Md State Withholding Form 2023

Md State Withholding Form 2023 - Web 2023 this edition of withholding tax facts offers information about filing your employer withholding tax forms, reconciliation statement and other employer withholding related forms. These rates were current at the time this guide was developed. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. Web form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor/seller's tax liability for the transaction. But does include the special 2.25% nonresident rate. Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. This guide is effective january 2023 and includes local income tax rates. Web maryland employer withholding guide. Income tax rate the local income tax is computed without regard to the impact of the state tax rate. The maryland legislature may change this tax rate when in session.

Consider completing a new form mw507 each year and when your personal or financial situation changes. But does include the special 2.25% nonresident rate. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. Consider completing a new form mw507 each year and when your personal or financial situation changes. Web annuity and sick pay request for maryland income tax withholding. Amended annual employer withholding reconciliation return. Web maryland employer withholding guide. These rates were current at the time this guide was developed. Income tax rate the local income tax is computed without regard to the impact of the state tax rate. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%.

For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local tax; Enter on line 1 below, the number of personal exemptions you will claim on your tax return. This guide is effective january 2023 and includes local income tax rates. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. The maryland legislature may change this tax rate when in session. Web form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor/seller's tax liability for the transaction. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. But does include the special 2.25% nonresident rate. Web annuity and sick pay request for maryland income tax withholding. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%.

2019 Form VA DoT 763 Fill Online, Printable, Fillable, Blank pdfFiller

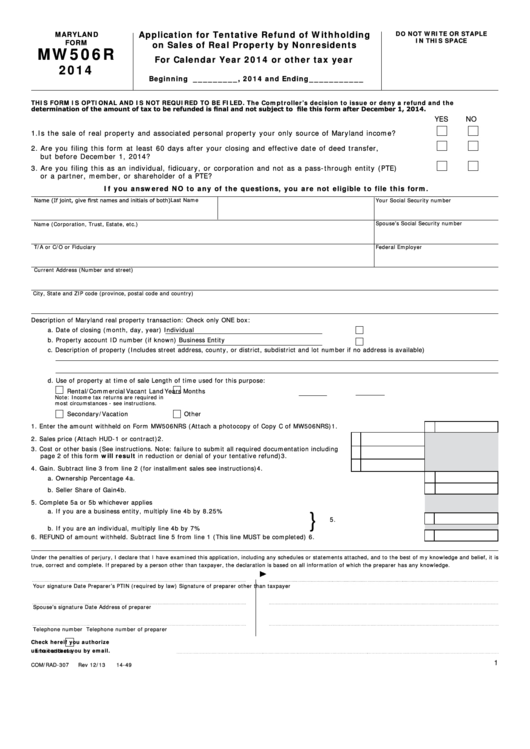

Web maryland employer withholding guide. Web annuity and sick pay request for maryland income tax withholding. Web form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor/seller's tax liability for the transaction..

Fillable Maryland Form Mw506r Application For Tentative Refund Of

Web form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor/seller's tax liability for the transaction. But does include the special 2.25% nonresident rate. Form used by recipients of annuity, sick pay.

