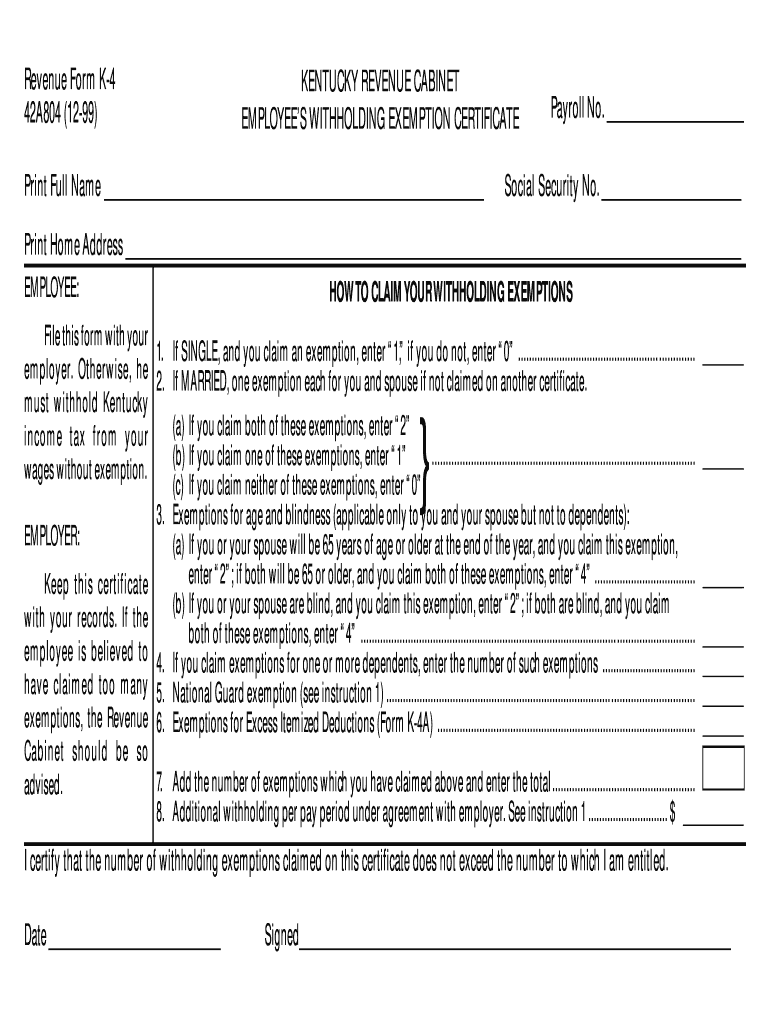

K 4 Form Kentucky

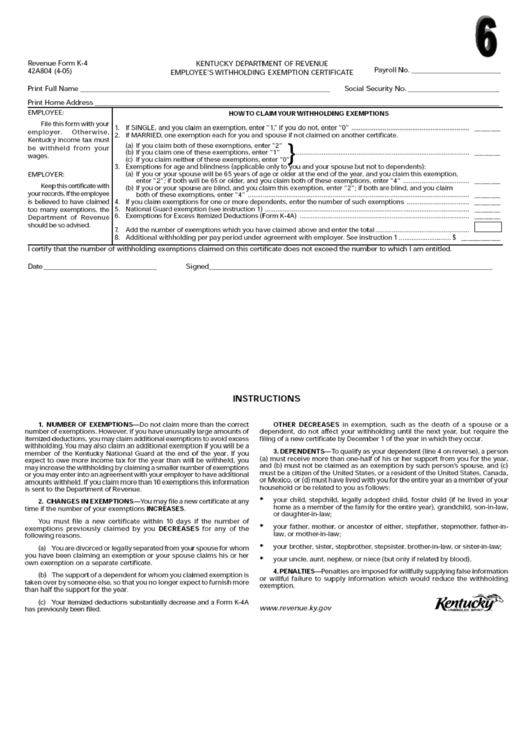

K 4 Form Kentucky - Keep it simple when filling out your kentucky form k 4 and use pdfsimpli. Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back form no. Sign it in a few clicks draw. Save or instantly send your ready documents. Compared to the 2021 version, the formula’s standard deduction. 7/97) department of workers claims 1270 louisville road frankfort, kentucky 40601 written notice of withdrawal of form 4. Web download the taxpayer bill of rights. Web kentucky’s 2022 withholding formula was released dec. 5 written notice of withdrawal (rev.

Web up to $40 cash back form no. Web open the k 4 form 2022 and follow the instructions easily sign the kentucky withholding form 2022 with your finger send filled & signed kentucky state withholding form 2022 or. You may be exempt from withholding if any of the. 7/97) department of workers claims 1270 louisville road frankfort, kentucky 40601 written notice of withdrawal of form 4. Easily fill out pdf blank, edit, and sign them. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Your federal income taxes withheld from your pay are not affected by work location. Sign it in a few clicks draw. Web instructions for employers revised november 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more.

