Mn M1 Form

Mn M1 Form - Web filing a paper income tax return. You must file yearly by april 17. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. If zero or less leave blank. Web form m1 is the most common individual income tax return filed for minnesota residents. A copy of the federal form 1040, including a copy of schedule c or. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. This form is for income earned in tax year 2022, with tax. We'll make sure you qualify, calculate your minnesota property tax refund,. And schedules kpi, ks, and kf.

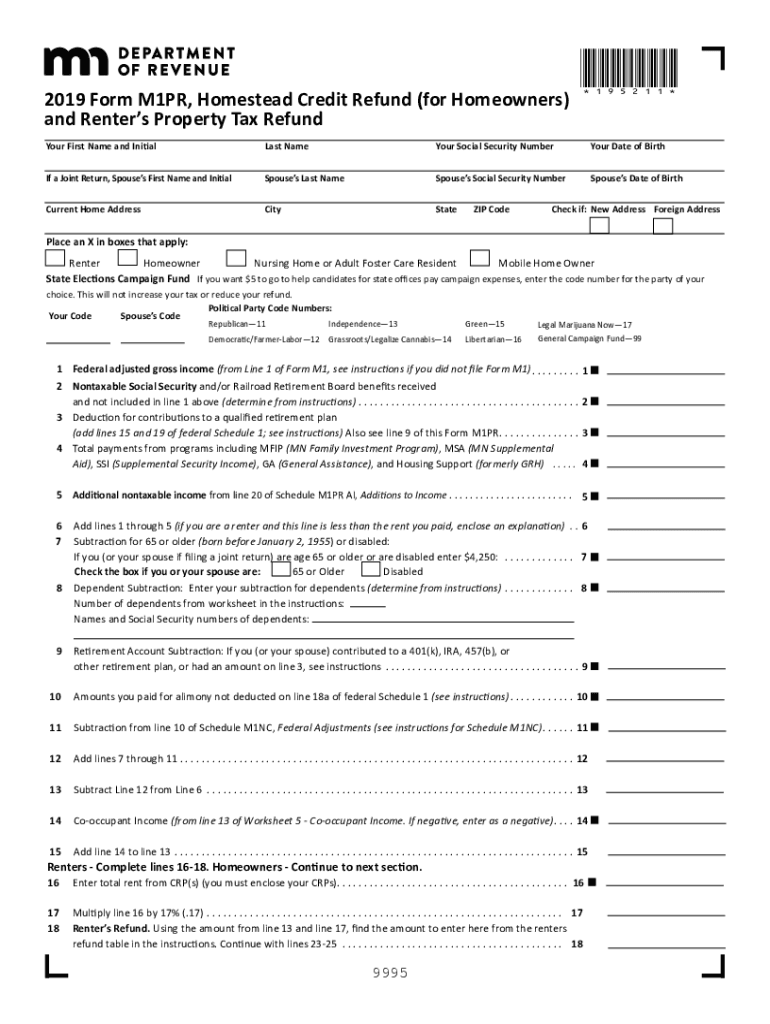

Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: The purpose of form m1 is to determine your tax liability for the state. Complete form m1 using the minnesota. It will help candidates for state offices. Web find and fill out the correct minnesota form m1. You are a minnesota resident if either of. And schedules kpi, ks, and kf. For more information about the minnesota income tax,. Web filing a paper income tax return. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice.

Web find and fill out the correct minnesota form m1. Web use form m1 , individual income tax , to estimate your minnesota tax. Web minnesota income tax withheld. A copy of the federal form 1040, including a copy of schedule c or. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. You are a minnesota resident if either of. This form is for income earned in tax year 2022, with tax. Complete form m1 using the minnesota. Income you calculated in step 1 on form m1 , line 1. If zero or less leave blank.

