Missouri Gas Tax Refund Form

Missouri Gas Tax Refund Form - Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Web number of gallons purchased and charged missouri fuel tax, as a separate item. The increases were approved in senate. Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel taxes are now able to start preparing. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. Web since the gas tax was increased in october from 17 cents to 19.5, this year people will be able to claim 2.5 cents on each gallon of gas bought in missouri over the. 26, 2022 at 2:44 am pdt springfield, mo. Web to claim a refund on the most recent tax increase, drivers must submit information from saved gas receipts for gas purchased from oct. Refund claims can be submitted from july 1, 2022, to sept. In october 2021, missouri's motor fuel tax rose.

Web anne marie moy, department of revenue director of strategy and communications, said the department will have a refund claim form available on its. Web number of gallons purchased and charged missouri fuel tax, as a separate item. The information will be retained in the missouri. Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has been released by the department of. A claim must be filed by the customer who purchased the fuel, and. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. 26, 2022 at 2:44 am pdt springfield, mo. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. The increases were approved in senate.

Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. In october 2021, missouri's motor fuel tax rose. A claim must be filed by the customer who purchased the fuel, and. If you are hoping to cash in on the missouri gas tax. Web file a motor fuel consumer refund for highway use claim using excel upload you may also upload your motor fuel consumer refund highway use claim as an excel. Web since the gas tax was increased in october from 17 cents to 19.5, this year people will be able to claim 2.5 cents on each gallon of gas bought in missouri over the. The increases were approved in senate. Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel taxes are now able to start preparing. 26, 2022 at 2:44 am pdt springfield, mo. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025.

missouri gas tax refund Christel Engel

Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has been released by the department of. Web 9 rows resources forms and.

