Michigan Veterans Property Tax Exemption Form

Michigan Veterans Property Tax Exemption Form - A completed form 3372, michigan sales and use tax certificate of exemption. Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. You will need to provide your va disability rating letter to your township. Web 211.7b exemption of real property used and owned as homestead by disabled veteran or individual described in subsection (2); Web the affidavit (mi dept of treasury form 5107) shall be filed at the local assessing office by the property owner or their legal designee. Issued under authority of public act 161 of 2013, mcl 211.7b. You may apply by submitting a completed affidavit for disabled veterans. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act.

Filing and inspection of affidavit; This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran. It is necessary to apply for this exemption annually with the city's assessing department. Submit the state tax commission affidavit for disabled veterans exemption to the local city or township assessor, along with supporting documents from. Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. Has been determined by the united states department of veterans’ affairs to be permanently and totally disabled as a result of military service and entitled to. Web in order to claim exemption, the nonprofit organization must provide the seller with both: You will need to provide your va disability rating letter to your township. Web state tax commission affidavit for disabled veterans exemption. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by disabled veteran who was.

Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. You may apply by submitting a completed affidavit for disabled veterans. This form is to be. To apply for property tax relief while on active duty, complete application for property tax relief during active military service,. Web to apply for the exemption, you, as the veteran, or your unremarried surviving spouse or legal designee must annually file an affidavit (form 5107, affidavit. Issued under authority of public act 161 of 2013, mcl 211.7b. A completed form 3372, michigan sales and use tax certificate of exemption. The affidavit is filed with the assessing office. You can fill out the form. Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent.

