New York State Tax Form It-201 Instructions

New York State Tax Form It-201 Instructions - Part 1 — other new york state, new. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web this instruction booklet will help you to fill out and file form 201. Web file now with turbotax related new york individual income tax forms: We last updated the individual income tax instructions in january 2023, so this is the latest version of form. Web good news for 2022! Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. This form is for income earned in tax. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. Web this instruction booklet will help you to fill out and file form 203.

Web this instruction booklet will help you to fill out and file form 201. Web this instruction booklet will help you to fill out and file form 203. Part 1 — other new york state, new. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. Web file now with turbotax related new york individual income tax forms: Web good news for 2022! Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. This form is for income earned in tax.

If you are filing a joint personal. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. Web this instruction booklet will help you to fill out and file form 201. We last updated the individual income tax instructions in january 2023, so this is the latest version of form. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web good news for 2022! This form is for income earned in tax. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web this instruction booklet will help you to fill out and file form 203.

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

If you are filing a joint personal. Part 1 — other new york state, new. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Web file now with turbotax related new york individual income tax forms: Web good news for 2022!

Do these 2 things to get your New York state tax refund 2 weeks sooner

Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web file now with turbotax related new york individual income tax forms: Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. To report new york state tax preference.

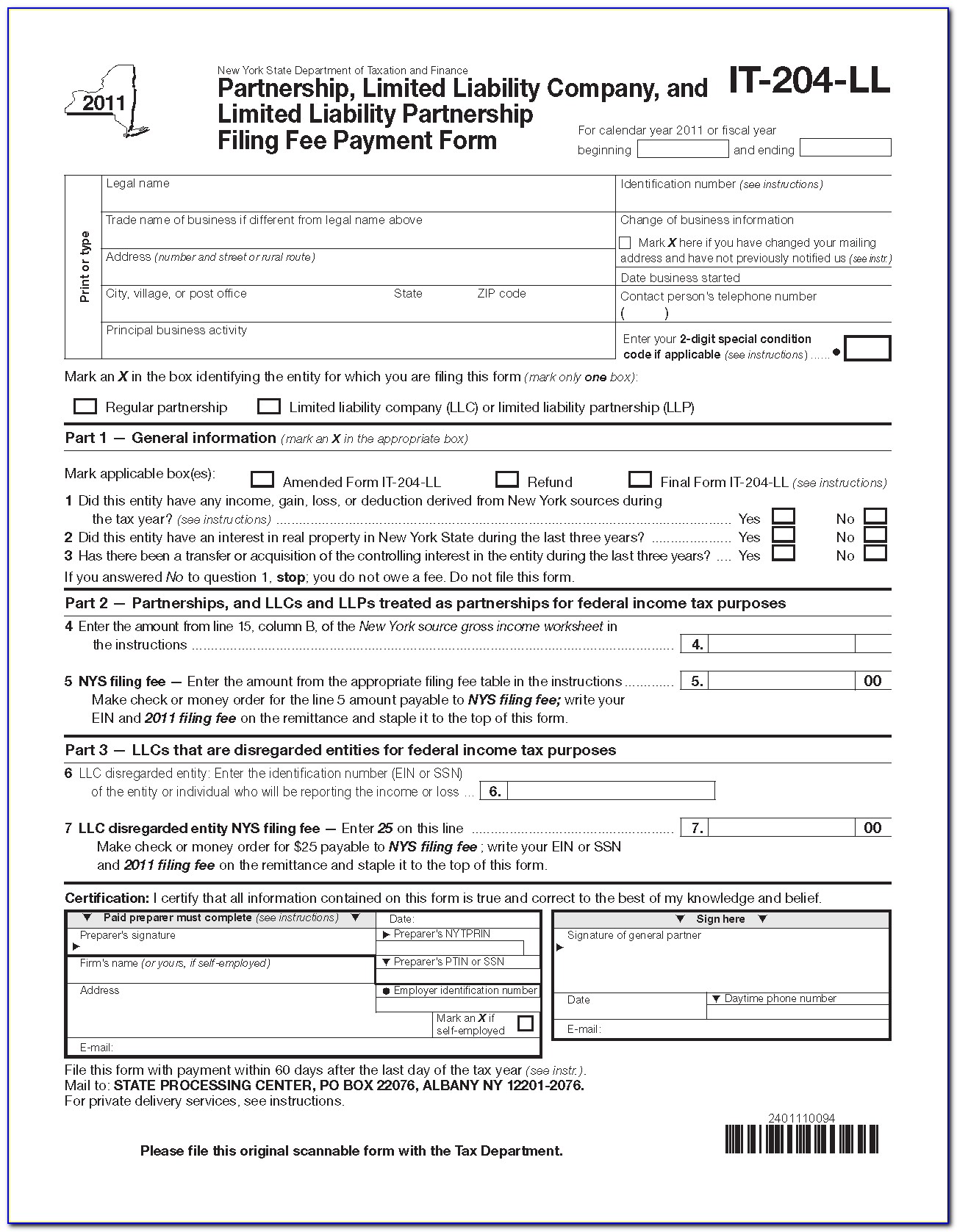

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

Web this instruction booklet will help you to fill out and file form 203. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Part 1 — other new york state, new. Web new york state return, and which of the two new york resident returns you should file, use the flow chart.

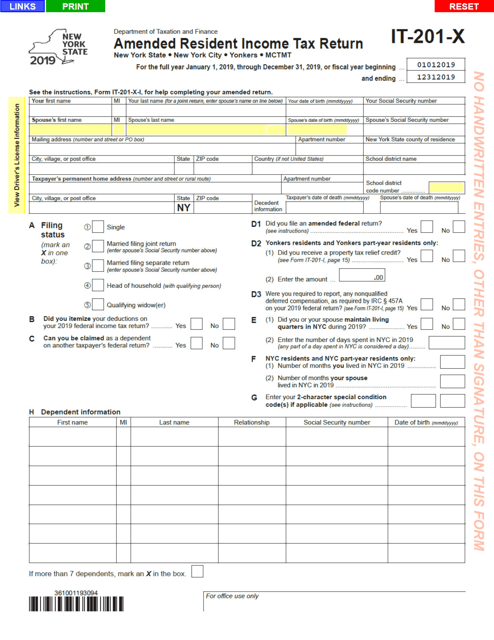

Form IT201X Download Fillable PDF or Fill Online Amended Resident

Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web this instruction booklet will help you to fill out and file form 203. Web file now with turbotax related new york individual income.

