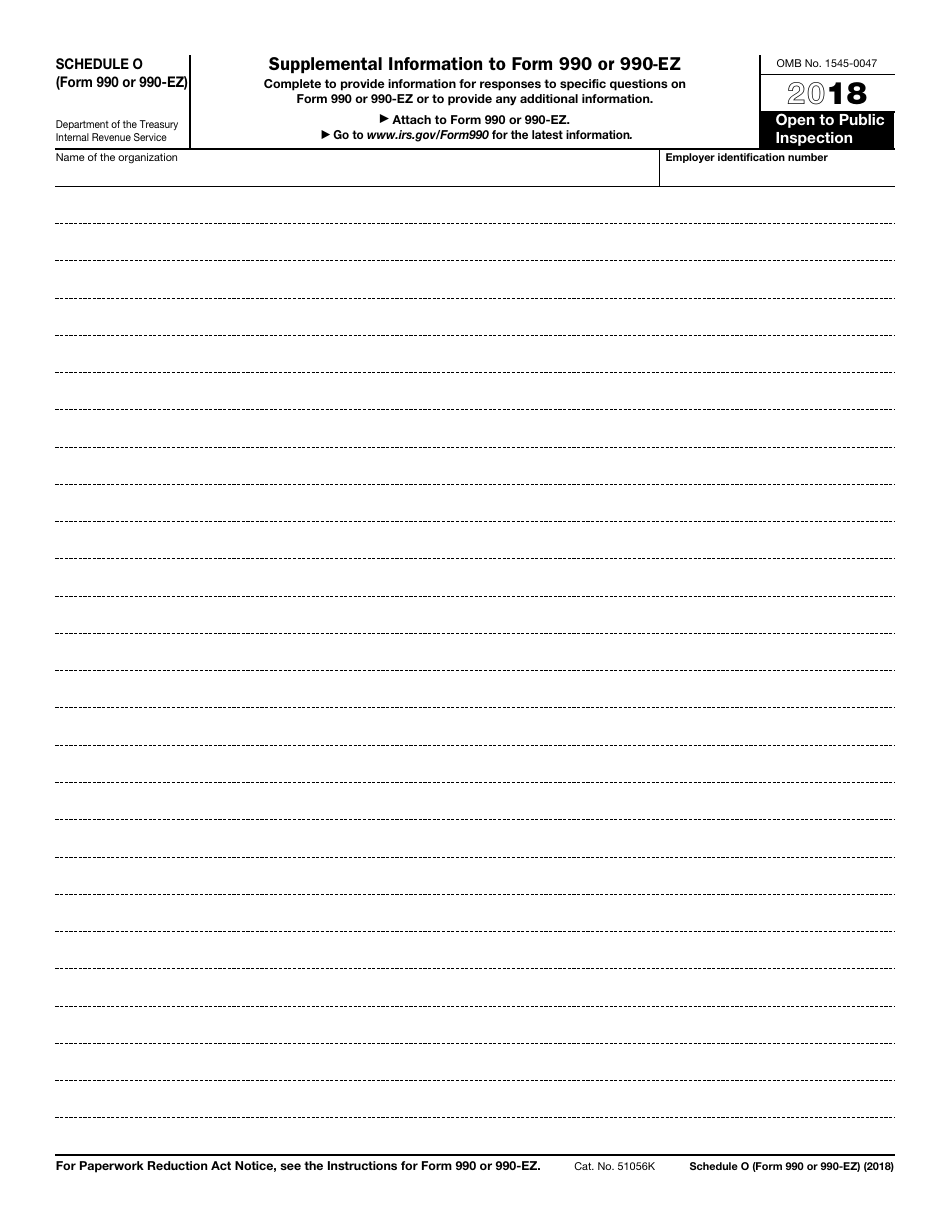

Irs Form 990 Schedule O

Irs Form 990 Schedule O - Web edit, fill, sign, download form 990 schedule o online on handypdf.com. Web schedule o (form 990) is used by an organization that files form 990 to provide the irs with narrative information required for responses to specific questions on form 990, or to. Web 990 schedule o form: Ad edit, sign or email irs 990 so & more fillable forms, register and subscribe now! Web answer “yes” if the organization completed schedule o (form 990). Do you know which version of form 990 your nonprofit should use? Optional for others.) balance sheets (see the instructions for. Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Web an organization should use schedule o (form 990), rather than separate attachments, to: Printable and fillable form 990 schedule o.

