Montana State Tax Form 2022

Montana State Tax Form 2022 - If you live in montana. This form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. You must be filing as single or married with no dependants. Taxformfinder provides printable pdf copies of 79 current montana income tax forms. We will update this page with a new version of the form for 2024 as soon as it is made available by the montana government. Web montana department of revenue Web the montana tax forms are listed by tax year below and all mt back taxes for previous years would have to be mailed in. Web show sources > form 2 is a montana individual income tax form. The 2023 state personal income tax brackets are updated from the montana and tax foundation data. “after hearing from montanans impacted by the recent winter storms, particularly in eastern montana, we moved quickly.

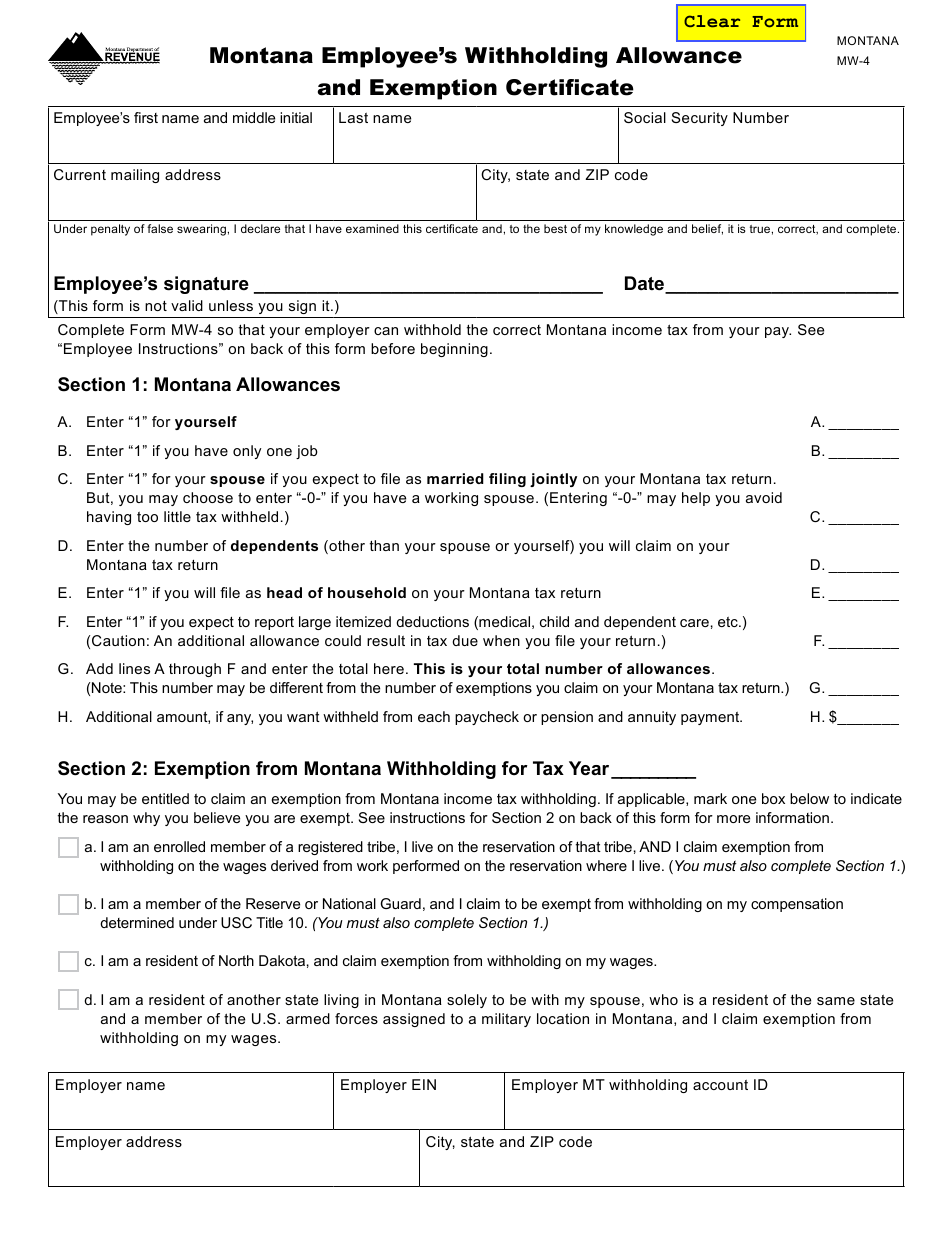

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in montana during calendar year 2023. Filing information for native americans. Amending or correcting a return. Web the montana income tax rate for tax year 2022 is progressive from a low of 1.0% to a high of 6.75%. Property assessment division announces business equipment reporting requirement; Web we last updated the withholding tax guide with tax tables in april 2023, so this is the latest version of withholding instructions, fully updated for tax year 2022. Web we last updated the montana individual estimated income tax worksheet in april 2023, so this is the latest version of form esw, fully updated for tax year 2022. This form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. Ad simply snap a photo of your annual payslip. You can complete the forms with the help of efile.com free tax calculators.

