Meaning Of Special Drawing Rights

Meaning Of Special Drawing Rights - Sdrs are not money per se but rather a potential claim on freely usable currencies of member countries. Web special drawing rights (sdrs) were created by the international monetary fund (imf) in 1969 at a time of international reserve scarcity to supplement the reserve assets of imf member countries. Special drawing rights (sdrs) are a form of global reserve currency that is not issued by any individual country. Dollar, japanese yen, euro, pound sterling and chinese renminbi. Web special drawing rights (sdrs) are an asset, though not money in the classic sense because they can’t be used to buy things. Sdrs were first introduced in the context of the bretton woods’ fixed exchange rate system which came into operation in 1944 and saw many countries. They represent a claim to currency held by imf member countries for which they may be exchanged. Web special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf). Sdrs can be traded for these currencies. Web the bottom line.

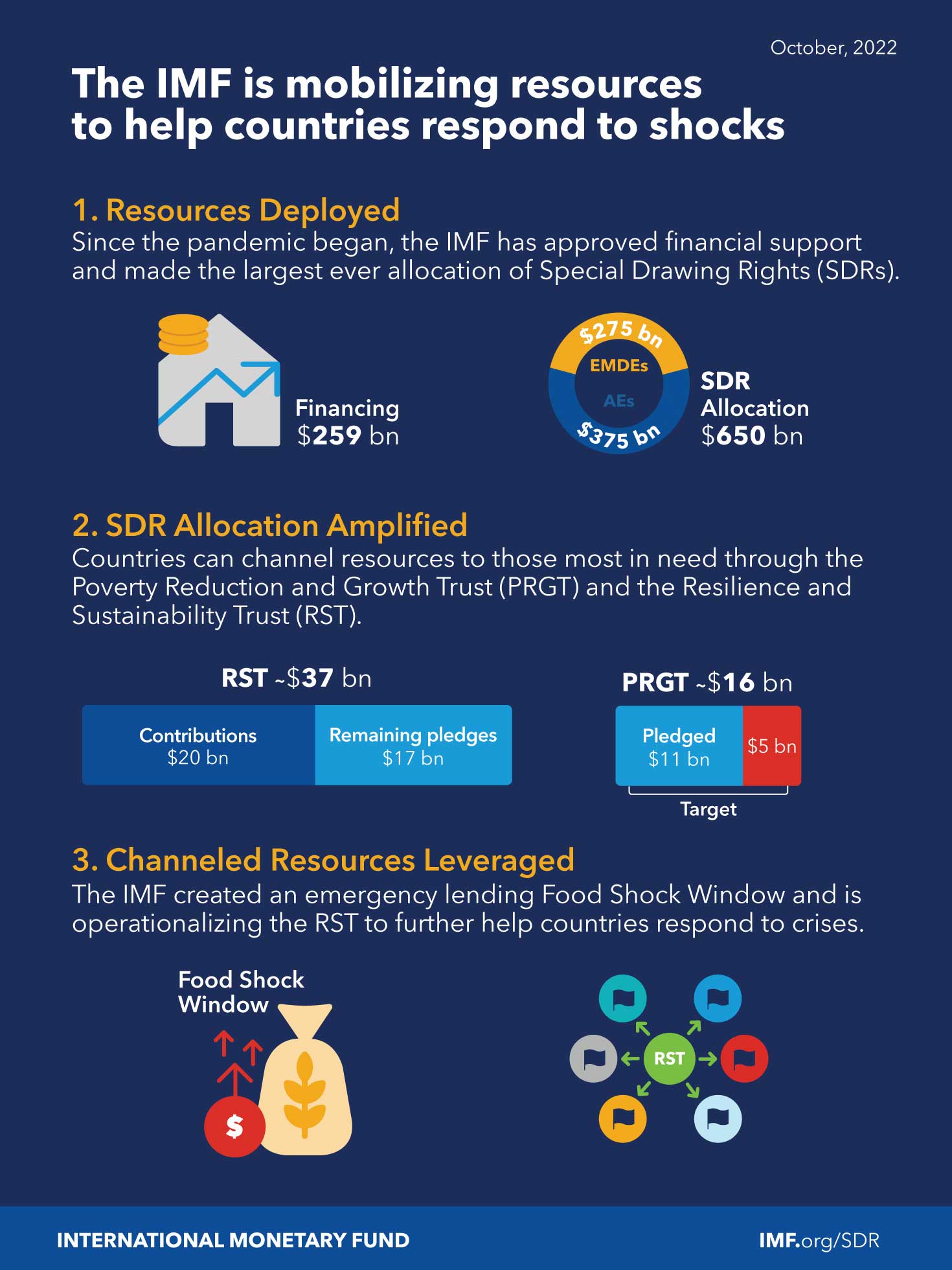

It is not a currency, nor a. Sdrs are used by the imf to make emergency loans and are. When fixed exchange rates ended in 1973, the imf redefined the sdr as equivalent to the value of a basket of world currencies. Dollar, japanese yen, euro, pound sterling and chinese renminbi. 2022 the $650 billion outlay of imf ious backed by the u.s. Web the imf defined the sdr as equivalent to a fractional amount of gold that was equivalent to one us dollar. It will particularly help our most vulnerable countries. Special drawing rights (sdrs) are a form of global reserve currency that is not issued by any individual country. Web special drawing rights (sdrs) were created by the international monetary fund (imf) in 1969 at a time of international reserve scarcity to supplement the reserve assets of imf member countries. Web special drawing rights (sdrs) are an asset, though not money in the classic sense because they can’t be used to buy things.

Sdrs are units of account for the imf, and not a currency per se. The sdr itself is not a currency but an asset that holders can exchange for currency when needed. It serves as the unit of account of the imf. Web special drawing rights were originally introduced in 1969 by the imf. Web ukraine's president volodymyr zelenskiy speaks at a joint press conference with finnish president alexander stubb, amid russia's attack on ukraine, in kyiv, ukraine, april 3, 2024. Web abstract the sdr was created as a result of the first amendment of the articles of agreement, which became effective in 1969. Web a severe geomagnetic storm that hit earth has the potential to knock out power and electronics this weekend, but it could also bring a spectacular light show from the aurora borealis as far south. Web the bottom line. Web special drawing rights (sdrs) are an asset, though not money in the classic sense because they can’t be used to buy things. Instead, they are created and allocated by the international monetary fund (imf) to member countries to supplement their official reserves.

Free of Charge Creative Commons special drawing rights Image Financial 8

Web the bottom line. Web latindadd’s handbook for the use of special drawing rights sdrs for fiscal purposes goes into more detail regarding the legal and accounting possibilities for sdrs. Sdrs are not money per se but rather a potential claim on freely usable currencies of member countries. Web special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve.

Free of Charge Creative Commons special drawing rights Image Financial 3

Sdrs were first introduced in. The benefits of the special drawing rights are reduced dependence on the u.s., issues of balance of payment, and a stable system. To deal with the inability of the existing system to create an adequate quantity of reserves without requiring the united states to run large deficits, a new kind of reserve called special drawing.

Special Drawing Rights Meaning Of Special Drawing Rights Paper Gold

The unit of account value is based on the us dollar, the japanese yen, the british pound, the euro and the chinese renminbi. At that time, the sdr was the equivalent of one us. Since july 1974 the sdr has been defined in terms of a basekt of currencies. Web a general allocation of special drawing rights (sdrs) equivalent to.

SDR Explained in 2 Minutes What is Special Drawing Rights KYC

The benefits of the special drawing rights are reduced dependence on the u.s., issues of balance of payment, and a stable system. Web special drawing rights were originally introduced in 1969 by the imf. At this time, the main purpose of creating sdrs was for use as a supplementary foreign exchange reserve. When fixed exchange rates ended in 1973, the.

Special Drawing Rights (SDRs) Definition and Requirements

At that time, the sdr was the equivalent of one us. Sdrs were first introduced in. Sdrs were created in 1969 to. Nasa's solar dynamics observatory captured this image of solar flares early saturday afternoon. Web firstly, let’s start with the definition of sdrs.

Special Drawing Rights (SDR)

The international monetary fund (imf) allocates. Web ukraine's president volodymyr zelenskiy speaks at a joint press conference with finnish president alexander stubb, amid russia's attack on ukraine, in kyiv, ukraine, april 3, 2024. At that time, the sdr was the equivalent of one us. It is not a currency, nor a. 2022 the $650 billion outlay of imf ious backed.

Special Drawing Rights

Special drawing rights (sdr) refer to an international type of monetary reserve currency created by the international monetary fund (imf) in 1969 that operates as a. Special drawing rights (sdrs) are a form of global reserve currency that is not issued by any individual country. They represent a claim to currency held by imf member countries for which they may.

The IMF's Special Drawing Rights (SDR or XDR) Defined and Explained in

They represent a claim to currency held by imf member countries for which they may be exchanged. Web special drawing rights (sdrs) are an asset, though not money in the classic sense because they can’t be used to buy things. At that time, the sdr was the equivalent of one us. Web the main objective of the special drawing rights.

Special Drawing Rights (SDR) Challenges, Uses, Significance

The purpose for which it has been created and used At this time, the main purpose of creating sdrs was for use as a supplementary foreign exchange reserve. Nasa's solar dynamics observatory captured this image of solar flares early saturday afternoon. It was created as a supplement to existing reserve assets as the demand for reserves was expected to grow.

sdr ppt. Special Drawing Rights International Fund

Web special drawing rights (sdrs) are an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. The sdr is based on a basket of international currencies comprising the u.s. Instead, they are created and allocated by the international monetary fund (imf) to member countries to supplement their official reserves. It will particularly help.

Web The Main Objective Of The Special Drawing Rights Is To Provide Additional Liquidity And Discard Several Restrictions The International Community Faces In Flourishing World Trade.

Web the huge solar storm is keeping power grid and satellite operators on edge. Sdrs are used by the imf to make emergency loans and are. This was due to a lack of us dollars and gold, which at the time were the main assets held in foreign exchange reserves. Dollar, japanese yen, euro, pound sterling and chinese renminbi.

Web The Imf Defined The Sdr As Equivalent To A Fractional Amount Of Gold That Was Equivalent To One Us Dollar.

The purpose for which it has been created and used Nasa's solar dynamics observatory captured this image of solar flares early saturday afternoon. When fixed exchange rates ended in 1973, the imf redefined the sdr as equivalent to the value of a basket of world currencies. The articles establish a criterion for the allocation of sdrs as follows:

Instead, They Are Created And Allocated By The International Monetary Fund (Imf) To Member Countries To Supplement Their Official Reserves.

At this time, the main purpose of creating sdrs was for use as a supplementary foreign exchange reserve. Web latindadd’s handbook for the use of special drawing rights sdrs for fiscal purposes goes into more detail regarding the legal and accounting possibilities for sdrs. To deal with the inability of the existing system to create an adequate quantity of reserves without requiring the united states to run large deficits, a new kind of reserve called special drawing rights (sdrs) was devised by the international monetary fund.members of the fund were to be allocated sdrs, year by year, in. Web special drawing rights (sdrs) were created by the international monetary fund (imf) in 1969 at a time of international reserve scarcity to supplement the reserve assets of imf member countries.

The Sdr Itself Is Not A Currency But An Asset That Holders Can Exchange For Currency When Needed.

The sdr is based on a basket of international currencies comprising the u.s. The unit of account value is based on the us dollar, the japanese yen, the british pound, the euro and the chinese renminbi. Web increased solar activity could cause auroras as far south as alabama and northern california, but may disrupt communications on earth tonight and over the weekend. It is not a currency, nor a.

:max_bytes(150000):strip_icc()/sdr.asp-final-3b506abece934ccc89789e8b43d04bc5.png)