Ad keep your nonprofit in irs compliance. Home > irs gov forms > form 990. Schedule o requires supplemental information, such as. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Web all organizations that file form 990 must submit schedule o. Web schedule o (form 990) is used by an organization that files form 990 to provide the irs with narrative information required for responses to specific questions on form 990, or to. And turbot ax irs form 970 schedule o or form. Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Form 990 schedule o (990 form). Web an organization should use schedule o (form 990), rather than separate attachments, to:

Ad keep your nonprofit in irs compliance. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Web 990 schedule o form: Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Web the blank paper of the irs form 990 schedule o is an important tool to provide an accurate and useful summary of your organization's financial and operational activity. Printable and fillable form 990 schedule o. Web an organization should use schedule o (form 990), rather than separate attachments, to: Schedule o requires supplemental information, such as. Contact brytebridge for form 990 help. Web schedule o (form 990) is used by an organization that files form 990 to provide the irs with narrative information required for responses to specific questions on form 990, or to.

Form 990 (Schedule O) Supplemental Information to Form 990 or 990EZ

Ad edit, sign or email irs 990 so & more fillable forms, register and subscribe now! Instructions for these schedules are. Web answer “yes” if the organization completed schedule o (form 990). Get ready for tax season deadlines by completing any required tax forms today. At a minimum, the schedule must be used to answer form 990, part vi, lines.

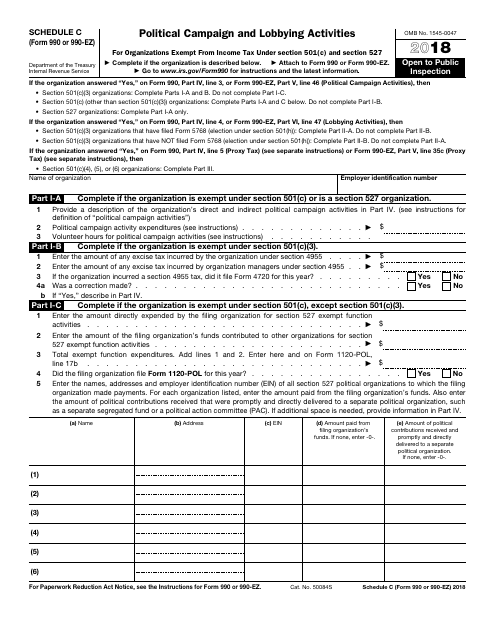

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Web everyone from donors and volunteers to members of the media can view your form 990, so make the most of schedule o to showcase your mission and accomplishments. Schedule o (form 990) must be completed and filed by all organizations that file form 990. Web an organization should use schedule o (form 990), rather than separate attachments, to: And.

IRS 990 or 990EZ Schedule N 2019 Fill out Tax Template Online US

Web request for taxpayer identification number (tin) and certification. Printable and fillable form 990 schedule o. Web we last updated federal 990 (schedule o) in december 2022 from the federal internal revenue service. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. At a minimum, the schedule must be used.

2023 Form 990 Schedule F Instructions Fill online, Printable

Ad keep your nonprofit in irs compliance. Web request for taxpayer identification number (tin) and certification. This form is for income earned in tax year 2022, with tax returns due. Provide the irs with narrative information required for responses to specific. Home > irs gov forms > form 990.

2010 Form IRS 990 Schedule A Fill Online, Printable, Fillable, Blank

Ad edit, sign or email irs 990 so & more fillable forms, register and subscribe now! Web all organizations that file form 990 must submit schedule o. This form is for income earned in tax year 2022, with tax returns due. Web answer “yes” if the organization completed schedule o (form 990). Web form 990 has 16 supplementary schedules that.