The montana form 2 instructions and the most commonly filed individual income tax forms are listed below on this page. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug. Web we last updated the montana individual estimated income tax worksheet in april 2023, so this is the latest version of form esw, fully updated for tax year 2022. Function description montana state income tax rate: Web we last updated the withholding tax guide with tax tables in april 2023, so this is the latest version of withholding instructions, fully updated for tax year 2022. Web the montana income tax rate for tax year 2022 is progressive from a low of 1.0% to a high of 6.75%. Web prepared for the revenue interim committee by jaret coles, legislative staff attorney june 2022 *link to bill text: The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Other montana individual income tax forms: The address is listed on the form.

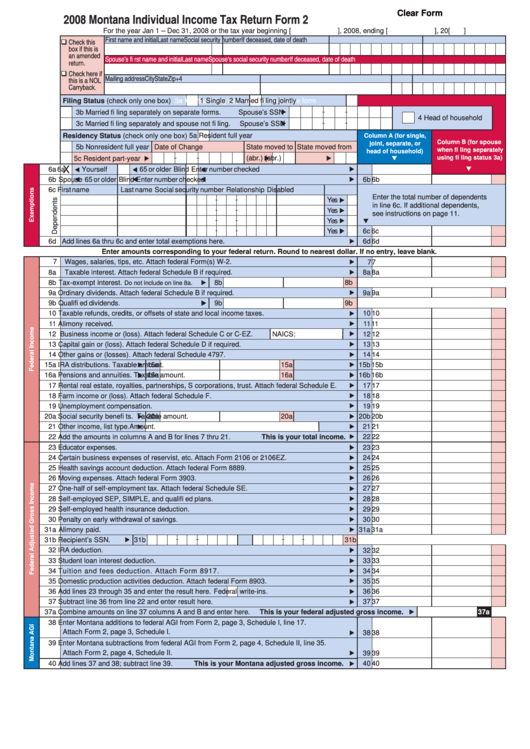

Fillable Form 2 Montana Individual Tax Return 2008 printable

The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form during an application period that runs from aug. Web montana has a state income tax that ranges between 1% and 6.9% , which is administered by the montana department of revenue. Web show sources > form 2 is.

Montana Tax MT State Tax Calculator Community Tax

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in montana during calendar year 2023. Web we last updated the withholding tax guide with tax tables in april 2023, so this is the latest version of withholding instructions, fully updated for tax year 2022. You can print other.

