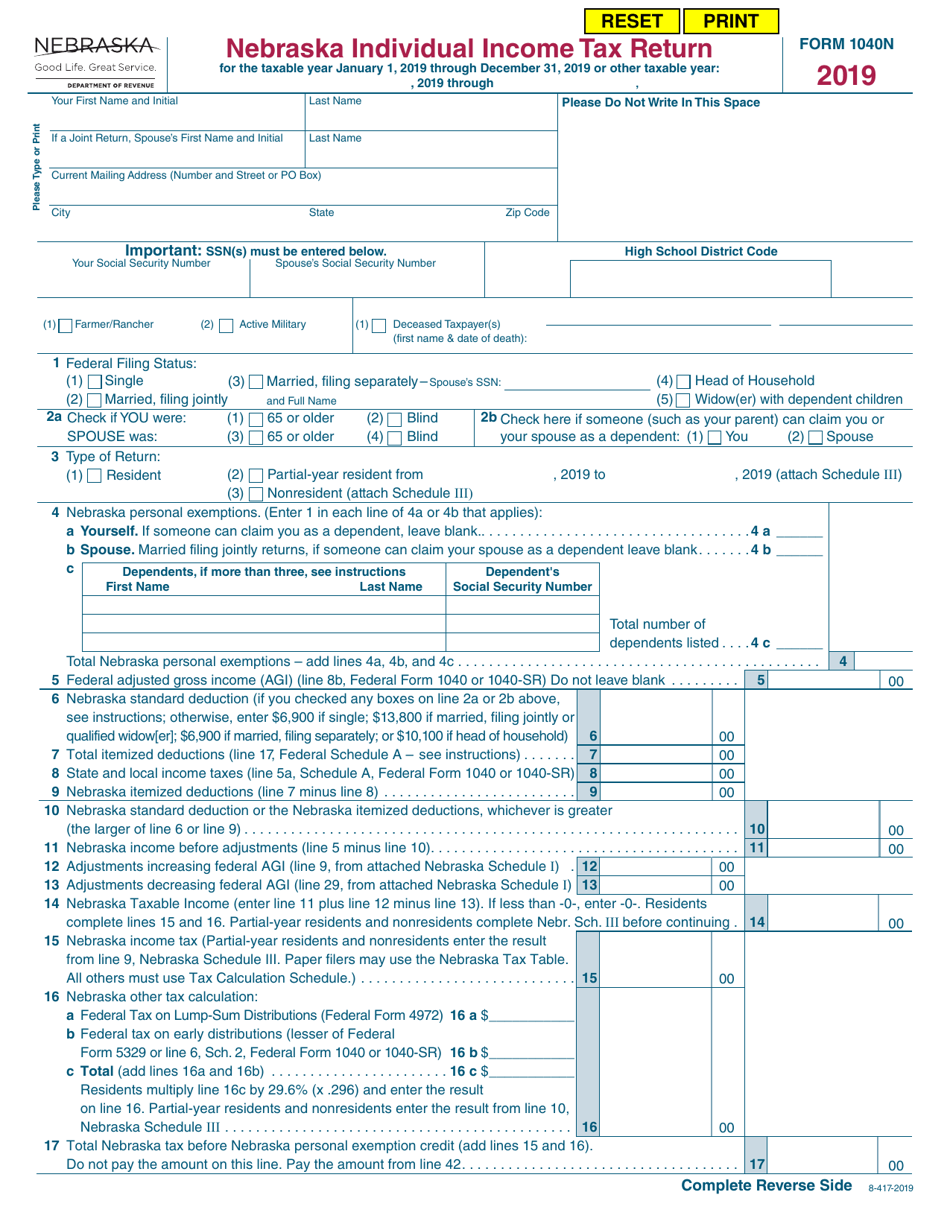

Nebraska Form 1040N 2022

Nebraska Form 1040N 2022 - — computation of nebraska tax. Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse side.) schedule i attach this page to form 1040n. Penalty and interest will apply if this filing results in a balance due. Web it appears you don't have a pdf plugin for this browser. Part b —adjustments decreasing federal agi. This form is for income earned in tax year 2022, with tax returns due in april. You must have an email address. 2022 nebraska individual income tax return (12/2022). Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Complete, edit or print tax forms instantly.

