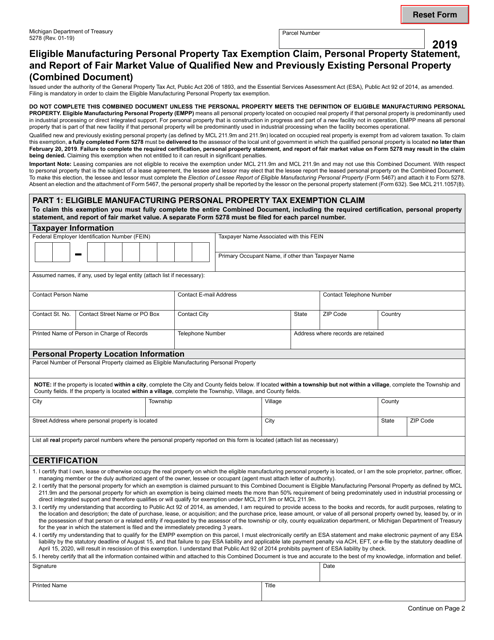

Michigan Form 5278

Michigan Form 5278 - Treasury is committed to protecting. Web the michigan tax commission jan. 4278 a bill to amend 1949 pa 300, entitled Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Web welcome to michigan treasury online (mto)! Web o february 22, 2022: Do not use this form to claim an exemption of eligible manufacturing personal property (empp) pursuant to mcl 211.9m. Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) Web to claim the empp exemption, a fully completed and signed form 5278, affidavit and statement for eligible manufacturing personal property and essential. Web michigan department of treasury parcel number 5278 (rev.

For example, if you know the form has the word change in the title,. Web michigan department of treasury parcel number 5278 (rev. Web taxpayers wishing to claim the exemption must file a michigan department of treasury form 5278 with the local assessor by monday, february 20, each year, or february 22. Web eligible claimants cannot report depreciated costs on form 5278. Health insurance claims assessment (hica) ifta / motor carrier. How do i report leasehold improvements that are also empp? Web to claim the empp exemption, a fully completed and signed form 5278, affidavit and statement for eligible manufacturing personal property and essential. Web disclosure forms and information. Industrial processing is defined in mcl 205.54t of the general sales tax act and mcl 205.94o of the use tax act. Web affidavit and statement for eligible manufacturing personal property and essential services assessment form 5278 affidavit to rescind exemption of eligible manufacturing.

Web if a small business has more than $80,000 in business personal property and is eligible for a manufacturing personal property tax exemption, form 5278 must be filed. Web michigan department of treasury parcel number 5278 (rev. Web o february 22, 2022: Do not use this form to claim an exemption of eligible manufacturing personal property (empp) pursuant to mcl 211.9m. Web the michigan tax commission jan. Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing. Web eligible claimants cannot report depreciated costs on form 5278. Web affidavit and statement for eligible manufacturing personal property and essential services assessment form 5278 affidavit to rescind exemption of eligible manufacturing. How do i report leasehold improvements that are also empp? Web disclosure forms and information.

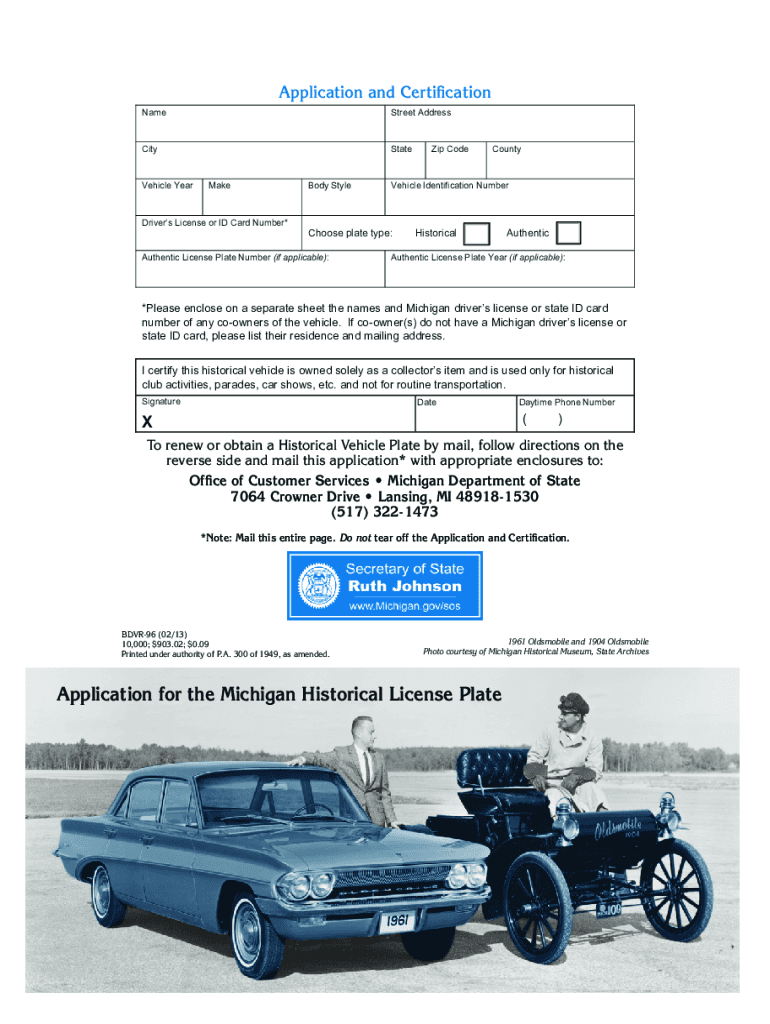

Application For The Michigan Historical License Plate Michigan Fill

Web disclosure forms and information. Web if a small business has more than $80,000 in business personal property and is eligible for a manufacturing personal property tax exemption, form 5278 must be filed. Treasury is committed to protecting. Web welcome to michigan treasury online (mto)! Do not use this form to claim an exemption of eligible manufacturing personal property (empp).

Fillable Online michigan mortgage form Fax Email Print pdfFiller

How do i report leasehold improvements that are also empp? Web welcome to michigan treasury online (mto)! Web to claim the empp exemption, a fully completed and signed form 5278, affidavit and statement for eligible manufacturing personal property and essential. Web use this option to browse a list of forms by entering a key word or phrase that describes the.

Michigan Form 3372 Fillable Fill Online, Printable, Fillable, Blank

Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Web eligible claimants cannot report depreciated costs on form 5278. Web michigan department of treasury parcel number 5278 (rev. How do i report leasehold improvements that are also empp? Web disclosure forms and information.

표준 공사 안전관리자 선임계(작성방법 포함) 부서별서식

The state tax commission is responsible for issuing. For example, if you know the form has the word change in the title,. Web if a small business has more than $80,000 in business personal property and is eligible for a manufacturing personal property tax exemption, form 5278 must be filed. Web use this option to browse a list of forms.

Michigan Nonprofit Form Form Resume Examples GM9OLwlYDL

4278 a bill to amend 1949 pa 300, entitled For example, if you know the form has the word change in the title,. Eligible manufacturing personal property tax exemption claim, ad valorem personal property. Health insurance claims assessment (hica) ifta / motor carrier. Treasury is committed to protecting.

Tax Savings for Michigan Manufacturers Form 5278 Extension YouTube

Web welcome to michigan treasury online (mto)! Eligible manufacturing personal property tax exemption claim, ad valorem personal property. Deadline to file form 5278 with the assessor of the local unit in which the personal property is located. Web what is industrial processing? Web disclosure forms and information.

Michigan Form 151 mimekodesign

Web taxpayers wishing to claim the exemption must file a michigan department of treasury form 5278 with the local assessor by monday, february 20, each year, or february 22. Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing. Web welcome to michigan treasury online (mto)! Industrial.

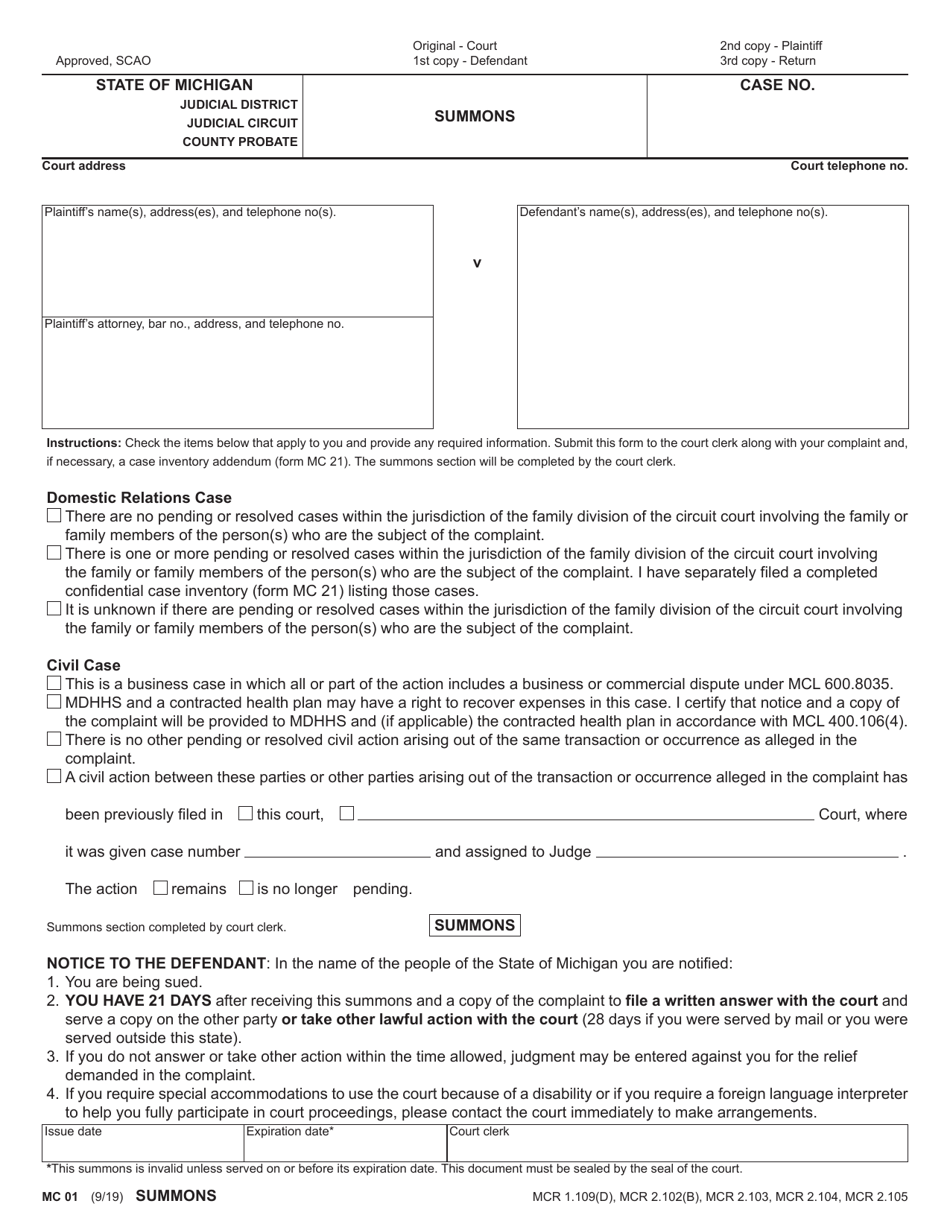

Form MC01 Download Fillable PDF or Fill Online Summons Michigan

Do not use this form to claim an exemption of eligible manufacturing personal property (empp) pursuant to mcl 211.9m. Health insurance claims assessment (hica) ifta / motor carrier. Web welcome to michigan treasury online (mto)! Industrial processing is defined in mcl 205.54t of the general sales tax act and mcl 205.94o of the use tax act. Web if a small.

Form 5278 Download Fillable PDF or Fill Online Eligible Manufacturing

Web welcome to michigan treasury online (mto)! Treasury is committed to protecting. For example, if you know the form has the word change in the title,. Industrial processing is defined in mcl 205.54t of the general sales tax act and mcl 205.94o of the use tax act. Web eligible claimants cannot report depreciated costs on form 5278.

Michigan Form 154 Fill Out and Sign Printable PDF Template signNow

Eligible manufacturing personal property tax exemption claim, ad valorem personal property. Web to claim the empp exemption, a fully completed and signed form 5278, affidavit and statement for eligible manufacturing personal property and essential. Health insurance claims assessment (hica) ifta / motor carrier. For example, if you know the form has the word change in the title,. Treasury is committed.

10 Issued A Reminder To Timely File Form 5278, Combined Document, In Order To Claim The Eligible Manufacturing Personal.

Health insurance claims assessment (hica) ifta / motor carrier. Industrial processing is defined in mcl 205.54t of the general sales tax act and mcl 205.94o of the use tax act. Web michigan department of treasury parcel number 5278 (rev. Web what is industrial processing?

Web Welcome To Michigan Treasury Online (Mto)!

Web michigan department of treasury parcel number 5278 (rev. Web the michigan tax commission jan. Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing. Mto is the michigan department of treasury's web portal to many business taxes.

How Do I Report Leasehold Improvements That Are Also Empp?

For example, if you know the form has the word change in the title,. Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) 4278 a bill to amend 1949 pa 300, entitled Do not use this form to claim an exemption of eligible manufacturing personal property (empp) pursuant to mcl 211.9m.

Web If A Small Business Has More Than $80,000 In Business Personal Property And Is Eligible For A Manufacturing Personal Property Tax Exemption, Form 5278 Must Be Filed.

Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Treasury is committed to protecting. Web to claim the empp exemption, a fully completed and signed form 5278, affidavit and statement for eligible manufacturing personal property and essential. The state tax commission is responsible for issuing.