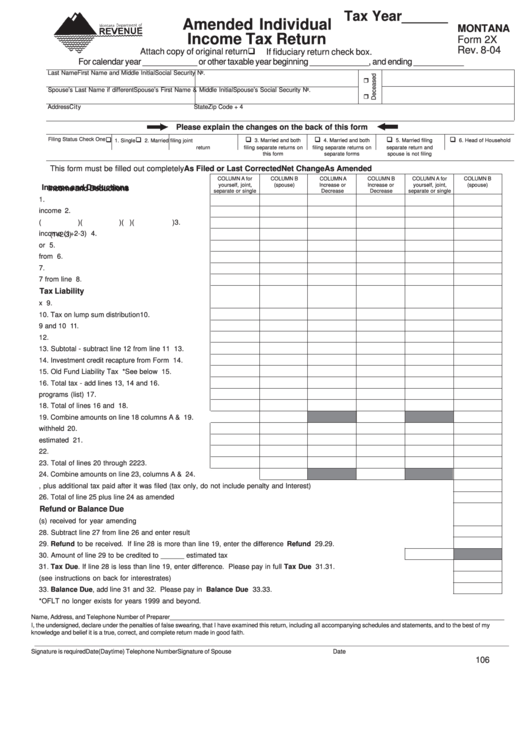

Fillable Montana Form 2x Amended Individual Tax Return

Complete the respective montana tax form(s) then download, print, sign, and mail them to the montana department of revenue. And you are not enclosing a payment,. Web download or print the 2022 montana form it payment voucher (individual income tax payment voucher) for free from the montana department of revenue. The department says taxpayers can apply for the 2022 property.

