New Mexico State Income Tax Form

New Mexico State Income Tax Form - All others must file by april 18, 2023. It administers more than 35. Web the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and motor vehicle services. Web apply to new retirees. New mexico taxation and revenue department, p.o. Personal and business income taxes, gross receipts. Complete, edit or print tax forms instantly. Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is administered by the new mexico taxation and revenue department.taxformfinder. Web new mexico has a state income tax that ranges between 1.7% and 4.9%. If you file by paper or pay by check your filing due date is on or before april 18, 2023.

New mexico taxpayer access point (tap). Web welcome to the taxation and revenue department’s online services page. If you file by paper or pay by check your filing due date is on or before april 18, 2023. Personal and business income taxes, gross receipts. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. File your taxes and manage your account online. If you are a new mexico resident, you must file if you meet any of the following conditions: All others must file by april 18, 2023. Web view all 81 new mexico income tax forms form sources: Web the taxation and revenue department serves the state of new mexico by providing fair and efficient tax and motor vehicle services.

If you file by paper or pay by check your filing due date is on or before april 18, 2023. Web 55 rows printable income tax forms. Complete, edit or print tax forms instantly. Web welcome to the taxation and revenue department’s online services page. All others must file by april 18, 2023. Web your online tax center. New mexico state withholding election (right facing green column) box number one (1) new mexico income tax withholding status/ number of exemptions. Be sure to verify that the form you are downloading is for the correct. New mexico taxation and revenue department, p.o. Web apply to new retirees.

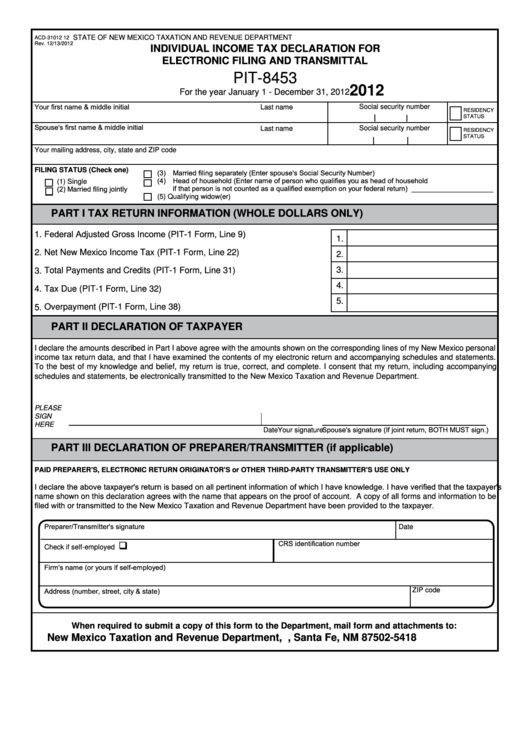

Form Pit8453 Individual Tax Declaration For Electronic Filing

Be sure to verify that the form you are downloading is for the correct. Web welcome to the taxation and revenue department’s online services page. File your taxes and manage your account online. Web apply to new retirees. Complete, edit or print tax forms instantly.

