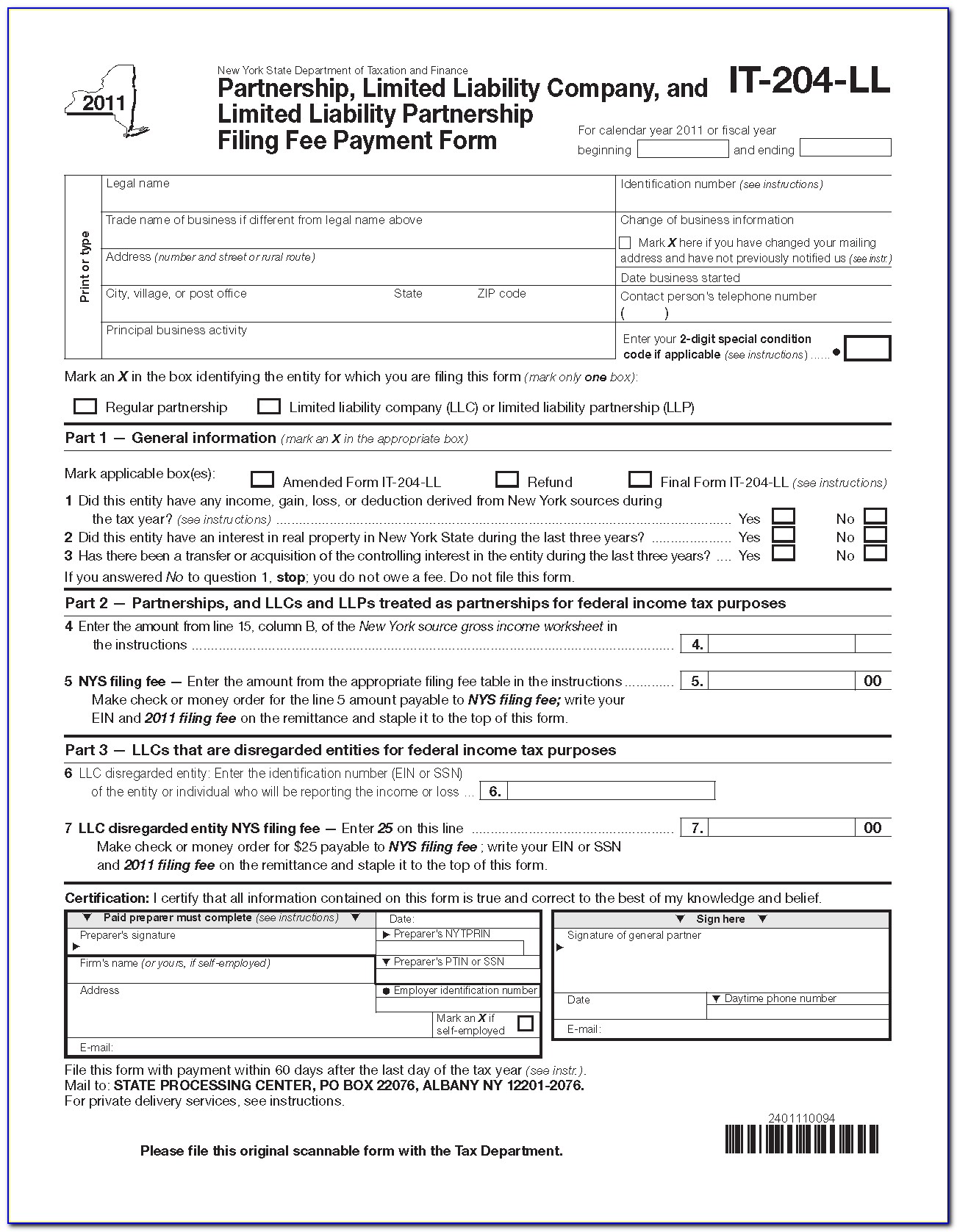

New York Form It-204-Ll

New York Form It-204-Ll - Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. From within your taxact return ( online or desktop), click state. On the left side menu, select income, then click on business income (sch c).; Web 72 rows mandated. We last updated the partnership tax return in january 2023, so this is. Scroll down to the other. Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross.

Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross. Scroll down to the other. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Web 72 rows mandated. On the left side menu, select income, then click on business income (sch c).; We last updated the partnership tax return in january 2023, so this is. From within your taxact return ( online or desktop), click state.

Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross. From within your taxact return ( online or desktop), click state. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. We last updated the partnership tax return in january 2023, so this is. Scroll down to the other. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. On the left side menu, select income, then click on business income (sch c).; Web 72 rows mandated.

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

On the left side menu, select income, then click on business income (sch c).; Scroll down to the other. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. From within your taxact return ( online or desktop), click state. Llc that is a disregarded entity for federal income tax purposes that.

