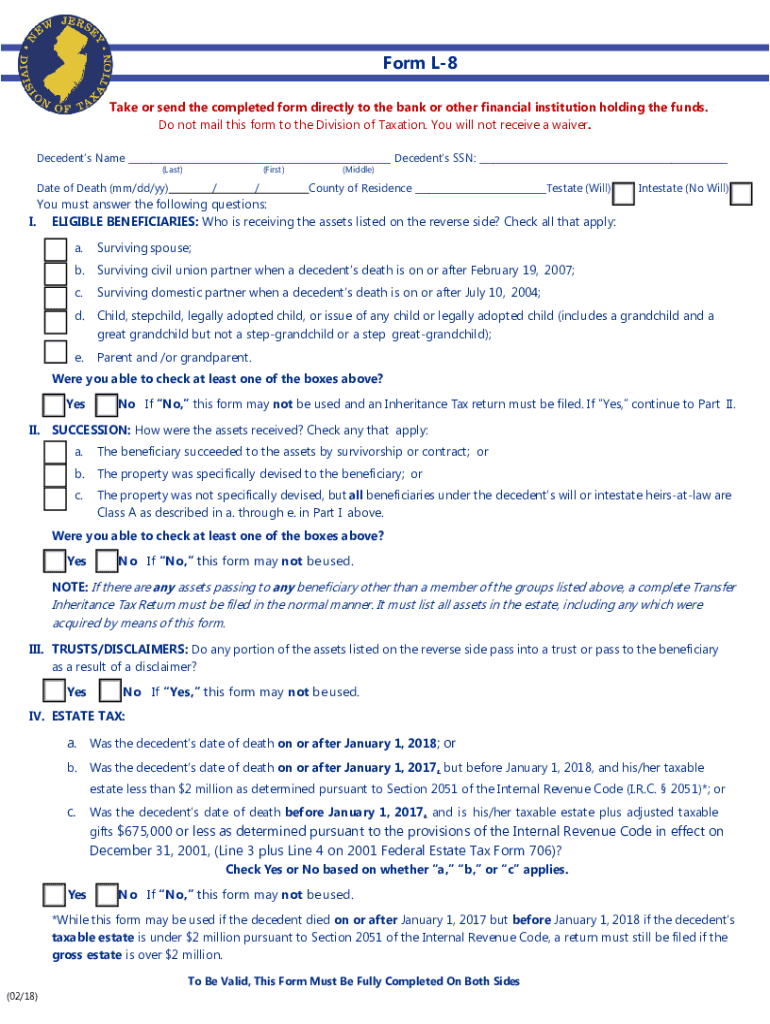

L-8 Form Nj

L-8 Form Nj - You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. And • new jersey investment bonds. This is new jersey law. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. Use this form for release of: However, if other heirs file to claim real estate property, then the value may not exceed $20,000. • new jersey bank accounts; No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. No estate tax is ever due when there is a surviving spouse. • stock in new jersey corporations;

No estate tax is ever due when there is a surviving spouse. Use this form for release of: • stock in new jersey corporations; You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. • new jersey bank accounts; This form cannot be used for real estate. And • new jersey investment bonds. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. For real estate investments, use.

No estate tax is ever due when there is a surviving spouse. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. • new jersey bank accounts; Use this form for release of: However, if other heirs file to claim real estate property, then the value may not exceed $20,000. For real estate investments, use. • stock in new jersey corporations; No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. And • new jersey investment bonds. This is new jersey law.

Nj L8 Form 2018 Fill Out and Sign Printable PDF Template signNow

No estate tax is ever due when there is a surviving spouse. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. • new jersey bank accounts; No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. Use this form for release of:

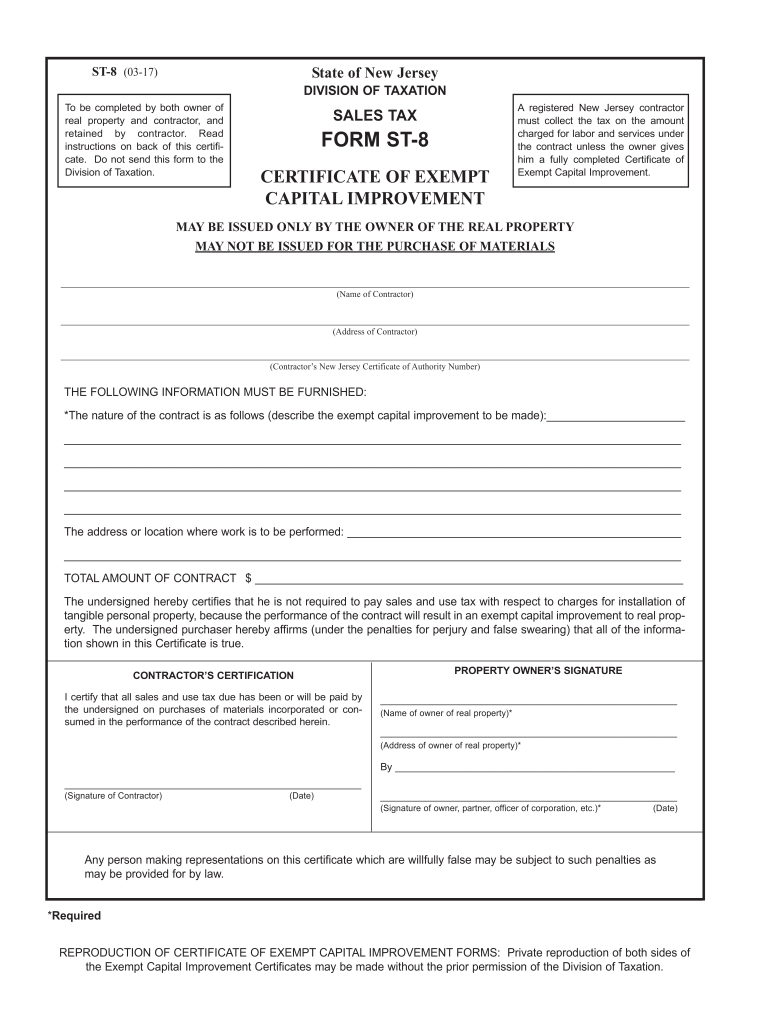

20172023 Form NJ DoT ST8 Fill Online, Printable, Fillable, Blank

For real estate investments, use. • stock in new jersey corporations; No estate tax is ever due when there is a surviving spouse. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. This form cannot be used for real estate.

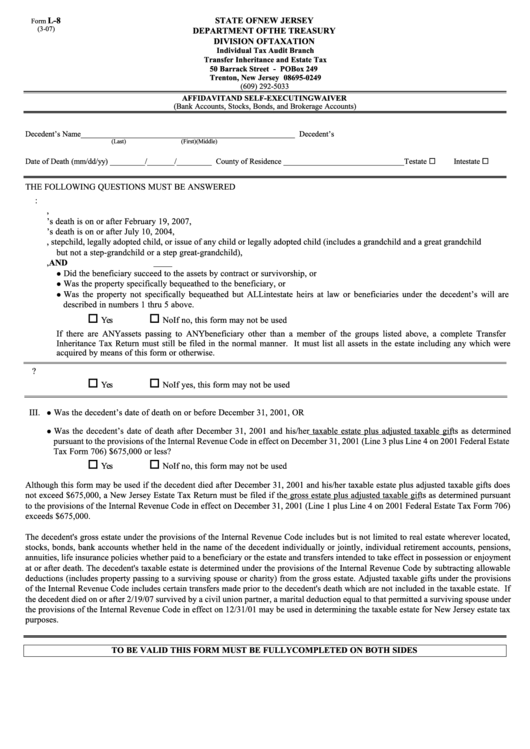

Form L8 Affidavit And SelfExecuting Waiver New Jersey Department

This is new jersey law. No estate tax is ever due when there is a surviving spouse. • stock in new jersey corporations; And • new jersey investment bonds. No inheritance tax is due on inheritances to a surviving spouse, child or grandchild.

