Lpr Insurance Form

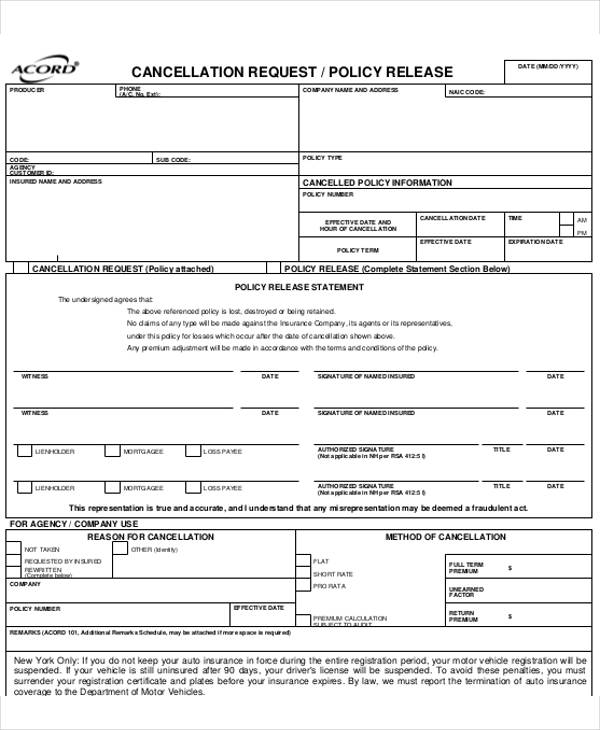

Lpr Insurance Form - This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) By so doing, you will ensure you do not have a lapse or duplication of coverage. Remarks (acord 101, additional remarks schedule, may be attached if more space is required) policy number effective date company subject to. Web lawfully present immigrants are eligible for coverage through the health insurance marketplace ®. By and large, an insured party that wanted to cancel an insurance policy would need to produce the original. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. Web a lost policy release (lpr) is a statement delivering an insurance company from its liabilities. If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. By law, we must report the termination of auto insurance coverage to the department of motor vehicles.

If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) Humanitarian statuses or circumstances (including temporary protected status, special. If your vehicle is still uninsured after 90 days, your driver’s license will be suspended. Web lawfully present immigrants are eligible for coverage through the health insurance marketplace ®. Remarks (acord 101, additional remarks schedule, may be attached if more space is required) policy number effective date company subject to. The term “lawfully present” includes immigrants who have:

On this page additional information The term “lawfully present” includes immigrants who have: If your vehicle is still uninsured after 90 days, your driver’s license will be suspended. If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. In the modern day, canceling an insurance policy no longer requires mailing back original. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. By so doing, you will ensure you do not have a lapse or duplication of coverage. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) By and large, an insured party that wanted to cancel an insurance policy would need to produce the original.

