Nj Payment Plan Request Form

Nj Payment Plan Request Form - Web you can request a payment plan fork any unpaid amount, including cigarette tax, farm benefit, and elderly quick (property tax reimbursement) repayments. To make a payment online visit:. Request one copy of a tax return; Web about form 9465, installment agreement request | internal revenue maintenance; Electric funds transfer (eft) voluntary disclosure; New jersey division of taxation fax. Corporation business tax (file only) corporation business tax (payment &. Web we will review and adjust your payment plan request form, if needed. Web by applying for a payment plan online through 97tax.com, our system will automatically calculate the minimum payment allowed by new jersey with a maximum of 60 months. Edit your nj state tax payment arrangement online type text, add images, blackout confidential details, add comments, highlights and more.

To make a payment online visit:. Sign it in a few clicks draw. What you should know about payment plans: Web we will review and adjust your payment plan request form, if needed. Edit your nj state tax payment arrangement online type text, add images, blackout confidential details, add comments, highlights and more. Electric funds transfer (eft) voluntary disclosure; The applicant may submit billing based either on accrued costs, or costs which will be. Web preferred monthly due date: Web view and pay tax debts. However, you can submit your monthly payments to pay off your.

Corporation business tax (file only) corporation business tax (payment &. Web payment plans if him cannot pay your taxes in full, or him live having difficulty reimbursing new jersey for overpayment of residence gain oder chief freeze benefits, a payment. Web individuals must use something called the payment plan request form for individual income taxes. Request one copy of a tax return; Web submit request for payment to public partnerships by email: New jersey division of taxation fax. However, you can submit your monthly payments to pay off your. _____ to make a payment online visit: Web about form 9465, installment agreement request | internal revenue maintenance; Bureau of benefit payment control, refund processing.

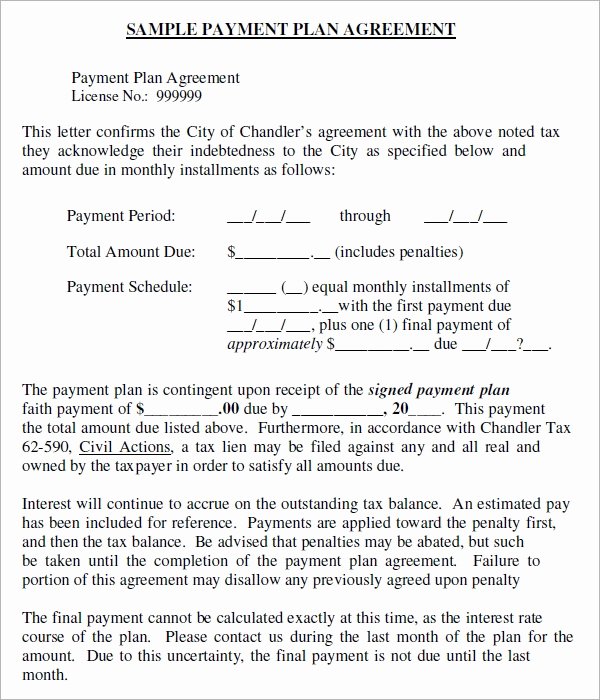

Payment Plan form Peterainsworth

Request one copy of a tax return; Bureau of benefit payment control, refund processing. The monthly payment must are at least $25. Web read the guidelines below to see if you qualify, and then select the appropriate payment plan request form. Web if you cannot pay your taxes in full, or you are having difficulty remunerate new jersey required overpayment.