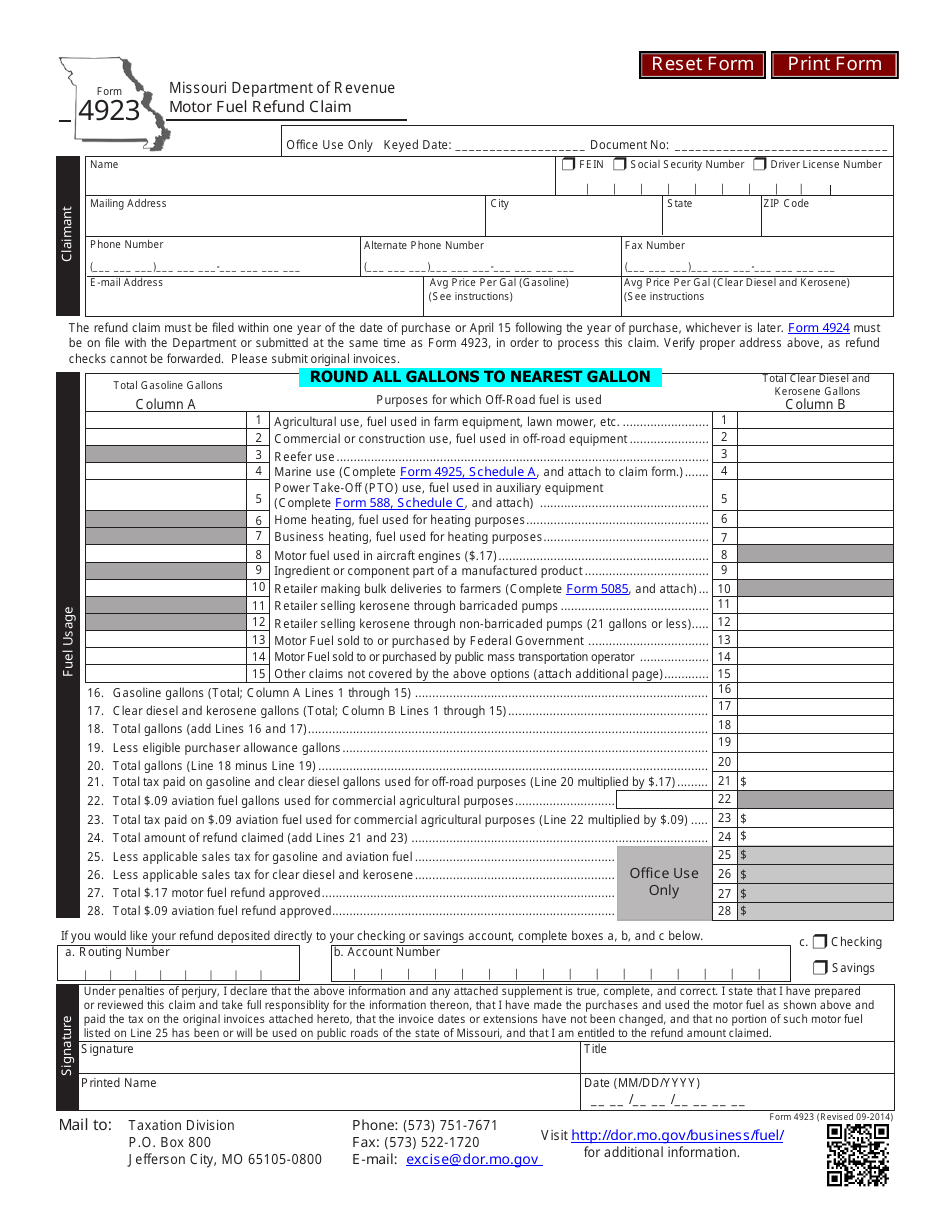

MO DoR 4923 2008 Fill out Tax Template Online US Legal Forms

Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Web since the gas tax was increased in october from 17 cents to 19.5, this year people will be able to claim 2.5 cents on each gallon of gas bought in missouri over the. A.

Here's how to get a refund for Missouri's gas tax increase Howell

Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel taxes are now able to start preparing. In october 2021, missouri's motor fuel tax rose. The information will be retained in the missouri. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning.

Missouri gas tax app can help Missourians get refund on gas tax

Web 9 rows resources forms and manuals find your form to search, type a keyword in. Web namratha prasad sep 26, 2022 friday will be the last day to submit receipts to collect gas tax refunds in missouri. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web david carson.

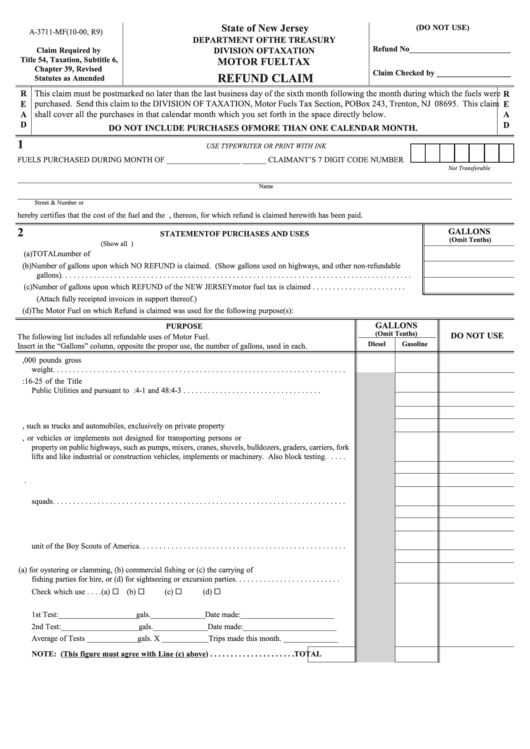

Fillable Form A3711Mf Refund Claim Motor Fuel Tax 2000 printable

This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. The information will be retained in the missouri. “does missouri have a highway gasoline tax refund for the. Web the first.

Military Journal Missouri 500 Tax Refund If the total amount of

“does missouri have a highway gasoline tax refund for the. Web namratha prasad sep 26, 2022 friday will be the last day to submit receipts to collect gas tax refunds in missouri. Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has.