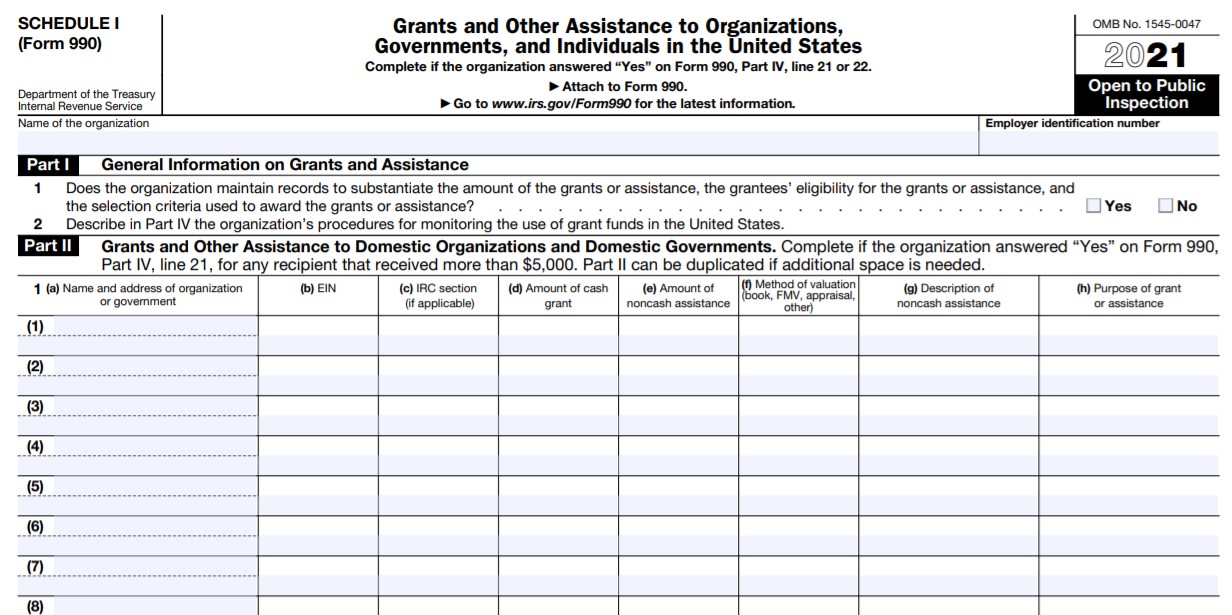

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Web schedule o (form 990) is used by an organization that files form 990 to provide the irs with narrative information required for responses to specific questions on form 990, or to. Provide the irs with narrative information required for responses to specific. Optional for others.) balance sheets (see the instructions for. Web form 990 schedule o — filler for.

2018 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

Form 990 schedule o (990 form). Get ready for tax season deadlines by completing any required tax forms today. Web edit, fill, sign, download form 990 schedule o online on handypdf.com. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web we last updated federal 990 (schedule o) in december.

IRS Form 990 Schedule O Download Fillable PDF or Fill Online

Web everyone from donors and volunteers to members of the media can view your form 990, so make the most of schedule o to showcase your mission and accomplishments. Web form 990 schedule o — filler for 2023 tax season irs forms 990 schedule o filler — 2023 tax season get your schedule o blank, complete and send it free.

Form 990 (Schedule J) online Washington Fill Exactly for Your State

Web form 990 has 16 supplementary schedules that may need to be filed, one of which is schedule o. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Optional for others.) balance sheets (see the instructions for. Web request for taxpayer identification number (tin) and certification. Web an organization should use.

Irs Form 990 Ez Schedule O 2017 Form Resume Examples Dp3OmM010Q

Do you know which version of form 990 your nonprofit should use? Home > irs gov forms > form 990. Web all organizations that file form 990 must submit schedule o. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web request for taxpayer identification number (tin) and certification.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Home > irs gov forms > form 990. Web schedule o is completed if necessary, based on answers to various questions on form 990 throughout your input on different screens. Do you know which version of form 990 your nonprofit should use? Web the blank paper of the irs form 990 schedule o is an important tool to provide an accurate and useful summary of your organization's financial and operational activity.

Web Form 990 Schedule O — Filler For 2023 Tax Season Irs Forms 990 Schedule O Filler — 2023 Tax Season Get Your Schedule O Blank, Complete And Send It Free To Your.

Web schedule o (form 990) is used by an organization that files form 990 to provide the irs with narrative information required for responses to specific questions on form 990, or to. Ad edit, sign or email irs 990 so & more fillable forms, register and subscribe now! Form 990 schedule o (990 form). Schedule o requires supplemental information, such as.

Web Request For Taxpayer Identification Number (Tin) And Certification.

Instructions for these schedules are. Web an organization should use schedule o (form 990), rather than separate attachments, to: Web internal revenue service file by the due date for filing your return. (form 990) schedule o supplemental information to form 990 or.

First Impressions Can Be Deceiving.

Web form 990 has 16 supplementary schedules that may need to be filed, one of which is schedule o. Provide the irs with narrative information required for responses to specific. And turbot ax irs form 970 schedule o or form. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.