Kentucky State Tax Form 2023

Kentucky State Tax Form 2023 - The kentucky general assembly's 2023 session kicks off next week. Tobacco and vapor products taxes; Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Visit our individual income tax page for more information. Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Motor vehicle rental/ride share excise tax; Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Be sure to verify that the form you are downloading is for the correct year.

Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Tobacco and vapor products taxes; Motor vehicle rental/ride share excise tax; Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. Visit our individual income tax page for more information. The kentucky general assembly's 2023 session kicks off next week. The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Utility gross receipts license tax; Keep in mind that some states will not update their tax forms for 2023 until january 2024.

Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Utility gross receipts license tax; Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Be sure to verify that the form you are downloading is for the correct year. Visit our individual income tax page for more information. Keep in mind that some states will not update their tax forms for 2023 until january 2024. The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year.

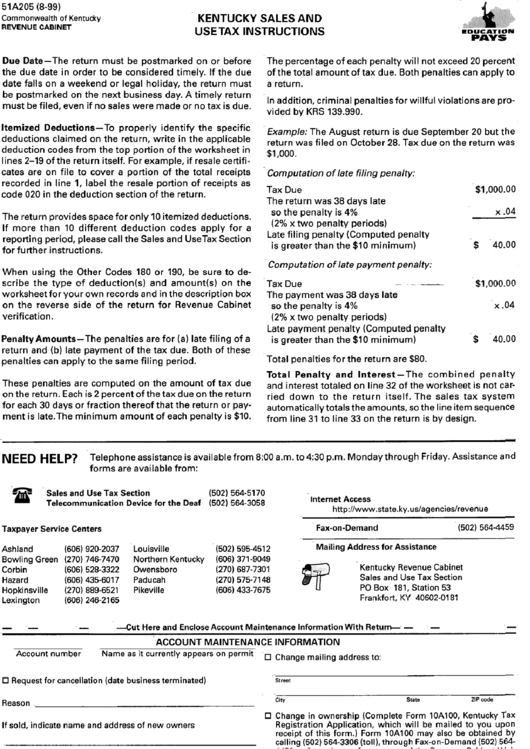

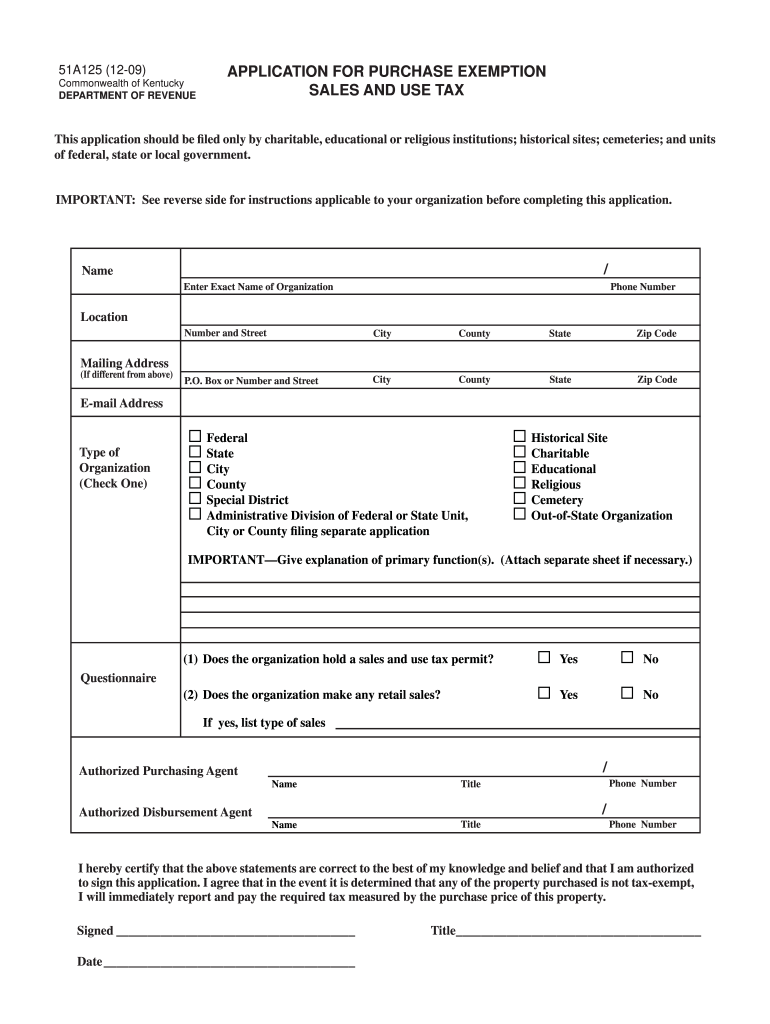

Form 51a205 Kentucky Sales And Use Tax Instructions printable pdf

The kentucky general assembly's 2023 session kicks off next week. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Be sure to verify that the form you are downloading is for the correct year. Tobacco and vapor products taxes; Web current individual income tax forms schedule p, kentucky pension income exclusion for.

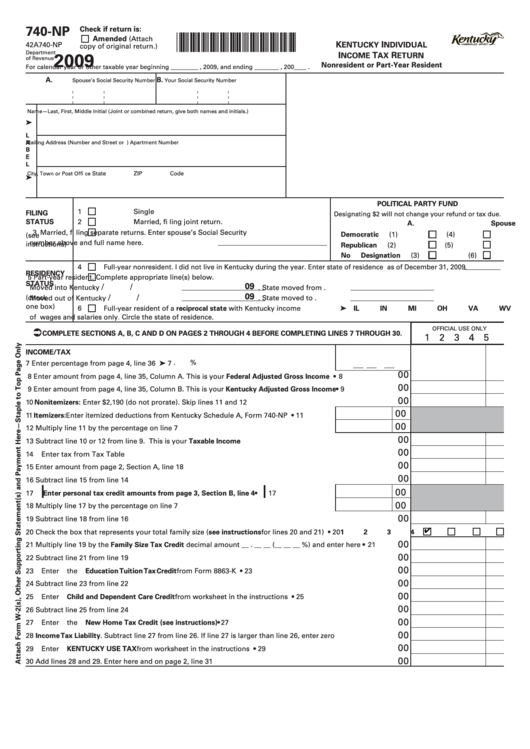

dipitdesign Kentucky Tax Form 740

Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Motor vehicle rental/ride share excise tax; Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Web • for 2023, you expect a refund of all your kentucky.

