Irs Payment Calendar

Irs Payment Calendar - It shows when you need to submit tax forms, pay taxes, and do other things required by federal tax law. For individuals, the last day to file your 2023 taxes without an extension is april. These postponements are automatic and apply to all. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. The universal calendar format (ics) is. The irs accepts tax refunds from the starting date of the tax season and issues refunds throughout the year. Among the reminders in the publication are the payment deadlines for amounts of the. 16, 2024, and january 2025. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Web 2022 estimated tax payment dates.

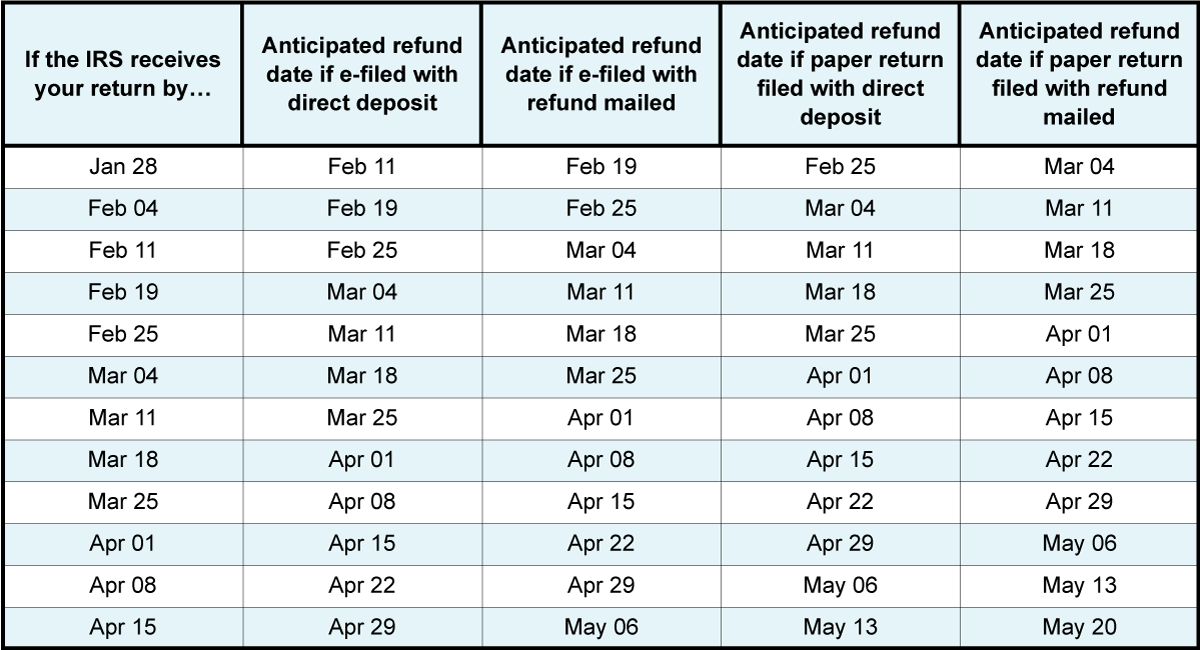

It’s important to note that taxpayers. Web there are four payment due dates in 2024 for estimated tax payments: Made by expats for expats€149 flat feesimple and affordabletax filing made easy Generally, most individuals are calendar year filers. Keep your federal tax planning strategy on track with key irs filing dates. Web the holiday is june 19, and is to be observed monday, june 20, in 2022. When will i receive my tax refund? Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. For individuals, the last day to file your 2023 taxes without an extension is april. 22, 2023 — with the 2023 tax filing season in full swing, the irs reminds taxpayers to gather their necessary information and visit irs.gov for.

Web an irs tax calendar is like a year planner split into quarters. Make a payment or view 5 years of payment history and any pending or scheduled payments. The schedule for this is varied. It shows when you need to submit tax forms, pay taxes, and do other things required by federal tax law. The irs accepts tax refunds from the starting date of the tax season and issues refunds throughout the year. Web learn how to pay your taxes online or by other methods, including payment plans and offers in compromise. Web as a result of all of this, the deadline for filing federal income tax returns (generally form 1040), will be tuesday, april 18, 2023, and most states usually follow the same. Access the calendar online from your mobile device or desktop. The universal calendar format (ics) is. For individuals, the last day to file your 2023 taxes without an extension is april.

Irs Tax Payment Schedule 2024 Ketti Meridel

Web most federal tax return filing and payment deadlines are postponed from april 15 to july 15, 2020. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. Find out the fees, deadlines and requirements for different. The universal calendar format (ics) is. Among the reminders in.