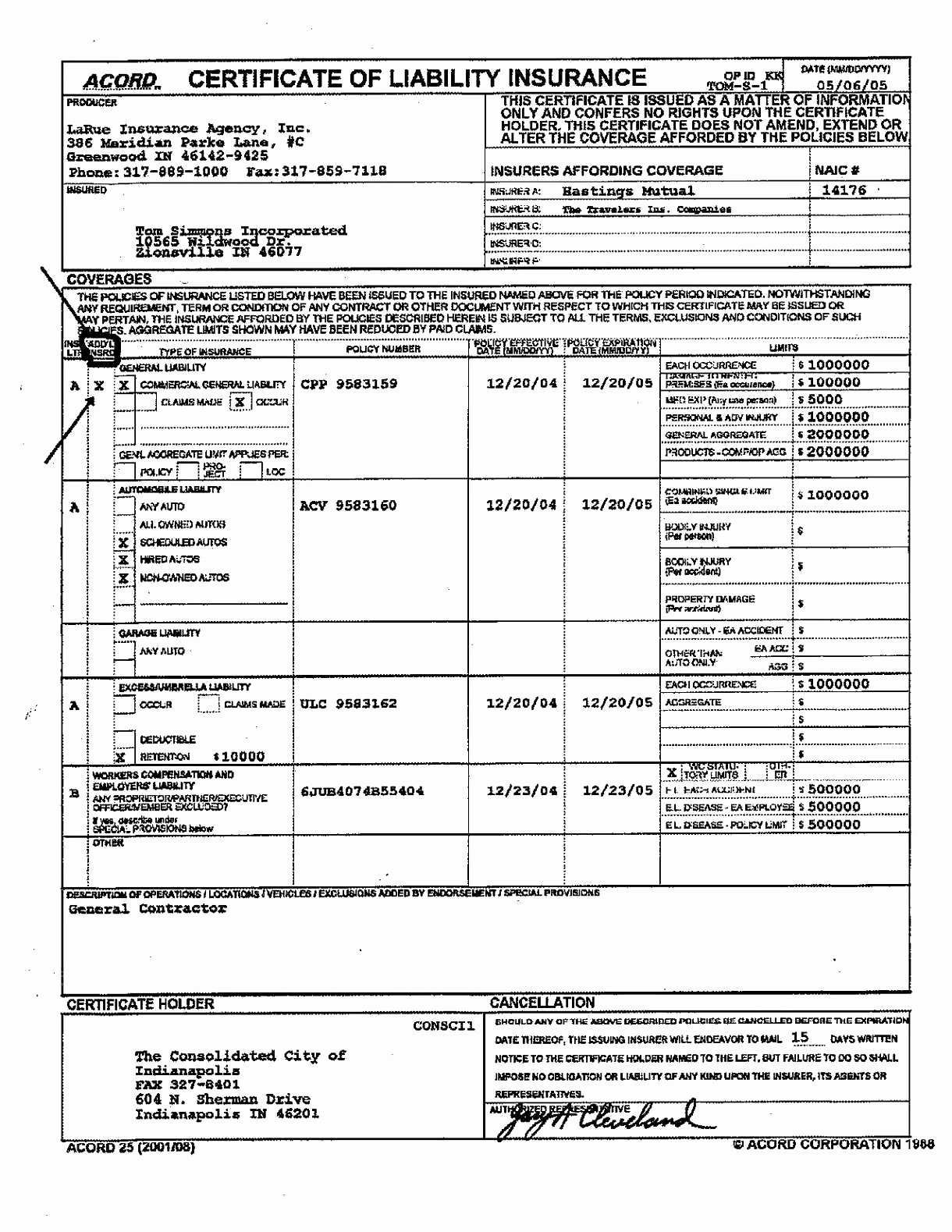

16 Printable acord form cancellation Templates Fillable Samples in

This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) Web in this video, james shows you how to fill out an acord 35 form. Web lawfully present immigrants are eligible for coverage through the health insurance marketplace ®. A lpr is endorsed by the insured party and connotes that.

Acord Insurance Certificate Template

By law, we must report the termination of auto insurance coverage to the department of motor vehicles. Web surrender your registration certificate and plates before your insurance expires. Web in this video, james shows you how to fill out an acord 35 form. In the modern day, canceling an insurance policy no longer requires mailing back original. Web a lost.

Low hour TEAC LPR400 all in one system can record Vinyl to CD even has

Web this form, which the insured signs, releases the insurance company from any further responsibility. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. The term “lawfully present” includes immigrants who.

