Nj Form 1040 Instructions

Nj Form 1040 Instructions - Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. Web estimated income tax payment voucher for 2023. Underpayment of estimated tax by individuals, estates, or trusts. See page 14 for more information about the mailing label. Individual income tax return tax return: You can download or print. Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). Web (cu) recognized under new jersey law. Use only a 2016 return for the 2016 tax year. Estimated income tax payment voucher for 4th quarter 2022.

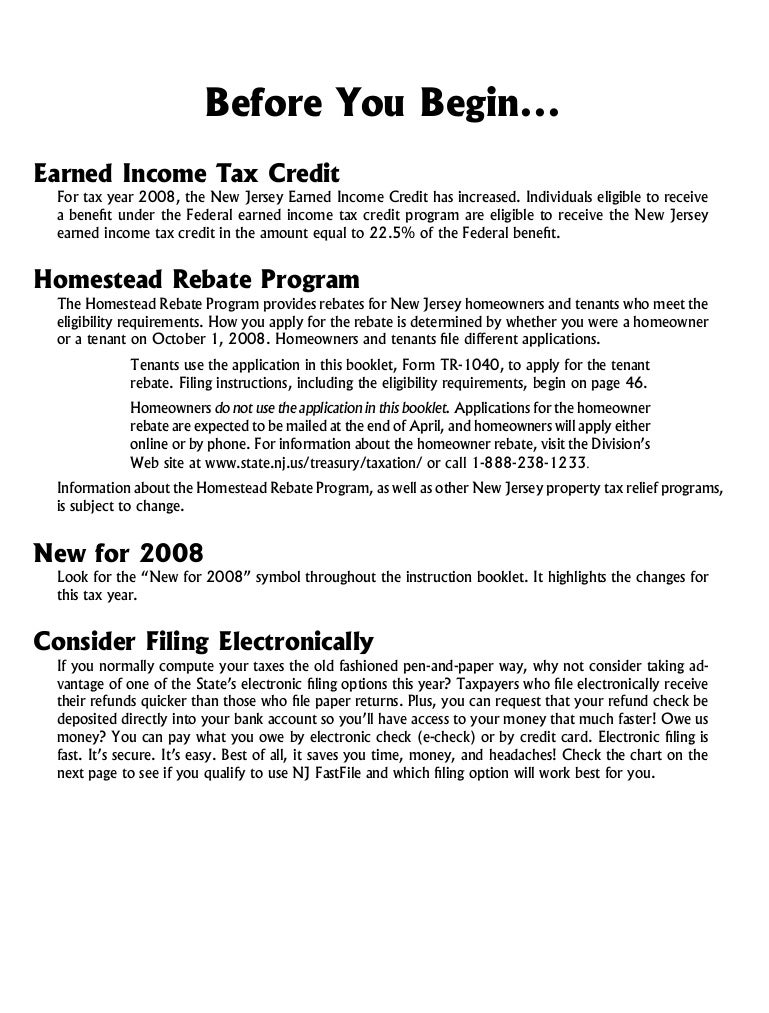

Web • you are eligible for a new jersey earned income tax credit or other credit and are due a refund. Web form code form name; This amount is the difference between the total amount taxed by. • are a homeowner or tenant age. Web (cu) recognized under new jersey law. Web you must file a new jersey income tax return if œ and your gross income your residency status is: Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. ♦ were 65 or older or blind or disabled on the last day of the tax year; Web new jersey tax rate schedules 2021 filing status: Use only a 2016 return for the 2016 tax year.

If you are not required to file a return and you: Use only a 2016 return for the 2016 tax year. Web form code form name; Use only blue or black ink when completing forms. Web you must file a new jersey income tax return if œ and your gross income your residency status is: Read the instruction booklet before completing the return. Web new jersey tax rate schedules 2021 filing status: Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. This form must be filed by all out of state or part time resident taxpayers who earned over $10,000. This amount is the difference between the total amount taxed by.

