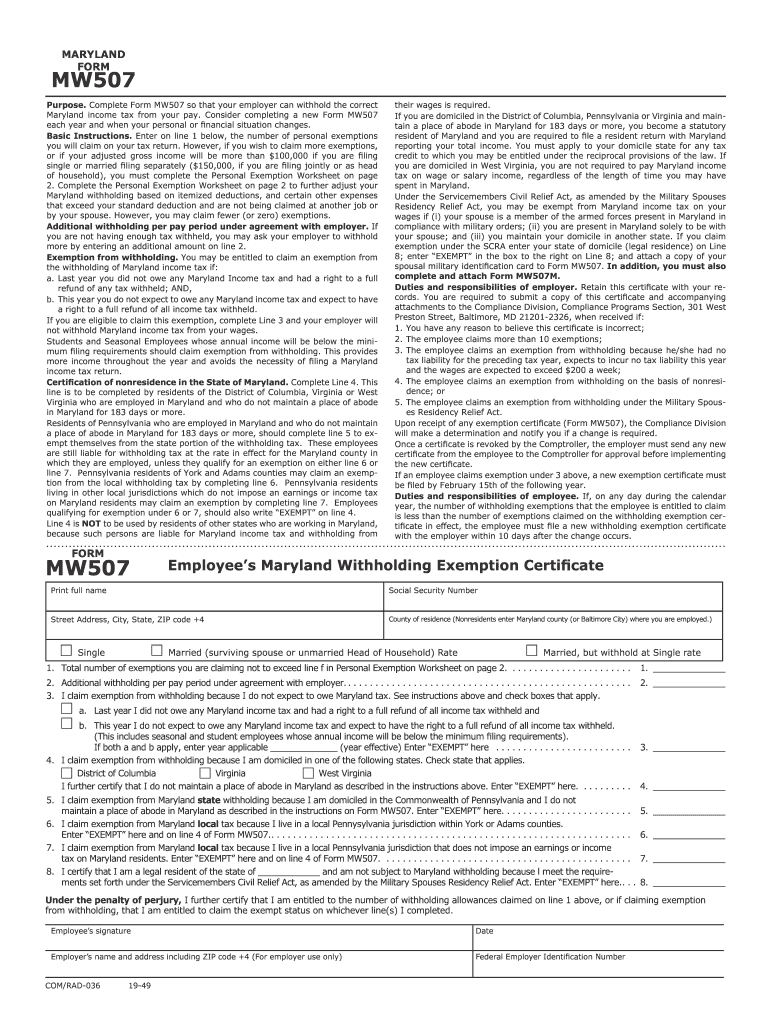

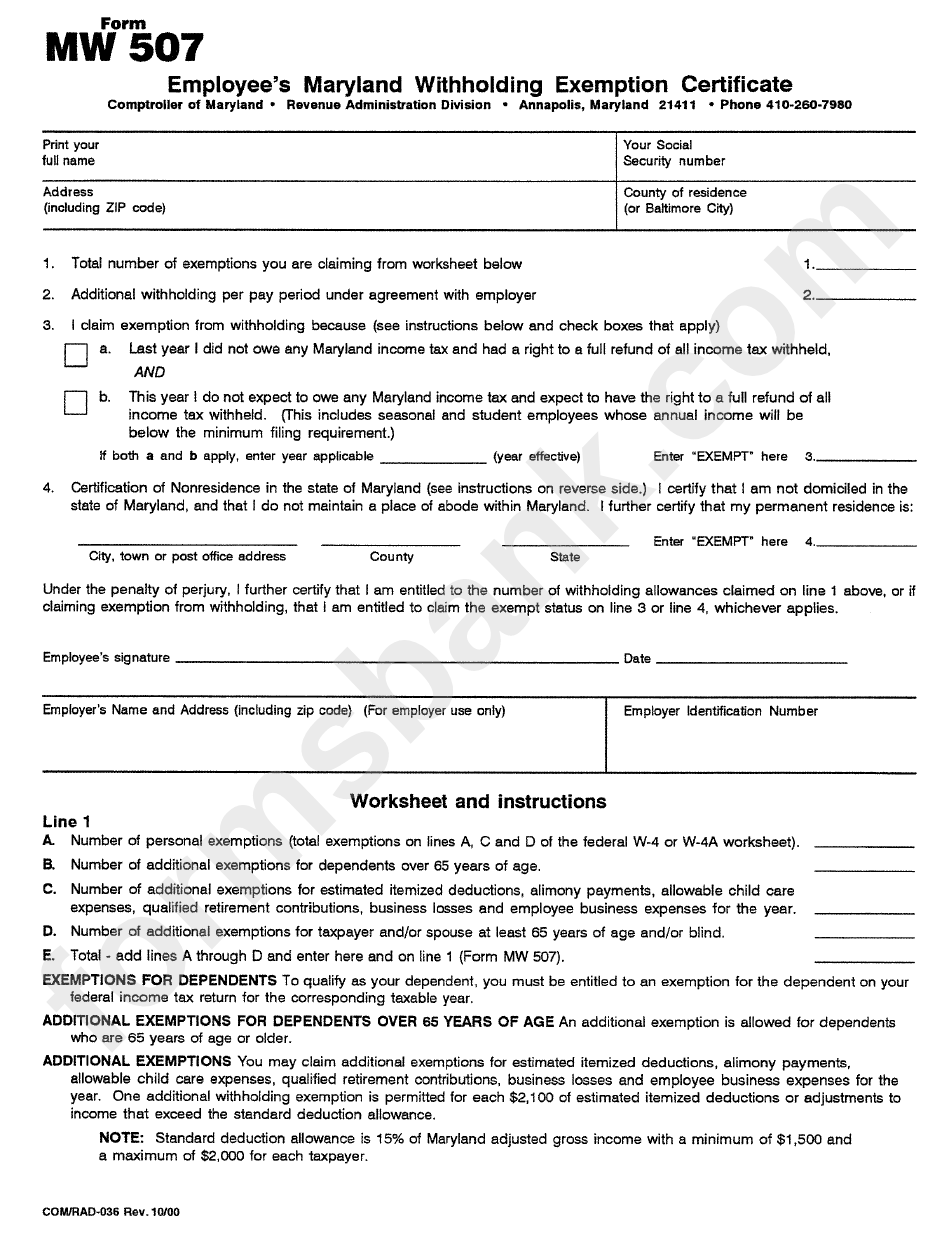

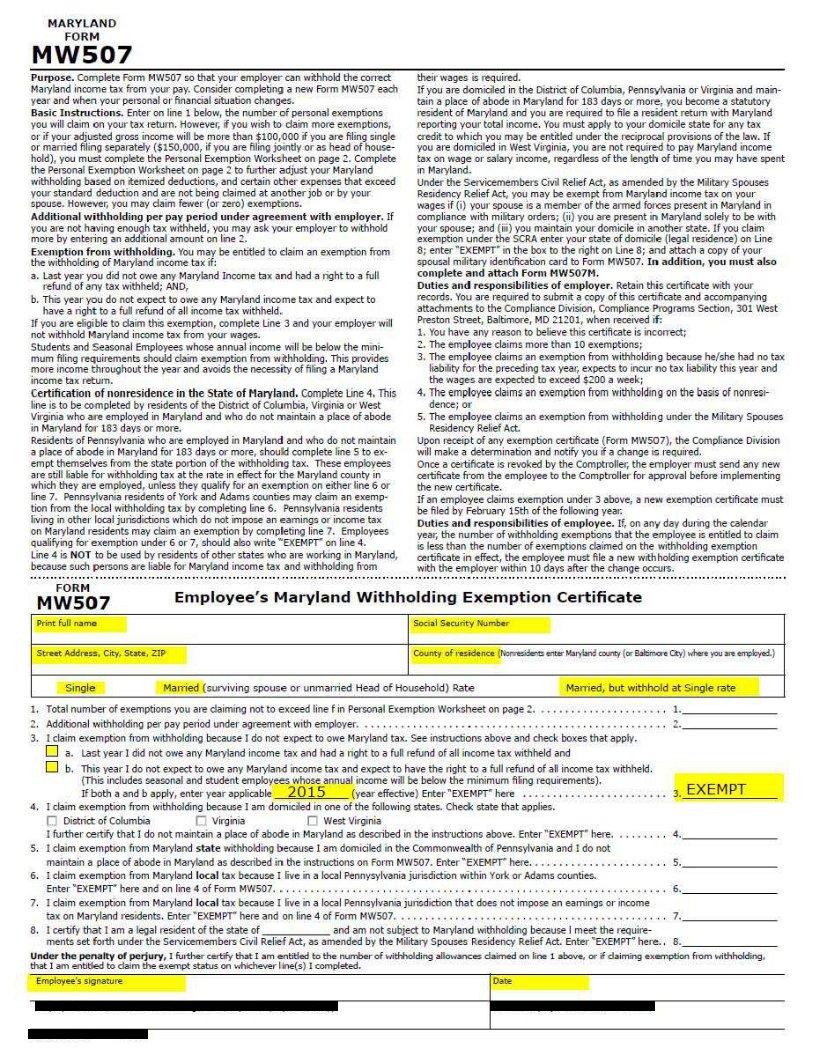

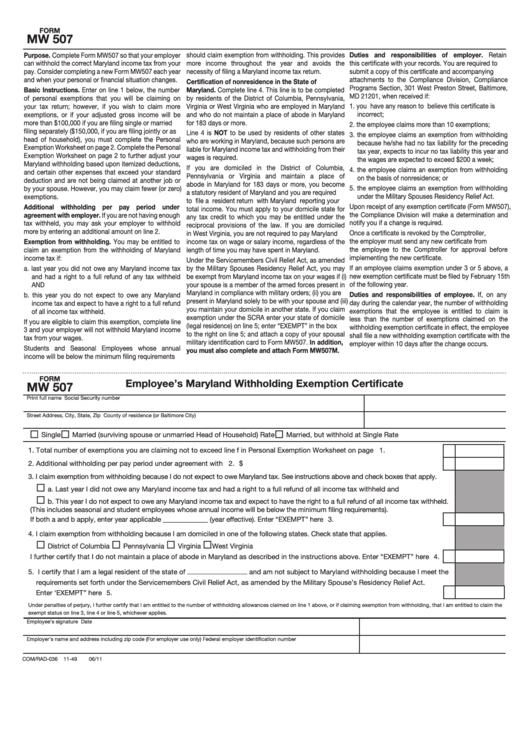

Md 507 Form

Md 507 Form - For maryland state government employees only. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Your employer may discontinue this. Consider completing a new form mw507 each year and when your personal or financial situation changes. Mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web form mw507m is valid only for the calendar year for which it is. This form is for income earned in tax year 2022, with tax returns due in april 2023. Form mw507 and mw507m for each subsequent year you want. Web maryland form mw507 page 2 line 1 a. Web marylandtaxes.gov | welcome to the office of the comptroller

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. However, if your federal adjusted gross income is This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Web form mw507m is valid only for the calendar year for which it is. California, for example, has it’s form de 4. Web marylandtaxes.gov | welcome to the office of the comptroller Form used by individuals to direct their employer to withhold maryland income tax from their pay. Form mw507 and mw507m for each subsequent year you want. Exemption from maryland withholding tax for a qualified civilian spouse of military.

California, for example, has it’s form de 4. Provided you are still eligible, you must file a new. To continue the exemption from maryland withholding. For maryland state government employees only. The due date for renewing forms mw507 and mw507m is february 15. Web more about the maryland mw507 individual income tax ty 2022. Mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Your employer may discontinue this. Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland.

Md 507 Fill Out and Sign Printable PDF Template signNow

Web maryland form mw507 page 2 line 1 a. Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Every state, other than states with no state income tax, have a similar form. Web form mw507m is valid only for the calendar year for which it is. Web marylandtaxes.gov.

