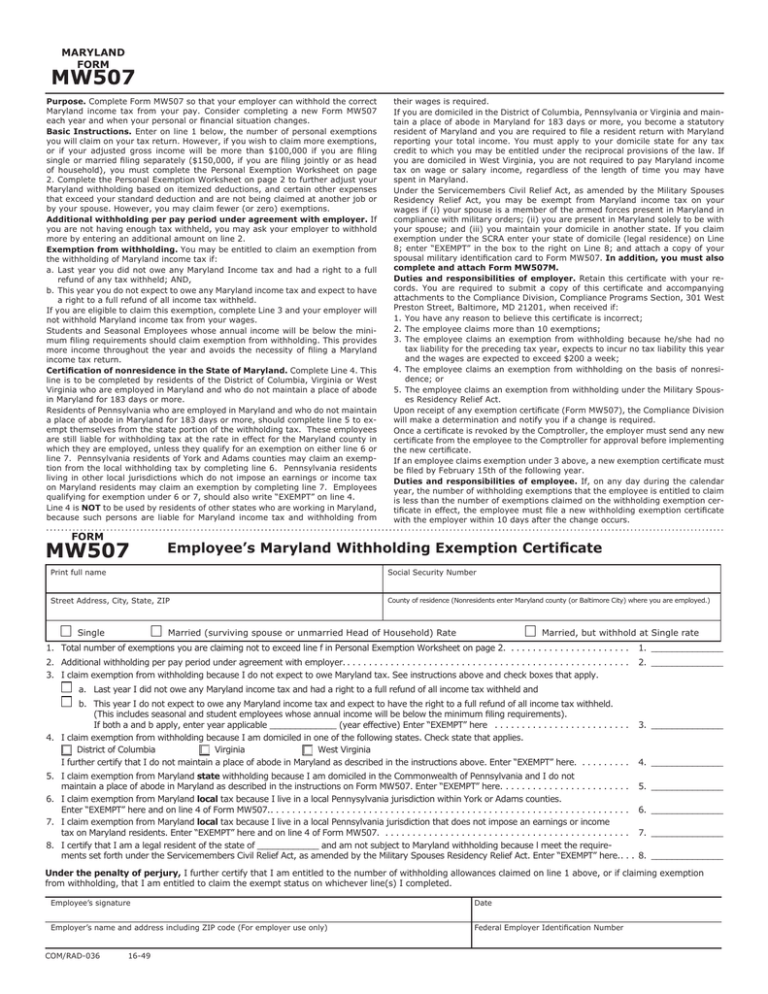

Md507 Form 2022

Md507 Form 2022 - Number of exemptions from mw507 form: This form is for income earned in tax year 2022, with tax returns due in april. Web withholding exemption certificate/employee address update. Consider completing a new form mw507 each year and. Duties and responsibilities of employer. Enter on line 1 below the number of personal. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Personal exemptions employees may be required to adjust their personal. Md mw507m (2023) exemption from maryland withholding tax for a qualified civilian spouse. To be mailed with the mw506 or mw506m.

Personal exemptions employees may be required to adjust their personal. Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Mail separately if filed electronically. Consider completing a new form mw507 each year and. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Form used to determine the amount of income tax withholding due on the sale of property. Mail separately if filed electronically. Web up to 10% cash back the maryland form mw 507, employee's maryland withholding exemption certificate, must be completed so that you know how much state income tax to. Number of exemptions from mw507 form: Md mw507m (2023) exemption from maryland withholding tax for a qualified civilian spouse.

Personal exemptions employees may be required to adjust their personal. Mail separately if filed electronically. This form is for income earned in tax year 2022, with tax returns due in april. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. To be mailed with the mw506 or mw506m. Web withholding exemption certificate/employee address update. Web up to 10% cash back the maryland form mw 507, employee's maryland withholding exemption certificate, must be completed so that you know how much state income tax to. Mail separately if filed electronically. To be mailed with the mw506 or mw506m. Web maryland return of income tax withholding for nonresident sale of real property.

CA Foundation Declaration form 20222023 Steps to Download and Submit

It to your employer or. Form used to determine the amount of income tax withholding due on the sale of property. If you meet all of the eligibility requirements for the exemption from withholding, fill out lines 1 through 3 of part 1. Web form mw507 and give them to your employer. Web maryland return of income tax withholding for.

