Nj-1040X Form

Nj-1040X Form - State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. We do not have a separate amended form for nonresidents. New jersey resident returns state of new jersey division of taxation revenue processing center'. (you may file both federal and state income tax returns.) state of new jersey You cannot use form nj‐1040x to file an original resident return. State of new jersey division of taxation revenue processing center po box 664 trenton nj. Processing of electronic (online) returns typically takes a minimum of 4 weeks. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Include an explanation of the changes in the space provided on page three of the return. Resident income tax return instructions.

We do not have a separate amended form for nonresidents. State of new jersey division of taxation revenue processing center po box 664 trenton nj. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. Resident income tax return instructions. Amended resident income tax return. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. New jersey resident returns state of new jersey division of taxation revenue processing center'. Processing of electronic (online) returns typically takes a minimum of 4 weeks. Include an explanation of the changes in the space provided on page three of the return. How can i check the status of my refund?

(you may file both federal and state income tax returns.) state of new jersey You cannot use form nj‐1040x to file an original resident return. We do not have a separate amended form for nonresidents. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Include an explanation of the changes in the space provided on page three of the return. New jersey resident returns state of new jersey division of taxation revenue processing center'. Resident income tax return instructions. How can i check the status of my refund? Amended resident income tax return. State of new jersey division of taxation revenue processing center po box 664 trenton nj.