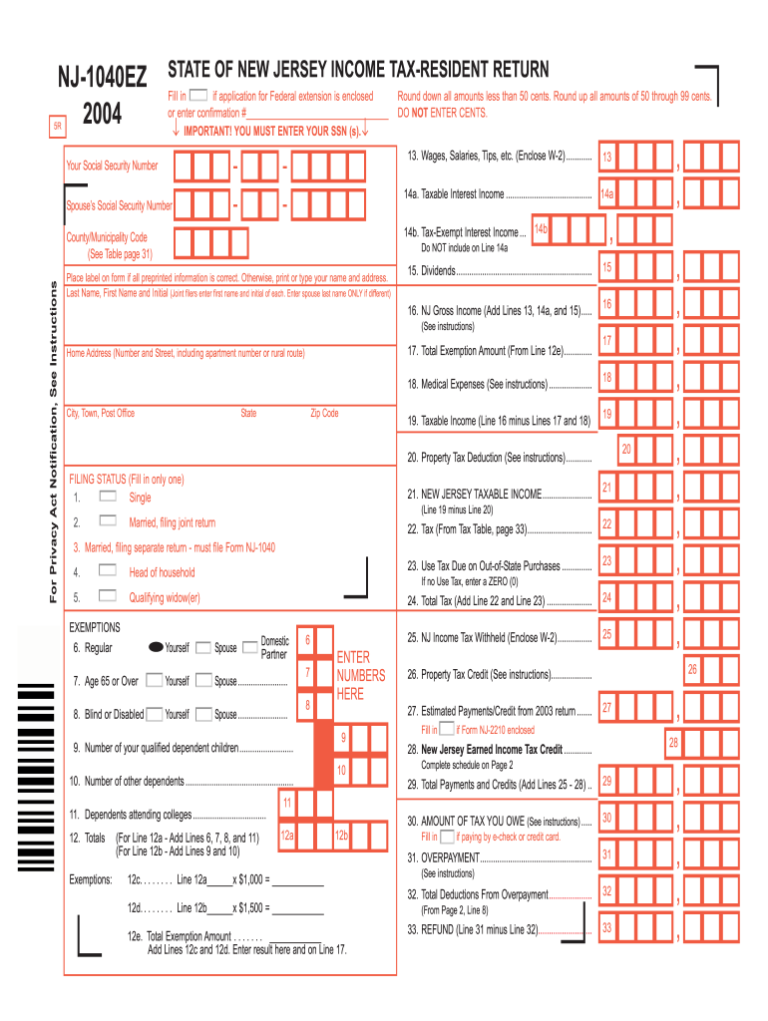

Instructions for the NJ1040

See page 14 for more information about the mailing label. Fill out the requested fields. You can download or print. • are a homeowner or tenant age. ♦ were 65 or older or blind or disabled on the last day of the tax year;

Nj 1040 Instructions Fill Online, Printable, Fillable, Blank pdfFiller

If you are not required to file a return and you: Use only blue or black ink when completing forms. • are a homeowner or tenant age. Read the instruction booklet before completing the return. Web (cu) recognized under new jersey law.

Nj 1040 Fill Online Printable Fillable Blank PDFfiller 1040 Form

Fill out the requested fields. Web employer payroll tax. It’s simple and easy to follow the instructions, complete your. Use only a 2016 return for the 2016 tax year. Estimated income tax payment voucher for 4th quarter 2022.