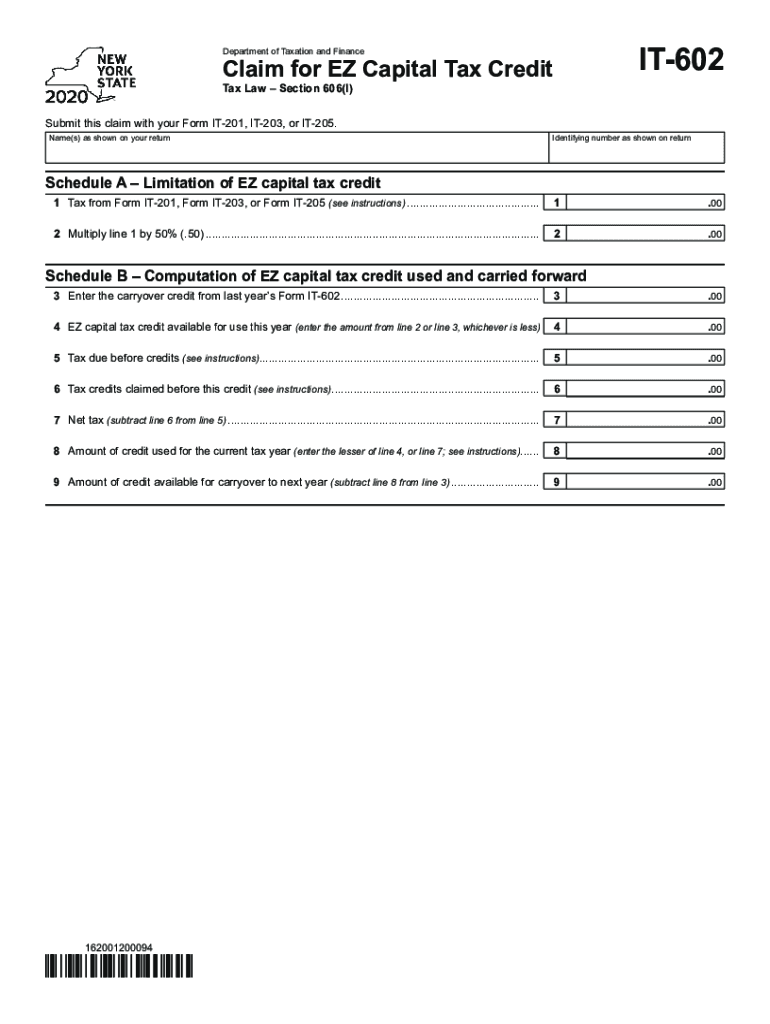

Printable New York Form IT 602 Claim For EZ Capital Tax Credit Fill

On the left side menu, select income, then click on business income (sch c).; From within your taxact return ( online or desktop), click state. Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross. Llc that is.