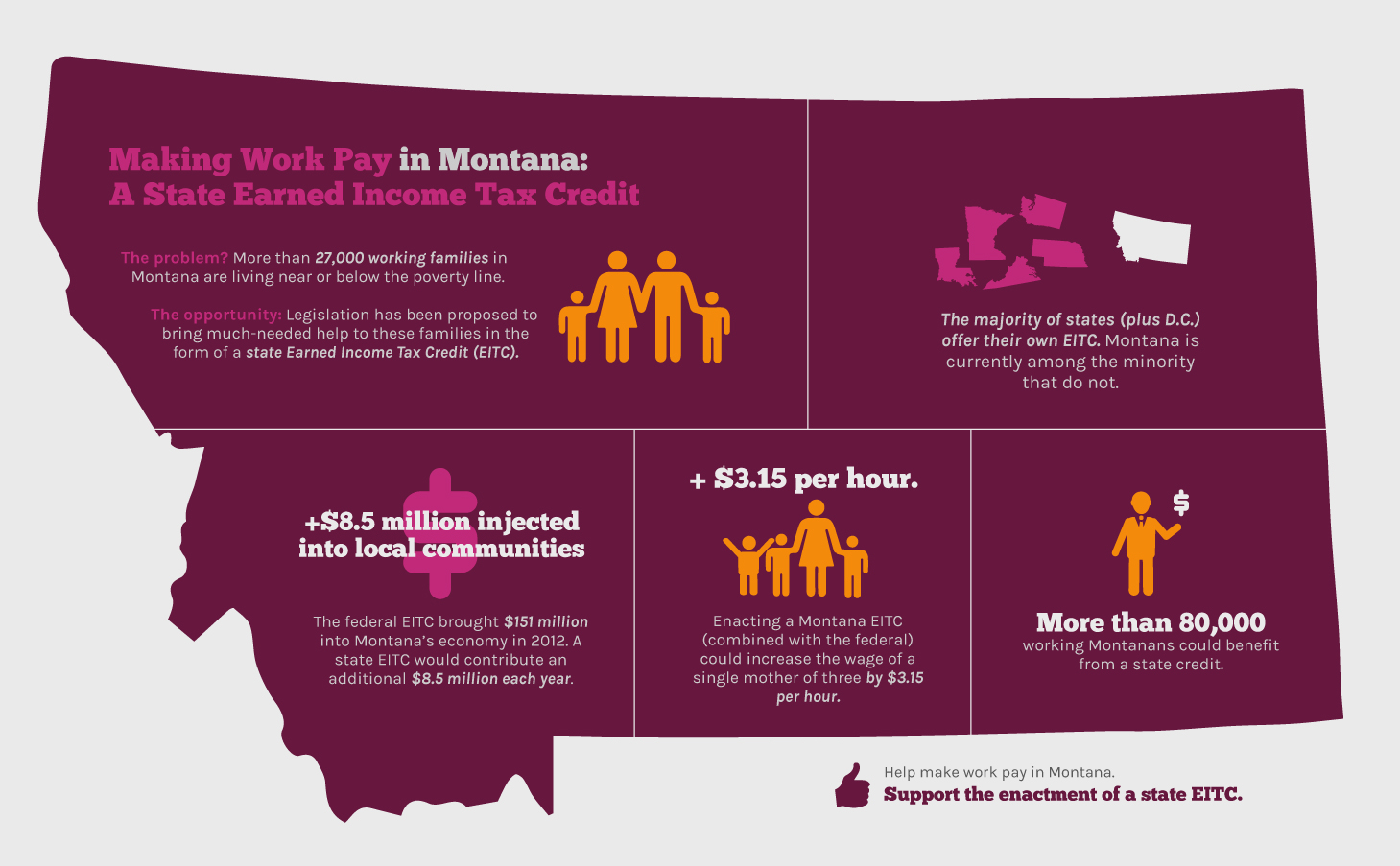

Making Work Pay in Montana A State Earned Tax Credit Tax

Web these you have to apply for. Function description montana state income tax rate: Web montana has a state income tax that ranges between 1% and 6.9% , which is administered by the montana department of revenue. Web you may use this form to file your montana individual income tax return. We will update this page with a new version.

New Employee Forms Montana 2023

You can complete the forms with the help of efile.com free tax calculators. Filing information for military personnel and spouses. Be sure to verify that the form you are downloading is for the correct year. Web income tax rates, deductions, and exemptions. You can print other montana tax forms here.

Montana Form Pte Instructions Fill Online, Printable, Fillable, Blank

Keep in mind that some states will not update their tax forms for 2023 until january 2024. Ad simply snap a photo of your annual payslip. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in montana during calendar year 2023. “after hearing from montanans impacted by the.

2022 State Business Tax Climate Index Tax Foundation

Web the montana income tax rate for tax year 2022 is progressive from a low of 1.0% to a high of 6.75%. Web we last updated the montana individual estimated income tax worksheet in april 2023, so this is the latest version of form esw, fully updated for tax year 2022. Web income tax rates, deductions, and exemptions. A second.