Part b —adjustments decreasing federal agi. Web you are filing your 2022 return after the last timely filed date of april 18, 2023. Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. You must have an email address. Web • attach this page to form 1040n. Complete, edit or print tax forms instantly. — computation of nebraska tax. 2022 please do not write in this. Try it for free now!

Nebraska adjustments to income for nebraska. Nebraska individual income tax return: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web • attach this page to form 1040n. Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. Web you are filing your 2022 return after the last timely filed date of april 18, 2023. Nebraska usually releases forms for the current tax year between january and april. Web you can check the status of your nebraska state tax refund online at the nebraska department of revenue website. Upload, modify or create forms. Complete, edit or print tax forms instantly.

Nebraska Form 1040NSchedules (Schedules I, II, and III) 2021

2022 please do not write in this. Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year: 2022 nebraska.

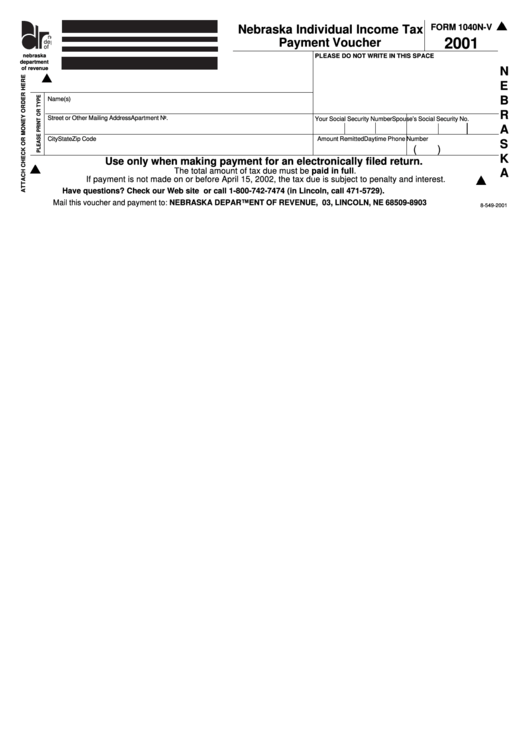

Form 1040nV Nebraska Individual Tax Payment Voucher 2001

Web • attach this page to form 1040n. Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. Nebraska individual income tax return: This form is for income earned in tax year 2022, with tax returns due in april. You must have.

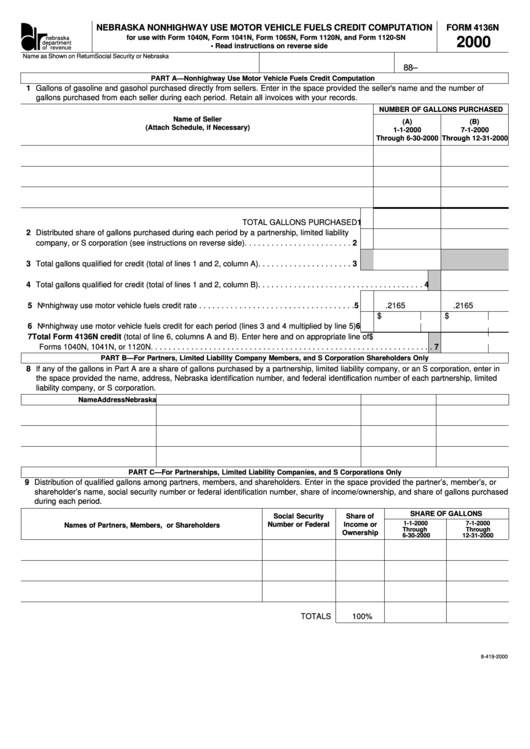

Form 4136n Nebraska Nonhighway Use Motor Vehicle Fuels Credit printable

Web it appears you don't have a pdf plugin for this browser. This form is for income earned in tax year 2022, with tax returns due in april. Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Web view.

