Louisiana Form L 3

Louisiana Form L 3 - If an employer fails to submit copies of the employees w. Beginning january 1, 2014, all employers filing. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. You must file copies of: Mark box if address has changed. Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. Complete, edit or print tax forms instantly. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. If a billing notice is issued, a collection fee may also be imposed. File returns and make payments.

Find out when all state tax returns are due. Web access your account online. Third quarter employer's return of. Web 2023 estimated tax voucher for corporations. Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Beginning january 1, 2014, all employers filing. Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. Web as an employer in the state of louisiana, you must file. Mark box if address has changed. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer.

Web as an employer in the state of louisiana, you must file. Deadline to file form 1099 and. Any form 1099 that is reporting louisiana income tax withheld; Online applications to register a business. Please mark method of filing: Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Web what is the l 3 form for louisiana? Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. You must file copies of: Beginning january 1, 2014, all employers filing.

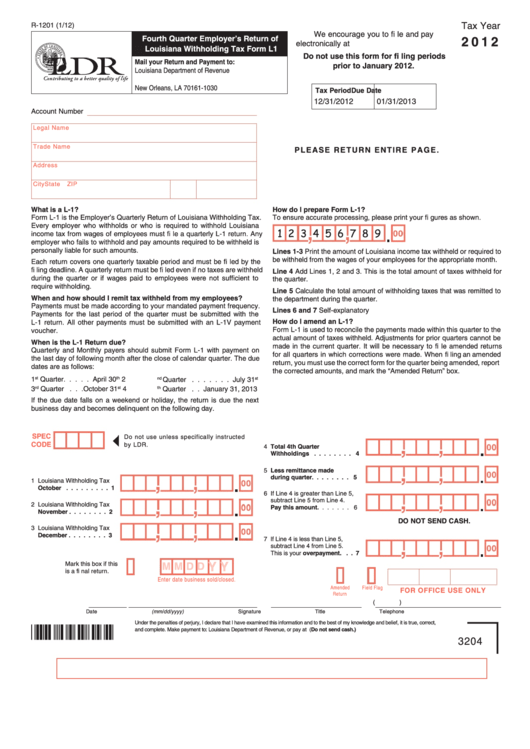

Fillable Form R1201 Fourth Quarter Employer'S Return Of Louisiana

Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. First, it is a reconciliation of the total amount of withheld income tax reported to the total withheld. Please mark method of filing: File returns and make payments. Any form 1099 that is.