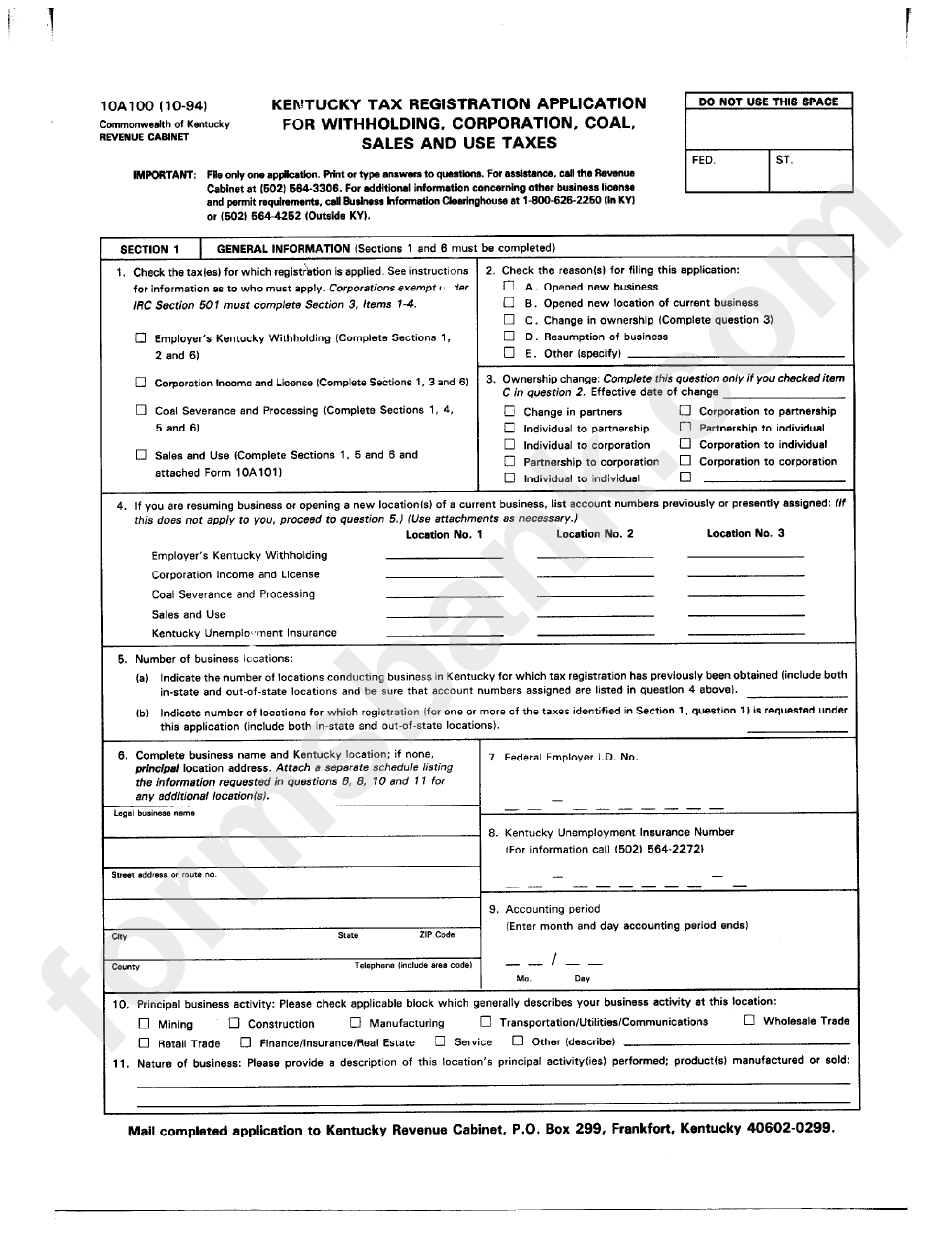

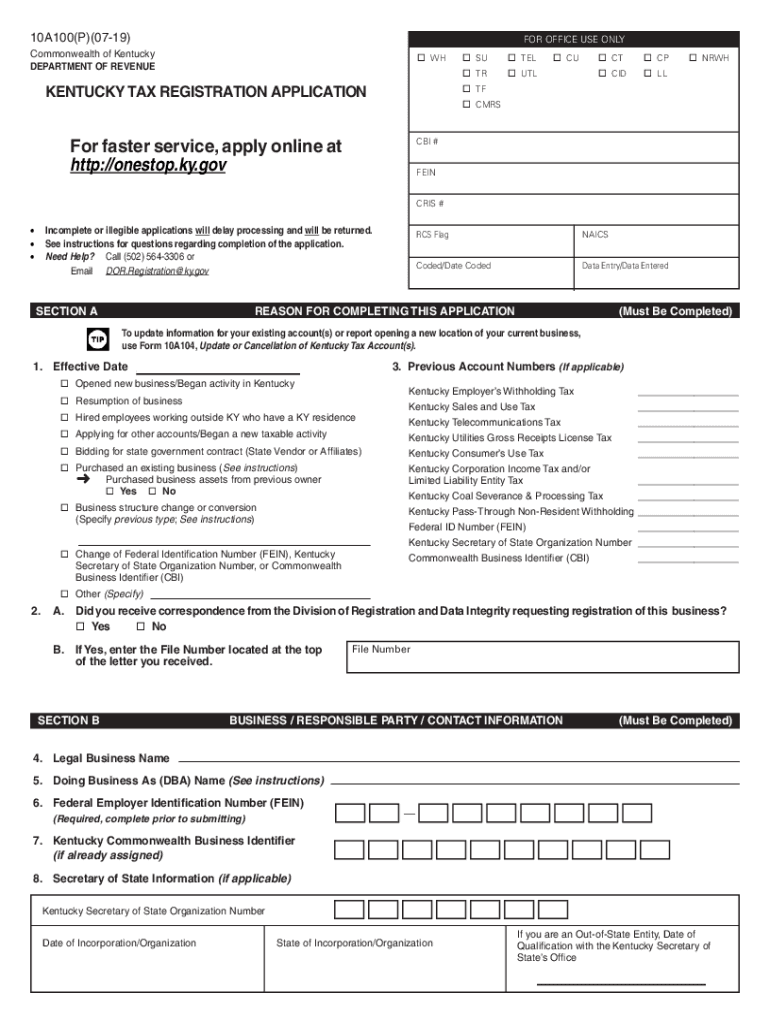

Fillable Form 10a100 Kentucky Tax Registration Application For

Motor vehicle rental/ride share excise tax; Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Utility gross receipts license tax; Be.

2021 year planner calendar download for a4 or a3 print infozio your

Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. Tobacco and vapor products taxes; Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Utility gross receipts license tax; The kentucky general assembly's 2023 session kicks off.

Kentucky tax registration application Fill out & sign online DocHub

Visit our individual income tax page for more information. The kentucky general assembly's 2023 session kicks off next week. Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the.

New Employee Sample Form 2023 Employeeform Net Kentucky State

Kentucky revised statute chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Web the kentucky withholding tax rate will be 4.5% for tax year 2023. The kentucky general assembly's 2023 session kicks off next week. Web • for 2023, you expect a refund of all your kentucky income tax withheld. Tobacco.

Ky Exemption Tax Form Fill Out and Sign Printable PDF Template signNow

Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Tobacco and vapor products taxes; The kentucky general assembly's 2023 session kicks.