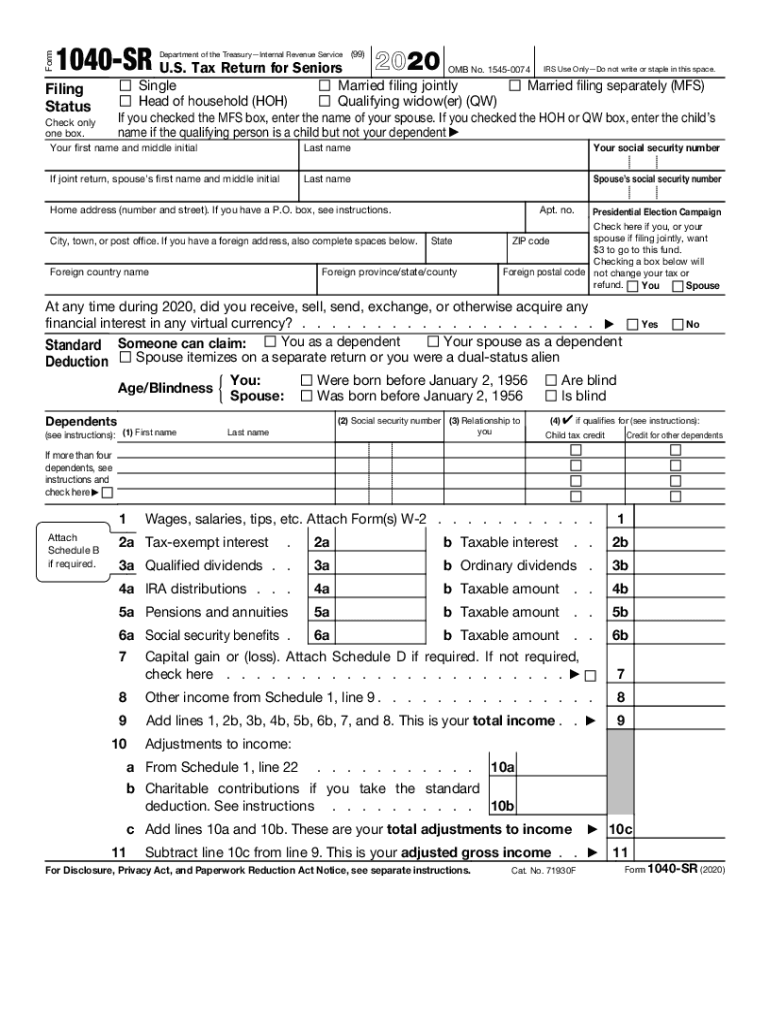

2019 1040 Sr Fill Out and Sign Printable PDF Template signNow

Web the following tips will help you fill out nj 1040 instructions easily and quickly: Web (cu) recognized under new jersey law. Underpayment of estimated tax by individuals, estates, or trusts. Web estimated income tax payment voucher for 2023. ♦ were 65 or older or blind or disabled on the last day of the tax year;