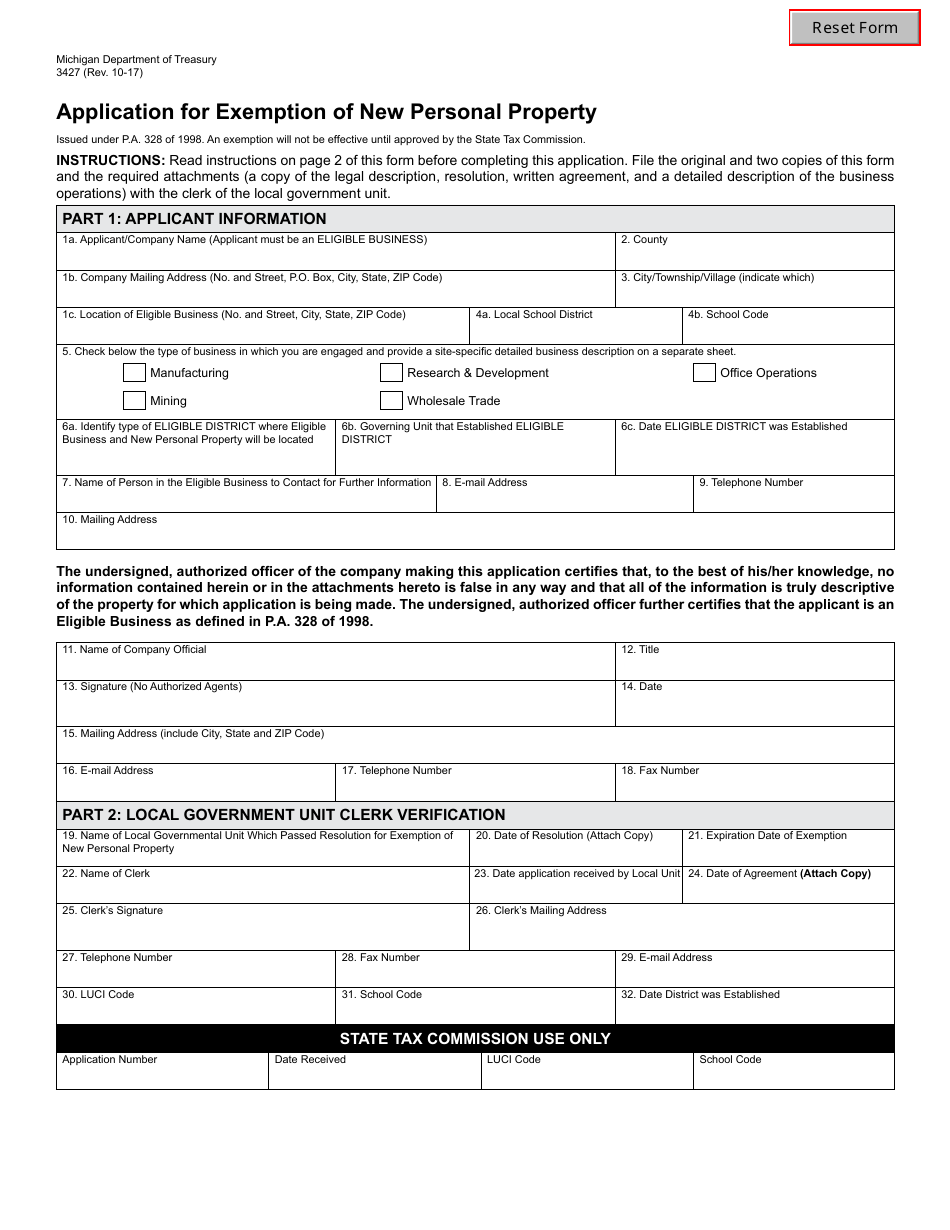

Form 3427 Download Fillable PDF or Fill Online Application for

Web property tax relief for active military personnel. To apply for property tax relief while on active duty, complete application for property tax relief during active military service,. Filing and inspection of affidavit; Web to apply for the exemption, you, as the veteran, or your unremarried surviving spouse or legal designee must annually file an affidavit (form 5107, affidavit. Submit.

18 States With Full Property Tax Exemption for 100 Disabled Veterans

This form is to be. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act. Web.

Top 7 Veteran Benefits in Arizona VA Claims Insider

A completed form 3372, michigan sales and use tax certificate of exemption. Web property tax relief for active military personnel. The affidavit is filed with the assessing office. Filing and inspection of affidavit; You may apply by submitting a completed affidavit for disabled veterans.

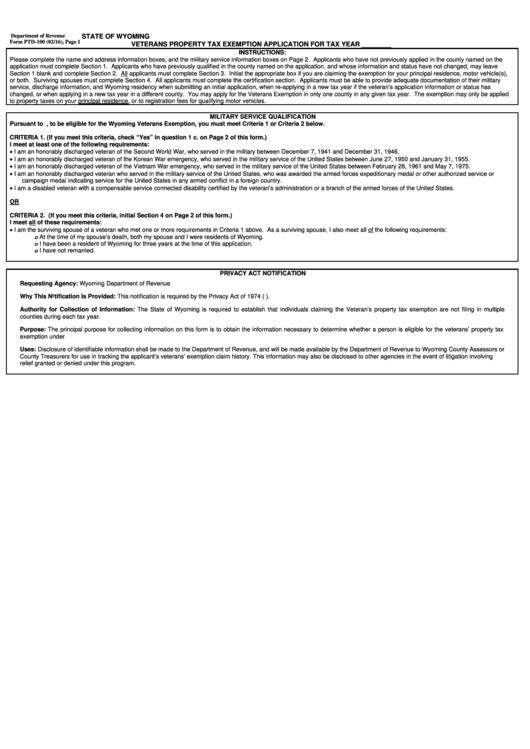

Fillable Form Ptd100 State Of Wyoming Veterans Property Tax

Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. Web the affidavit (mi dept of treasury form 5107) shall be filed at the local assessing office by the property owner or their legal designee. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying.

16 States With Full Property Tax Exemption for 100 Disabled Veterans

It is necessary to apply for this exemption annually with the city's assessing department. Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in.

18 States With Full Property Tax Exemption for 100 Disabled Veterans

You will need to provide your va disability rating letter to your township. Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a.

Michigan veterans property tax exemption form 5107 Fill out & sign

Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act. You can fill out the form. Issued under authority of public act 161 of 2013, mcl 211.7b. Has been determined by the united states department of veterans’ affairs to be permanently and totally disabled as a.