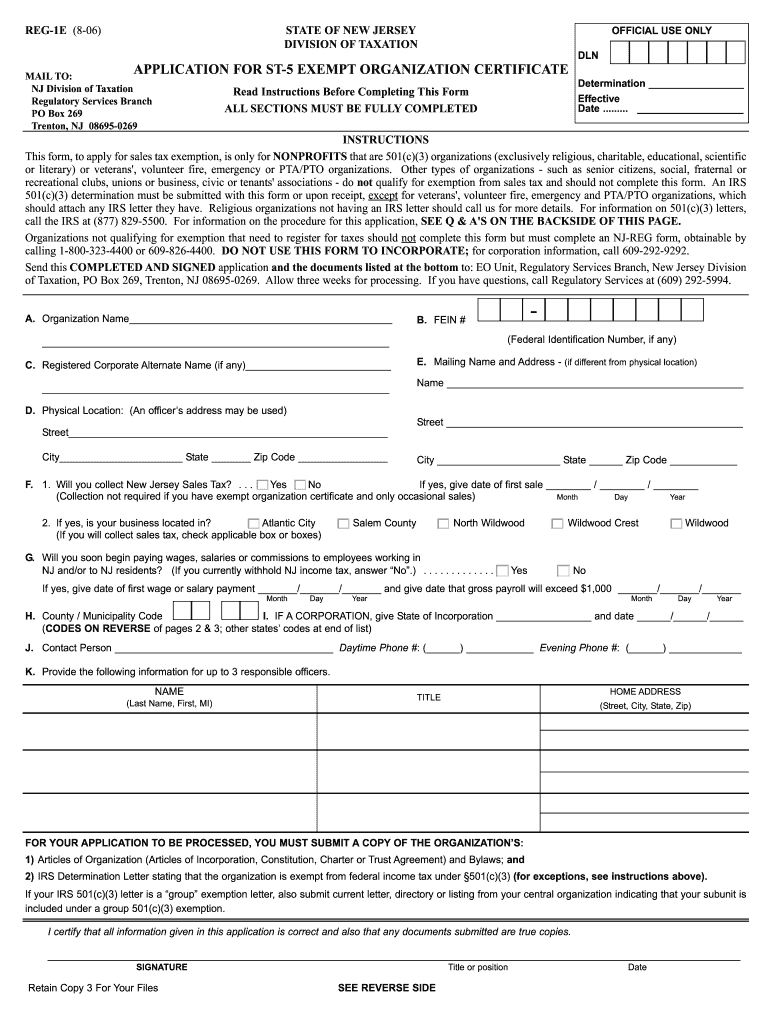

Reg 1e application 2006 form Fill out & sign online DocHub

Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. This form cannot be used for real estate. • stock in new jersey corporations; You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. For real estate investments, use.

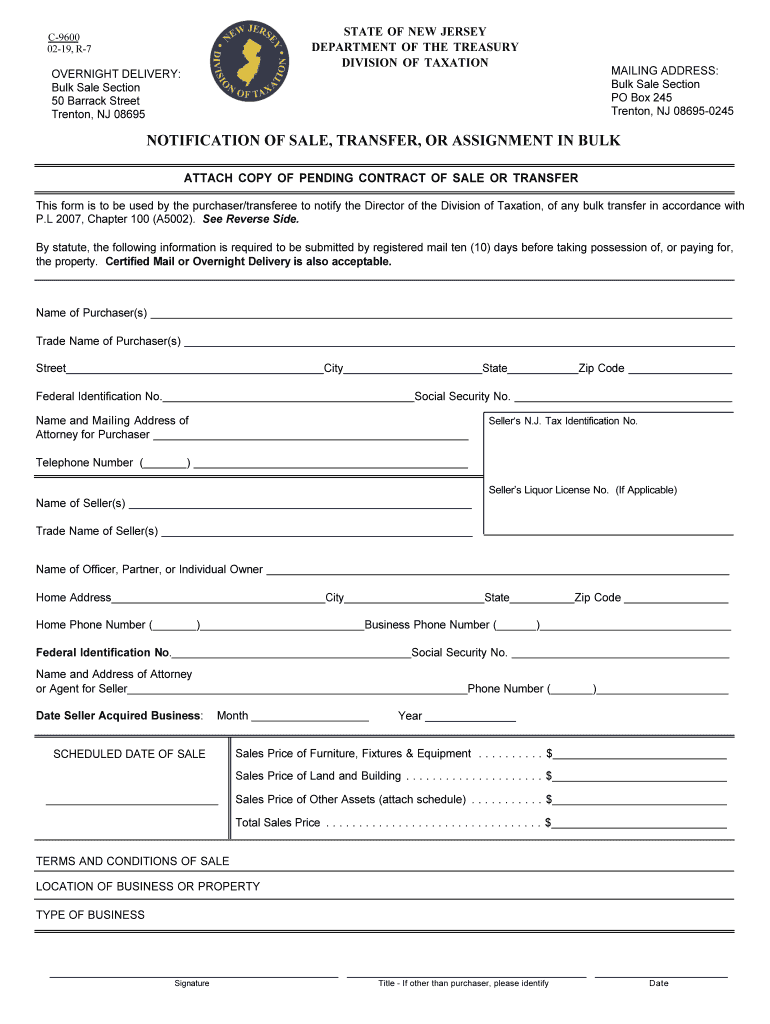

20192021 Form NJ DoT C9600 Fill Online, Printable, Fillable, Blank

No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. For real estate investments, use. This is new jersey law. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding.

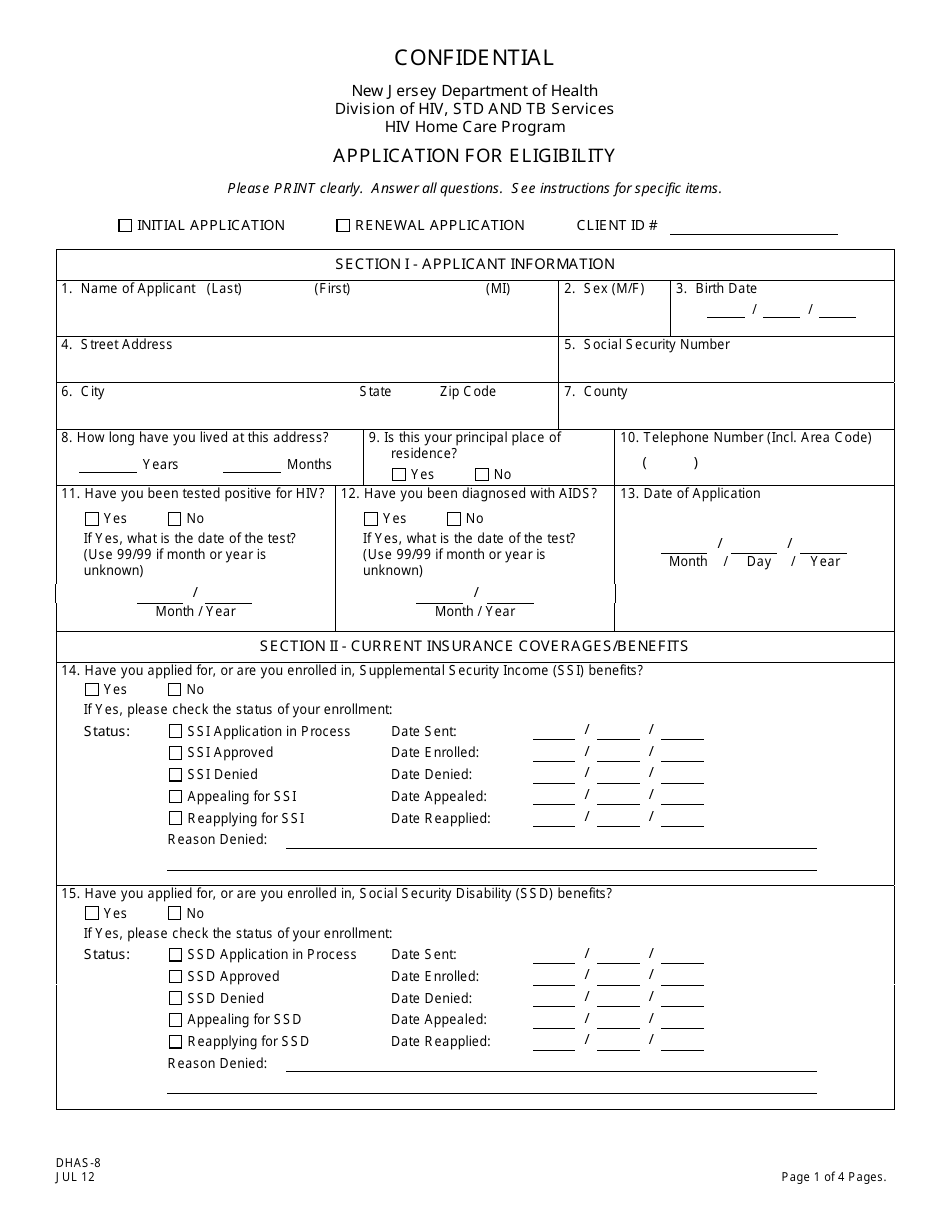

Form DHAS8 Download Printable PDF or Fill Online Application for

And • new jersey investment bonds. This is new jersey law. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. No estate tax is ever due when there is a surviving spouse. This form cannot be used for real estate.