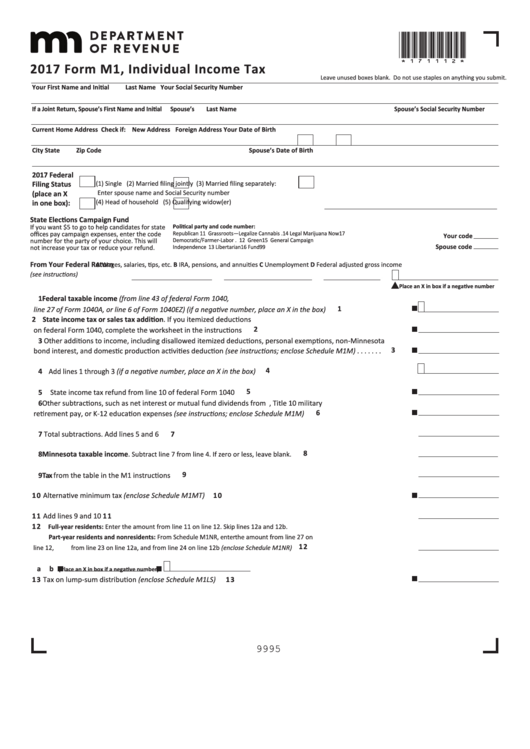

Form M1 Individual Tax 2017 printable pdf download

Web to compute minnesota income tax, the proprietor uses form m1, the individual income tax return form. Web minnesota income tax withheld. Choose the correct version of the editable pdf form. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. You must file yearly by april 15.

Fill Free fillable Minnesota Department of Revenue PDF forms

Income you calculated in step 1 on form m1 , line 1. Web find and fill out the correct minnesota form m1. Web form m1 is the most common individual income tax return filed for minnesota residents. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. The purpose of form m1 is.

MN DoR M1 2005 Fill out Tax Template Online US Legal Forms

Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web filing a paper income tax return. Choose the correct version of the editable pdf form. The purpose of form m1 is to determine your tax liability for the state. A copy of the.

2012 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. We'll make sure you qualify, calculate your minnesota property tax refund,. 10 tax from the table in. For more information about the minnesota income tax,. Choose the correct version of the editable pdf form.

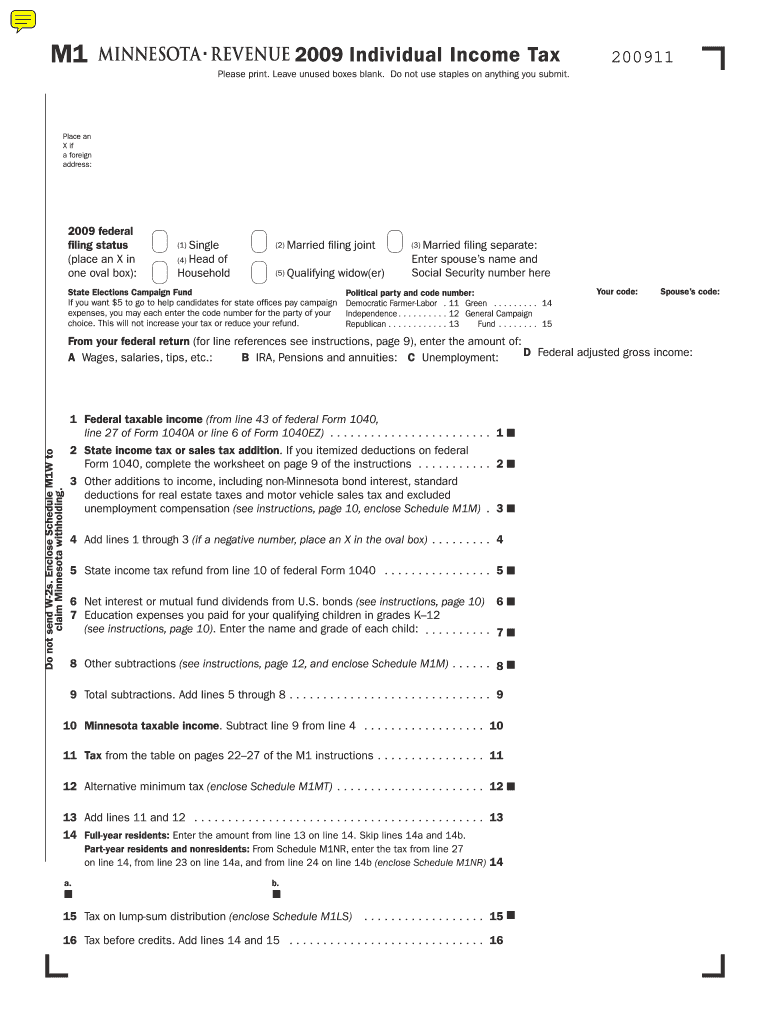

MN DoR M1 2009 Fill out Tax Template Online US Legal Forms

Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: You must file yearly by april 15. Complete form m1 using the minnesota. Web find and fill out the correct minnesota form m1. It will help candidates for state offices.

