Maryland Executor Of Estate Form

Maryland Executor Of Estate Form - Web of maryland under the authority of the constitution and laws of maryland. Web funeral contract/bill approximate value of assets in the decedent's name alone title to decedent's automobiles and/or other motor vehicles names and addresses of persons. If the vehicle is being sold by the executor or the administrator, the assignment of ownership section on. Web this form, which lists the necessary requirements for filing, may be obtained from any register of wills office in maryland. Web rw1138 will be available july 1, 2023. If your relationship to the deceased doesn't make you the probate court's. Create a free legal form in minutes. Web the register of wills serves as the clerk to the orphans cour t, which has jurisdiction over judicial probate, administration of estates and conduct of personal representatives. Web if you are the estate executor or administrator this is what you need to do: Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more.

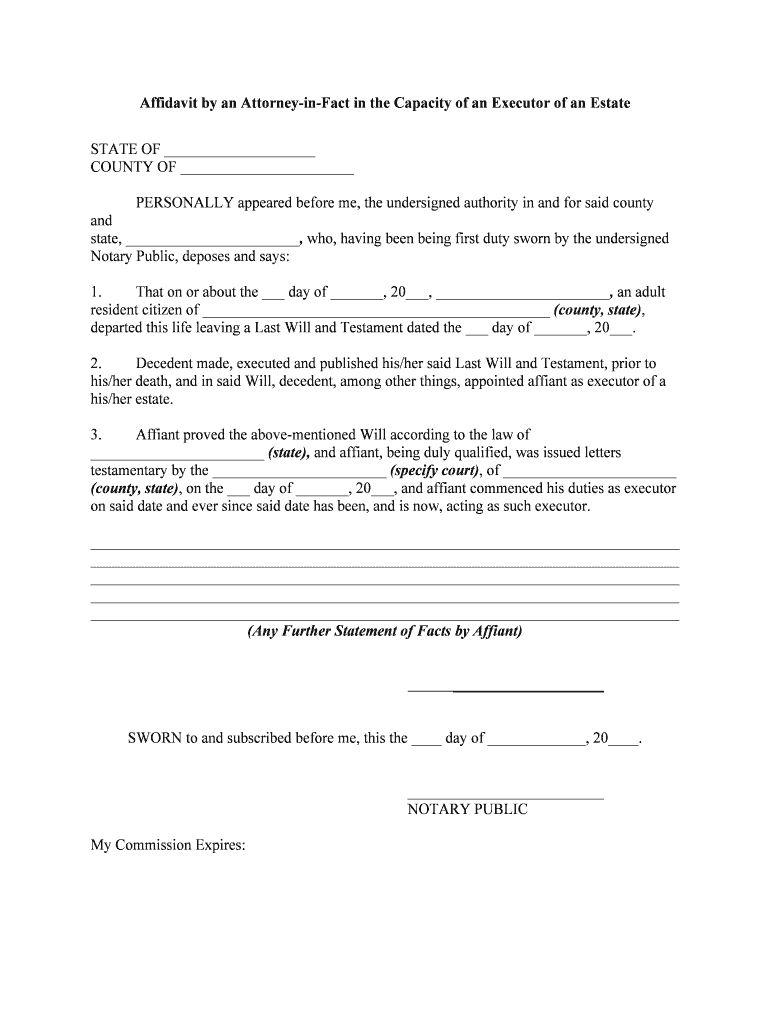

Web the executor is most often times the person responsible for making the funeral arrangements and obtaining the important documents, such as: Web of maryland under the authority of the constitution and laws of maryland. File the return within nine (9) months after the decedent's date of death, or by the approved extension date. Web you can administer an estate even if the deceased died without a will or failed to specify an executor. Web funeral contract/bill approximate value of assets in the decedent's name alone title to decedent's automobiles and/or other motor vehicles names and addresses of persons. The old rw1138 form will be accepted for a short time after july 1, 2023, when register of wills offices will begin requiring the new form. Web an executor, called personal representative in maryland, has an important role in the estate administration process. Probate fees, costs and inheritance taxes. Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Web the register of wills serves as the clerk to the orphans cour t, which has jurisdiction over judicial probate, administration of estates and conduct of personal representatives.