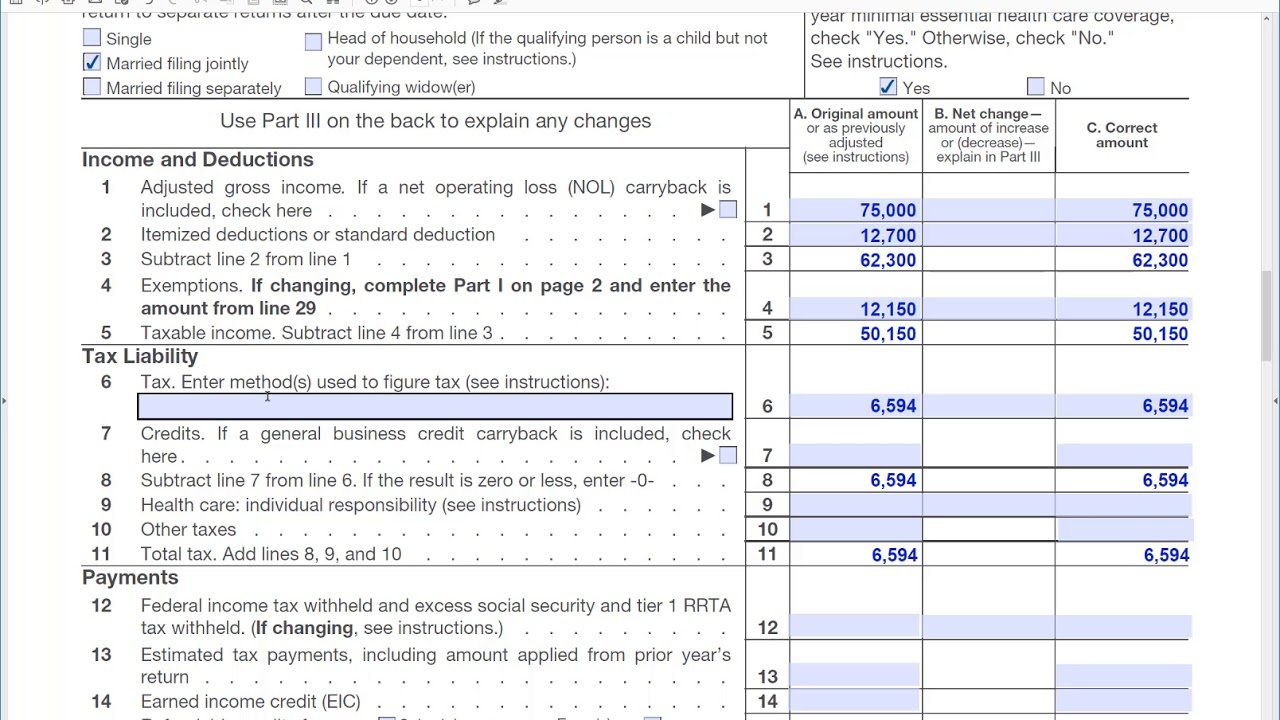

1040x Free Fillable Forms 2018 Form Resume Examples nO9br7B94D

We do not have a separate amended form for nonresidents. Include an explanation of the changes in the space provided on page three of the return. Amended resident income tax return. New jersey resident returns state of new jersey division of taxation revenue processing center'. How can i check the status of my refund?

1040 X Form 1040 Form Printable

How can i check the status of my refund? State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. (you may file both federal and state income tax returns.) state of new jersey Processing of electronic (online) returns typically takes a minimum of 4 weeks. New jersey resident returns state of new jersey division.