Maryland Withholding

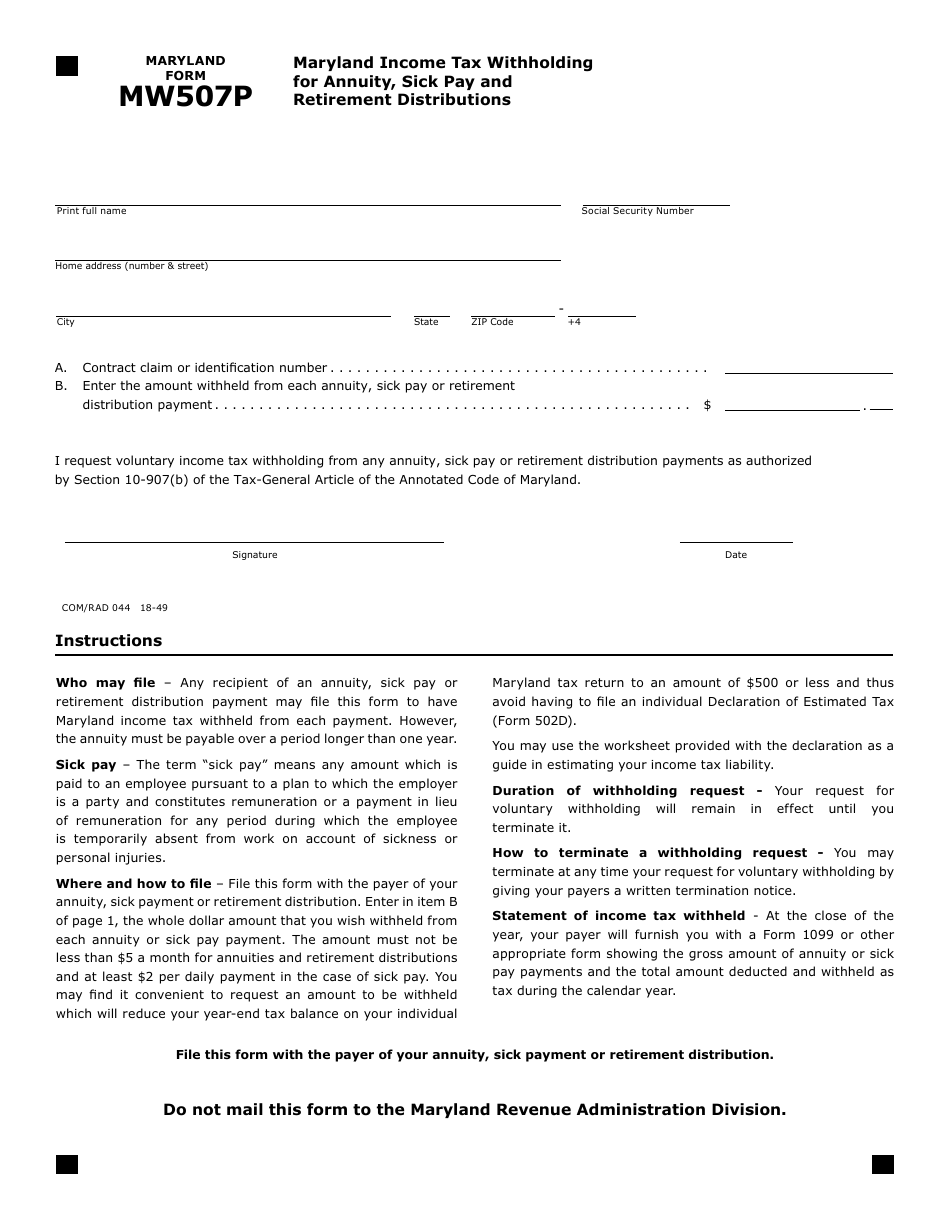

But does include the special 2.25% nonresident rate. Web maryland employer withholding guide. Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. These rates were current at the time this guide was developed. Income tax rate the local income tax is computed without regard to the.

Form MW507P Download Fillable PDF or Fill Online Maryland Tax

Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. Consider completing a new form mw507 each year and when your.