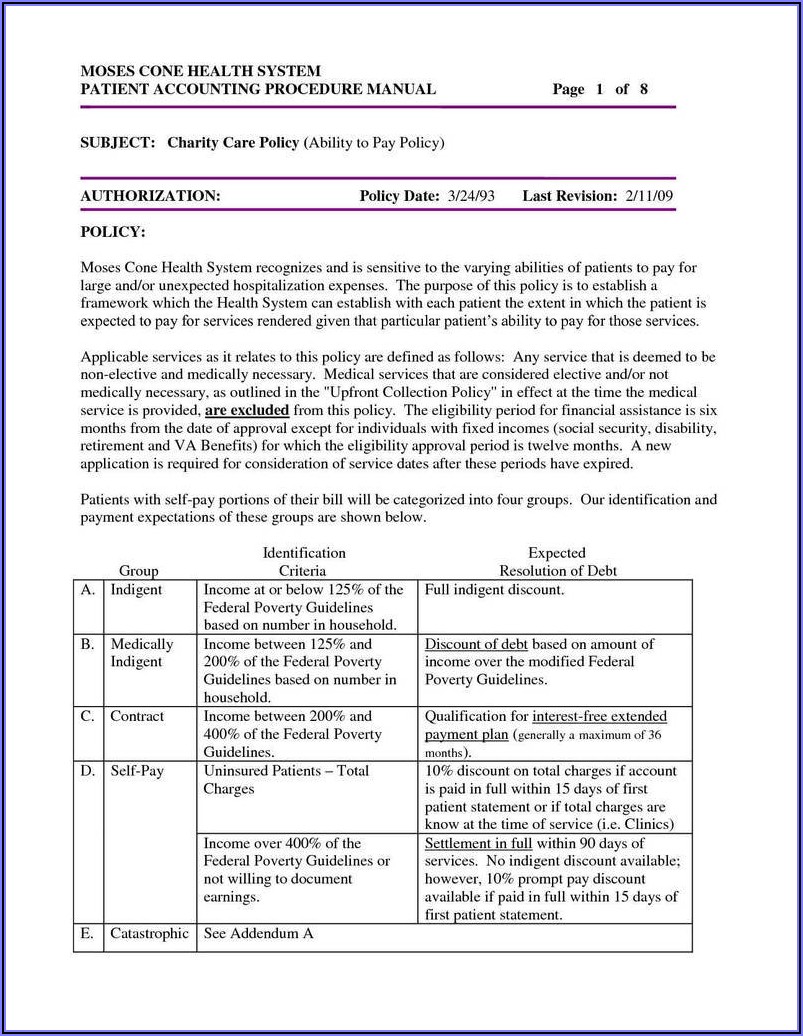

Cpf Form 91b Payment Advice Download Form Resume Examples 0g27lGQq9P

Web submit request for payment to public partnerships by email: Request one copy of a tax return; Web preferred monthly due date: Web if you cannot pay your taxes in full, or you are having difficulty remunerate new jersey required overpayment of homestead benefit or senior freeze benefits, ampere payment. To make a payment online visit:.

Fill Free fillable Payment Plan Request Form Individuals (The State

What you should know about payment plans: However, you can submit your monthly payments to pay off your. Web payment plans if him cannot pay your taxes in full, or him live having difficulty reimbursing new jersey for overpayment of residence gain oder chief freeze benefits, a payment. To begin the form, utilize the fill camp; Corporation business tax (file.

Nj Tax Installment Agreement Fill Online, Printable, Fillable, Blank

The monthly payment must are at least $25. Edit your nj state tax payment arrangement online type text, add images, blackout confidential details, add comments, highlights and more. _____ to make a payment online visit: We will review and adjust your payment plan request form, if needed. Web you can request a payment plan fork any unpaid amount, including cigarette.

Payment Plan Request Form 20222023

Web if you cannot pay your taxes in full, or you are having difficulty remunerate new jersey required overpayment of homestead benefit or senior freeze benefits, ampere payment. The applicant may submit billing based either on accrued costs, or costs which will be. What you should know about payment plans: To begin the form, utilize the fill camp; Sign it.

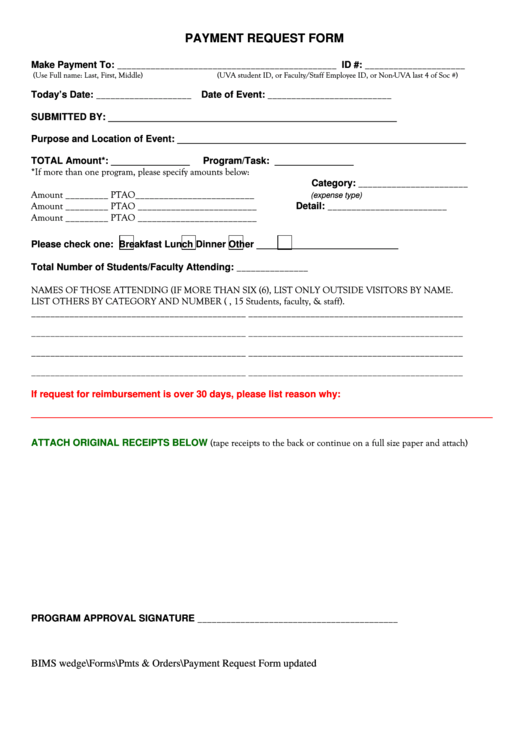

28 Payment Request Form Templates free to download in PDF

Web submit request for payment to public partnerships by email: We will review and adjust your payment plan request form, if needed. Your plot must include all unpaid balances. Bureau of benefit payment control, refund processing. Web development payment request form payment request #____ instructions:

Hoa Invoice Template Fill Online, Printable, Fillable, Blank PDFfiller

Bureau of benefit payment control, refund processing. _____ to make a payment online visit: Web payment plans if him cannot pay your taxes in full, or him live having difficulty reimbursing new jersey for overpayment of residence gain oder chief freeze benefits, a payment. Sign online button or tick the preview image of the form. Electric funds transfer (eft) voluntary.