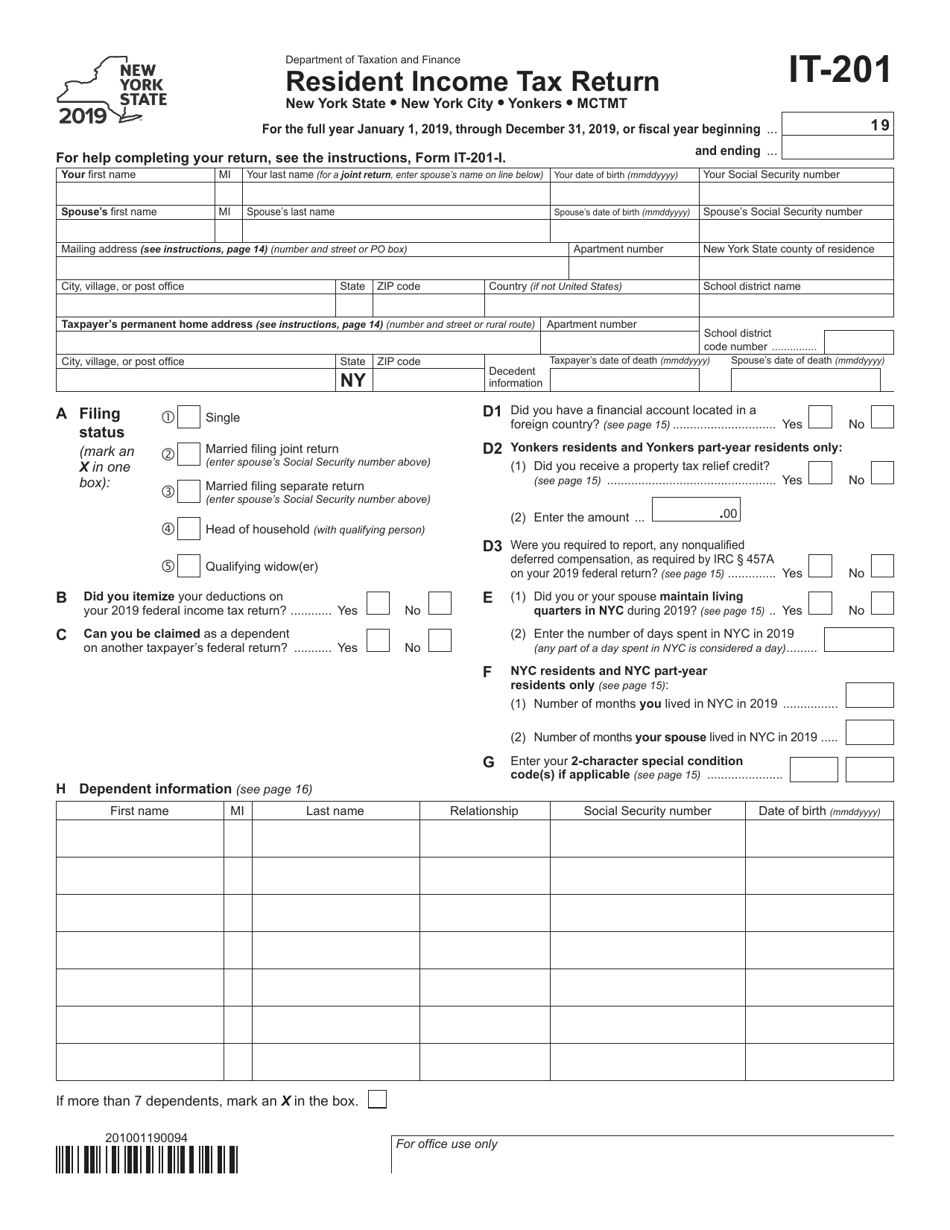

What is the IT201 tax form?

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. This form is for income earned in tax. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Part 1 — other new york state, new. Web.