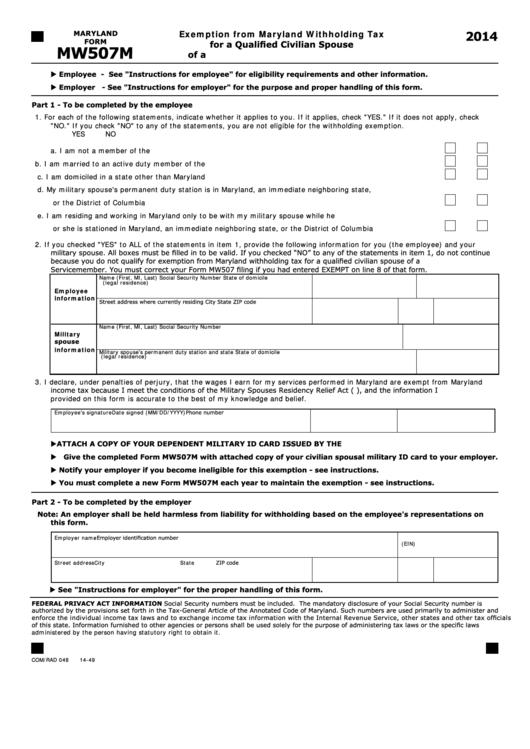

Fillable Maryland Form Mw507m Exemption From Maryland Withholding Tax

Web 2023 this edition of withholding tax facts offers information about filing your employer withholding tax forms, reconciliation statement and other employer withholding related forms. These rates were current at the time this guide was developed. But does include the special 2.25% nonresident rate. Your withholding is subject to review by the. For most employees who are not residents of.

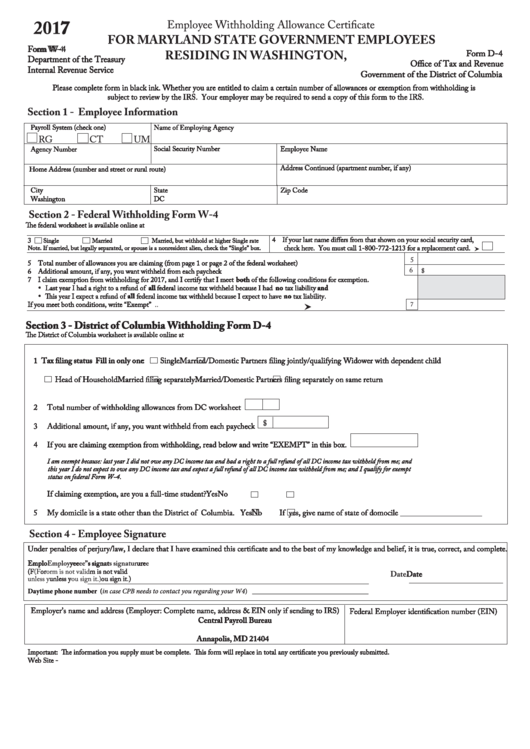

Fillable Form W4 Employee Withholding Allowance Certificate

But does include the special 2.25% nonresident rate. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. The state rates and rate brackets are indicated below: Consider completing a new form mw507 each year and when your personal or financial situation changes. Web.