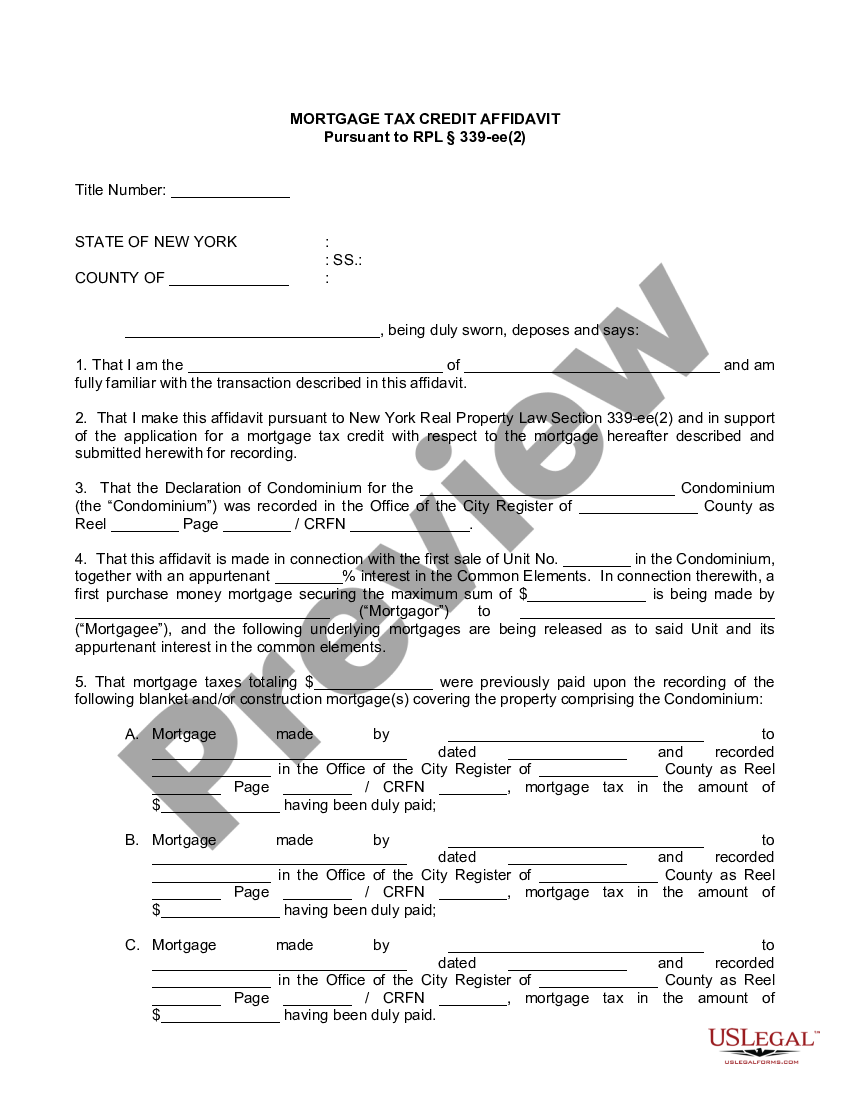

Yonkers New York City Veterans Property Tax Exemption Form US Legal Forms

Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act. You will need to provide your va disability rating letter to your township. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and.

Fill Free fillable 2021 CLAIM FOR DISABLED VETERANS' PROPERTY TAX

Web to apply for the exemption, you, as the veteran, or your unremarried surviving spouse or legal designee must annually file an affidavit (form 5107, affidavit. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. Web this form is to be used.