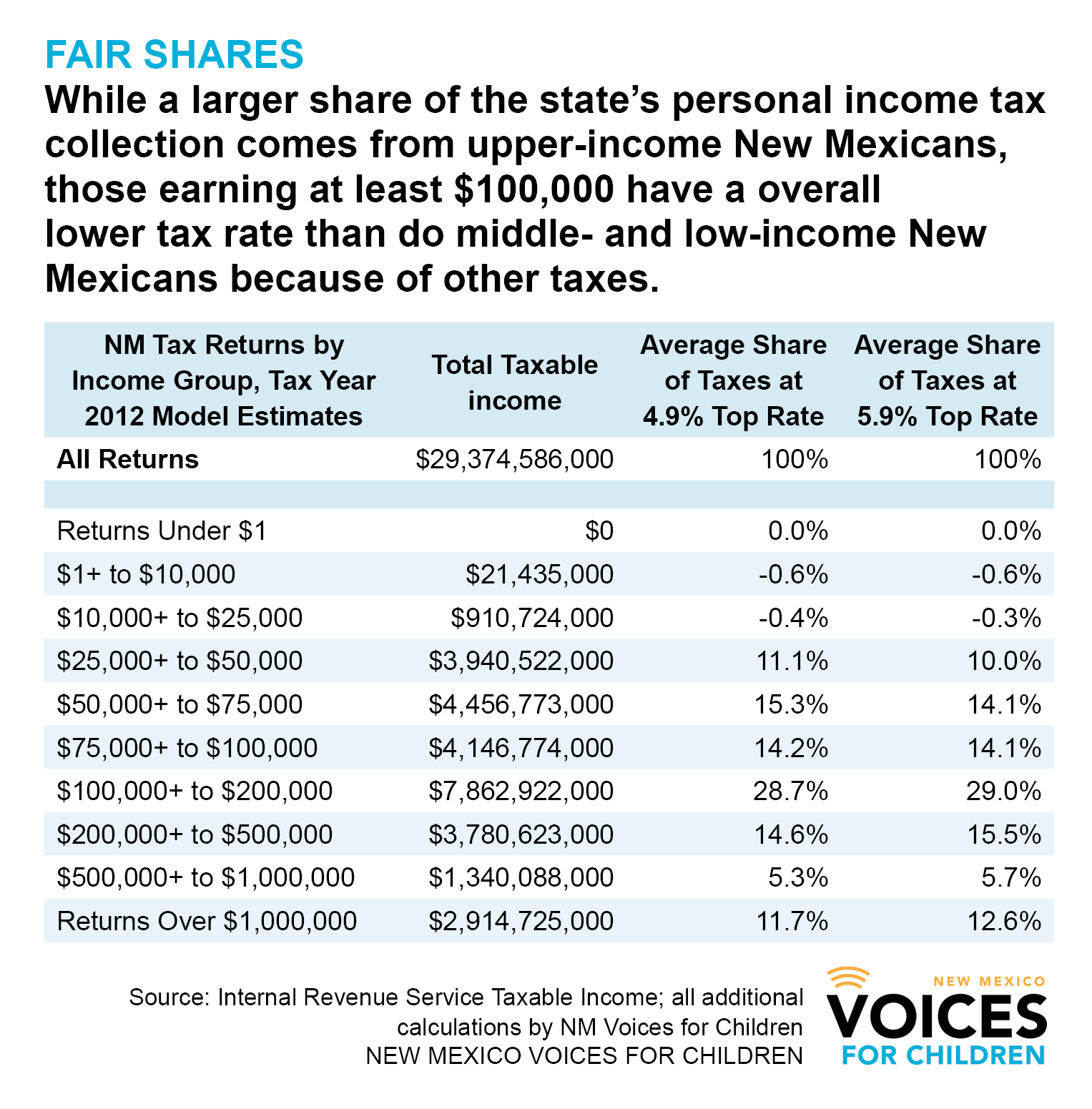

Why the poor pay the highest tax rate in New Mexico—and one step toward

Web when required to submit a copy of this form to the department, mail the form and attachments to: If you file and pay your. New mexico state withholding election (right facing green column) box number one (1) new mexico income tax withholding status/ number of exemptions. Web 55 rows printable income tax forms. New mexico state income tax forms.

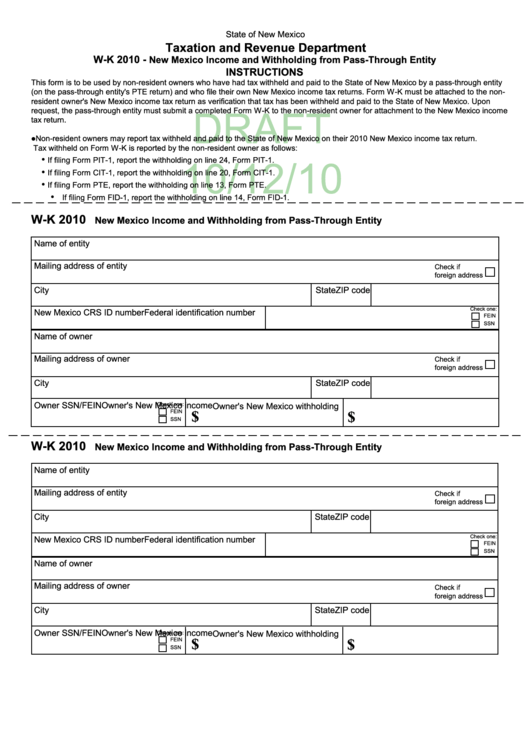

Form Wk New Mexico And Withholding From Passthrough Entity

Complete, edit or print tax forms instantly. Web view all 81 new mexico income tax forms form sources: Web when required to submit a copy of this form to the department, mail the form and attachments to: New mexico state income tax forms for current and previous tax years. Web your authorization submit this erb new mexico state tax withholding.