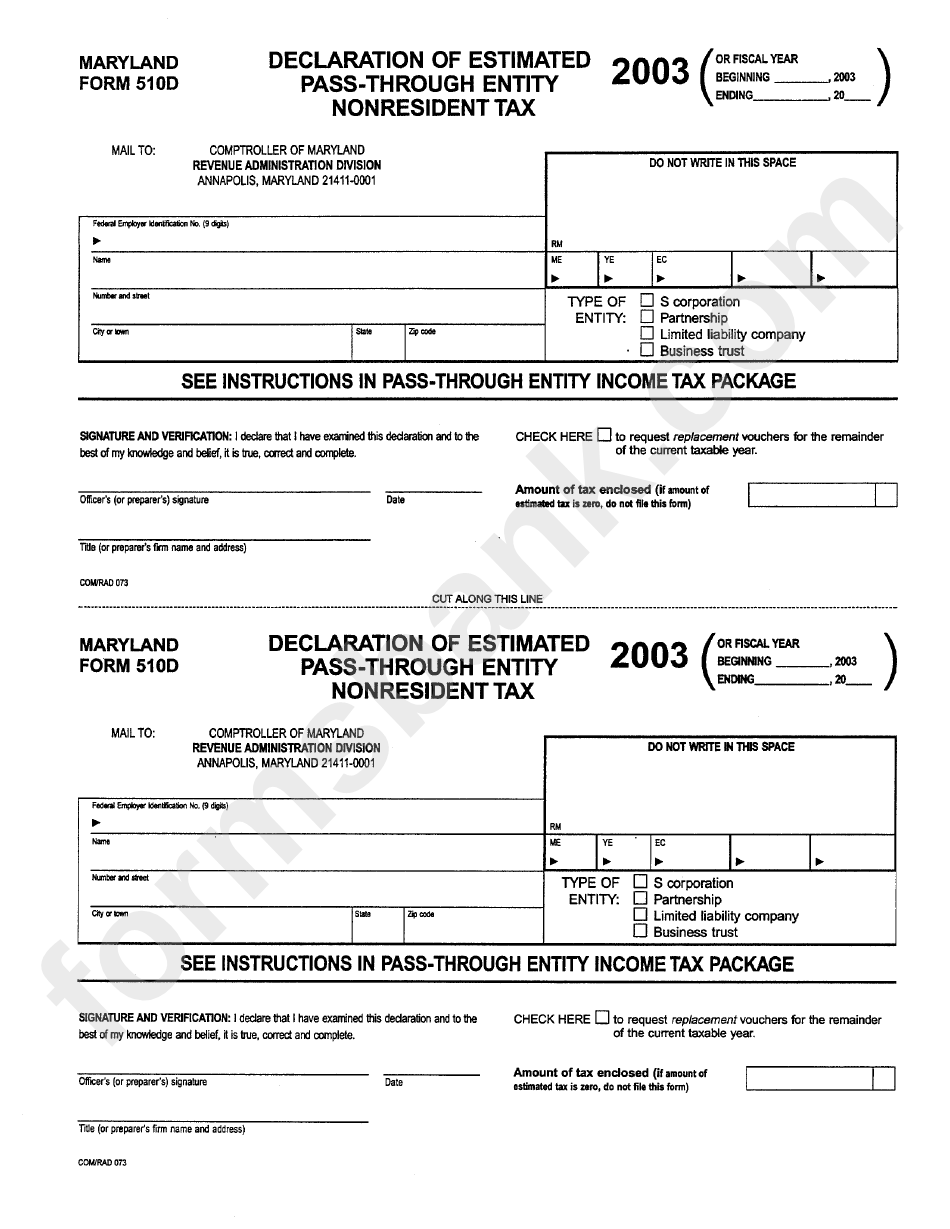

Maryland Form 510d Declaration Of Estimated PassThrough Entity

Web maryland employer withholding guide. Web form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor/seller's tax liability for the transaction. But does include the special 2.25% nonresident rate. Complete form mw507.