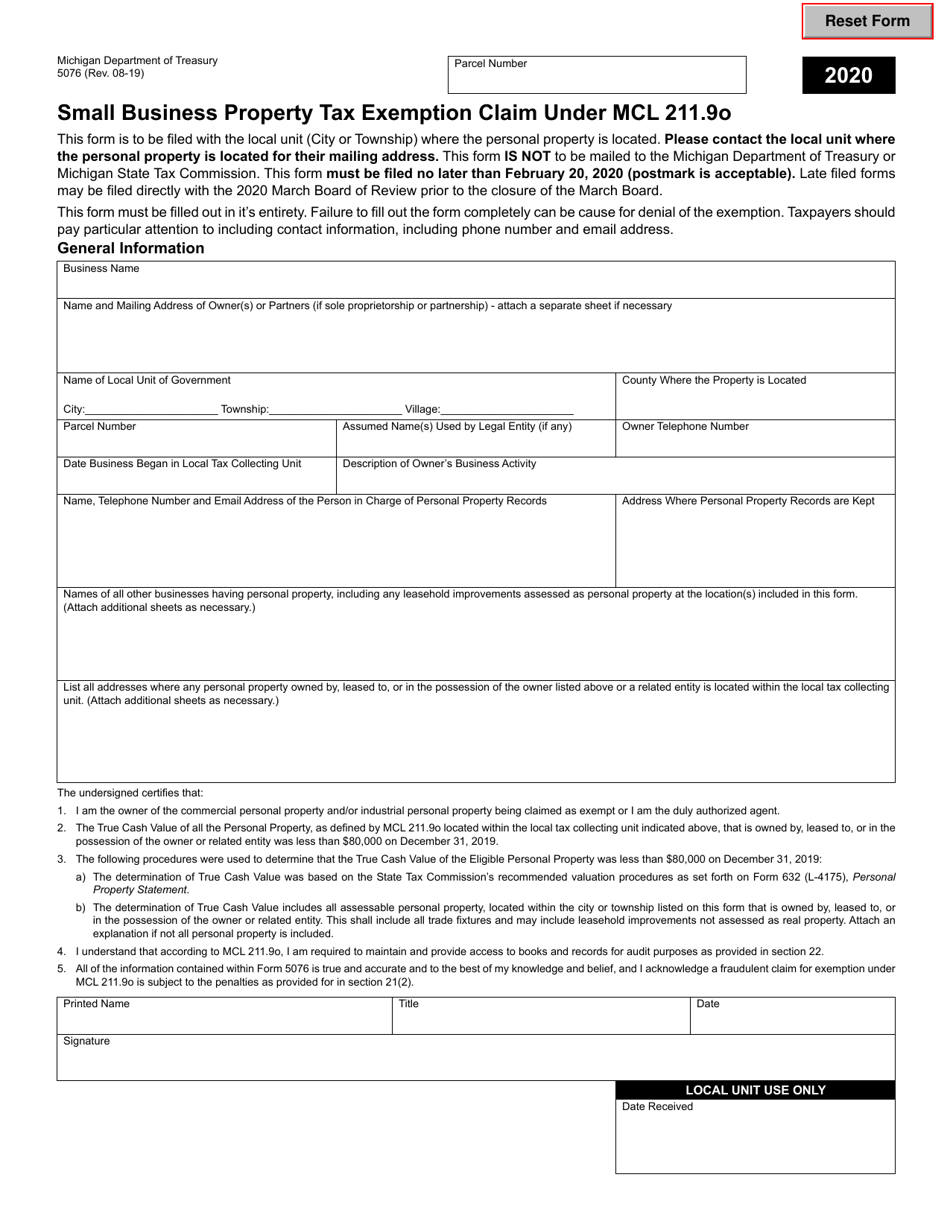

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Web 211.7b exemption of real property used and owned as homestead by disabled veteran or individual described in subsection (2); It is necessary to apply for this exemption annually with the city's assessing department. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act. Web state.

You Can Fill Out The Form.

Web 211.7b exemption of real property used and owned as homestead by disabled veteran or individual described in subsection (2); The affidavit is filed with the assessing office. Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. You may apply by submitting a completed affidavit for disabled veterans.

Web To Apply For The Exemption, You, As The Veteran, Or Your Unremarried Surviving Spouse Or Legal Designee Must Annually File An Affidavit (Form 5107, Affidavit.

To apply for property tax relief while on active duty, complete application for property tax relief during active military service,. Has been determined by the united states department of veterans’ affairs to be permanently and totally disabled as a result of military service and entitled to. Web state tax commission affidavit for disabled veterans exemption. Web go to the frequently asked questions guide prepared by the michigan state tax commission.

Disabled Veterans Exemption Faq (Updated February 2023) Disabled Veterans Reminded To Contact Local Municipality To.

Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. This form is to be. Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption.

Web Property Tax Relief For Active Military Personnel.

Web the affidavit (mi dept of treasury form 5107) shall be filed at the local assessing office by the property owner or their legal designee. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act. Submit the state tax commission affidavit for disabled veterans exemption to the local city or township assessor, along with supporting documents from. Web in order to claim exemption, the nonprofit organization must provide the seller with both: