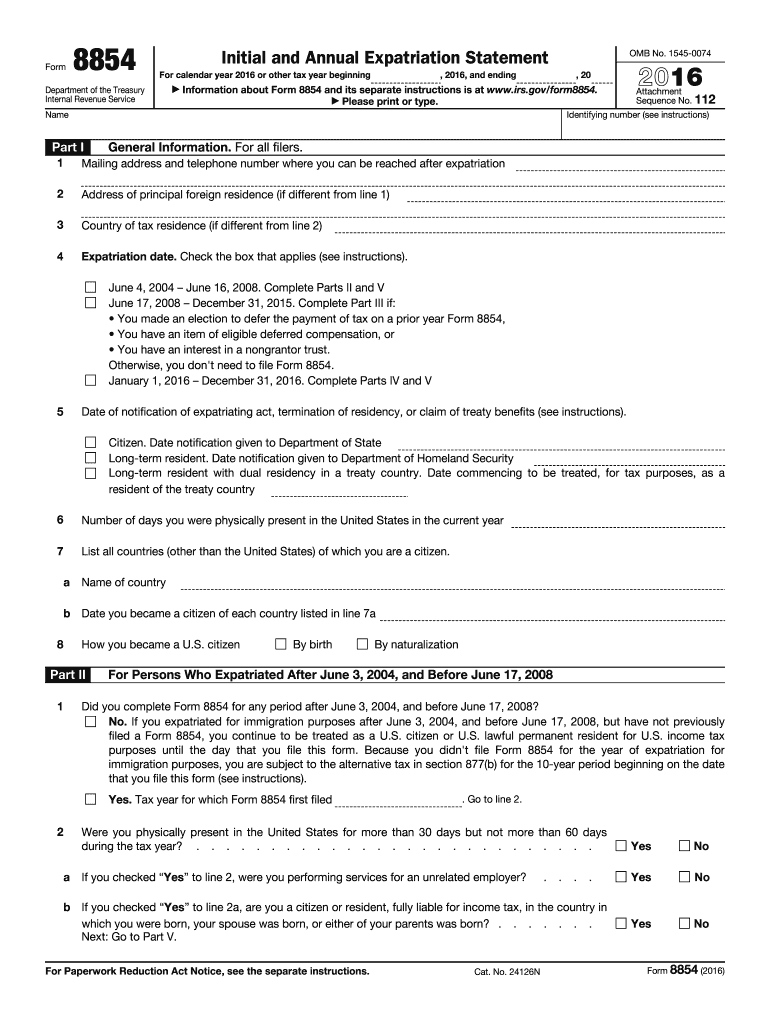

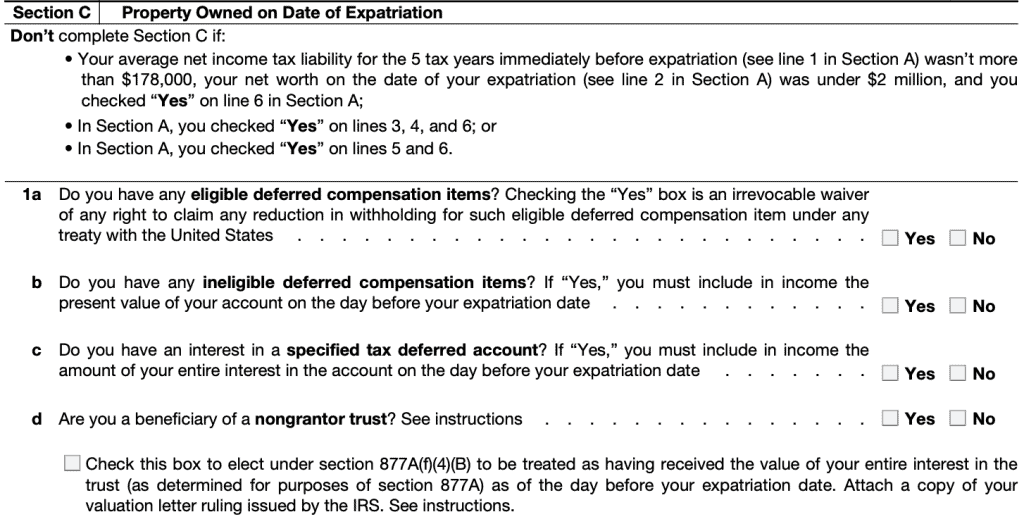

Irs Form 8854 - Income tax returns and paying any tax owed. Web filed a form 8854, but who still have an annual reporting requirement in 2022 under section 877 should also use the 2018 form 8854 but modify the year on the form by crossing out 2018 and entering 2022. The form must be timely filed with final income tax return. Form 8854 is used by individuals who have expatriated on or after june 4, 2004. This could mean relief from “covered expatriate” status which in turn, means an escape from the very harsh tax consequences that come along with this toxic status. What's new increase in average annual net income tax liability. If you are a covered expatriate becomes more complex. Who must file you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. Form 8854 also determines whether. If it is not, the former citizen is treated as a covered expatriate.

For instructions and the latest information. Web form 8884 is used by expatriates to certify compliance with tax obligations in the five years before expatriation and to comply with their initial and annual information reporting obligations under section 6039g. Government that you’ve settled all your tax bills. Web form 8854 certifies to the irs that an expatriating taxpayer has complied with u.s tax obligations for at least five years before their expatriation, such as filing all u.s. For calendar year 2022 or other tax year beginning, 2022, and ending, 20 go to. If the taxpayer is also a covered expatriate, there may exit tax consequences. It shows that you are not a covered expatriate and proves to the u.s. Web we last updated the initial and annual expatriation statement in december 2022, so this is the latest version of form 8854, fully updated for tax year 2022. Web the irs form 8854 is required for u.s. If it is not, the former citizen is treated as a covered expatriate.