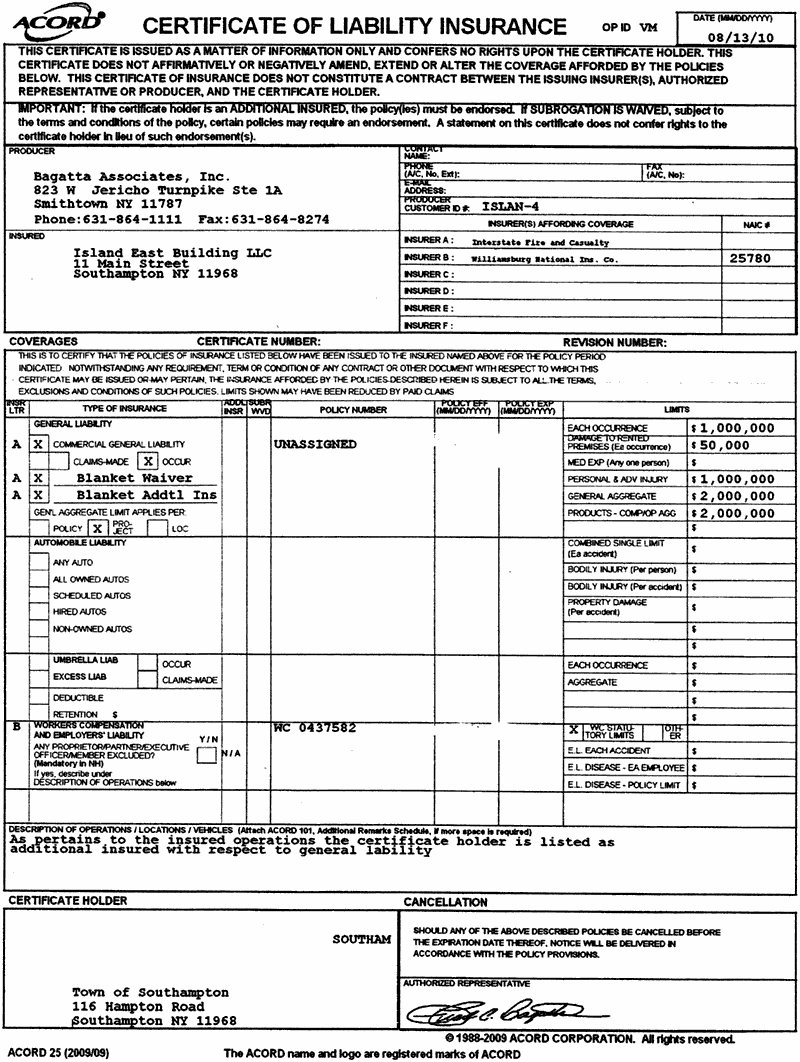

Acord® Certificate of Liability Insurance Island East Building

By so doing, you will ensure you do not have a lapse or duplication of coverage. If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. Web a lost policy release (lpr) is a statement delivering an insurance company from its liabilities..

How Insurers Can Maximize LPR Use Throughout Insurance Cycle

In the modern day, canceling an insurance policy no longer requires mailing back original. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. If your vehicle is still uninsured after 90 days, your driver's license will be suspended. Web a lost policy release (lpr) is a statement.

Insurance Lpr Pdf

By and large, an insured party that wanted to cancel an insurance policy would need to produce the original. If your vehicle is still uninsured after 90 days, your driver’s license will be suspended. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) Web lawfully present immigrants are eligible.

What Is An Lpr Insurance Form

Remarks (acord 101, additional remarks schedule, may be attached if more space is required) policy number effective date company subject to. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. The.

Printable Acord Cancellation Form Printable Word Searches

Web a lost policy release (lpr) is a statement that releases an insurance company from its liabilities. Web lawfully present immigrants are eligible for coverage through the health insurance marketplace ®. If your vehicle is still uninsured after 90 days, your driver’s license will be suspended. On this page additional information By so doing, you will ensure you do not.

What Is An Lpr Insurance Form

If your vehicle is still uninsured after 90 days, your driver's license will be suspended. By law, we must report the termination of auto insurance coverage to the department of motor vehicles. On this page additional information If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. A.