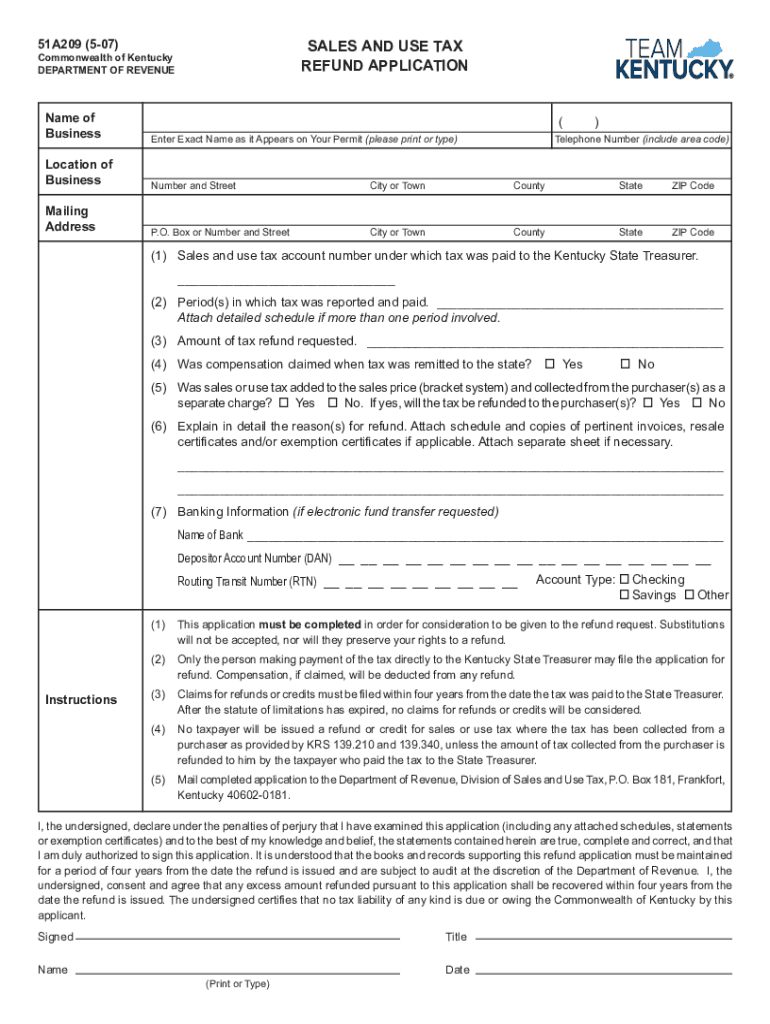

Refund Kentucky Form Fill Out and Sign Printable PDF Template signNow

Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Utility gross receipts license tax; The new individual income tax rate for.

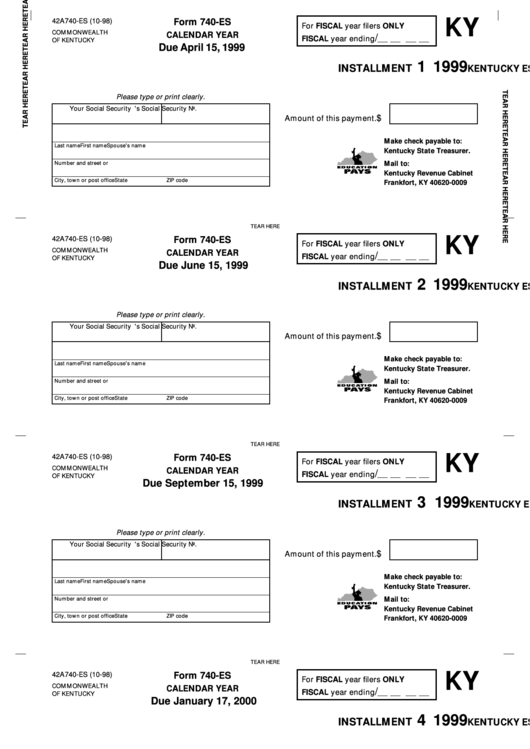

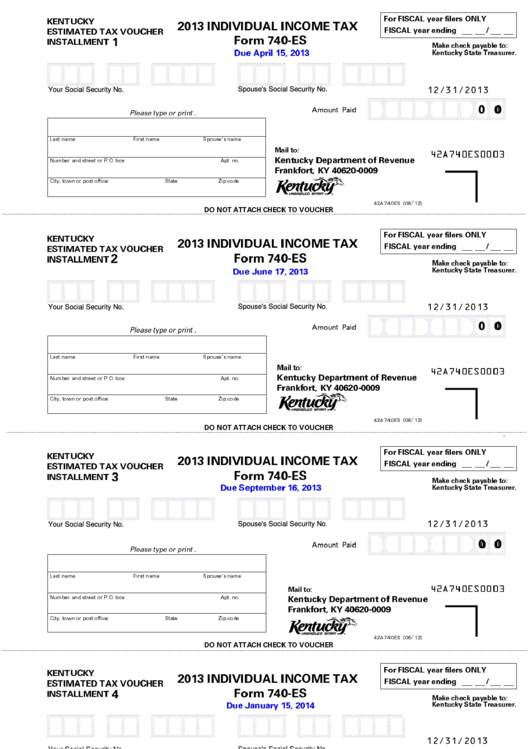

Fillable Form 740Es Individual Tax Kentucky Estimated Tax

Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Motor vehicle rental/ride share excise tax; Web the kentucky withholding tax rate.