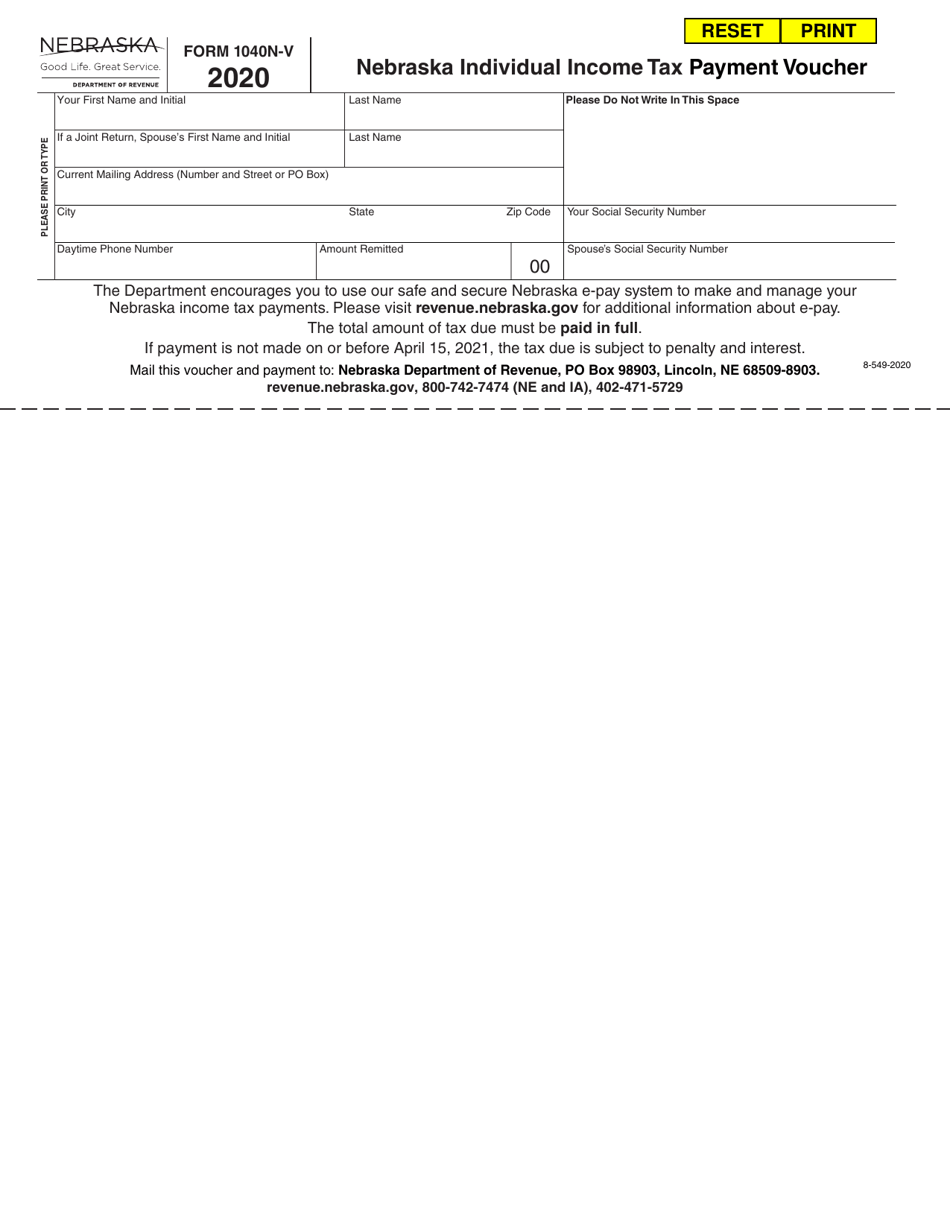

Form 1040NV Download Fillable PDF or Fill Online Nebraska Individual

Web it appears you don't have a pdf plugin for this browser. Web view all 35 nebraska income tax forms. You can download or print. Part b —adjustments decreasing federal agi. Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the.