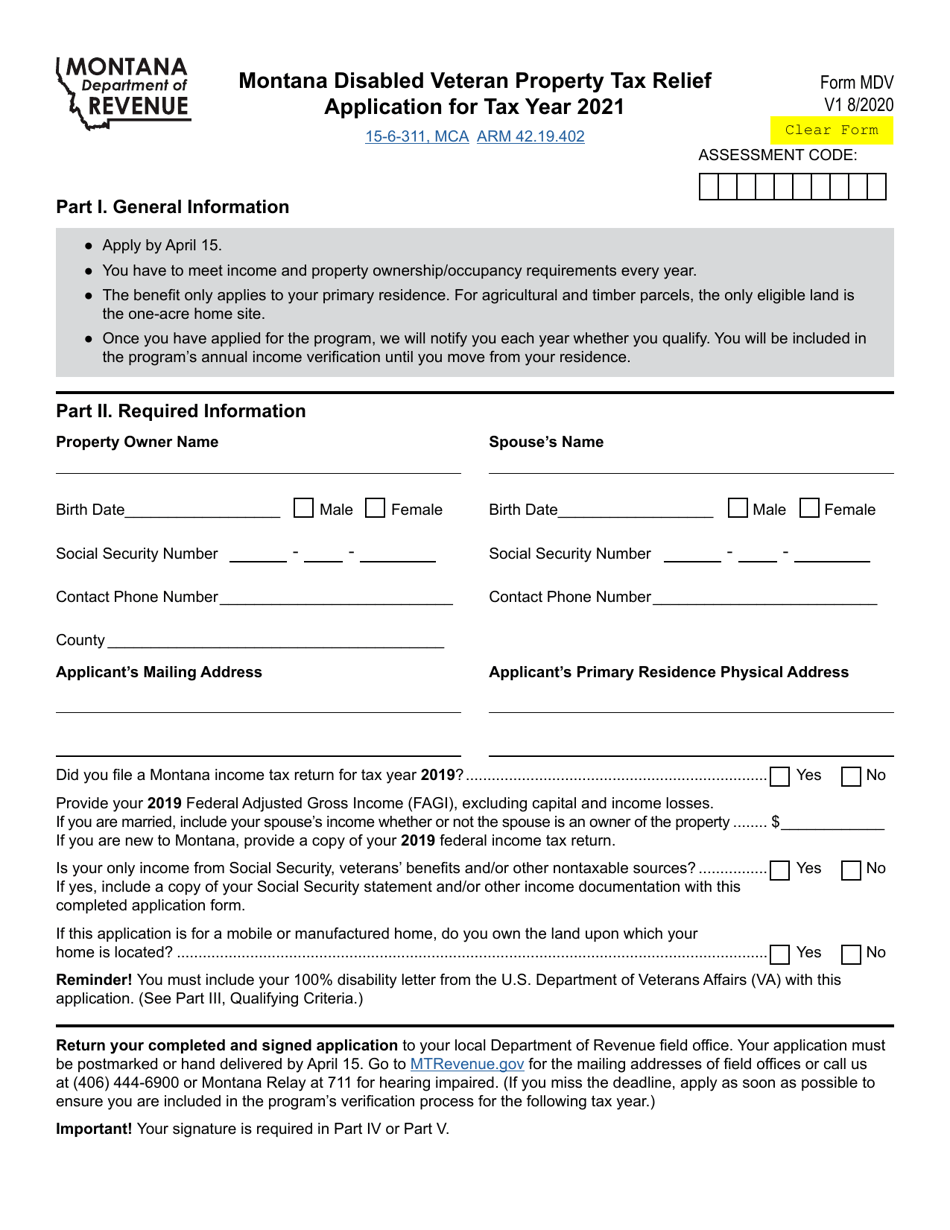

Form MDV Download Fillable PDF or Fill Online Montana Disabled Veteran

Web the montana income tax rate for tax year 2022 is progressive from a low of 1.0% to a high of 6.75%. You can complete the forms with the help of efile.com free tax calculators. Web prepared for the revenue interim committee by jaret coles, legislative staff attorney june 2022 *link to bill text: Web before the official 2023 montana.