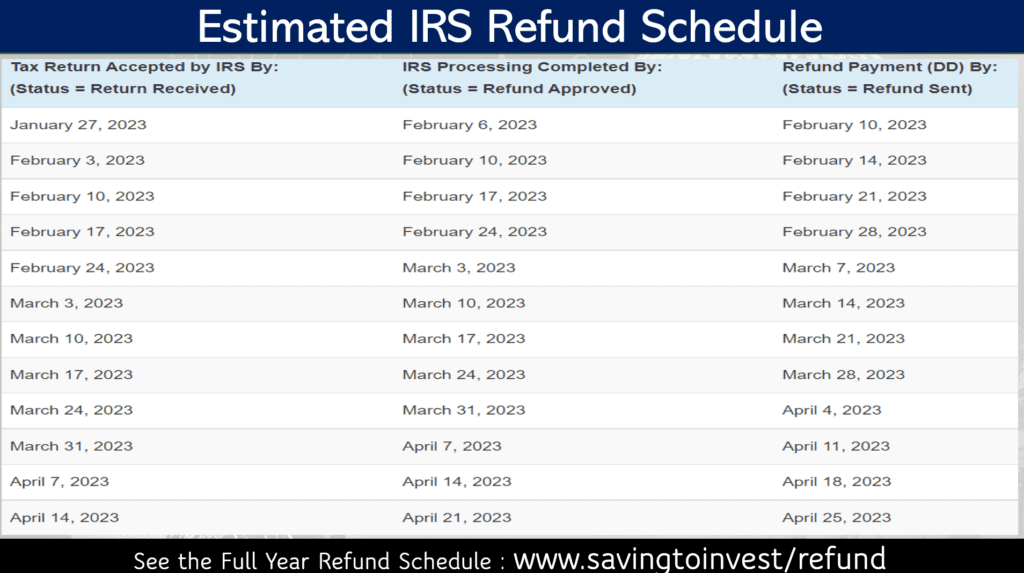

Irs Updates On Refunds 2023 Calendar 2023 Get Calender 2023 Update

Web 2022 estimated tax payment dates. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. It’s important to note that taxpayers. These postponements are automatic and apply to all. Made by expats for expats€149 flat feesimple and affordabletax filing made easy

Irs Estimated Tax Payments 2024 Dotti Gianina

Web you can pay the entire estimated tax by the sept. 15 due date or pay it in two installments by sept. Web as a result of all of this, the deadline for filing federal income tax returns (generally form 1040), will be tuesday, april 18, 2023, and most states usually follow the same. Generally, most individuals are calendar year.

IRS Payment Plan How It Works Tax Relief Center

Web use the irs tax calendar to view filing deadlines and actions each month. The schedule for this is varied. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Web use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings.

When Are IRS Estimated Tax Payments Due?

Web there are four payment due dates in 2024 for estimated tax payments: Web use the irs tax calendar to view filing deadlines and actions each month. Web use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. It’s important to note that taxpayers. Download the.

Irs Tax Payments 2024 Online Carlin Carolina

Make a payment or view 5 years of payment history and any pending or scheduled payments. Web there are four payment due dates in 2024 for estimated tax payments: It shows when you need to submit tax forms, pay taxes, and do other things required by federal tax law. Generally, most individuals are calendar year filers. Every employer engaged in.

A StepbyStep Guide to IRS Payment Plans Gusto

22, 2023 — with the 2023 tax filing season in full swing, the irs reminds taxpayers to gather their necessary information and visit irs.gov for. Access the calendar online from your mobile device or desktop. The schedule for this is varied. These postponements are automatic and apply to all. Web you can pay the entire estimated tax by the sept.

How to View Your IRS Tax Payments Online • Countless

Web an irs tax calendar is like a year planner split into quarters. Find out the fees, deadlines and requirements for different. Web use the irs tax calendar to view filing deadlines and actions each month. Web add the gsa payroll calendar to your personal calendar. These postponements are automatic and apply to all.

Irs Tax Refund Payment Schedule 2024 Vitia Meriel

15 due date or pay it in two installments by sept. Find out the fees, deadlines and requirements for different. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. It shows when you need to submit tax forms, pay taxes, and do other things required by.

When Does Irs Efile Open For 2024 Jade Rianon

Web 2022 estimated tax payment dates. Web most federal tax return filing and payment deadlines are postponed from april 15 to july 15, 2020. Web see payment plan details or apply for a new payment plan. Find out the fees, deadlines and requirements for different. Download the gsa payroll calendar ics file.

Web 2024 Irs Tax Refund Schedule (2023 Tax Year):

Web an irs tax calendar is like a year planner split into quarters. Among the reminders in the publication are the payment deadlines for amounts of the. Web use the irs tax calendar to view filing deadlines and actions each month. 16, 2024, and january 2025.

Web 2022 Estimated Tax Payment Dates.

Access the calendar online from your mobile device or desktop. When will i receive my tax refund? Web add the gsa payroll calendar to your personal calendar. Make a payment or view 5 years of payment history and any pending or scheduled payments.

Web The Due Date For Filing Your Tax Return Is Typically April 15 If You’re A Calendar Year Filer.

Web the holiday is june 19, and is to be observed monday, june 20, in 2022. Web you can pay the entire estimated tax by the sept. These postponements are automatic and apply to all. Download the gsa payroll calendar ics file.

For Individuals, The Last Day To File Your 2023 Taxes Without An Extension Is April.

Made by expats for expats€149 flat feesimple and affordabletax filing made easy Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. The schedule for this is varied. It shows when you need to submit tax forms, pay taxes, and do other things required by federal tax law.