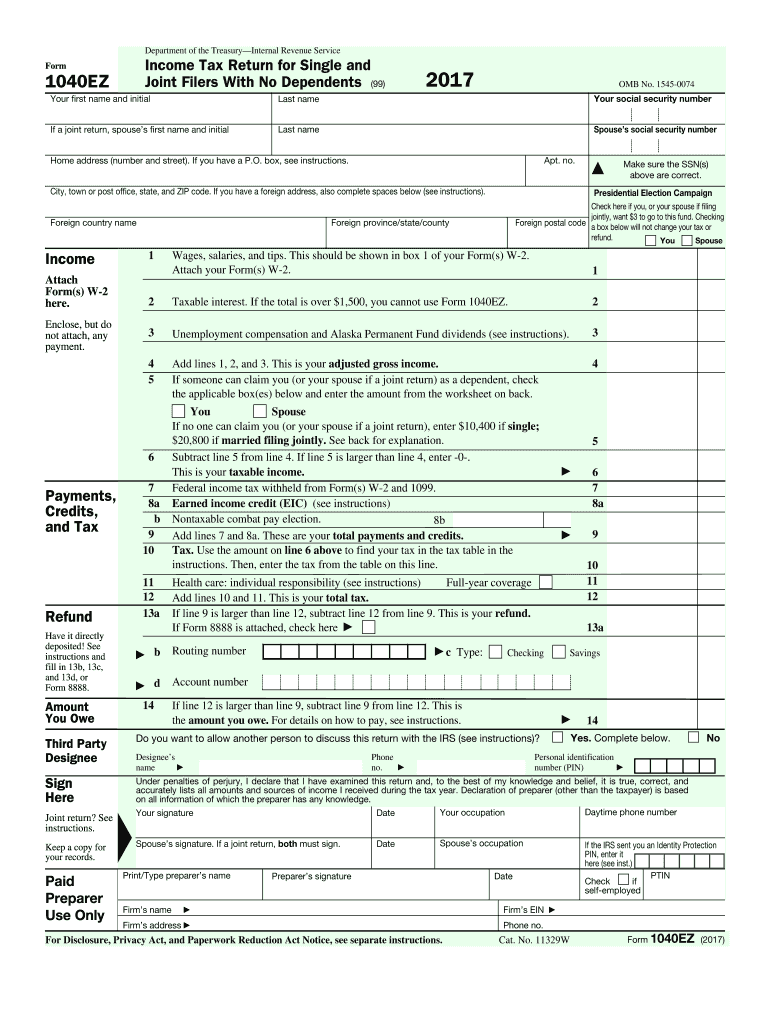

1040ez Form 20172022 Fill Out and Sign Printable PDF Template signNow

Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. Web • you are eligible for a new jersey earned income tax credit or other credit and are due a refund. ♦ were 65 or older or blind or disabled on the last day of the tax year; Web employer payroll tax. Web the following tips will help.