Citizenship on the earliest of four possible dates: Federal tax obligations for the 5 years preceding the date of your expatriation or termination of residency. Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions). This could mean relief from “covered expatriate” status which in turn, means an escape from the very harsh tax consequences that come along with this toxic status. Government that you’ve settled all your tax bills. The 5 preceding “taxable years” are: Web the 8854 form is filed in the year after expatriation. Taxpayer expatriated on january 25, 2021 taking the oath of renunciation on that date. For instructions and the latest information. Web department of the treasury internal revenue service initial and annual expatriation statement for calendar year 2021 or other tax year beginning , 2021, and ending, 20 go to www.irs.gov/form8854 for instructions and the latest information please print or type.

IRS Form 8854 A Guide for U.S. Expatriates

Expatriation tax provisions apply to u.s. Web filed a form 8854, but who still have an annual reporting requirement in 2022 under section 877 should also use the 2018 form 8854 but modify the year on the form by crossing out 2018 and entering 2022. Web irs form 8854 (initial and annual expatriation statement). The form must be timely filed.

Download Instructions for IRS Form 8854 Initial and Annual Expatriation

The 5 preceding “taxable years” are: Government uses to when do you have to file irs form 8854? Initial and annual expatriation statement. Web the taxpayer fails to certify that he or she has met the requirements of u.s. Web form 8854 2022 department of the treasury internal revenue service.

Form 8854 Initial and Annual Expatriation Statement Fill Out and Sign

The form must be timely filed with final income tax return. Web tax form 8854 is the form every u.s. Web irs form 8854, initial and annual expatriation statement, is the tax form that expatriates must use to report the u.s. Taxpayer expatriated on january 25, 2021 taking the oath of renunciation on that date. Form 8854 also determines whether.

IRS Form 8854 A Guide for U.S. Expatriates

Web irs form 8854, initial and annual expatriation statement, is the tax form that expatriates must use to report the u.s. Web tax form 8854 is the form every u.s. It shows that you are not a covered expatriate and proves to the u.s. Taxpayer expatriated on january 25, 2021 taking the oath of renunciation on that date. Web irs.