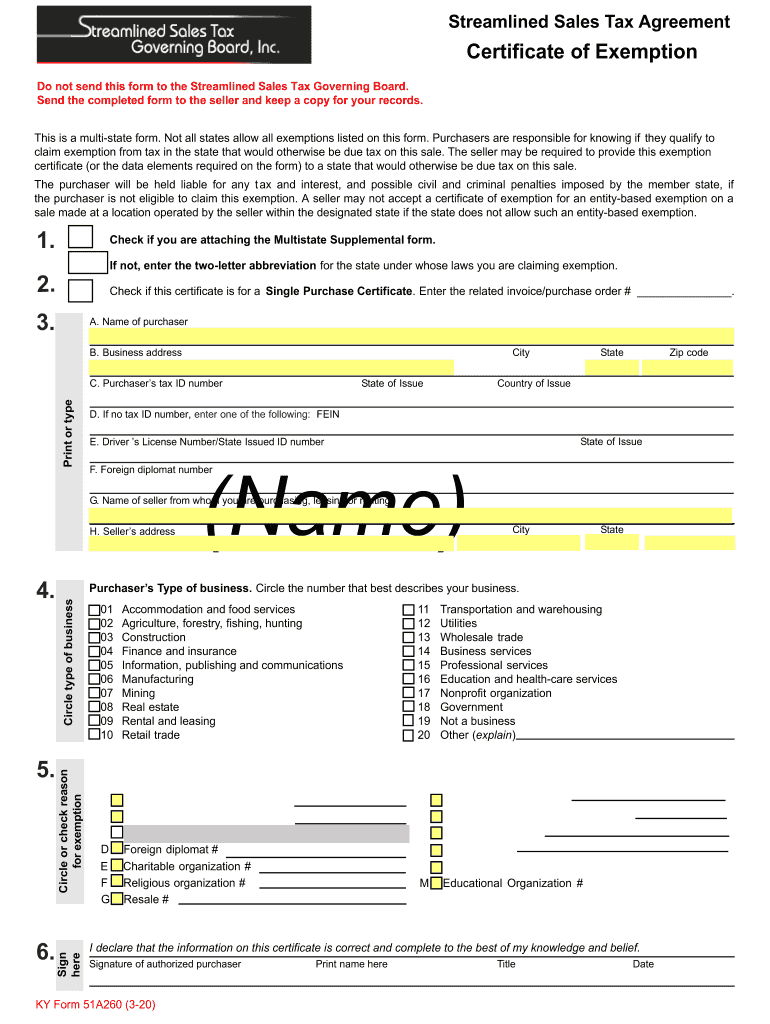

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Web current individual income tax forms schedule p, kentucky pension income exclusion for all individuals who are retired from the federal government, the commonwealth of kentucky, or a kentucky local government with service performed prior to january 1, 1998, you may be able to exclude more than $31,110*. Motor vehicle rental/ride share excise tax; Kentucky revised statute chapter 141 requires.

Be Sure To Verify That The Form You Are Downloading Is For The Correct Year.

Tobacco and vapor products taxes; The kentucky general assembly's 2023 session kicks off next week. Web • for 2023, you expect a refund of all your kentucky income tax withheld. Utility gross receipts license tax;

Kentucky Revised Statute Chapter 141 Requires Employers To Withhold Income Tax For Both Residents And Nonresidents Employees (Unless Exempted By Law).

The new individual income tax rate for 2023 has also been established to be 4.5%, a reduction by.5% from the 2022 tax rate. Web the kentucky withholding tax rate will be 4.5% for tax year 2023. Web this amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year. Visit our individual income tax page for more information.

Web Current Individual Income Tax Forms Schedule P, Kentucky Pension Income Exclusion For All Individuals Who Are Retired From The Federal Government, The Commonwealth Of Kentucky, Or A Kentucky Local Government With Service Performed Prior To January 1, 1998, You May Be Able To Exclude More Than $31,110*.

Keep in mind that some states will not update their tax forms for 2023 until january 2024. Income tax liability thresholds— the 2022 filingthreshold amount based upon federal poverty level is expected to be $13,590 for a family Motor vehicle rental/ride share excise tax;