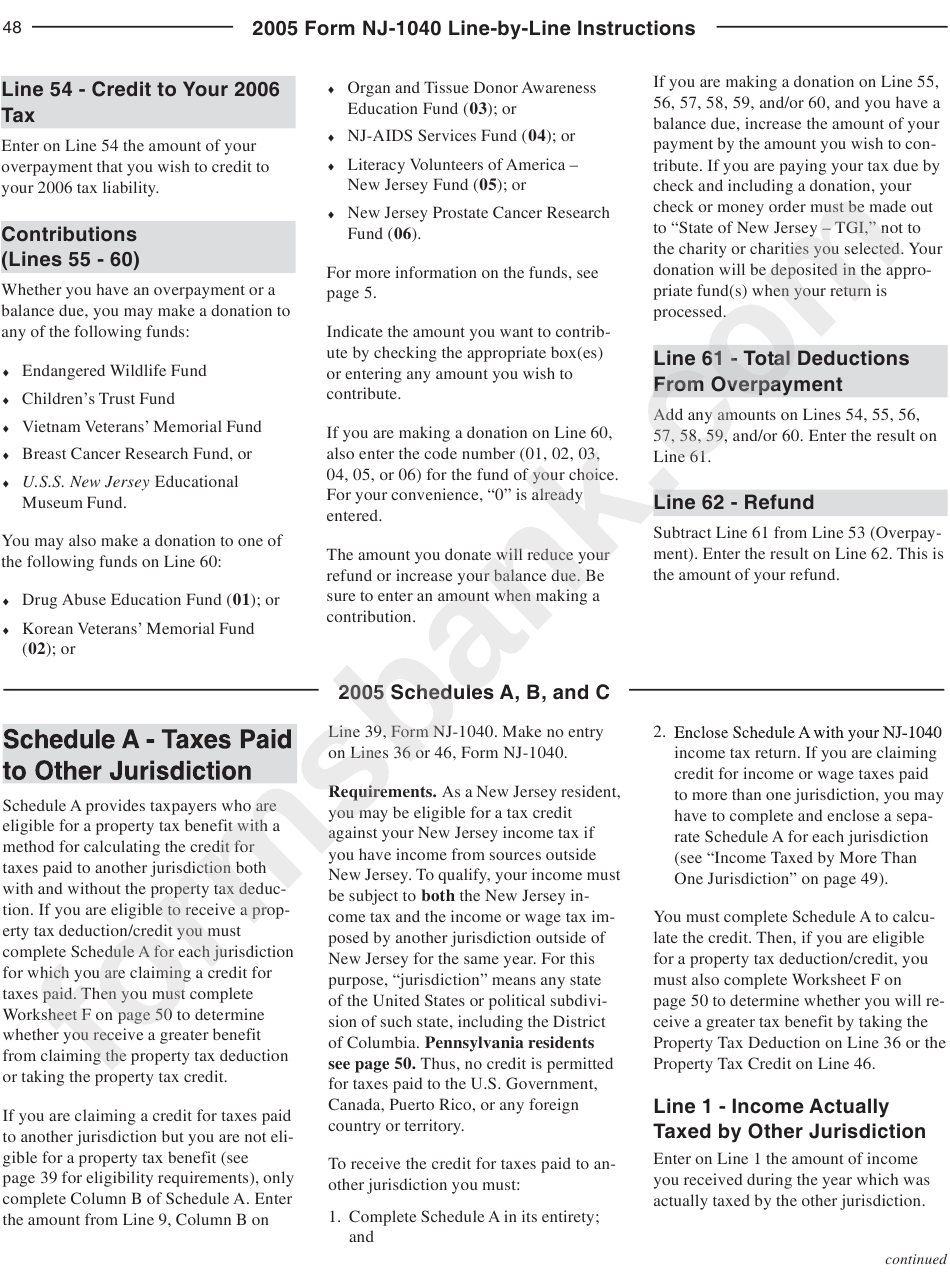

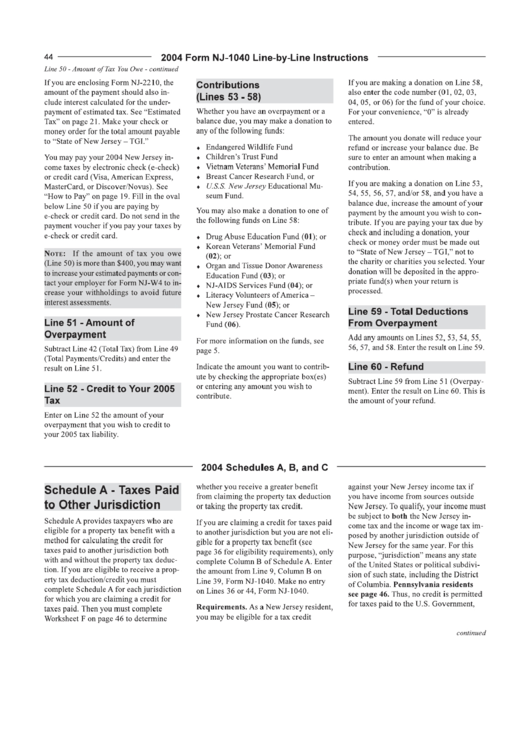

Form Nj1040 LineByLine Instructions 2005 printable pdf download

Estimated income tax payment voucher for 4th quarter 2022. Web estimated income tax payment voucher for 2023. Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. See page 14 for more information about the mailing label. This form must be filed by all out of state or part time resident taxpayers who earned over $10,000.