Tax Return 2022 When Will I Get It

Part b —adjustments decreasing federal agi. Complete, edit or print tax forms instantly. 2022 † schedules i, ii, and iii: You can download or print. Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest.

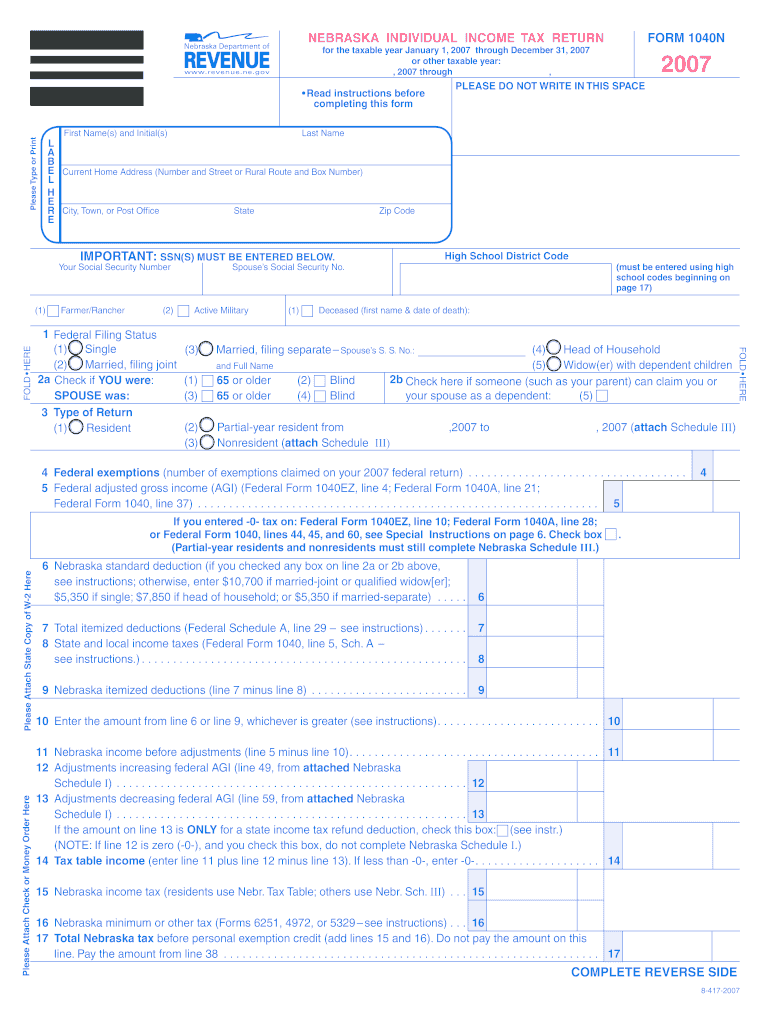

Printable state nebraska 1040n form Fill out & sign online DocHub

2022 nebraska individual income tax return (12/2022). This form is for income earned in tax year 2022, with tax returns due in april. — computation of nebraska tax. Nebraska adjustments to income for nebraska. Web it appears you don't have a pdf plugin for this browser.