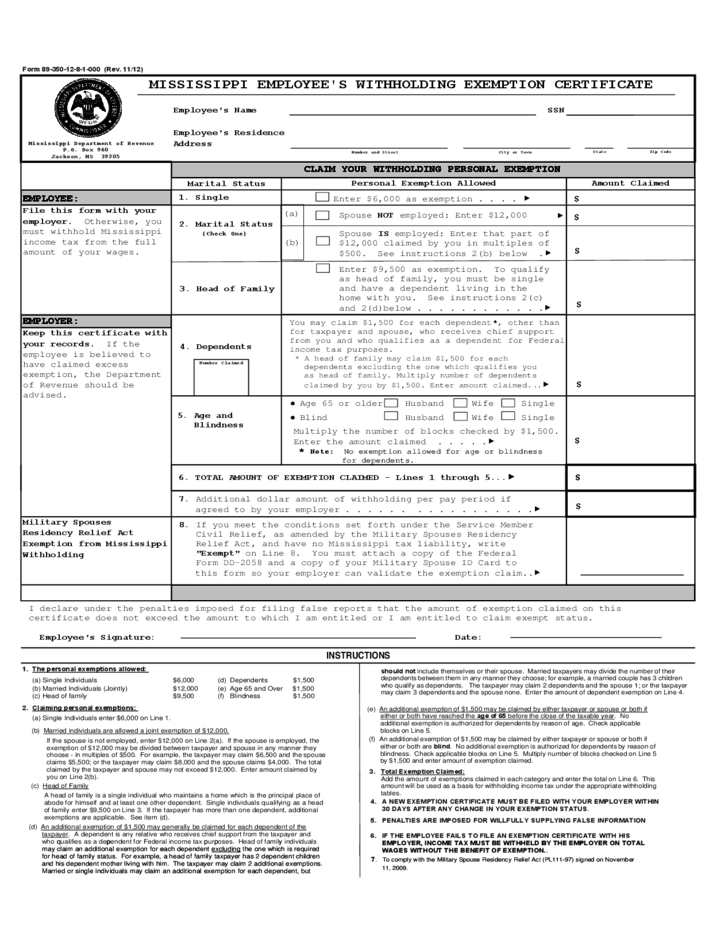

Mississippi Employee Withholding Form 2021 2022 W4 Form

For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local tax; Consider completing a new form mw507 each year and when your personal or financial situation changes. Web annuity and sick pay request for maryland income tax withholding. But does include the special 2.25% nonresident rate. Income tax rate the local.

Maryland Withholding Form 2021 2022 W4 Form

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. Complete form mw507.