Ad instant download and complete your probate forms, start now! Web an executor, called personal representative in maryland, has an important role in the estate administration process. Probate fees, costs and inheritance taxes. Web fiduciaries who are personal representatives of estates are subject to the maryland income tax and may have to file maryland form 504 and pay maryland fiduciary income tax. Web you can administer an estate even if the deceased died without a will or failed to specify an executor. Web funeral contract/bill approximate value of assets in the decedent's name alone title to decedent's automobiles and/or other motor vehicles names and addresses of persons. Web of maryland under the authority of the constitution and laws of maryland. Locate estate planning documents if you find a will, maryland law requires that you file it with the register of wills promptly after the. Web if you are the estate executor or administrator this is what you need to do: If your relationship to the deceased doesn't make you the probate court's.

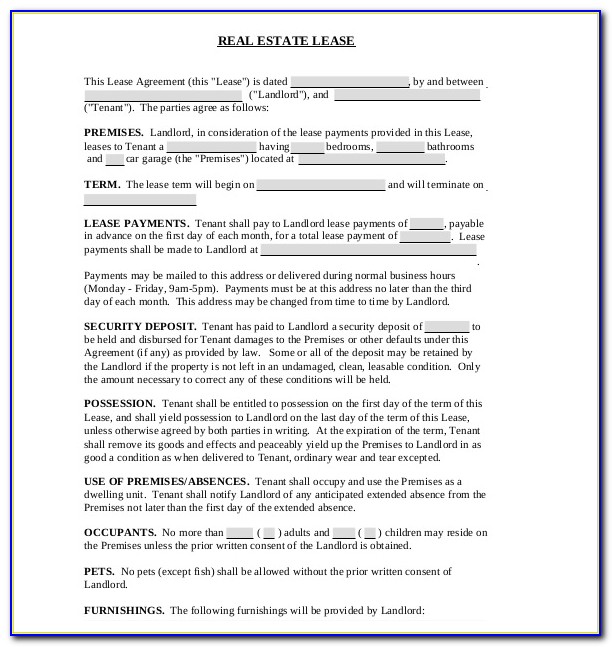