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web center for engaged teaching & learning. 7/97) department of workers claims 1270 louisville road frankfort, kentucky 40601 written notice of withdrawal of form 4. Save or instantly send your ready documents. Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Web fill out the kentucky form k 4 form for free! Due to this change all kentucky wage earners will be taxed at 5% with. Web up to $40 cash back form no. 5 written notice of withdrawal (rev. Web kentucky’s 2022 withholding formula was released dec.

kentucky k 4 fillable Fill out & sign online DocHub

5 written notice of withdrawal (rev. Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. Due to this change all kentucky wage earners will be taxed at 5% with. The kentucky department of revenue conducts work under the authority of the.

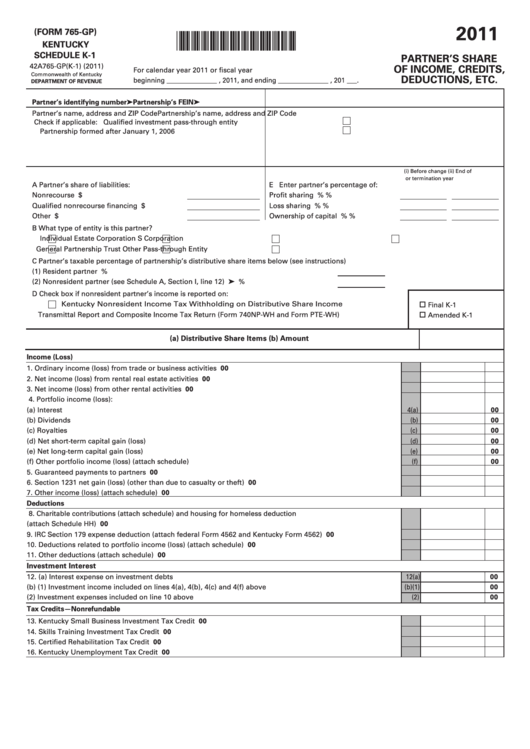

Kentucky Schedule K1 (Form 765Gp) Partner'S Share Of

Web fill out the kentucky form k 4 form for free! Easily fill out pdf blank, edit, and sign them. Web kentucky’s 2022 withholding formula was released dec. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Web center for engaged teaching & learning.