Form 8854 Initial and Annual Expatriation Statement (2014) Free Download

Its primary purpose is to confirm your compliance with federal tax obligations for the five years preceding your expatriation. If any of these rules apply, you are a “covered expatriate.” a citizen will be treated as relinquishing his or her u.s. For calendar year 2022 or other tax year beginning, 2022, and ending, 20 go to. Form 8854 also tells.

Failure to File IRS Form 8854 after Surrendering a Green Card or after

Government that you've settled all your tax bills. Late or incorrect filing of form 8854. Web form 8854 2022 department of the treasury internal revenue service. If any of these rules apply, you are a “covered expatriate.” a citizen will be treated as relinquishing his or her u.s. Web irs form 8854 (initial and annual expatriation statement).

Irs 8854 Instructions Fill Out and Sign Printable PDF Template signNow

For instructions and the latest information. Web the irs form 8854 is required for u.s. If it is not, the former citizen is treated as a covered expatriate. Form 8854 also tells the irs whether or not the taxpayer is a “covered expatriate.” covered expatriates have to pay an exit. Web form 8884 is used by expatriates to certify compliance.

IRS Form 8854 A Guide for U.S. Expatriates

What's new increase in average annual net income tax liability. Web remember the statute requires compliance “for the 5 preceding taxable years.” (although the notice and form 8854 apparently use 5 preceding calendar years). Citizenship on the earliest of four possible dates: The 5 preceding “taxable years” are: Web the irs form 8854 is required for u.s.

THE ROLE OF IRS FORM 8854 IN RENOUNCING US CITIZENSHIP Expat Tax

Government that you've settled all your tax bills. Web irs form 8854 (initial and annual expatriation statement). The 5 preceding “taxable years” are: Property owned at the time of exit. Web form 8854 2022 department of the treasury internal revenue service.

What Is Form 8854 The Initial and Annual Expatriation Statement?

What's new increase in average annual net income tax liability. For calendar year 2022 or other tax year beginning, 2022, and ending, 20 go to. Who must file form 8854? Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions). Until you’ve done this, the us government will consider you a citizen.

Web We Last Updated The Initial And Annual Expatriation Statement In December 2022, So This Is The Latest Version Of Form 8854, Fully Updated For Tax Year 2022.

Citizenship on the earliest of four possible dates: If any of these rules apply, you are a “covered expatriate.” a citizen will be treated as relinquishing his or her u.s. Web the irs form 8854 is required for u.s. Taxpayers must file irs form 8854 on or before the due date of their tax return (including extensions).

Web Filed A Form 8854, But Who Still Have An Annual Reporting Requirement In 2022 Under Section 877 Should Also Use The 2018 Form 8854 But Modify The Year On The Form By Crossing Out 2018 And Entering 2022.

Web department of the treasury internal revenue service initial and annual expatriation statement for calendar year 2021 or other tax year beginning , 2021, and ending, 20 go to www.irs.gov/form8854 for instructions and the latest information please print or type. Web form 8884 is used by expatriates to certify compliance with tax obligations in the five years before expatriation and to comply with their initial and annual information reporting obligations under section 6039g. If the taxpayer is also a covered expatriate, there may exit tax consequences. Web form 8854 2022 department of the treasury internal revenue service.

It Is Used To Show That You Are Not A Covered Expatriate And Have Settled Your Tax Obligations With The Us Government, When Giving Up Your Us Citizenship Or Residency For Good.

Web form 8854 certifies to the irs that an expatriating taxpayer has complied with u.s tax obligations for at least five years before their expatriation, such as filing all u.s. Expatriation tax provisions apply to u.s. If it is not, the former citizen is treated as a covered expatriate. Initial and annual expatriation statement.

Web Remember The Statute Requires Compliance “For The 5 Preceding Taxable Years.” (Although The Notice And Form 8854 Apparently Use 5 Preceding Calendar Years).

Web about form 8854, initial and annual expatriation statement. Who must file form 8854? Web you fail to certify on form 8854 that you have complied with all u.s. Government that you've settled all your tax bills.