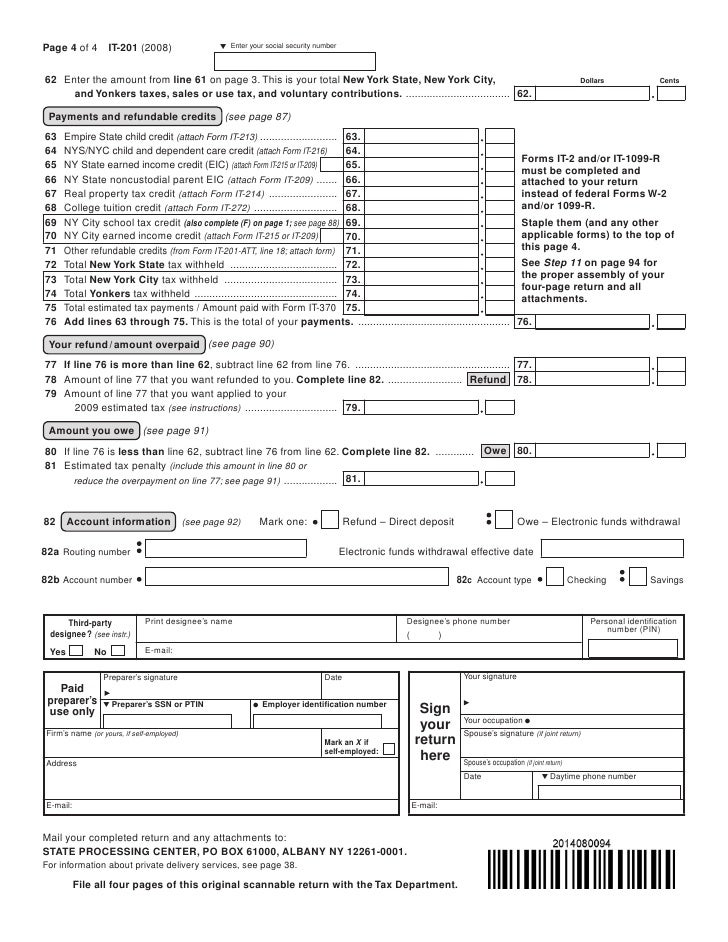

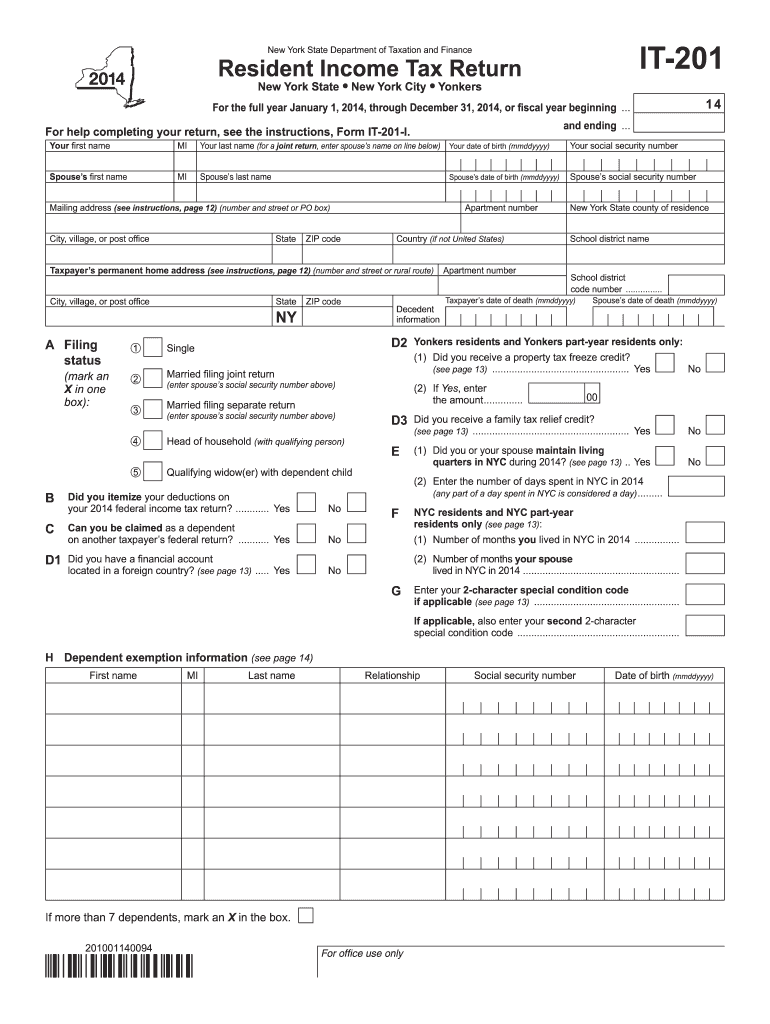

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

If you are filing a joint personal. Web this instruction booklet will help you to fill out and file form 203. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. This form is for income earned in tax. Payment vouchers are provided to accompany checks mailed.