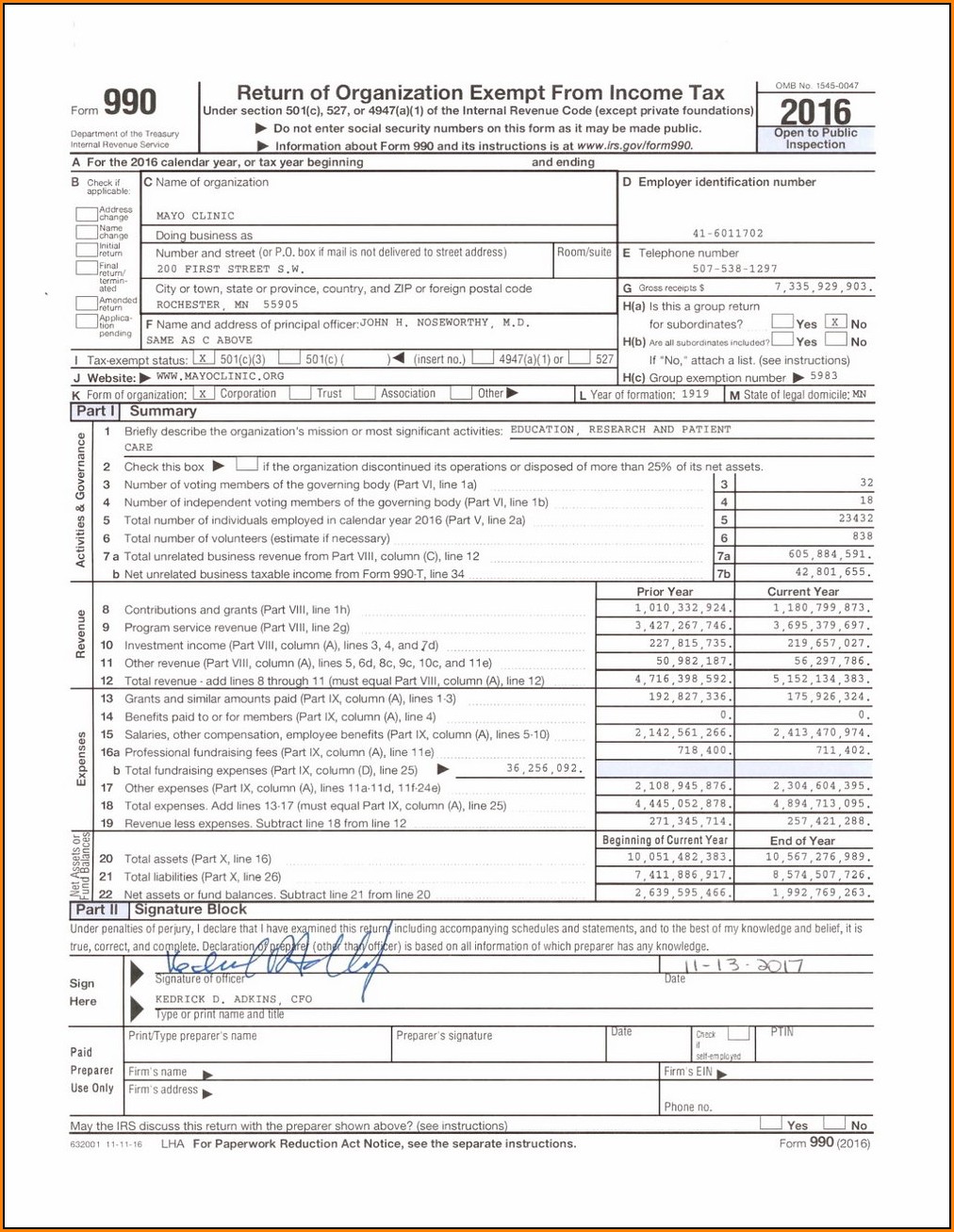

2019 Form NJ DoT NJ1040x Fill Online, Printable, Fillable, Blank

Processing of electronic (online) returns typically takes a minimum of 4 weeks. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Resident income tax return instructions. (you may file both federal and state.

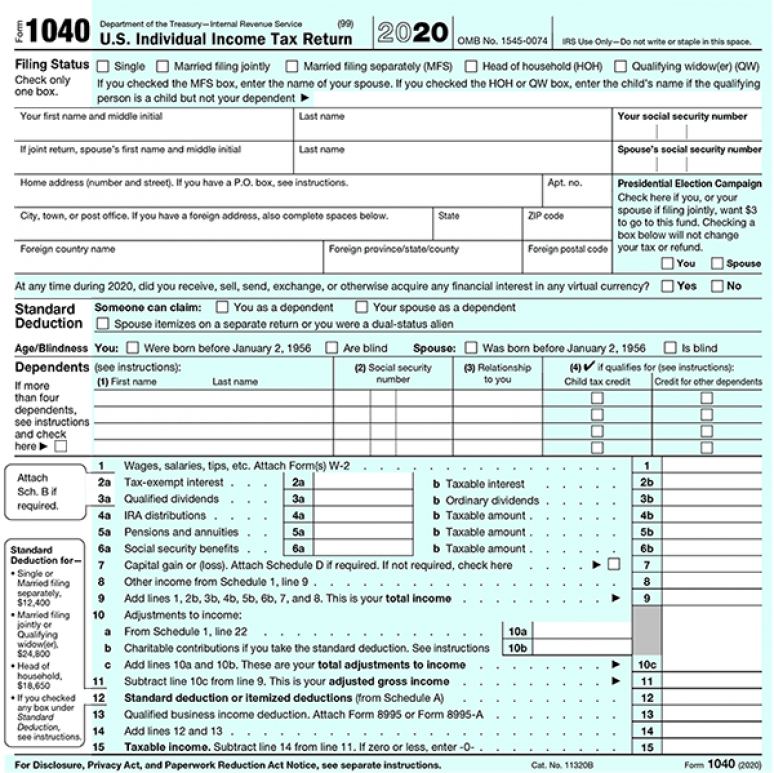

2020 Tax Form 1040 U.S. Government Bookstore

You cannot use form nj‐1040x to file an original resident return. We do not have a separate amended form for nonresidents. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. How can i check the status of my refund? Use tax software you purchase, go to an online tax preparation website, or have.

5 amended tax return filing tips Don't Mess With Taxes

Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Processing of electronic (online) returns typically takes a minimum of 4 weeks. Include an explanation of the changes in the space provided on page three of the return. (you may file both federal and state income tax returns.) state of.