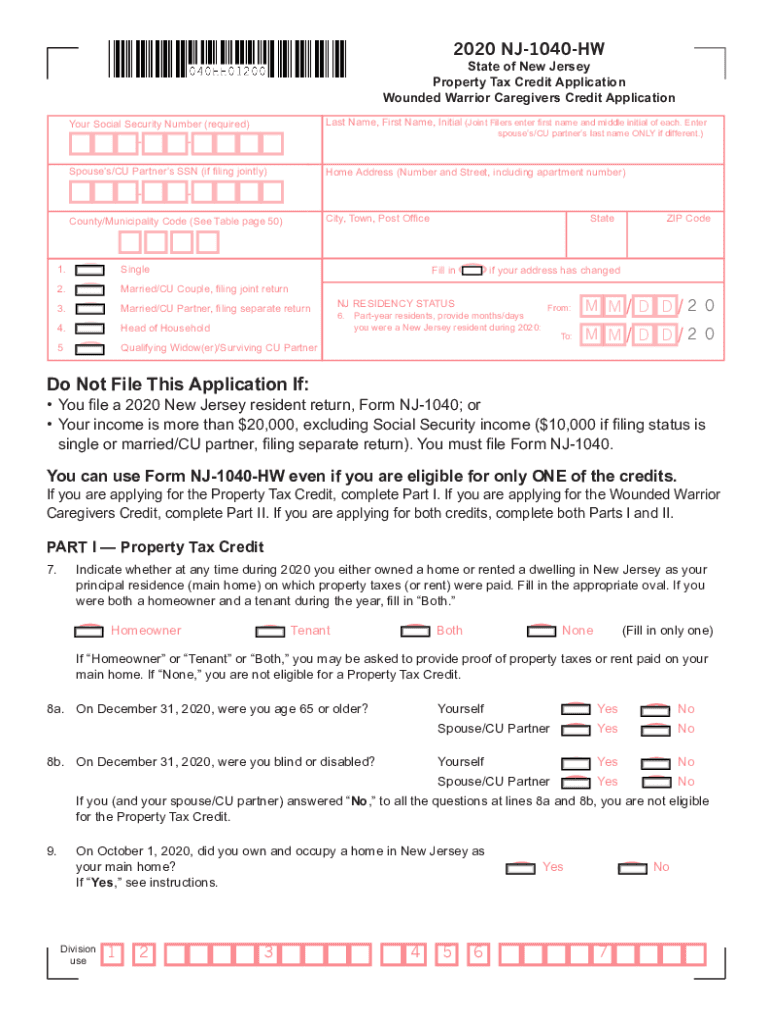

NJ NJ1040HW 20202022 Fill and Sign Printable Template Online US

Web you must file a new jersey income tax return if œ and your gross income your residency status is: Web (cu) recognized under new jersey law. • are a homeowner or tenant age. Web new jersey tax rate schedules 2021 filing status: See page 14 for more information about the mailing label.

2015 Nj 1040 Instructions

Web the following tips will help you fill out nj 1040 instructions easily and quickly: Web new jersey tax rate schedules 2021 filing status: Estimated income tax payment voucher for 4th quarter 2022. If you are not required to file a return and you: Use only a 2016 return for the 2016 tax year.

