Kiddie Tax Form 8814

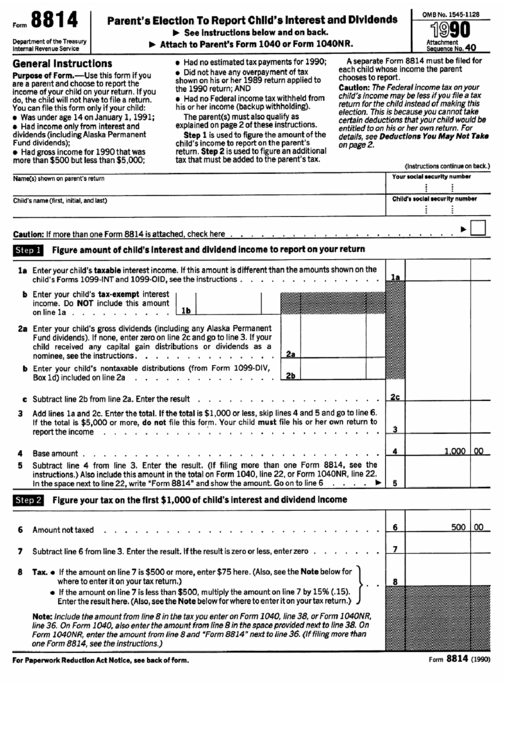

Kiddie Tax Form 8814 - Parents may elect to include their child's income from interest, dividends, and capital gains with. Find irs forms and answers to tax questions. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. Get ready for tax season deadlines by completing any required tax forms today. A separate form 8814 must be filed for. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. By signing below, i agree to the application process; Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web the kiddie tax should be included in 2 forms (form 8814 and form 8615).

Use this form if you. Web the kiddie tax should be included in 2 forms (form 8814 and form 8615). Per irs publication 929 tax rules for. A separate form 8814 must be filed for. For 2020 and later tax years, children’s unearned income is taxed at their parent’s marginal. Complete, edit or print tax forms instantly. It applies to children with over $2,300 unearned income and can significantly impact a. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web let’s walk through the irs form 8814 basics. Web the income is reported on form 8814.

We help you understand and meet your federal tax responsibilities. Web the kiddie tax is tax on a child's unearned income. We have reproduced key portions of the 8814 instructions, with our own summary below. A separate form 8814 must be filed for. Use this form if you. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Find irs forms and answers to tax questions. Advance payment process of the child tax credit; The child had more than $2,300 of unearned income. Web if you checked the box on line c above, see the instructions.

Understanding the new kiddie tax Additional examples Journal of

If the child's unearned income exceeds $2,200, then he or she is subject to the kiddie tax, says michael trank,. Complete, edit or print tax forms instantly. Was under age 18 at the end of 2022, b. Advance payment process of the child tax credit; We have reproduced key portions of the 8814 instructions, with our own summary below.

Child Tax Release Form f8332 Tax Exemption Social Security Number

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. I agree that all of the. We help you understand and meet your federal tax responsibilities. The child is required to file a tax return. Web the income is reported on form 8814.

2022 Child Tax Credits Form Fillable, Printable PDF & Forms Handypdf

Complete, edit or print tax forms instantly. Web if your child is required to file form 8615, the child may be subject to the net investment income tax (niit). Find irs forms and answers to tax questions. Updating your child tax credit information during 2021; If the child's unearned income exceeds $2,200, then he or she is subject to the.

Understanding the new kiddie tax Additional examples Journal of

Updating your child tax credit information during 2021; Complete, edit or print tax forms instantly. Was under age 18 at the end of 2022, b. Advance payment process of the child tax credit; Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc.

"Kiddie Tax" Hurts Families More Than Ever Roger Rossmeisl, CPA

Niit is a 3.8% tax on the lesser of net investment income or the. It applies to children with over $2,300 unearned income and can significantly impact a. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web the income is reported on form 8814..

2021 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

Updating your child tax credit information during 2021; Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. Web the kiddie tax should be included in 2 forms (form 8814 and form 8615). The child is required to file a tax.

Tax Reform for Individuals Kiddie Tax Changes Anders CPA

Web if your child is required to file form 8615, the child may be subject to the net investment income tax (niit). Complete, edit or print tax forms instantly. We help you understand and meet your federal tax responsibilities. Get ready for tax season deadlines by completing any required tax forms today. Web the kiddie tax should be included in.

What You Need to Know About Kiddie Tax Mariner Wealth Advisors

Web the kiddie tax is tax on a child's unearned income. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Updating your child tax credit information during 2021; Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the.

The kiddie tax trap

Parents may elect to include their child's income from interest, dividends, and capital gains with. Complete, edit or print tax forms instantly. Find irs forms and answers to tax questions. How much is the kiddie tax? Web fsd may hold the tax refund intercept for six months if the noncustodial parent filed a joint income tax return, and the noncustodial.

Form 8814 Parents' Election To Report Child'S Interest And Dividends

We have reproduced key portions of the 8814 instructions, with our own summary below. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). If the child's unearned income exceeds $2,200, then he or she is subject to the kiddie tax, says michael trank,. Complete, edit.

Web Fsd May Hold The Tax Refund Intercept For Six Months If The Noncustodial Parent Filed A Joint Income Tax Return, And The Noncustodial Parent’s Spouse Did Not Claim His/Her Portion Of.

We help you understand and meet your federal tax responsibilities. We have reproduced key portions of the 8814 instructions, with our own summary below. If the child's unearned income exceeds $2,200, then he or she is subject to the kiddie tax, says michael trank,. Niit is a 3.8% tax on the lesser of net investment income or the.

It Applies To Children With Over $2,300 Unearned Income And Can Significantly Impact A.

I agree that all of the. A separate form 8814 must be filed for. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web if you checked the box on line c above, see the instructions.

Web If Your Child Is Required To File Form 8615, The Child May Be Subject To The Net Investment Income Tax (Niit).

Complete, edit or print tax forms instantly. How much is the kiddie tax? Was under age 18 at the end of 2022, b. Parents may elect to include their child's income from interest, dividends, and capital gains with.

Per Irs Publication 929 Tax Rules For.

The child had more than $2,300 of unearned income. Web the kiddie tax should be included in 2 forms (form 8814 and form 8615). Find irs forms and answers to tax questions. Advance payment process of the child tax credit;