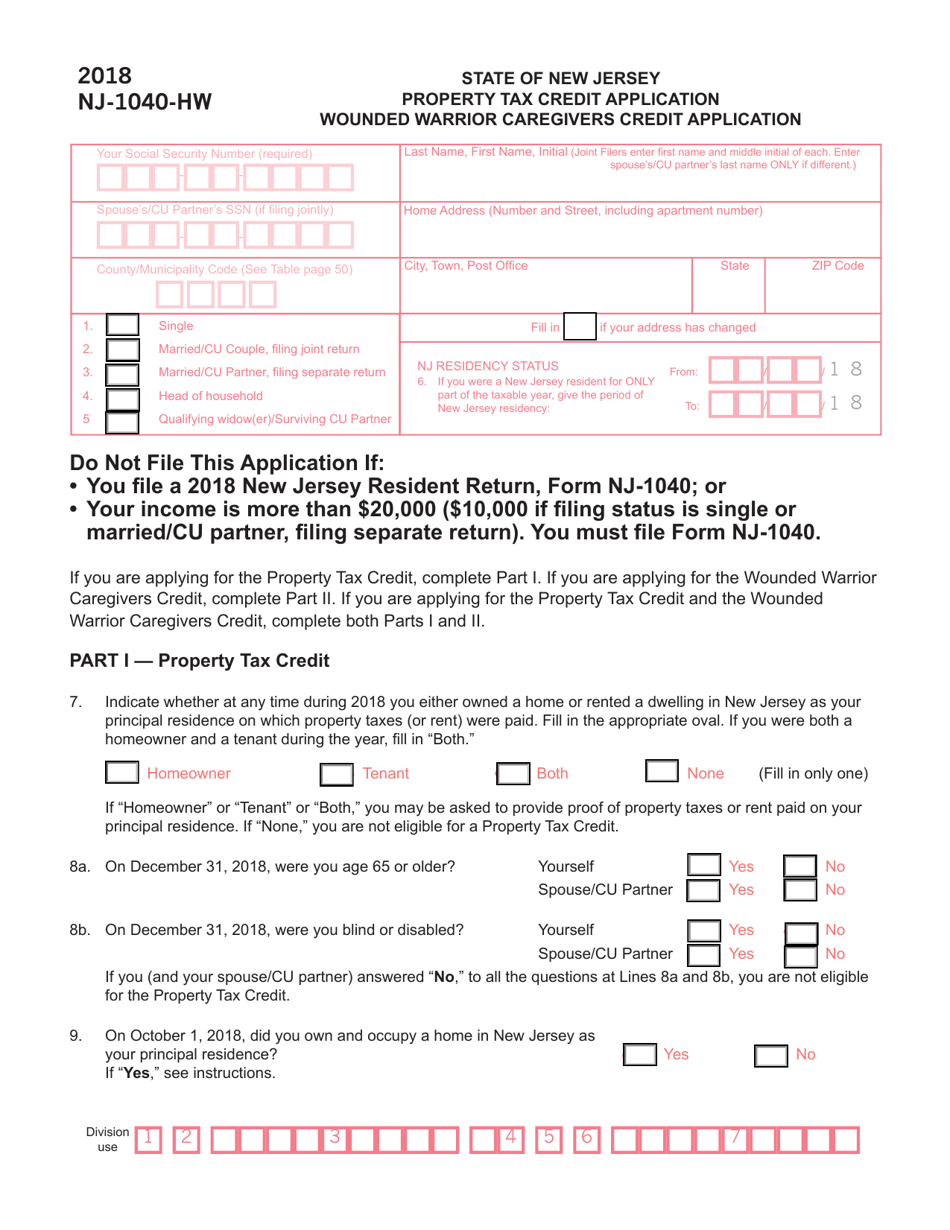

Form NJ1040HW Download Fillable PDF or Fill Online Property Tax

You cannot use form nj‐1040x to file an original resident return. How can i check the status of my refund? Resident income tax return instructions. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. New jersey resident returns state of new jersey division of taxation revenue processing center'.