Free Executor Of Estate Form Pdf Form Resume Examples R35xPPV51n

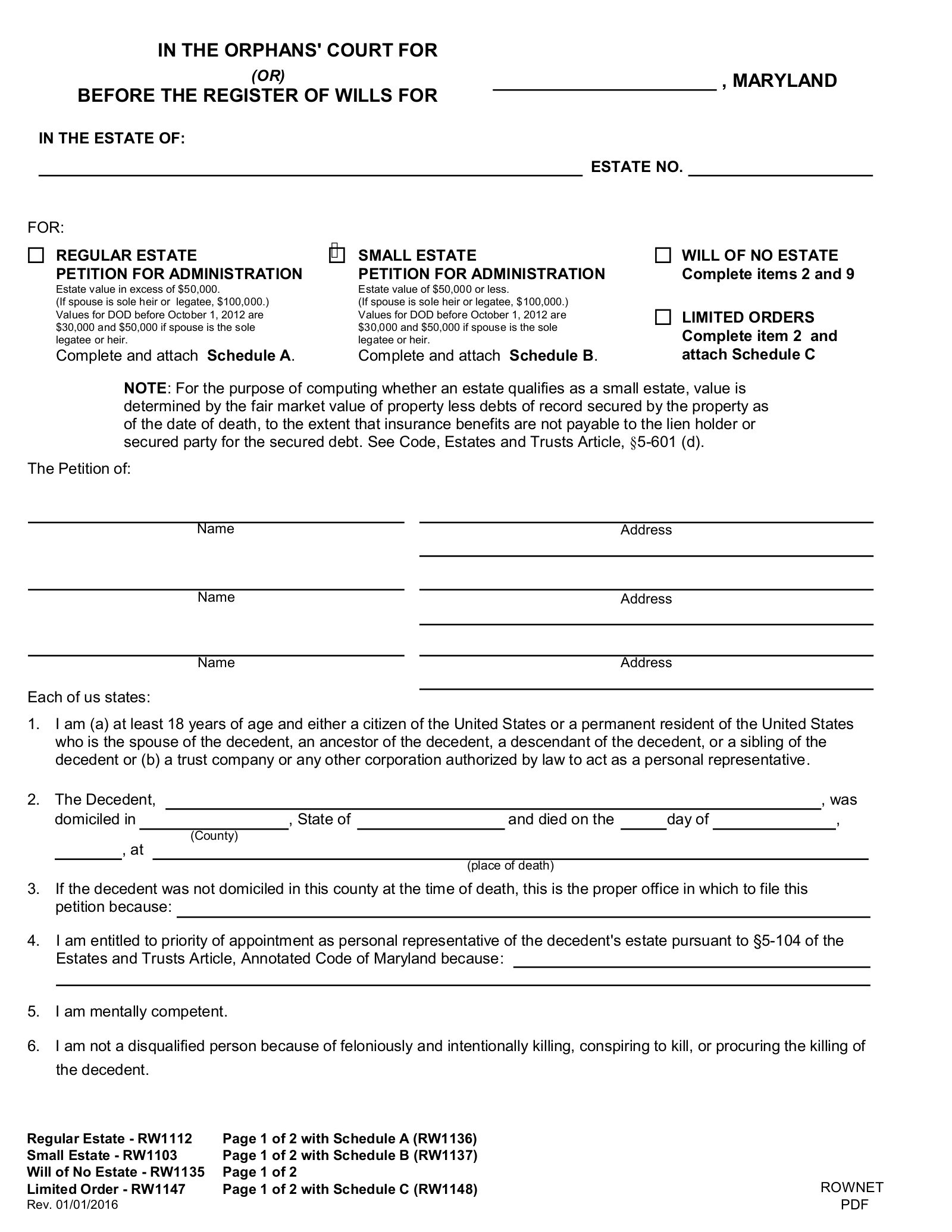

Web rw1138 will be available july 1, 2023. Web this form, which lists the necessary requirements for filing, may be obtained from any register of wills office in maryland. Ad instant download and complete your probate forms, start now! Web of maryland under the authority of the constitution and laws of maryland. Web if you are the estate executor or.

Free Maryland Small Estate Affidavit Form RW1103 PDF eForms

Web if you are the estate executor or administrator this is what you need to do: Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Web this form, which lists the necessary requirements.

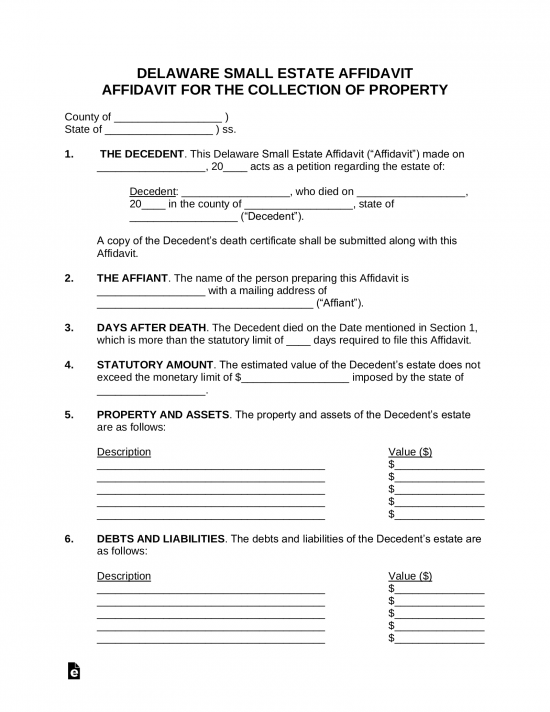

Free Delaware Small Estate Affidavit Form PDF Word eForms

Probate fees, costs and inheritance taxes. File the return within nine (9) months after the decedent's date of death, or by the approved extension date. Locate estate planning documents if you find a will, maryland law requires that you file it with the register of wills promptly after the. Web you can administer an estate even if the deceased died.