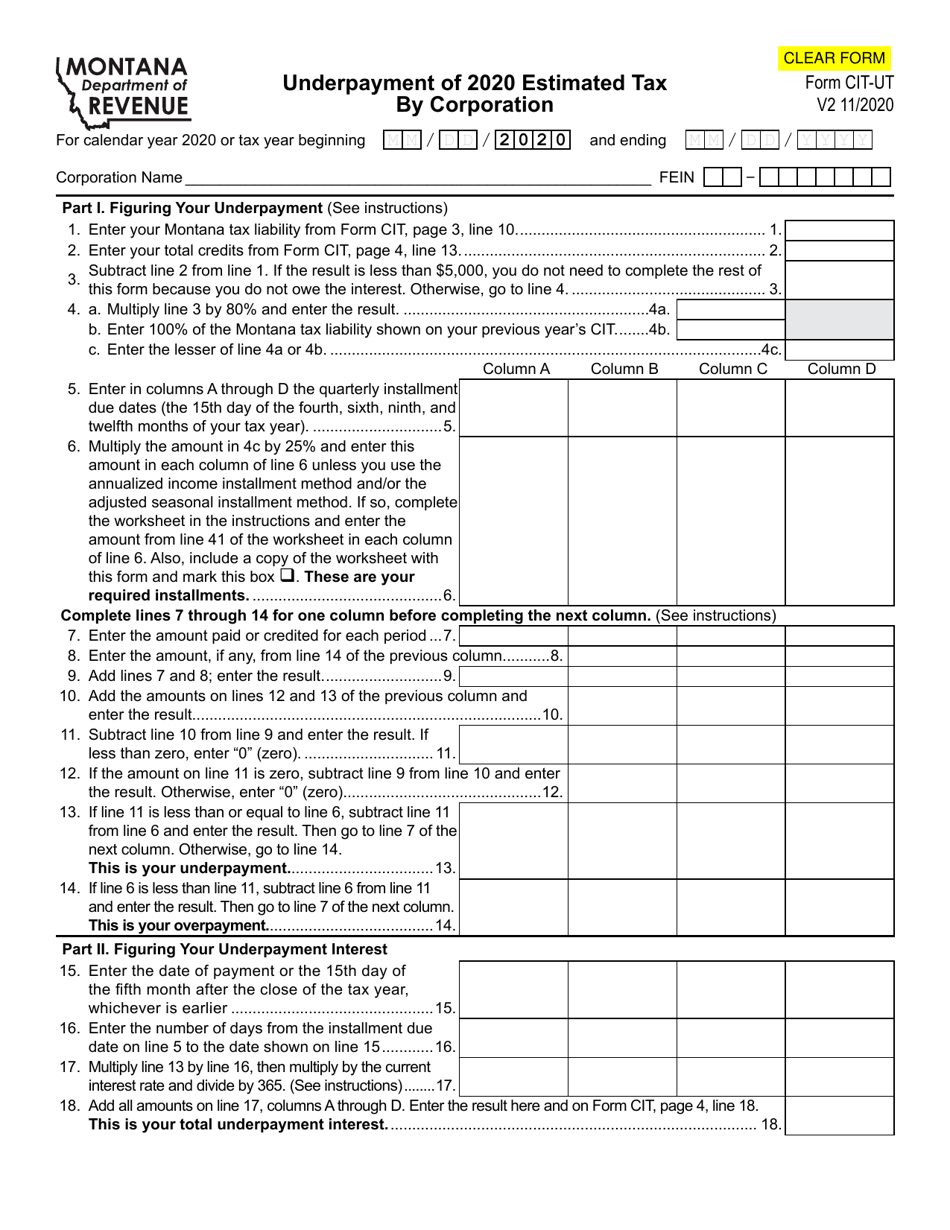

Form CITUT Download Fillable PDF or Fill Online Underpayment of

The montana form 2 instructions and the most commonly filed individual income tax forms are listed below on this page. Web download or print the 2022 montana form it payment voucher (individual income tax payment voucher) for free from the montana department of revenue. Web montana income tax forms 2022 montana printable income tax forms 79 pdfs montana has a.