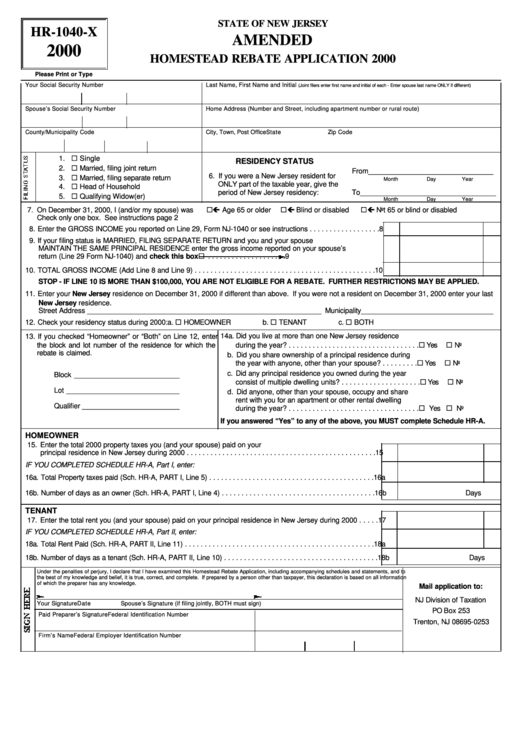

Fillable Form Hr1040X Amended Homestead Rebate Application 2000

New jersey resident returns state of new jersey division of taxation revenue processing center'. State of new jersey division of taxation revenue processing center po box 664 trenton nj. You cannot use form nj‐1040x to file an original resident return. (you may file both federal and state income tax returns.) state of new jersey Include an explanation of the changes.

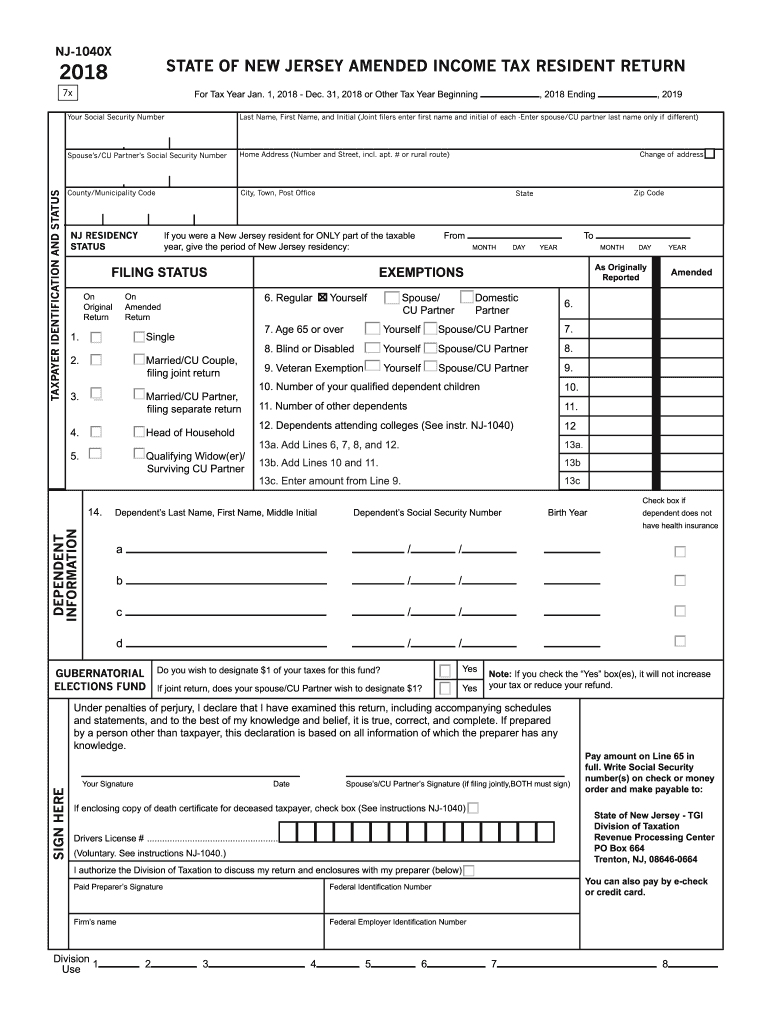

NJ DoT NJ1040x 2018 Fill out Tax Template Online US Legal Forms

Resident income tax return instructions. Include an explanation of the changes in the space provided on page three of the return. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. We do not have a separate amended form for nonresidents. State of new jersey division of taxation revenue processing.