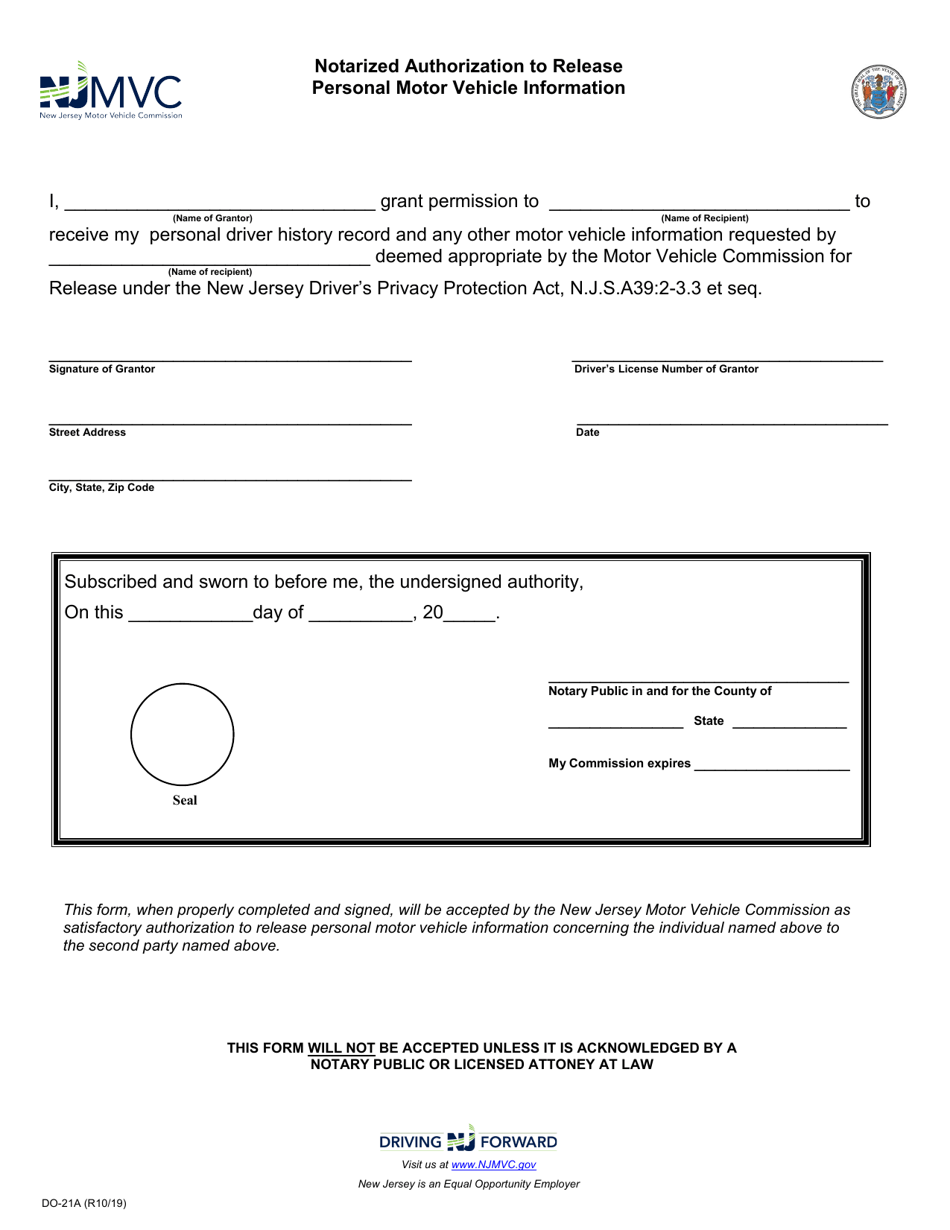

Form DO21A Download Fillable PDF or Fill Online Notarized

You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. This form cannot be used for real estate. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. • stock in new jersey corporations; For real estate investments, use.

Fillable Form L8 Individual Tax Audit Branch Transfer Inheritance And

• stock in new jersey corporations; You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. This is new jersey law. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. • new jersey bank accounts;

Nj State Tax Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. Use this form for release of: However, if other heirs file to claim real estate property, then the value may not exceed.

Statement of Assets, Liabilities and Net Worth (SALN) Form 2012

Use this form for release of: No estate tax is ever due when there is a surviving spouse. However, if other heirs file to claim real estate property, then the value may not exceed $20,000. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. • stock in new jersey.

• New Jersey Bank Accounts;

No inheritance tax is due on inheritances to a surviving spouse, child or grandchild. You must file this form directly with each bank, financial institution, broker or transfer agent holding the assets. Then they can be sent or brought directly to the bank, transfer agent, or other financial institutions holding the funds. However, if other heirs file to claim real estate property, then the value may not exceed $20,000.

And • New Jersey Investment Bonds.

Use this form for release of: This is new jersey law. • stock in new jersey corporations; For real estate investments, use.

No Estate Tax Is Ever Due When There Is A Surviving Spouse.

This form cannot be used for real estate.