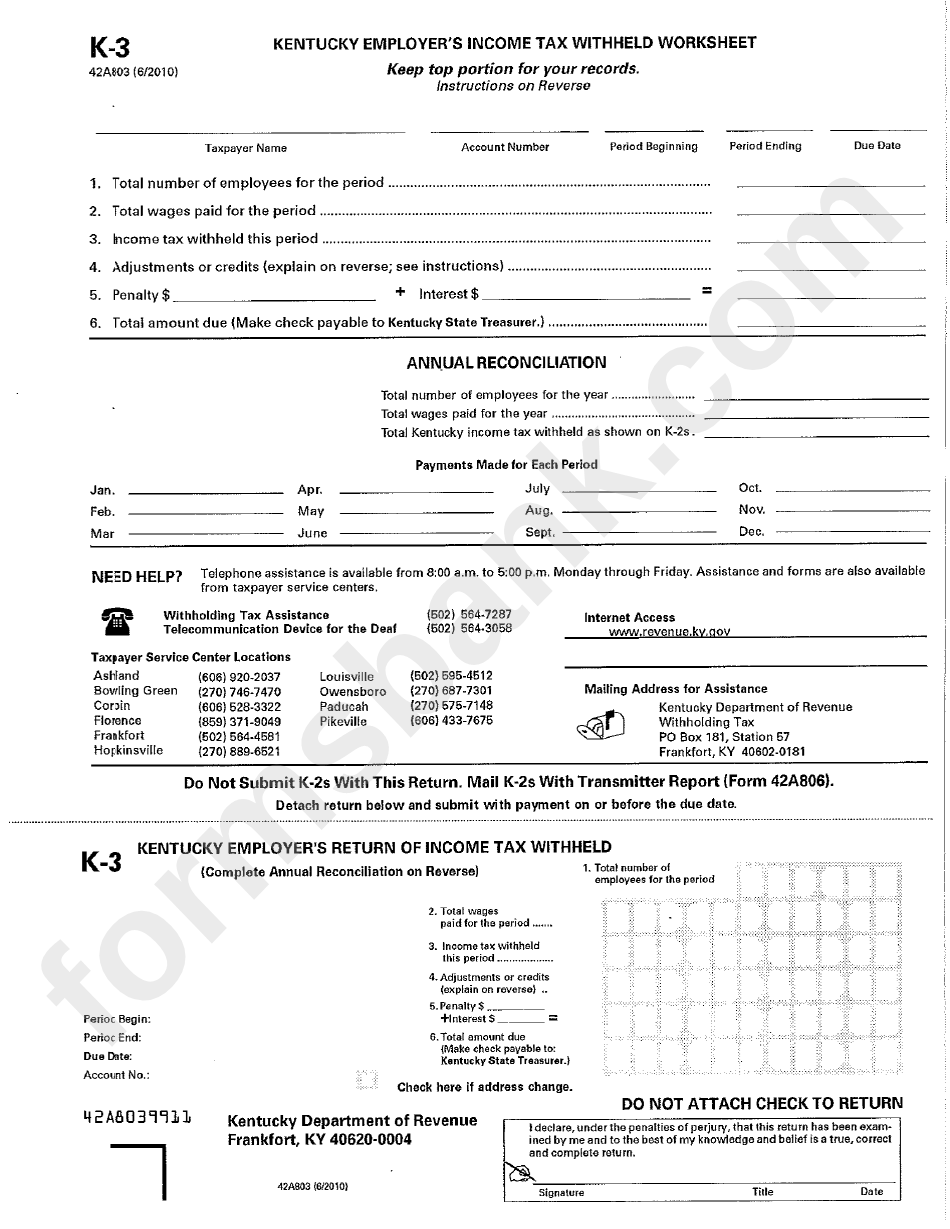

imperialpricedesign K 4 Form Kentucky

Web instructions for employers revised november 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. Web open the k 4 form 2022 and follow the instructions easily sign the kentucky withholding form 2022 with.

Kentucky K4 App

Web open the k 4 form 2022 and follow the instructions easily sign the kentucky withholding form 2022 with your finger send filled & signed kentucky state withholding form 2022 or. Web fill out the kentucky form k 4 form for free! Web download the taxpayer bill of rights. Compared to the 2021 version, the formula’s standard deduction. Web up.

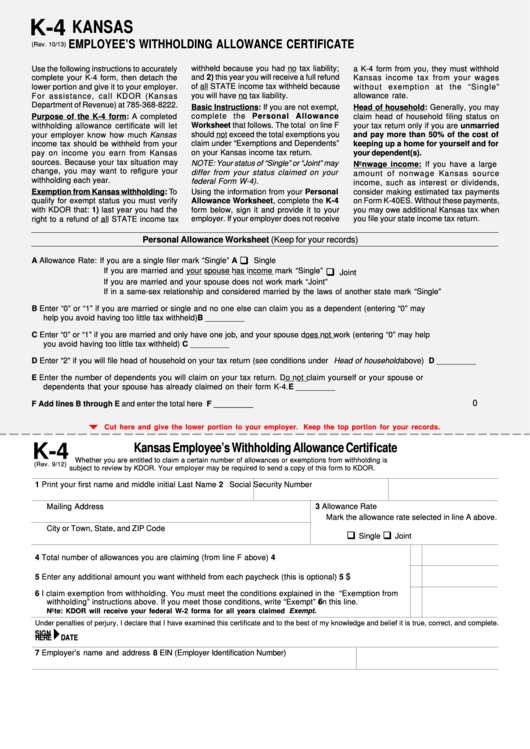

Kansas Withholding Form K 4 2022 W4 Form

Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw. Your federal income taxes withheld from your pay are not affected by work location. The internal revenue service suggests employees. Web up to $40 cash back form no.

Top Kentucky Form K4 Templates free to download in PDF format

Easily fill out pdf blank, edit, and sign them. 5 written notice of withdrawal (rev. Web download the taxpayer bill of rights. Web up to $40 cash back form no. The internal revenue service suggests employees.

Kansas K4 App

Web instructions for employers revised november 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Due to this change all kentucky wage earners will be taxed at 5% with. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web download the taxpayer bill of rights. Web center for.

imperialpricedesign K 4 Form Kentucky

Easily fill out pdf blank, edit, and sign them. Web center for engaged teaching & learning. 15 by the state revenue department. Keep it simple when filling out your kentucky form k 4 and use pdfsimpli. Sign it in a few clicks draw.

K for Kentucky

Web instructions for employers revised november 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. Easily fill out pdf blank, edit, and sign them. 5 written notice of withdrawal (rev. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Save or.

Federal W4 2022 W4 Form 2022 Printable

Web center for engaged teaching & learning. Web instructions for employers revised november 2021 commonwealth of kentucky department of revenue frankfort forms information forms 501 high street,. 5 written notice of withdrawal (rev. The internal revenue service suggests employees. 15 by the state revenue department.

Your Federal Income Taxes Withheld From Your Pay Are Not Affected By Work Location.

Edit your kentucky k 4 fillable tax form online type text, add images, blackout confidential details, add comments, highlights and more. You may be exempt from withholding if any of the. Easily fill out pdf blank, edit, and sign them. 5 written notice of withdrawal (rev.

The Kentucky Department Of Revenue Conducts Work Under The Authority Of The Finance And Administration Cabinet.

Web download the taxpayer bill of rights. Save or instantly send your ready documents. The internal revenue service suggests employees. Save or instantly send your ready documents.

Web Instructions To Employees All Kentucky Wage Earners Are Taxed At A Flat 5% Tax Rate With An Allowance For The Standard Deduction.

Web fill out the kentucky form k 4 form for free! Web center for engaged teaching & learning. Compared to the 2021 version, the formula’s standard deduction. Due to this change all kentucky wage earners will be taxed at 5% with.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

15 by the state revenue department. Web kentucky’s 2022 withholding formula was released dec. 7/97) department of workers claims 1270 louisville road frankfort, kentucky 40601 written notice of withdrawal of form 4. Keep it simple when filling out your kentucky form k 4 and use pdfsimpli.