Calculating Executor Fees In Maryland

Select popular legal forms & packages of any category. The old rw1138 form will be accepted for a short time after july 1, 2023, when register of wills offices will begin requiring the new form. Locate estate planning documents if you find a will, maryland law requires that you file it with the register of wills promptly after the. Create.

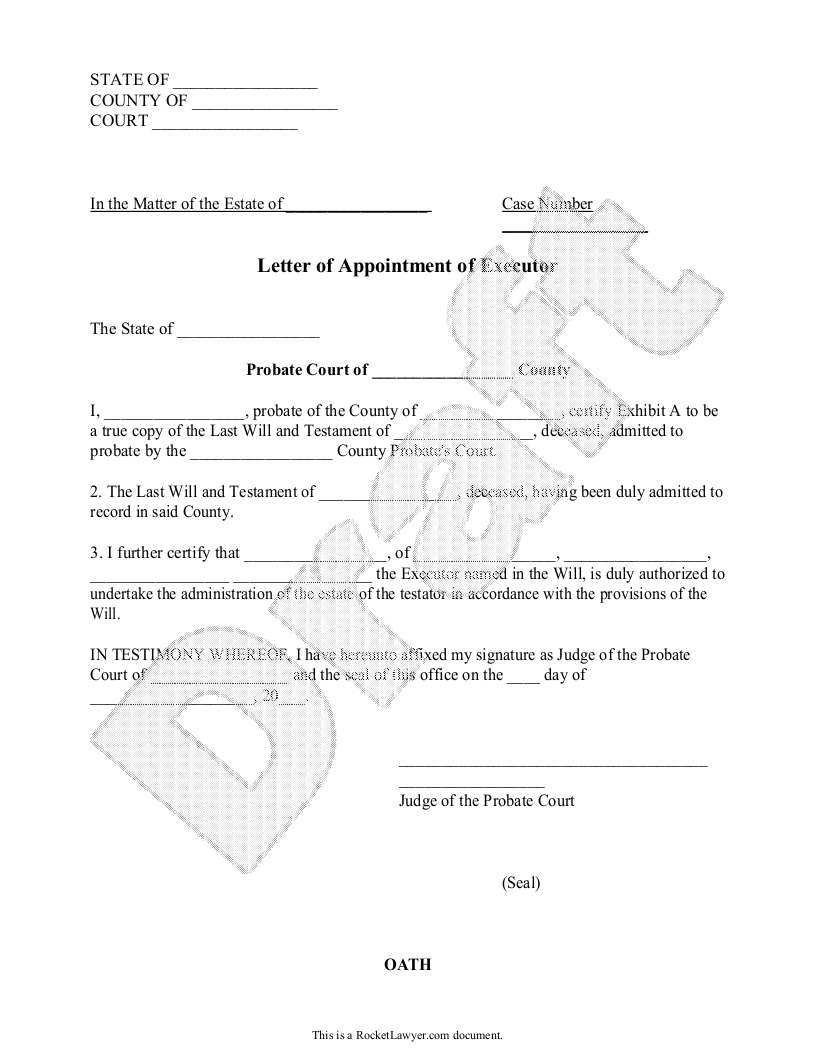

Letter Of Testamentary Form Oregon

Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. If the vehicle is being sold by the executor or the administrator, the assignment of ownership section on. Web rw1138 will be available july 1, 2023. The old rw1138 form will.

Executor Of Estate Form Fill Online, Printable, Fillable, Blank

Probate fees, costs and inheritance taxes. Create a free legal form in minutes. Select popular legal forms & packages of any category. Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. Web funeral contract/bill approximate value of assets in the.

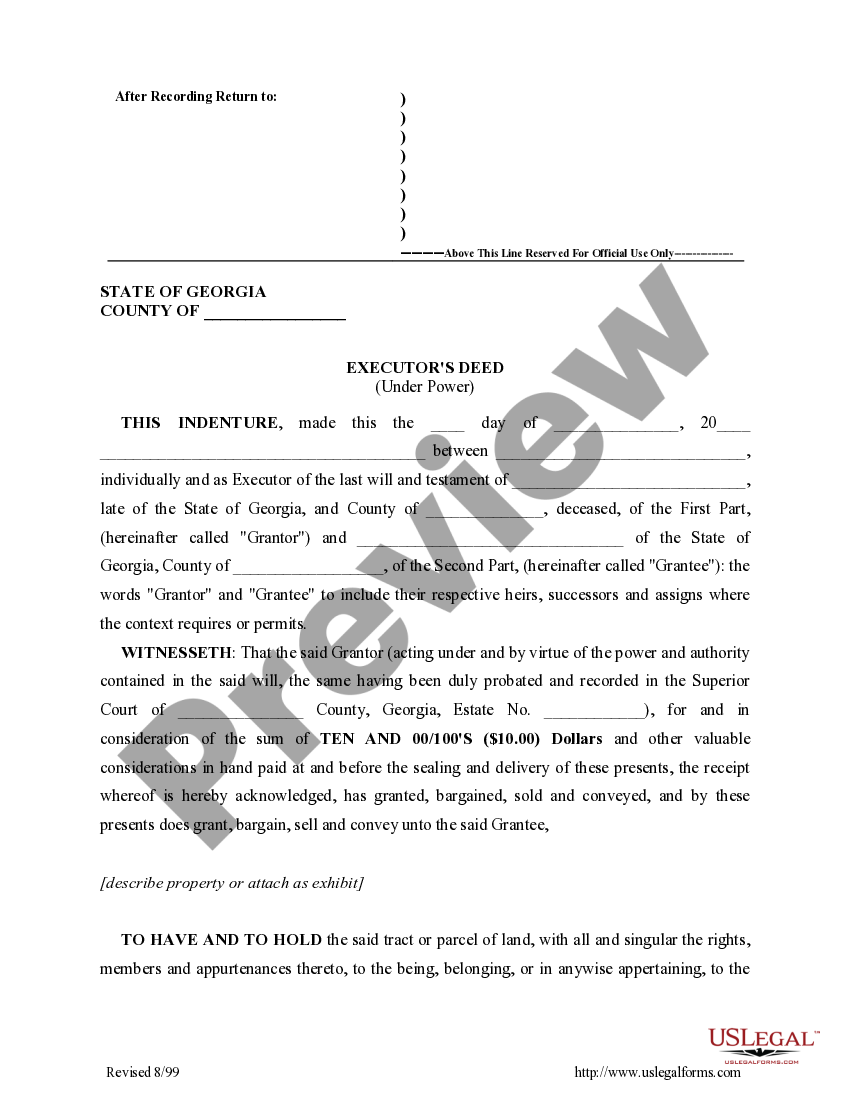

Executor's Deed Executors US Legal Forms

Web the executor is most often times the person responsible for making the funeral arrangements and obtaining the important documents, such as: Locate estate planning documents if you find a will, maryland law requires that you file it with the register of wills promptly after the. Web of maryland under the authority of the constitution and laws of maryland. The.

Executor Of Estate Form Pdf Form Resume Examples EpDLGGEkxR

Web you can administer an estate even if the deceased died without a will or failed to specify an executor. Web funeral contract/bill approximate value of assets in the decedent's name alone title to decedent's automobiles and/or other motor vehicles names and addresses of persons. (p) “net estate” means the property of the decedent exclusive of the family allowance and.

Executor Of Estate Template Master of Documents

Web of maryland under the authority of the constitution and laws of maryland. Web rw1138 will be available july 1, 2023. The old rw1138 form will be accepted for a short time after july 1, 2023, when register of wills offices will begin requiring the new form. Web if a person dies with a will, a petition to probate the.

Free Printable Executor Of Estate Form Printable Form, Templates and

Web of maryland under the authority of the constitution and laws of maryland. Web rw1138 will be available july 1, 2023. Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. If your relationship to the deceased doesn't make you the.

If Your Relationship To The Deceased Doesn't Make You The Probate Court's.

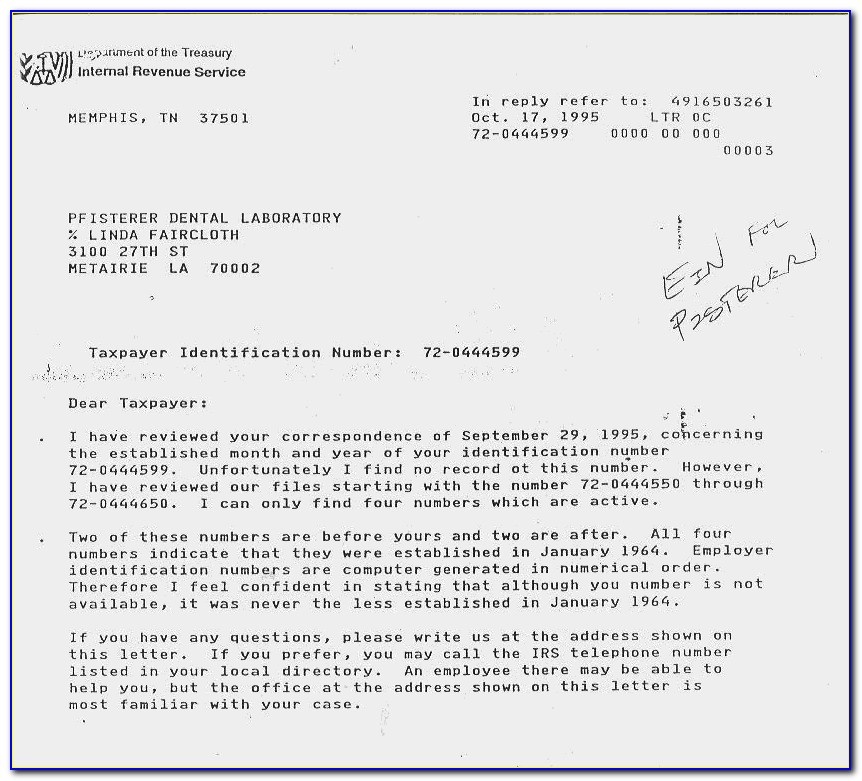

Web fiduciaries who are personal representatives of estates are subject to the maryland income tax and may have to file maryland form 504 and pay maryland fiduciary income tax. Create a free legal form in minutes. (p) “net estate” means the property of the decedent exclusive of the family allowance and enforceable. Select popular legal forms & packages of any category.

Web An Executor, Called Personal Representative In Maryland, Has An Important Role In The Estate Administration Process.

Web funeral contract/bill approximate value of assets in the decedent's name alone title to decedent's automobiles and/or other motor vehicles names and addresses of persons. Web 15th september 2021 estate planning faq comments off in maryland, an executor (also known as a personal representative) plays a crucial role when it is time to. Web the register of wills serves as the clerk to the orphans cour t, which has jurisdiction over judicial probate, administration of estates and conduct of personal representatives. Web the executor is most often times the person responsible for making the funeral arrangements and obtaining the important documents, such as:

The Old Rw1138 Form Will Be Accepted For A Short Time After July 1, 2023, When Register Of Wills Offices Will Begin Requiring The New Form.

Web if you are the estate executor or administrator this is what you need to do: If the vehicle is being sold by the executor or the administrator, the assignment of ownership section on. Web this form, which lists the necessary requirements for filing, may be obtained from any register of wills office in maryland. Ad instant download and complete your probate forms, start now!

Web You Can Administer An Estate Even If The Deceased Died Without A Will Or Failed To Specify An Executor.

Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. File the return within nine (9) months after the decedent's date of death, or by the approved extension date. Probate fees, costs and inheritance taxes.