MDSU Previous Year Exam Form 2022 Regular & Private

In addition, you must also complete and attach form mw507m. Mail separately if filed electronically. When the withholding exemption takes effect. Web form mw507 and give them to your employer. Form used to determine the amount of income tax withholding due on the sale of property.

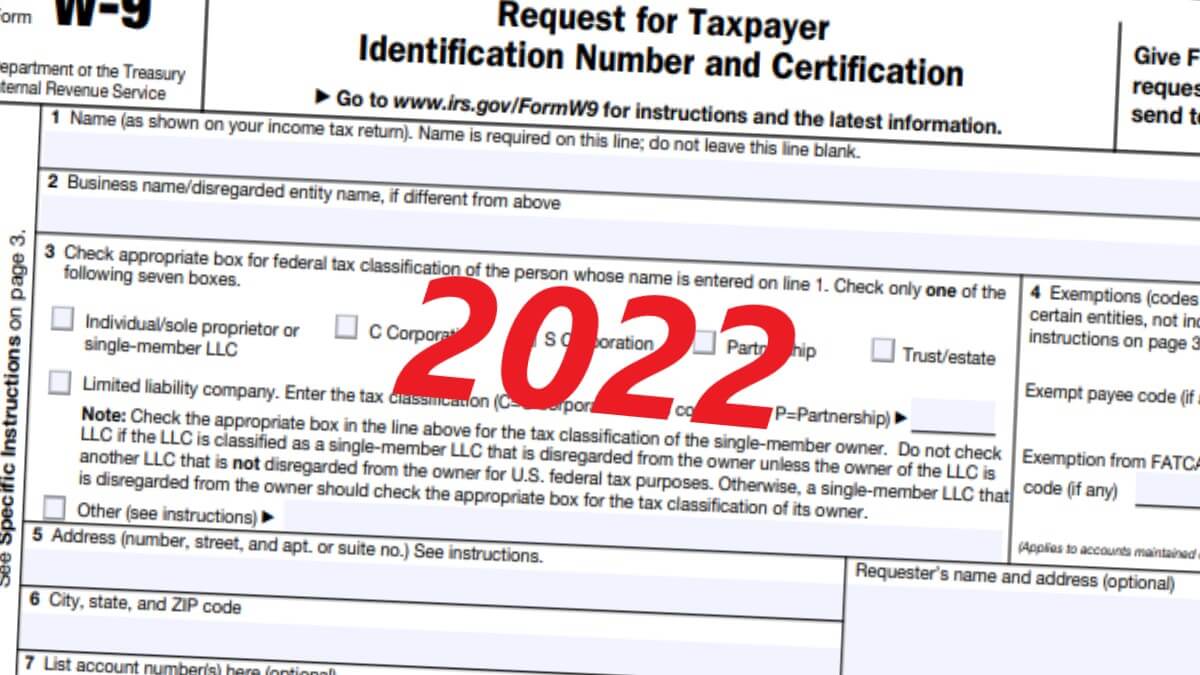

W9 Form 2022

Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form mw507 each year and when your. Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Form mw507m takes effect on the later of (1) the date you give. Md.

Morris 【MD507 / モーリス / アコースティックギター / ハードケース付属】 Dplusstock

It to your employer or. Duties and responsibilities of employer. Enter on line 1 below the number of personal. Form mw507m takes effect on the later of (1) the date you give. A copy of your dependent.

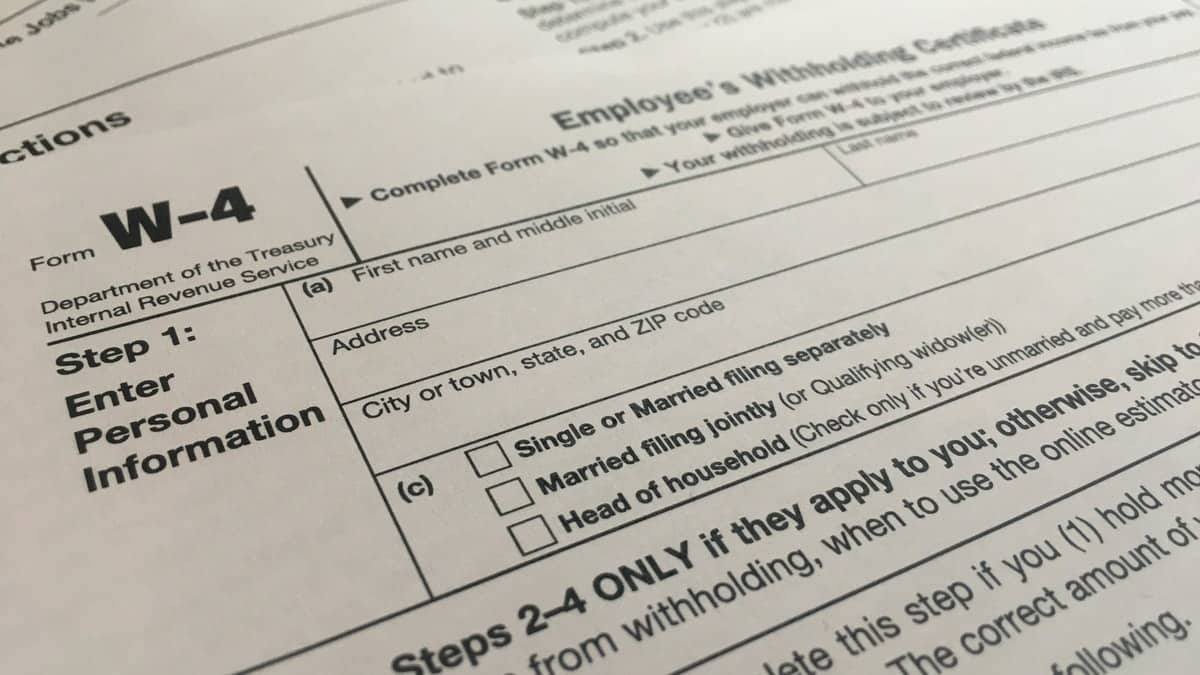

W4 Form 2023 Instructions

Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland. To be mailed with the mw506 or mw506m. Mail separately if filed electronically. Enter on line 1 below the number of personal. Personal exemptions employees may be required to adjust their personal.

Morris MD507 Guitar Piano Nhật Chính Hãng Tại Đà Nẵng

Form mw507m takes effect on the later of (1) the date you give. Consider completing a new form mw507 each year and when your. A copy of your dependent. Retain this certificate with your records. Consider completing a new form mw507 each year and.

manual edgebanders steel surface md507

A copy of your dependent. Duties and responsibilities of employer. Form used to determine the amount of income tax withholding due on the sale of property. Web withholding exemption certificate/employee address update. Web form used by employers who have discontinued or sold their business.

Adrian Steel Drawer Rack Module, Model MD507 U.S. Upfitters

Retain this certificate with your records. Web form used by employers who have discontinued or sold their business. This form is for income earned in tax year 2022, with tax returns due in april. Form used to determine the amount of income tax withholding due on the sale of property. Consider completing a new form mw507 each year and.

MW507 MARYLAND FORM

Web withholding exemption certificate/employee address update. Form mw507m takes effect on the later of (1) the date you give. Personal exemptions employees may be required to adjust their personal. Mail separately if filed electronically. To be mailed with the mw506 or mw506m.

1099 NEC Form 2022

It to your employer or. Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web form used by employers who have discontinued or sold their business. Web consider completing a new form mw507 each.

Web Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Your Pay.

Mail separately if filed electronically. To be mailed with the mw506 or mw506m. Web form used by employers who have discontinued or sold their business. Mail separately if filed electronically.

Web Maryland Form Mw507 Is The State’s Withholding Exemption Certificate And Must Be Completed By All Residents Or Employees In Maryland So Your Employer Can Withhold The.

Personal exemptions employees may be required to adjust their personal. Web withholding exemption certificate/employee address update. To be mailed with the mw506 or mw506m. This form is for income earned in tax year 2022, with tax returns due in april.

Consider Completing A New Form Mw507 Each Year And.

If you meet all of the eligibility requirements for the exemption from withholding, fill out lines 1 through 3 of part 1. Exemption from maryland withholding tax for a qualified civilian. Web maryland return of income tax withholding for nonresident sale of real property. Web consider completing a new form mw507 each year and when your personal or financial situation changes.

Web We Last Updated Maryland Mw507 In January 2023 From The Maryland Comptroller Of Maryland.

A copy of your dependent. Number of exemptions from mw507 form: Web form used by employers who have discontinued or sold their business. It to your employer or.

.jpg)