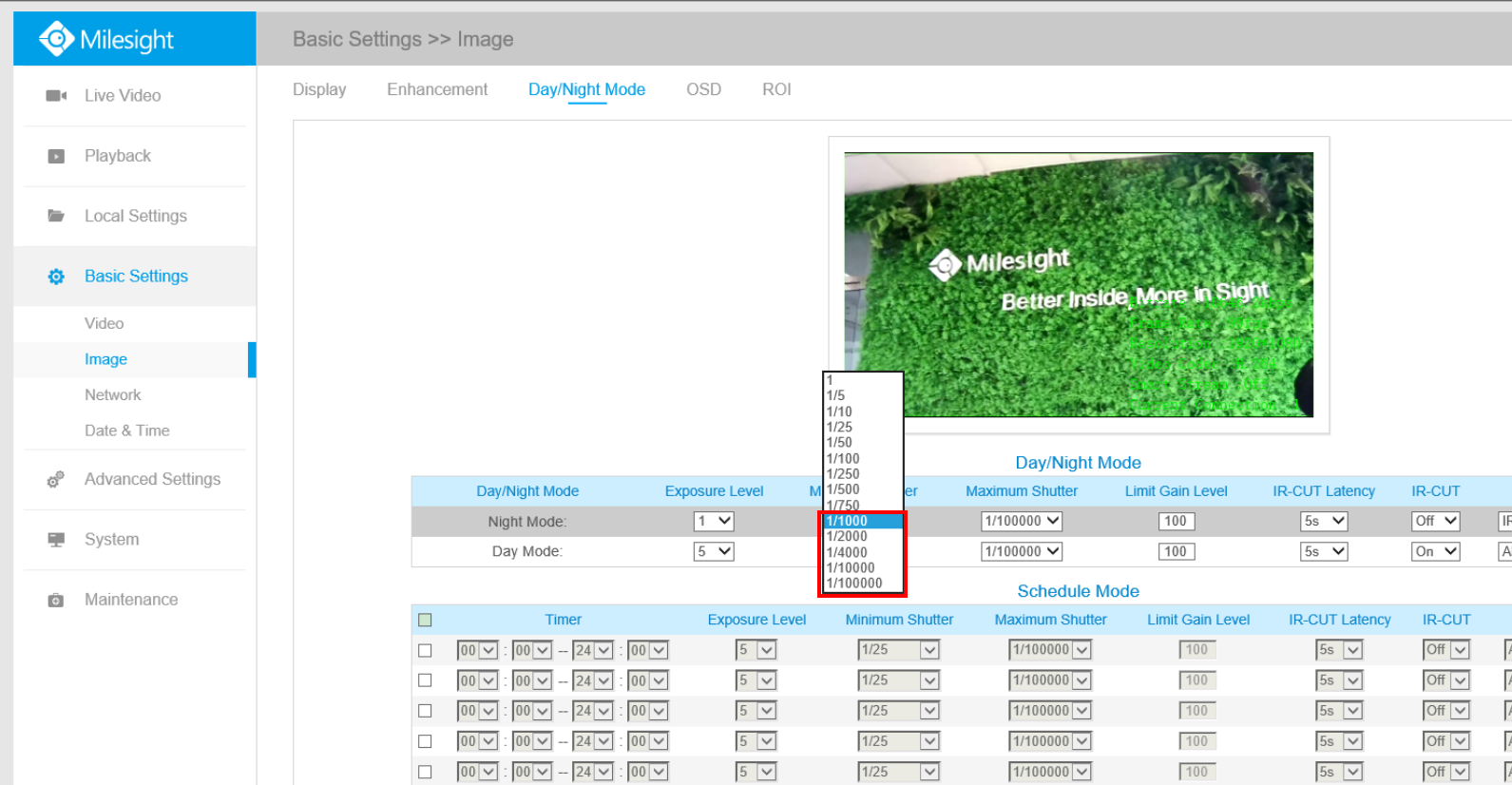

ElitewholesalersTroubleshootingLPR SettingLPR1 Elite Wholesalers

A lpr is endorsed by the insured party and connotes that the policy being referred to has been lost or obliterated or is being retained. If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. On this page additional information Web a.

Web A Lost Policy Release (Lpr) Is A Statement Delivering An Insurance Company From Its Liabilities.

A lpr is endorsed by the insured party and connotes that the policy being referred to has been lost or obliterated or is being retained. To avoid these penalties, you must Web lawfully present immigrants are eligible for coverage through the health insurance marketplace ®. By so doing, you will ensure you do not have a lapse or duplication of coverage.

Web A Lost Policy Release (Lpr) Is A Statement That Releases An Insurance Company From Its Liabilities.

If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. The term “lawfully present” includes immigrants who have: If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended.

You Can Find A Blank Lpr Here.

Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. Web surrender your registration certificate and plates before your insurance expires. If your vehicle is still uninsured after 90 days, your driver’s license will be suspended. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.)

Remarks (Acord 101, Additional Remarks Schedule, May Be Attached If More Space Is Required) Policy Number Effective Date Company Subject To.

On this page additional information In the modern day, canceling an insurance policy no longer requires mailing back original. If your vehicle is still uninsured after 90 days, your driver's license will be suspended. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy.

:max_bytes(150000):strip_icc()/hands-woman-laptop-hands-in-frame-business-woman-using-laptop-people-using-laptop-hands-on-laptop_t20_mvVV6l-5c912a4446e0fb0001f8d10f.jpg)