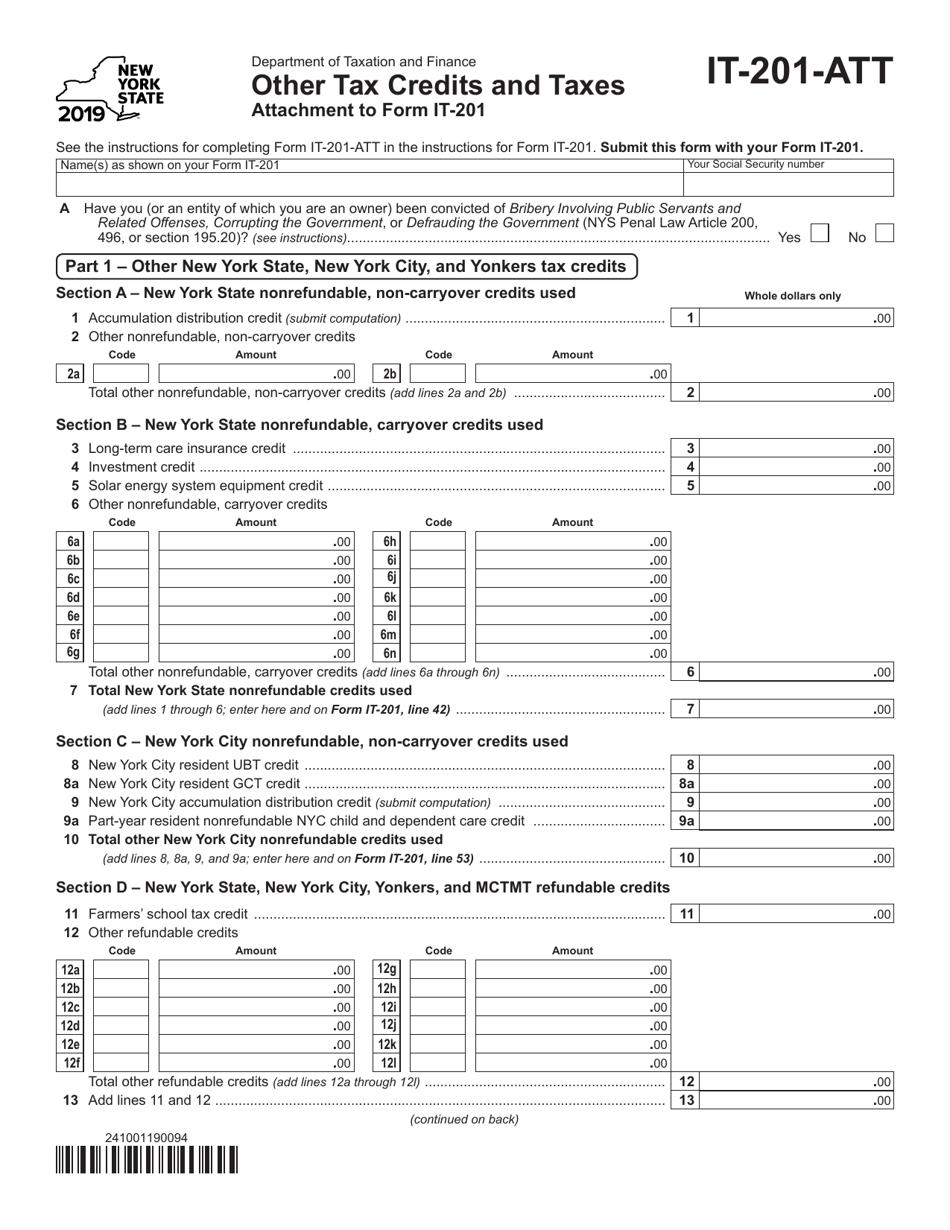

Form IT201ATT Download Fillable PDF or Fill Online Other Tax Credits

Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. This form is for income earned in tax. Part 1 — other new york state, new. Web file now with turbotax related new york.

20172022 Form NY DTF IT201D Fill Online, Printable, Fillable, Blank

This form is for income earned in tax. We last updated the individual income tax instructions in january 2023, so this is the latest version of form. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. If you are filing a joint personal. Web file now with turbotax related new york individual.

dadquantum Blog

Web this instruction booklet will help you to fill out and file form 203. Part 1 — other new york state, new. If you are filing a joint personal. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Taxformfinder has an additional 271 new york.

Free Printable State Tax Forms Printable Templates

Web file now with turbotax related new york individual income tax forms: Web good news for 2022! Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns.

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The Revenue.

Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. Web file now with turbotax related new york individual income tax forms: Web this instruction booklet will help you to fill out and file form 201. Web this instruction booklet will help you to fill out and file form 203.

We Last Updated The Individual Income Tax Instructions In January 2023, So This Is The Latest Version Of Form.

Web good news for 2022! Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Part 1 — other new york state, new.

To Report New York State Tax Preference Items Totaling More Than Your Specific Deduction Of $5,000 ($2,500 If You Are Married And Filing.

If you are filing a joint personal. This form is for income earned in tax.