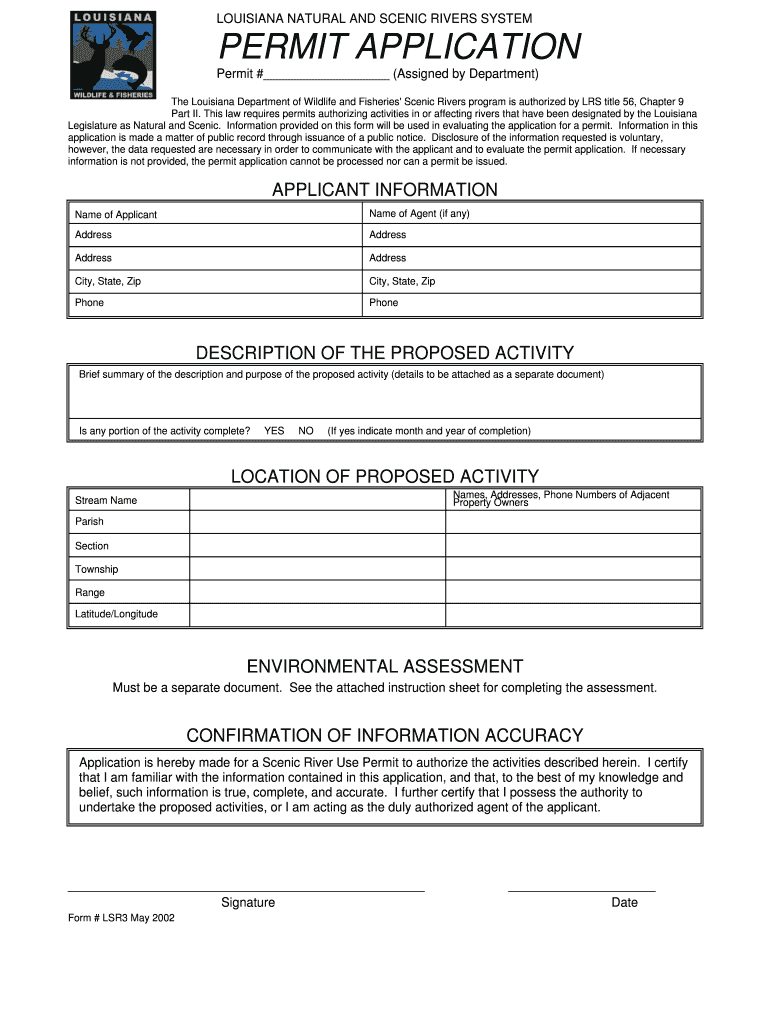

Wlf Louisiana Form Fill Out and Sign Printable PDF Template signNow

Any form 1099 that is reporting louisiana income tax withheld; Web as an employer in the state of louisiana, you must file. Online applications to register a business. Find out when all state tax returns are due. You must file copies of:

Land Ownership Maps Louisiana map Resume Examples Kw9kGPk9JN

You must file copies of: Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Find out when all state tax returns are due. First, it is a reconciliation of the total amount of withheld income tax reported to the total withheld. Any form 1099 that is reporting louisiana income tax.

Louisiana l4 form Fill out & sign online DocHub

Please enter the amount withheld in the appropriate 1st and 2nd half boxes. Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. Third quarter employer's return of. Complete, edit or print tax forms instantly. You must file copies of:

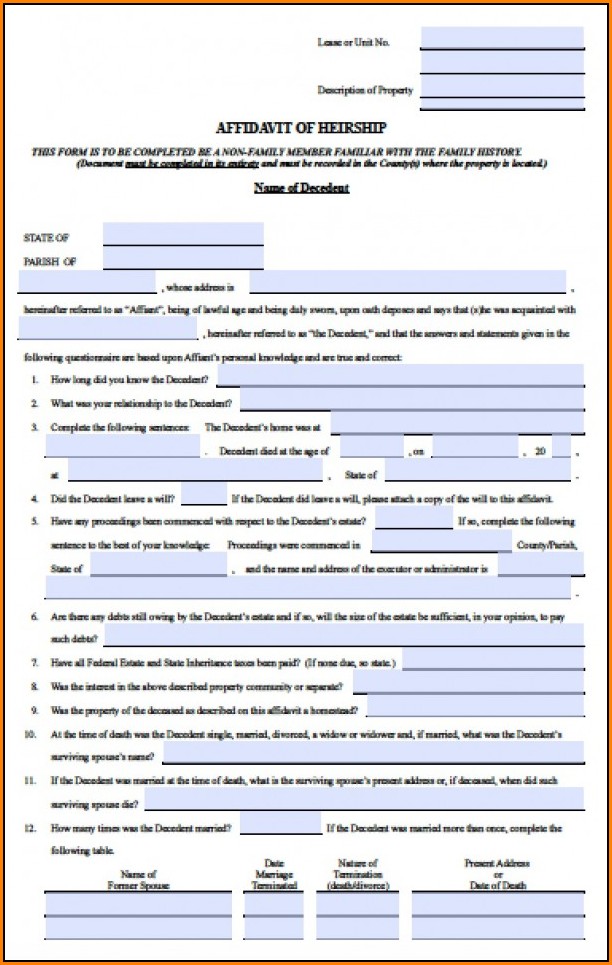

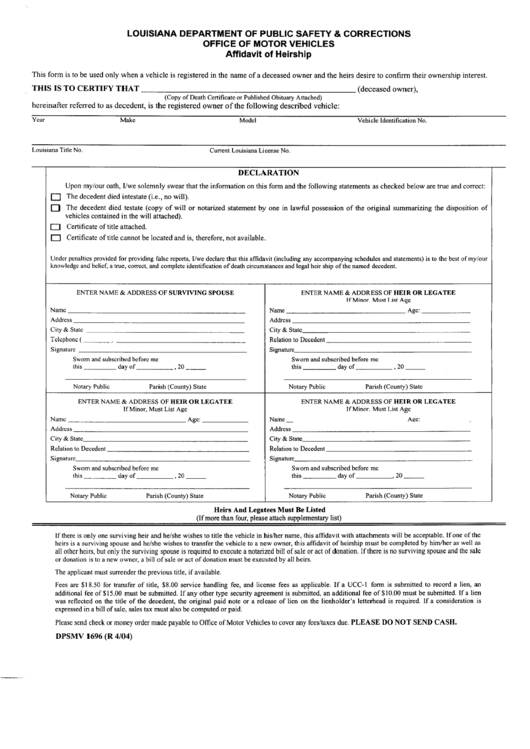

Louisiana Affidavit Forms / Download Blank Louisiana Affidavit for Free

First, it is a reconciliation of the total amount of withheld income tax reported to the total withheld. Mark box if address has changed. Deadline to file form 1099 and. Find out when all state tax returns are due. Please enter the amount withheld in the appropriate 1st and 2nd half boxes.

Power Of Attorney In Full

Mark box if address has changed. Find out when all state tax returns are due. Beginning january 1, 2014, all employers filing. Third quarter employer's return of. If a billing notice is issued, a collection fee may also be imposed.

Form L3 (R1203 WEB) Download Fillable PDF or Fill Online Transmittal

Web what is the l 3 form for louisiana? Web as an employer in the state of louisiana, you must file. Mark box if address has changed. You must file copies of: Web access your account online.

DELTA FORM L 3 Windelhose Slip 15 Stück online bestellen medpex

Third quarter employer's return of. Please mark method of filing: Web when filing an amended return, you must use the correct form for the quarter being amended, report the corrected amounts, and mark the “amended return” box. If an employer fails to submit copies of the employees w. Deadline to file form 1099 and.

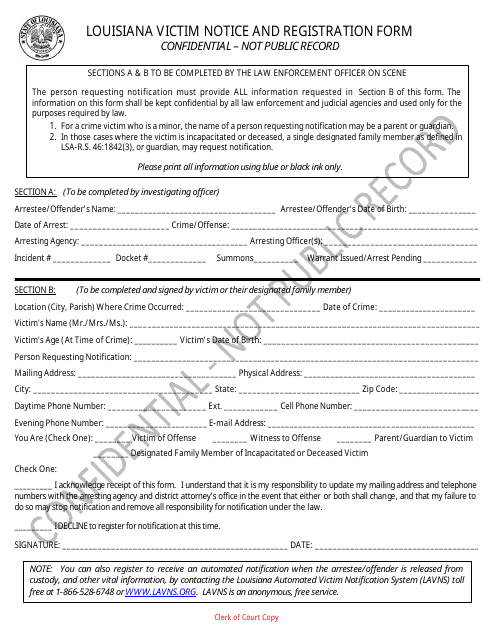

Louisiana Louisiana Victim Notice and Registration Form Download

Please mark method of filing: Complete, edit or print tax forms instantly. Third quarter employer's return of. If an employer fails to submit copies of the employees w. Web 2023 estimated tax voucher for corporations.

Louisiana Form L 3 Fill Online, Printable, Fillable, Blank pdfFiller

You must file copies of: If an employer fails to submit copies of the employees w. First, it is a reconciliation of the total amount of withheld income tax reported to the total withheld. Web access your account online. Third quarter employer's return of.

Web What Is The L 3 Form For Louisiana?

Please mark method of filing: Web as an employer in the state of louisiana, you must file. Web 2023 estimated tax voucher for corporations. Mark box if address has changed.

Find Out When All State Tax Returns Are Due.

If a billing notice is issued, a collection fee may also be imposed. Complete, edit or print tax forms instantly. If an employer fails to submit copies of the employees w. Web access your account online.

Please Enter The Amount Withheld In The Appropriate 1St And 2Nd Half Boxes.

File returns and make payments. Deadline to file form 1099 and. Any form 1099 that is reporting louisiana income tax withheld; Online applications to register a business.

Web When Filing An Amended Return, You Must Use The Correct Form For The Quarter Being Amended, Report The Corrected Amounts, And Mark The “Amended Return” Box.

First, it is a reconciliation of the total amount of withheld income tax reported to the total withheld. Beginning january 1, 2014, all employers filing. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Third quarter employer's return of.