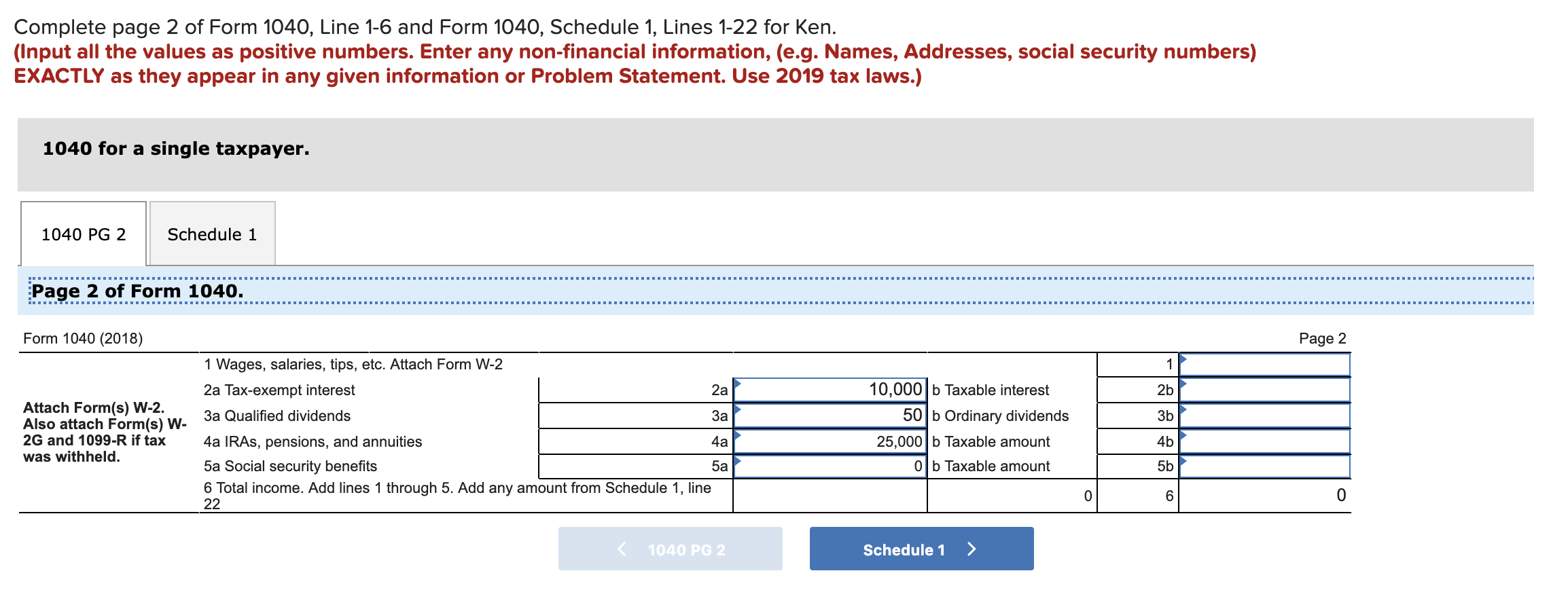

Required information (The following information

Complete, edit or print tax forms instantly. Web • attach this page to form 1040n. Web it appears you don't have a pdf plugin for this browser. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year: Web this form is for income earned in tax year.

Our Python Collections Counter Statements Telegraph

We will update this page with a new version of the form for 2024 as soon as it is made available. Web if you file your 2022 nebraska individual income tax return, form 1040n, on or before march 1, 2023, and pay the total income tax due at that time, you do not need to make. Web nebraska schedule i.

NE 1040N Schedule I 2020 Fill out Tax Template Online US Legal Forms

We will update this page with a new version of the form for 2024 as soon as it is made available. Web you are filing your 2022 return after the last timely filed date of april 18, 2023. 2022 † schedules i, ii, and iii: Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse.

Breanna Tax Form Image

Nebraska usually releases forms for the current tax year between january and april. 2022 † schedules i, ii, and iii: Web if you file your 2022 nebraska individual income tax return, form 1040n, on or before march 1, 2023, and pay the total income tax due at that time, you do not need to make. Web it appears you don't.

Upload, Modify Or Create Forms.

Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. — computation of nebraska tax. Web it appears you don't have a pdf plugin for this browser.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available.

Part b —adjustments decreasing federal agi. Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse side.) schedule i attach this page to form 1040n. Web • attach this page to form 1040n. Penalty and interest will apply if this filing results in a balance due.

Nebraska Individual Income Tax Return:

This form is for income earned in tax year 2022, with tax returns due in april. Web you are filing your 2022 return after the last timely filed date of april 18, 2023. Web you can check the status of your nebraska state tax refund online at the nebraska department of revenue website. Web view all 35 nebraska income tax forms.

Web Nebraska Individual Income Tax Return Form 1040N For The Taxable Year January 1, 2022 Through December 31, 2022 Or Other Taxable Year:

Try it for free now! Nebraska adjustments to income for nebraska. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. You can download or print.