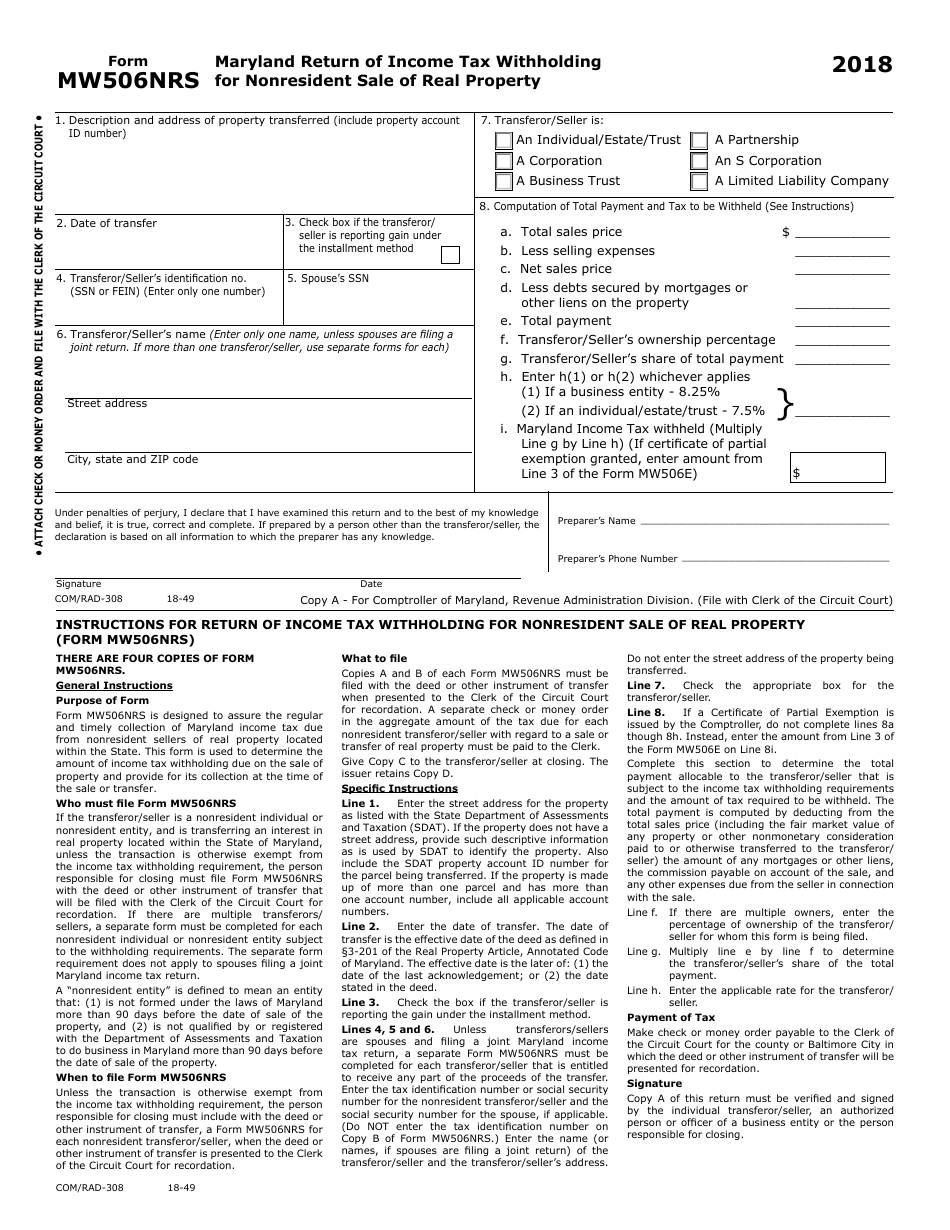

Form MW506NRS Download Fillable PDF or Fill Online Maryland Return of

But does include the special 2.25% nonresident rate. These rates were current at the time this guide was developed. The state rates and rate brackets are indicated below: Web maryland employer withholding guide. Web 2023 this edition of withholding tax facts offers information about filing your employer withholding tax forms, reconciliation statement and other employer withholding related forms.

The State Rates And Rate Brackets Are Indicated Below:

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form mw507 each year and when your personal or financial situation changes. These rates were current at the time this guide was developed. Consider completing a new form mw507 each year and when your personal or financial situation changes.

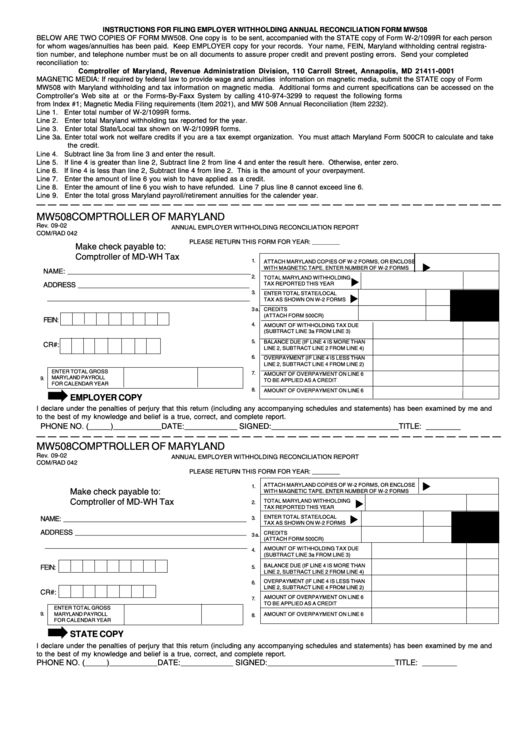

Amended Annual Employer Withholding Reconciliation Return.

Income tax rate the local income tax is computed without regard to the impact of the state tax rate. The maryland legislature may change this tax rate when in session. Web annuity and sick pay request for maryland income tax withholding. Enter on line 1 below, the number of personal exemptions you will claim on your tax return.

Form Used By Recipients Of Annuity, Sick Pay Or Retirement Distribution Payments That Choose To Have Maryland Income Tax Withheld From Each Payment.

Web 2023 this edition of withholding tax facts offers information about filing your employer withholding tax forms, reconciliation statement and other employer withholding related forms. But does include the special 2.25% nonresident rate. This guide is effective january 2023 and includes local income tax rates. Web maryland form mw507 purpose.

For Most Employees Who Are Not Residents Of Maryland The Nonresident Rate (7.0%) Is Used, Which Includes No Local Tax;

Web form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor/seller's tax liability for the transaction. Your withholding is subject to review by the. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%.