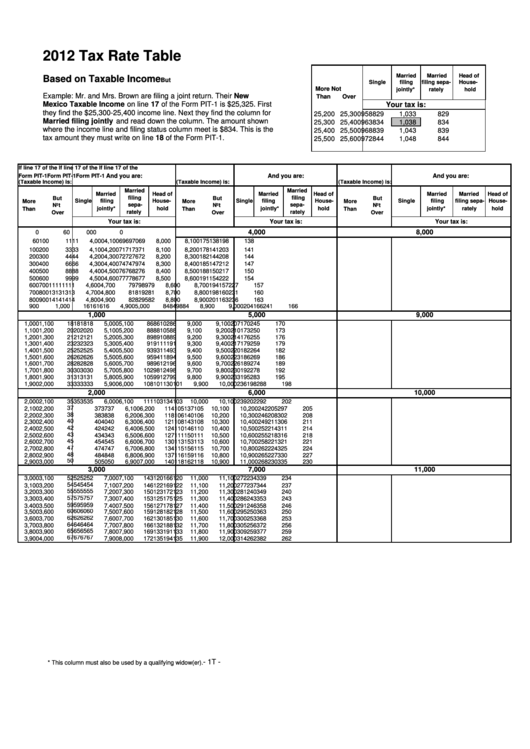

Tax Rate Table Form Based On Taxable State Of New Mexico

If you file by paper or pay by check your filing due date is on or before april 18, 2023. Personal and business income taxes, gross receipts. If you file and pay your. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Current new mexico.

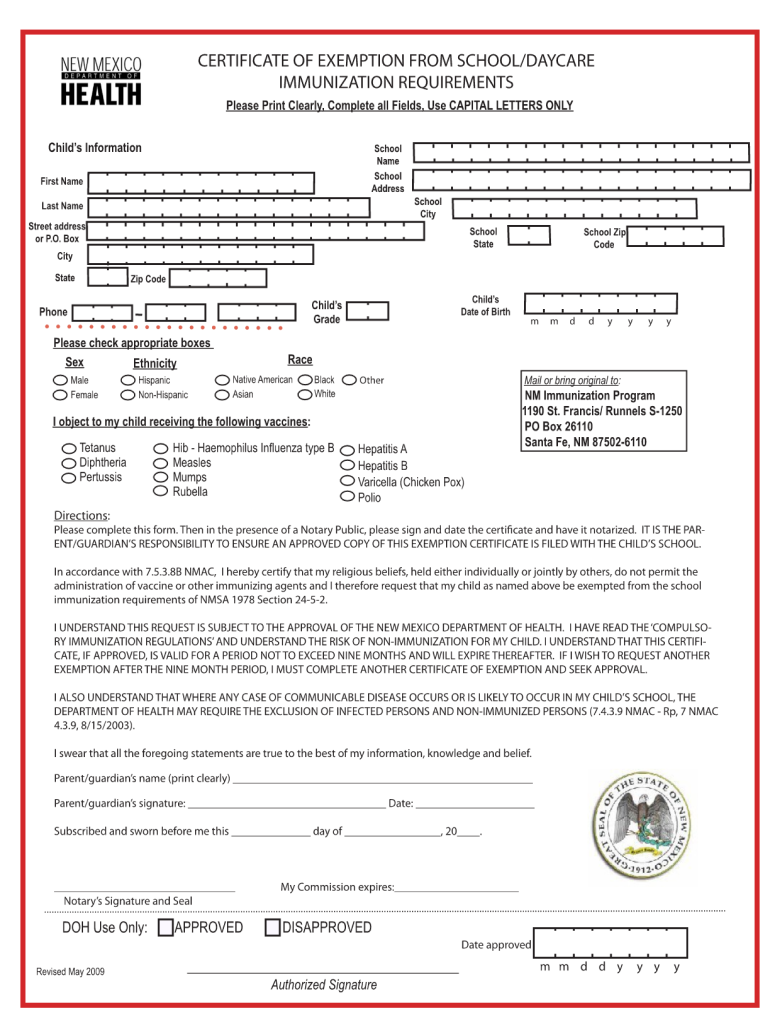

2009 Form NM Certificate of Exemption from School/Daycare Immunization

Web your online tax center. Web new mexico has a state income tax that ranges between 1.7% and 4.9%. If you file and pay your. Web view all 81 new mexico income tax forms form sources: Web when required to submit a copy of this form to the department, mail the form and attachments to:

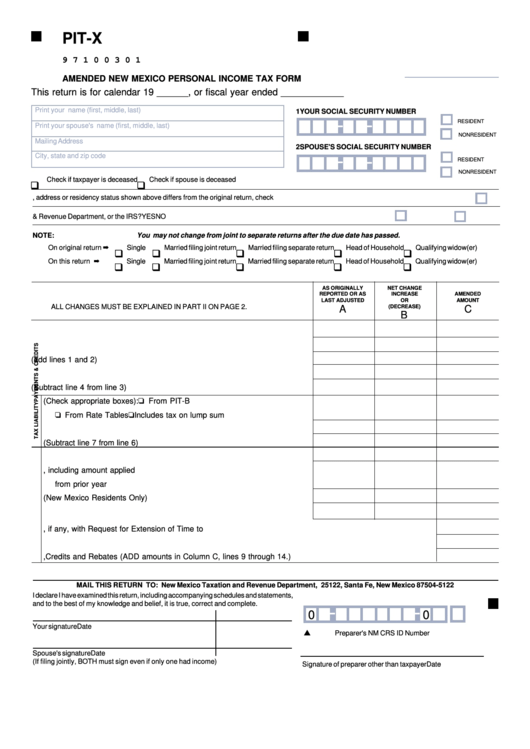

Fillable Form PitX Amended New Mexico Personal Tax Form

If you file and pay your. Complete, edit or print tax forms instantly. If you are a new mexico resident, you must file if you meet any of the following conditions: New mexico state withholding election (right facing green column) box number one (1) new mexico income tax withholding status/ number of exemptions. Web when required to submit a copy.

New Mexico Personal Tax Spreadsheet Feel Free to Download!

New mexico taxpayer access point (tap). New mexico usually releases forms for the current tax year between january and april. We last updated new mexico. It administers more than 35. If you are a new mexico resident, you must file if you meet any of the following conditions:

Tax News GILTI and Crazy Roundup February 5

Web apply to new retirees. Web welcome to the taxation and revenue department’s online services page. New mexico taxpayer access point (tap). Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is administered by the new mexico taxation and revenue department.taxformfinder. Web view all 81 new mexico income tax forms form sources:

Printable New Mexico Tax Forms for Tax Year 2021

If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Web your authorization submit this erb new mexico state tax withholding form specifying what deductions i authorize to be made from my erb retirement benefit for new mexico. Web new mexico has a state income tax.

New Mexico Tax Form Fill Out and Sign Printable PDF Template

New mexico taxpayer access point (tap). Web welcome to the taxation and revenue department’s online services page. New mexico state withholding election (right facing green column) box number one (1) new mexico income tax withholding status/ number of exemptions. New mexico has a state income tax that ranges between. Web new mexico has a state income tax that ranges between.

All Others Must File By April 18, 2023.

It administers more than 35. Current new mexico income taxes can be. Web view all 81 new mexico income tax forms form sources: Web apply to new retirees.

New Mexico Has A State Income Tax That Ranges Between.

Web when required to submit a copy of this form to the department, mail the form and attachments to: Web 55 rows printable income tax forms. Web new mexico has a state income tax that ranges between 1.7% and 4.9%, which is administered by the new mexico taxation and revenue department.taxformfinder. If you file and pay your.

Complete, Edit Or Print Tax Forms Instantly.

Web your authorization submit this erb new mexico state tax withholding form specifying what deductions i authorize to be made from my erb retirement benefit for new mexico. New mexico state income tax forms for current and previous tax years. New mexico taxpayer access point (tap). Web welcome to the taxation and revenue department’s online services page.

If You Are A New Mexico Resident, You Must File If You Meet Any Of The Following Conditions:

Be sure to verify that the form you are downloading is for the correct. Personal and business income taxes, gross receipts. File your taxes and manage your account online. New mexico usually releases forms for the current tax year between january and april.