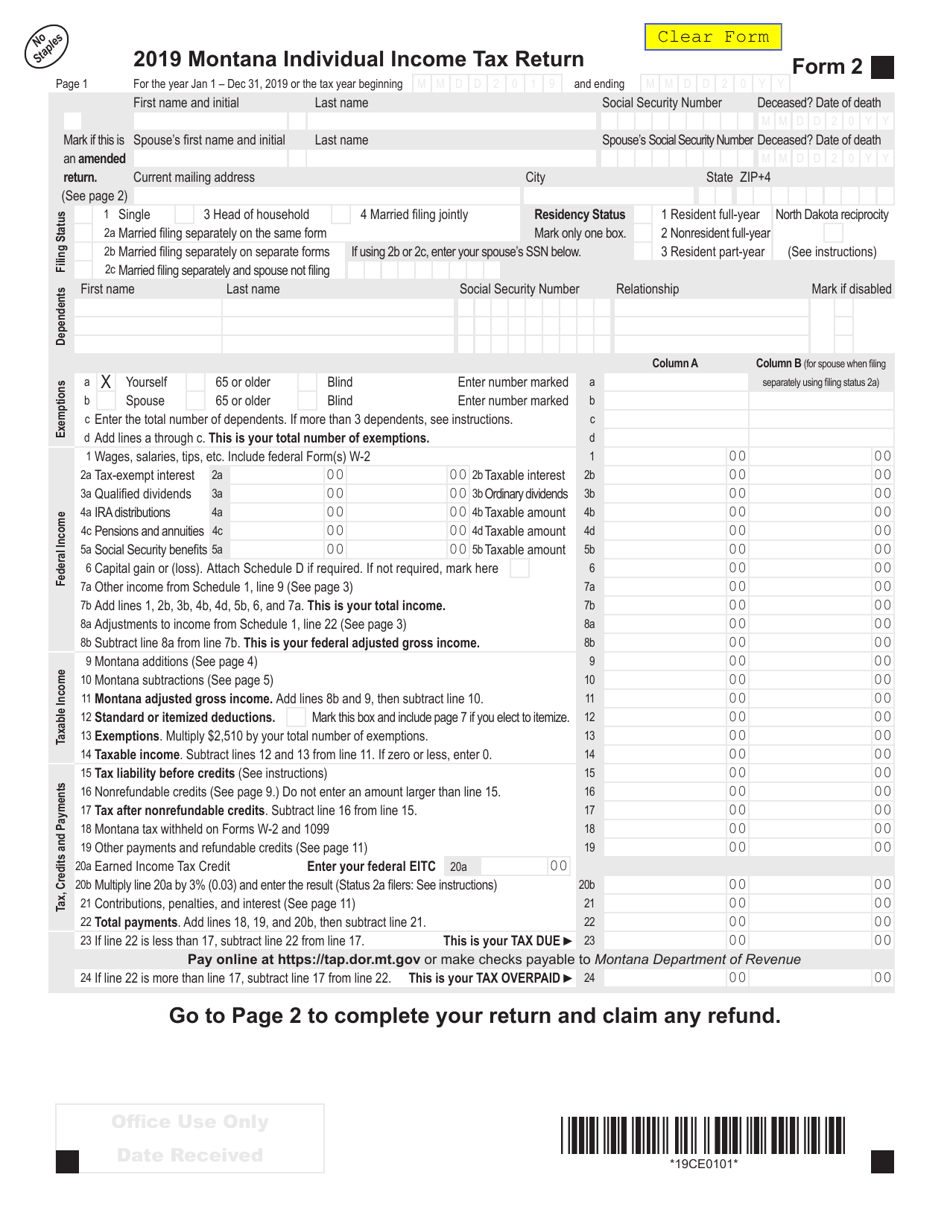

Form 2 Download Fillable PDF or Fill Online Montana Individual

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in montana during calendar year 2023. Web you may use this form to file your montana individual income tax return. Irs coronavirus tax relief the official irs updates on coronavirus impacts, tax relief, and stimulus checks. Retirements income exemptions,.

Montana Individual Income Tax Return (Form 2) 2020.

You can print other montana tax forms here. And you are not enclosing a payment,. You can complete the forms with the help of efile.com free tax calculators. You must be filing as single or married with no dependants.

Web Show Sources > Form 2 Is A Montana Individual Income Tax Form.

Web the montana tax forms are listed by tax year below and all mt back taxes for previous years would have to be mailed in. Ad simply snap a photo of your annual payslip. Web these you have to apply for. Filing information for military personnel and spouses.

The Department Says Taxpayers Can Apply For The 2022 Property Tax Rebates Through Its Online Transaction Portal Or Via A Paper Form During An Application Period That Runs From Aug.

Web montana department of revenue The 2023 state personal income tax brackets are updated from the montana and tax foundation data. We will update this page with a new version of the form for 2024 as soon as it is made available by the montana government. Web we last updated the montana individual estimated income tax worksheet in april 2023, so this is the latest version of form esw, fully updated for tax year 2022.

Be Sure To Verify That The Form You Are Downloading Is For The Correct Year.

Web prepared for the revenue interim committee by jaret coles, legislative staff attorney june 2022 *link to bill text: The current tax year is 2022, with tax returns due. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in montana during calendar year 2023.