2019 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

Choose the correct version of the editable pdf form. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: This form.

MN DoR M1PR 20192022 Fill out Tax Template Online US Legal Forms

Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. You are a minnesota resident if either of. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. If zero or less leave blank. It will help candidates for state offices.

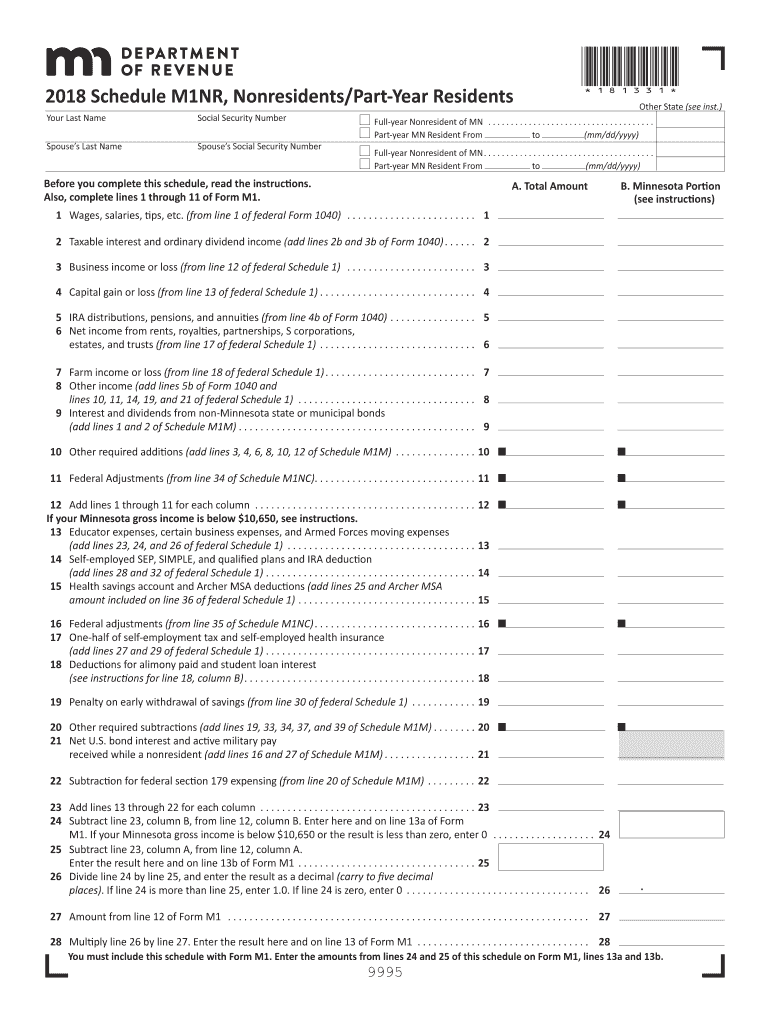

Schedule M1Nr Fill Out and Sign Printable PDF Template signNow

You are a minnesota resident if either of. This form is for income earned in tax year 2022, with tax. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund:.

Fill Free fillable M1 19 2019 Form M1, Individual Tax Return

You must file yearly by april 17. And schedules kpi, ks, and kf. You are a minnesota resident if either of. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. A copy of the federal form 1040, including a copy of schedule c or.

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

Web use form m1 , individual income tax , to estimate your minnesota tax. 10 tax from the table in. If zero or less leave blank. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a.

Do Not Use Staples On Anything You Submit.

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web file a 2021 minnesota income tax return if your income is more than the amount that applies to you in the chart below. We'll make sure you qualify, calculate your minnesota property tax refund,. Web filing a paper income tax return.

Web Form M1 Is The Most Common Individual Income Tax Return Filed For Minnesota Residents.

This form is for income earned in tax year 2022, with tax. For more information about the minnesota income tax,. Web minnesota income tax withheld. You must file yearly by april 15.

Web 2020 Form M1, Individual Income Tax State Elections Campaign Fund To Grant $5 To This Fund, Enter The Code For The Party Of Your Choice.

Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: It will help candidates for state offices. Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1.

Web Form M1 Is The Most Common Individual Income Tax Return Filed For Minnesota Residents.

And schedules kpi, ks, and kf. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. You must file yearly by april 17. Income you calculated in step 1 on form m1 , line 1.