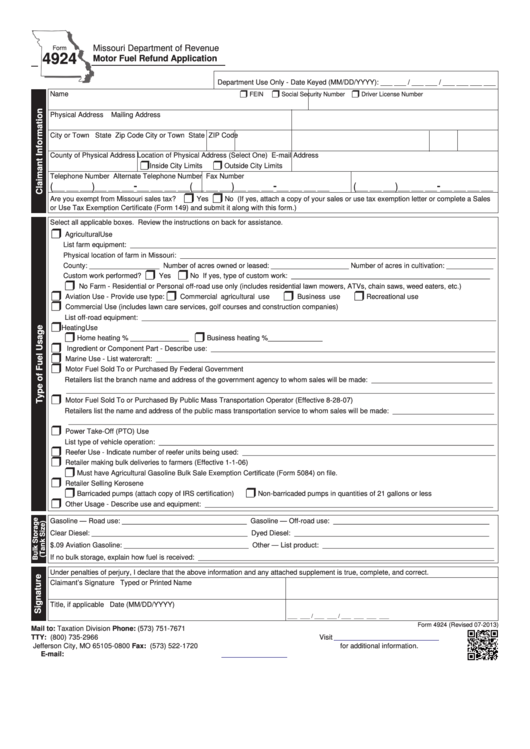

Fillable Form 4924 Motor Fuel Refund Application printable pdf download

Web namratha prasad sep 26, 2022 friday will be the last day to submit receipts to collect gas tax refunds in missouri. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. Web since the gas tax was increased in october from 17 cents to 19.5, this year people will be.

Car Tax Refund Form Missouri Free Download

“does missouri have a highway gasoline tax refund for the. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. Web refund claim form will be available on the department of revenue’s website prior to july 1, 2022..

missouri gas tax refund spreadsheet Lala Lombardo

Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. If you are hoping to cash in on the missouri gas tax. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to.

missouri gas tax refund spreadsheet Associated Himself Blook Photo

A claim must be filed by the customer who purchased the fuel, and. Web 9 rows resources forms and manuals find your form to search, type a keyword in. Web anne marie moy, department of revenue director of strategy and communications, said the department will have a refund claim form available on its. Web to claim a refund on the.

Web Namratha Prasad Sep 26, 2022 Friday Will Be The Last Day To Submit Receipts To Collect Gas Tax Refunds In Missouri.

“does missouri have a highway gasoline tax refund for the. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. A claim must be filed by the customer who purchased the fuel, and. Web number of gallons purchased and charged missouri fuel tax, as a separate item.

Web In 2021, The State Of Missouri Started Increasing The Gas Tax By 2 1/2 Cents Every Year Through 2025.

Web the first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025. Following the gas tax increase in october, missouri’s motor fuel tax rate. This schedule is to be completed by taxpayers claiming the remediation tax credits and is to be attached to. In october 2021, missouri's motor fuel tax rose.

Web To Claim A Refund On The Most Recent Tax Increase, Drivers Must Submit Information From Saved Gas Receipts For Gas Purchased From Oct.

Refund claims can be submitted from july 1, 2022, to sept. Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel taxes are now able to start preparing. Web refund claim form will be available on the department of revenue’s website prior to july 1, 2022. Web anne marie moy, department of revenue director of strategy and communications, said the department will have a refund claim form available on its.

Web 9 Rows Resources Forms And Manuals Find Your Form To Search, Type A Keyword In.

Web if you’re one of the missouri residents saving all of your gas receipts to get a refund on your state gas tax, the form to file has been released by the department of. If you are hoping to cash in on the missouri gas tax. 26, 2022 at 2:44 am pdt springfield, mo. Web since the gas tax was increased in october from 17 cents to 19.5, this year people will be able to claim 2.5 cents on each gallon of gas bought in missouri over the.