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

(generally the value of your exemption will be $3,200; Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Web marylandtaxes.gov | welcome to the office of the comptroller Web maryland form mw507 page 2 line 1 a. For maryland state government employees only.

Form Mw 507 Example ≡ Fill Out Printable PDF Forms Online

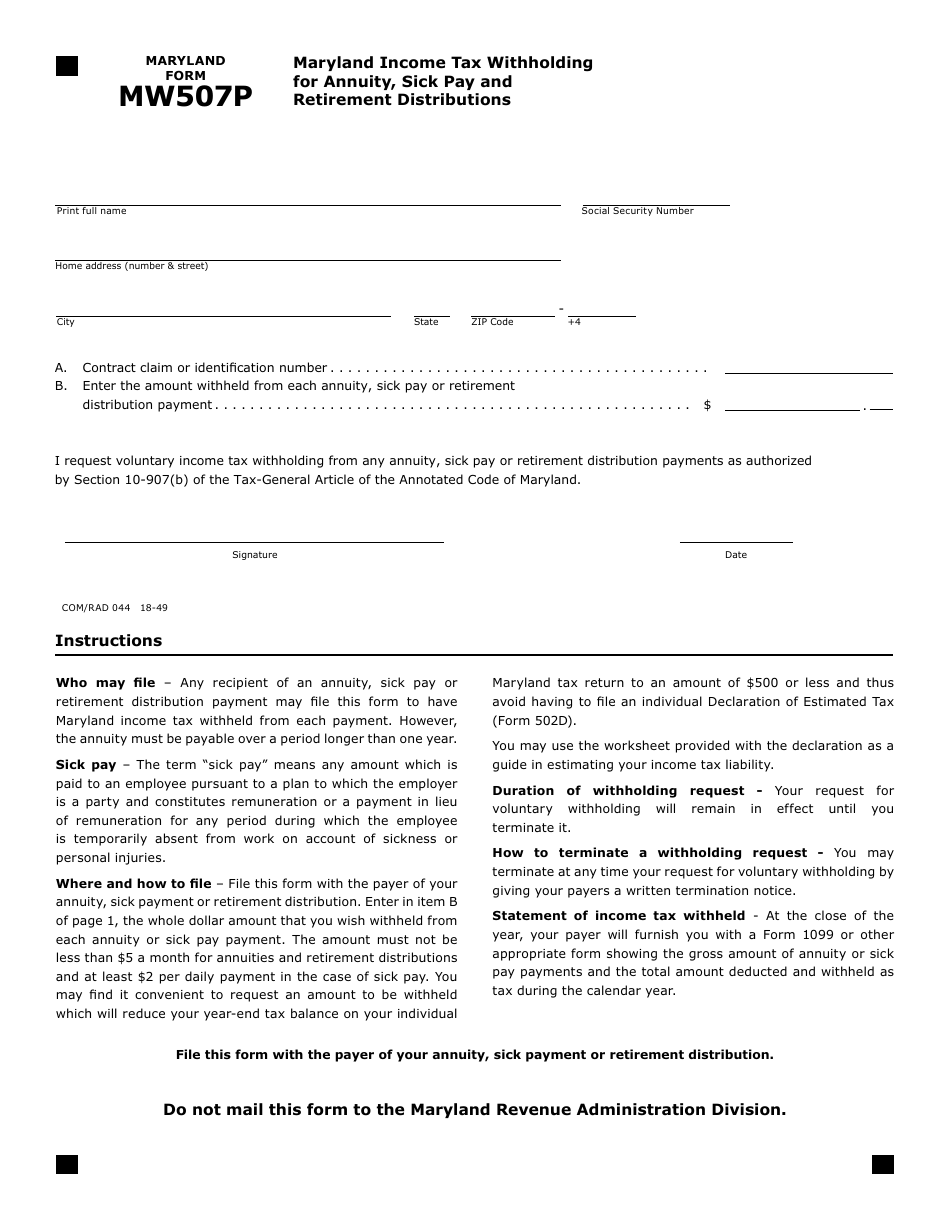

Annuity and sick pay request for maryland income tax withholding: Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Your employer may discontinue this. Web maryland form mw507 page 2 line 1 a. (generally the value of your exemption will be $3,200;

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Consider completing a new form mw507 each year and when your personal or financial situation changes. Form mw507 and mw507m for each subsequent year you want. Web form used by individuals to direct their employer to withhold the correct amount of maryland income.

Mw507 Form Help amulette

Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland. Web form mw507 employee withholding exemption certificate 2020. Form mw507 and mw507m for each subsequent year you want. However, if your federal adjusted gross.

Fillable Form Mw 507 Employee S Maryland Withholding Exemption

Form used by individuals to direct their employer to withhold maryland income tax from their pay. Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. Provided you are still eligible, you must file a new. Mw507 requires you to list multiple forms of income, such as.

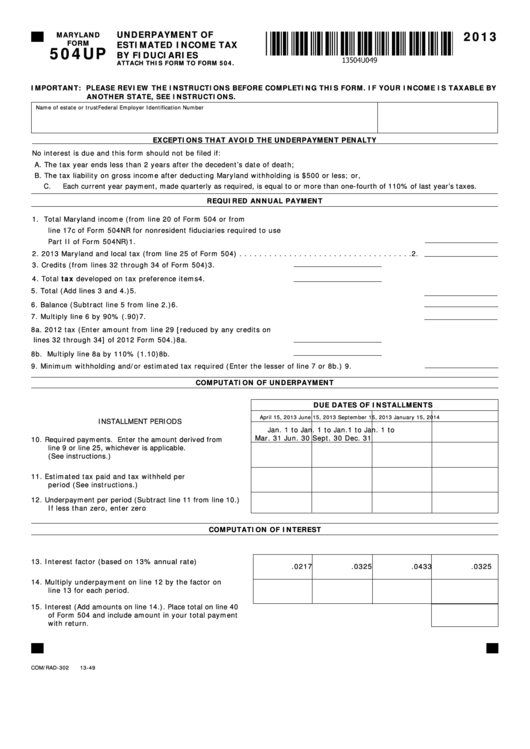

Fillable Maryland Form 504up Underpayment Of Estimated Tax By

Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland. To continue the exemption from maryland withholding. Form mw507 and mw507m for each subsequent year you want. Form used by individuals to direct their.

Form MW507P Download Fillable PDF or Fill Online Maryland Tax

California, for example, has it’s form de 4. Web maryland form mw507 page 2 line 1 a. Consider completing a new form mw507 each year and when your personal or financial situation changes. Web form mw507m is valid only for the calendar year for which it is. (generally the value of your exemption will be $3,200;

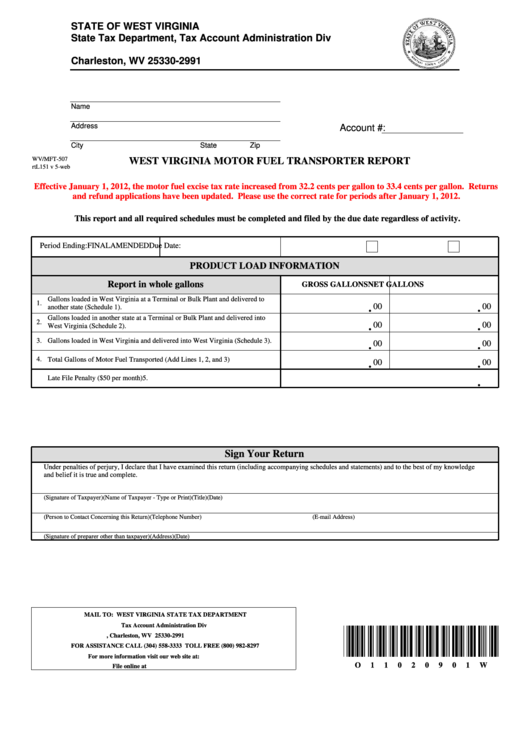

Fillable Form Wv/mft507 West Virginia Motor Fuel Transporter Report

To continue the exemption from maryland withholding. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web maryland form mw507 page 2 line 1 a. Web form mw507 employee withholding exemption certificate 2020. Annuity and sick pay request for maryland income tax withholding:

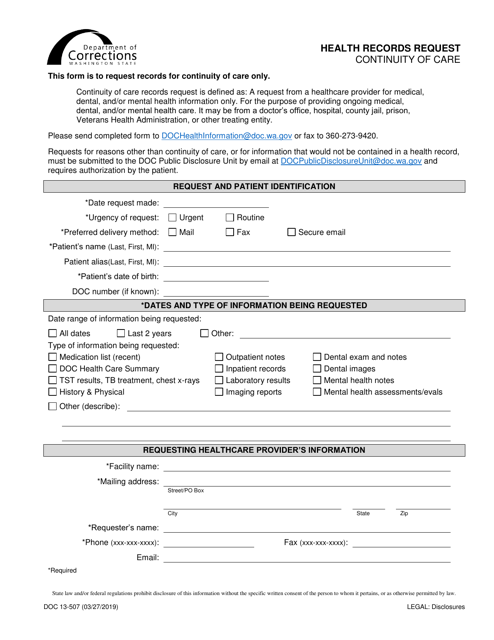

Form DOC13507 Download Printable PDF or Fill Online Health Records

Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Exemption from maryland withholding tax for a qualified civilian spouse.

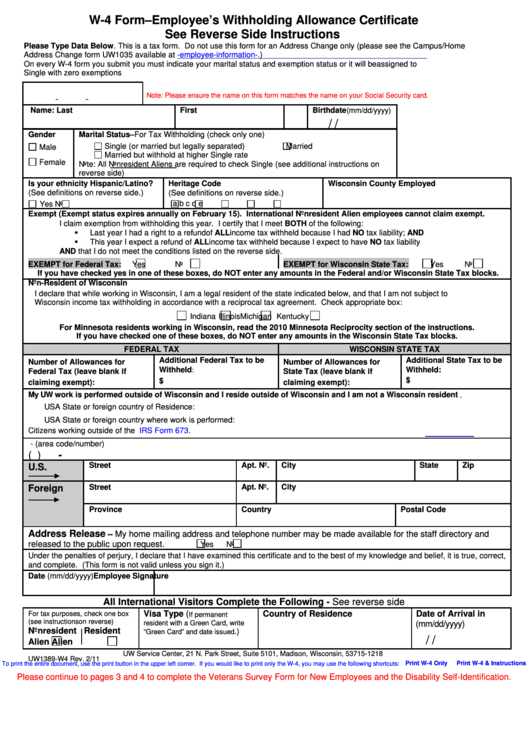

For Maryland State Government Employees Only.

Every state, other than states with no state income tax, have a similar form. Consider completing a new form mw507 each year and when your personal or financial situation changes. Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government.

Web We Last Updated Maryland Mw507 In January 2023 From The Maryland Comptroller Of Maryland.

Web maryland form mw507 is the state’s withholding exemption certificate and must be completed by all residents or employees in maryland so your employer can withhold the correct amount from your wages. Form used by civilian spouse to direct their employer to discontinue maryland withholding. Your employer may discontinue this. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay.

The Due Date For Renewing Forms Mw507 And Mw507M Is February 15.

Web more about the maryland mw507 individual income tax ty 2022. Web form mw507m is valid only for the calendar year for which it is. Form used by individuals to direct their employer to withhold maryland income tax from their pay. However, if your federal adjusted gross income is

Annuity And Sick Pay Request For Maryland Income Tax Withholding:

California, for example, has it’s form de 4. Web form mw507 employee withholding exemption certificate 2020. Provided you are still eligible, you must file a new. (generally the value of your exemption will be $3,200;