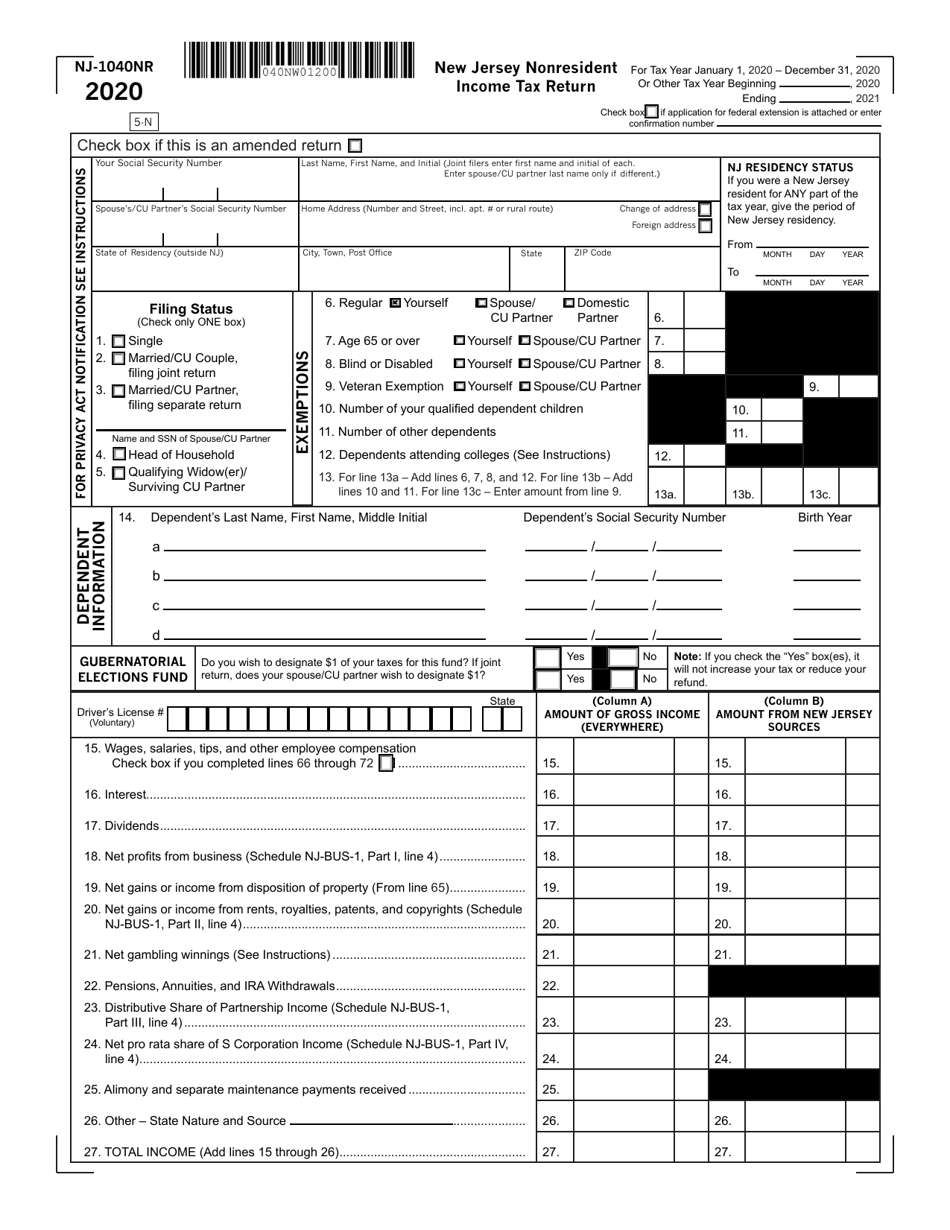

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

Use only blue or black ink when completing forms. • are a homeowner or tenant age. Individual income tax return tax return: Underpayment of estimated tax by individuals, estates, or trusts. Estimated income tax payment voucher for 4th quarter 2022.

Instructions for the NJ1040

Web • you are eligible for a new jersey earned income tax credit or other credit and are due a refund. Web form code form name; Estimated income tax payment voucher for 4th quarter 2022. Underpayment of estimated tax by individuals, estates, or trusts. Read the instruction booklet before completing the return.

If You Are Not Required To File A Return And You:

You can download or print. Use only a 2016 return for the 2016 tax year. See page 14 for more information about the mailing label. Web • you are eligible for a new jersey earned income tax credit or other credit and are due a refund.

Use Only Blue Or Black Ink When Completing Forms.

♦ were 65 or older or blind or disabled on the last day of the tax year; Read the instruction booklet before completing the return. Web you must file a new jersey income tax return if œ and your gross income your residency status is: Web the following tips will help you fill out nj 1040 instructions easily and quickly:

• Are A Homeowner Or Tenant Age.

This form must be filed by all out of state or part time resident taxpayers who earned over $10,000. This amount is the difference between the total amount taxed by. Estimated income tax payment voucher for 4th quarter 2022. Fill out the requested fields.

Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts.

Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply if taxable income (line 41). Individual income tax return tax return: Indicate the jurisdiction as “city y,” and enter $20,000 on line 1. Web employer payroll tax.