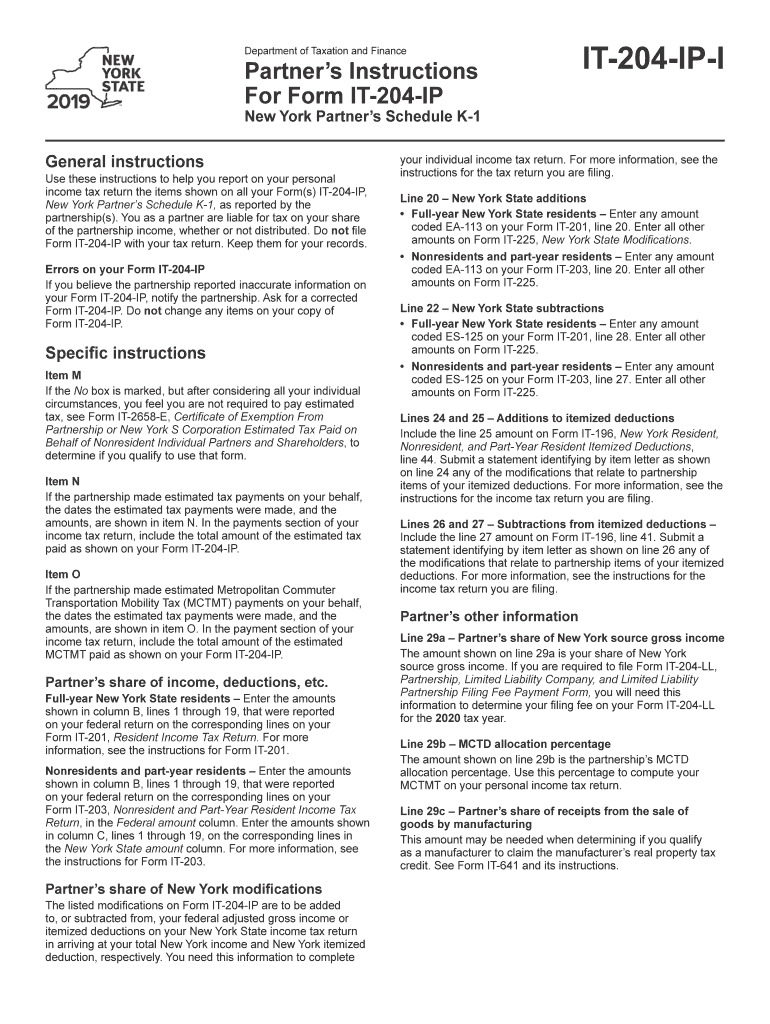

NY IT204LL 20152021 Fill and Sign Printable Template Online US

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Scroll down to the other. From within your taxact return ( online or desktop), click state. We last updated the partnership tax return in january 2023, so this is. Web 72 rows mandated.

NY IT204IPI 2019 Fill out Tax Template Online US Legal Forms

Web 72 rows mandated. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. We last updated the partnership tax return in january 2023, so this is. On the left side menu, select income, then click on business income (sch c).; Scroll down to the other.

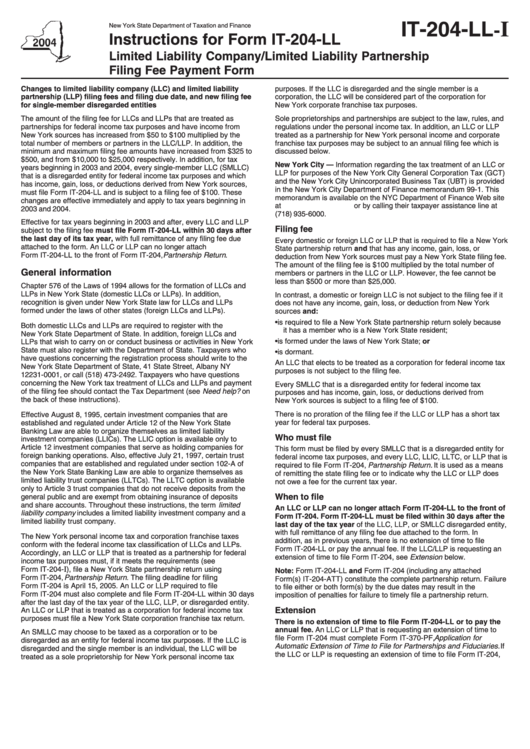

Instructions For Form It204Ll Limited Liability Company/limited

Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross. On the left side menu, select income, then click on business income (sch c).; Scroll down to the other. Payment vouchers are provided to accompany checks mailed to.

2021 Form NY IT204CP Fill Online, Printable, Fillable, Blank pdfFiller

Web 72 rows mandated. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. From within your taxact return ( online or desktop), click state. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. Web a regular partnership that is required to file a.

20162021 Form NY DTF IT203F Fill Online, Printable, Fillable, Blank

On the left side menu, select income, then click on business income (sch c).; Web 72 rows mandated. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Scroll down to the other.

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

Web 72 rows mandated. From within your taxact return ( online or desktop), click state. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had.

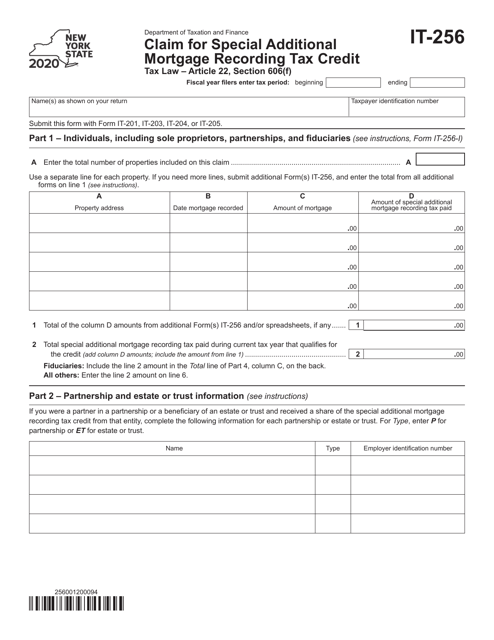

Form IT256 Download Fillable PDF or Fill Online Claim for Special

Web 72 rows mandated. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. Scroll down to the other. Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross. We last.

Ny It 203 B Instructions

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. On the left side menu, select income, then click on business income (sch c).; Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. Web 72 rows mandated. Scroll down to the other.

From Within Your Taxact Return ( Online Or Desktop), Click State.

Scroll down to the other. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or. We last updated the partnership tax return in january 2023, so this is. On the left side menu, select income, then click on business income (sch c).;

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The.

Web 72 rows mandated. Web a regular partnership that is required to file a new york partnership return that has income, gain, loss, or deduction from new york state sources, and had new york source gross.