Instructions for Form NJ1040X Amended Resident Return Download

Include an explanation of the changes in the space provided on page three of the return. You cannot use form nj‐1040x to file an original resident return. State of new jersey division of taxation revenue processing center po box 664 trenton nj. Processing of electronic (online) returns typically takes a minimum of 4 weeks. Use tax software you purchase, go.

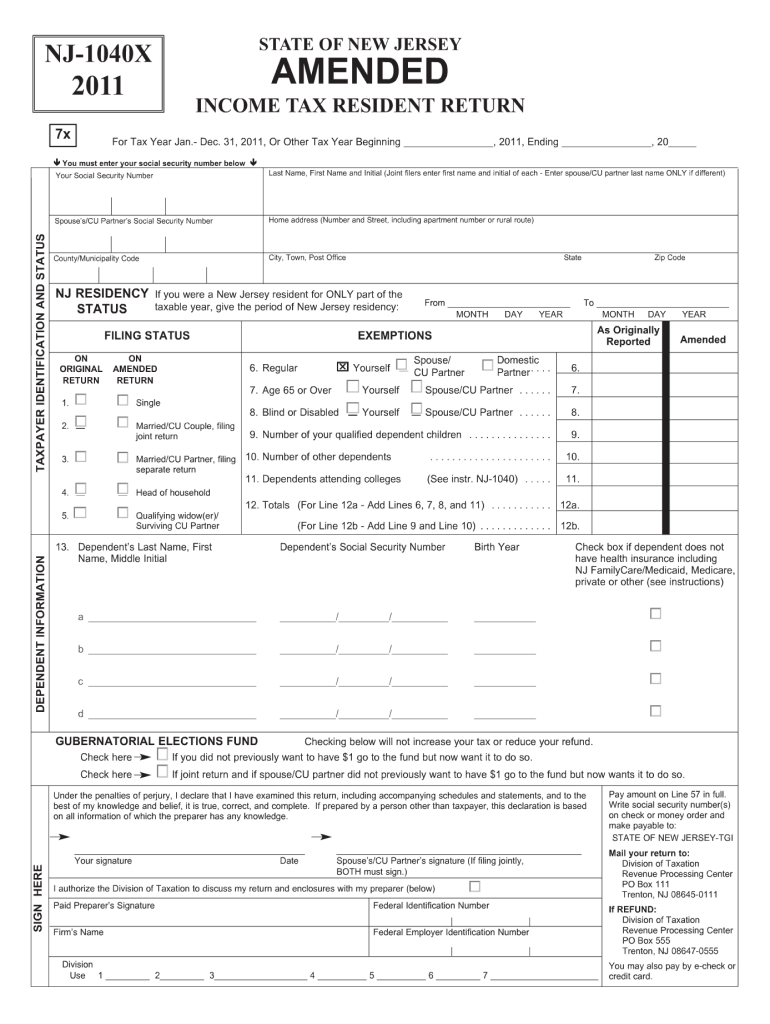

2011 nj 1040x form Fill out & sign online DocHub

We do not have a separate amended form for nonresidents. Resident income tax return instructions. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. State of new jersey division of taxation revenue processing center po box 664 trenton nj. New jersey resident returns state of new jersey division of.

Use Tax Software You Purchase, Go To An Online Tax Preparation Website, Or Have A Tax Preparer File Your Return.

State of new jersey division of taxation revenue processing center po box 664 trenton nj. State of new jersey division of taxation revenue processing center po box 664 trenton nj 08646. We do not have a separate amended form for nonresidents. Include an explanation of the changes in the space provided on page three of the return.

You Cannot Use Form Nj‐1040X To File An Original Resident Return.

Resident income tax return instructions. Processing of electronic (online) returns typically takes a minimum of 4 weeks. New jersey resident returns state of new jersey division of taxation revenue processing center'. Amended resident income tax return.

(You May File Both Federal And State Income Tax Returns.) State Of New Jersey

How can i check the status of my refund?