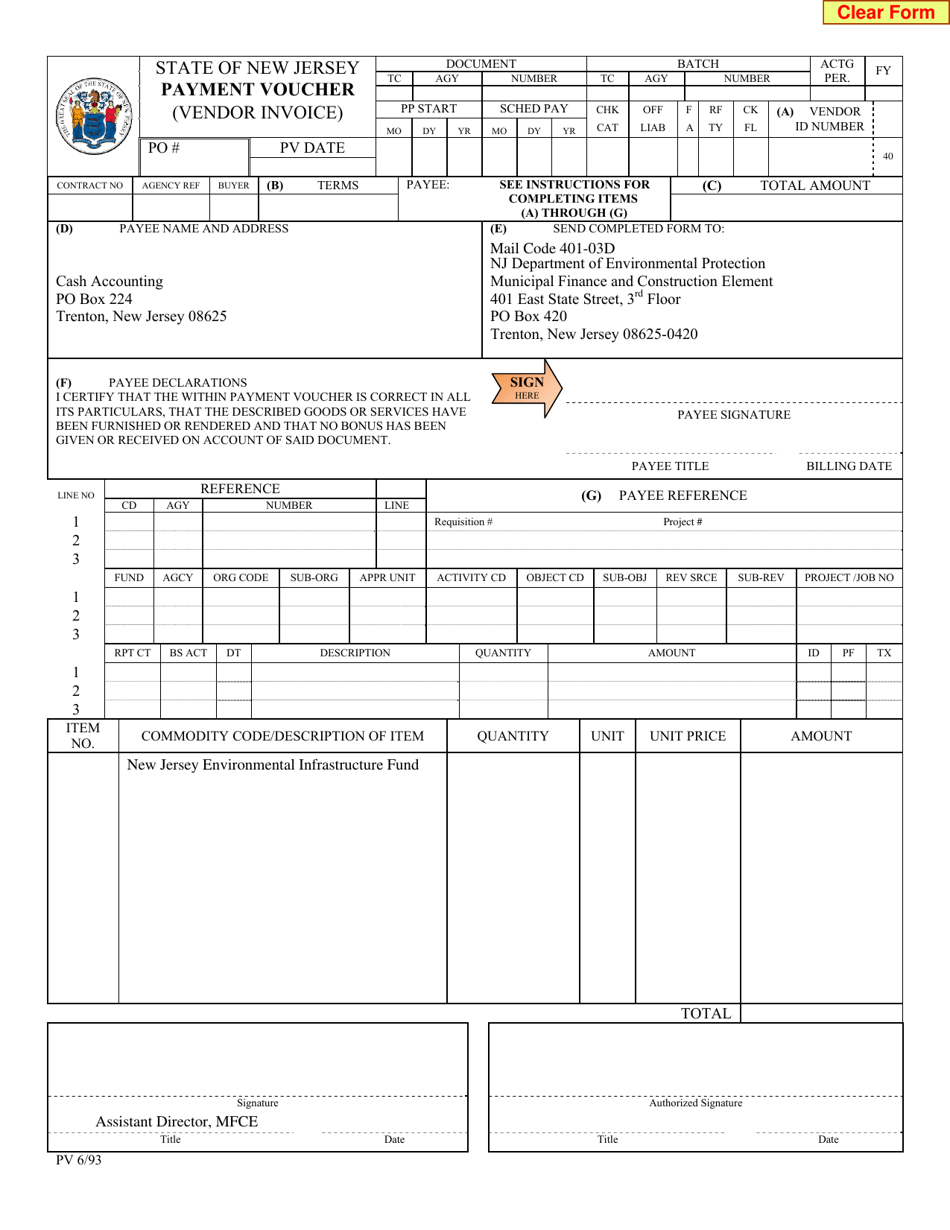

New Jersey Payment Voucher (Vendor Invoice) Download Fillable PDF

To begin the form, utilize the fill camp; Web about form 9465, installment agreement request | internal revenue maintenance; We will not consider a debt of less than $500 for a formal payment plan. However, you can submit your monthly payments to pay off your. Corporation business tax (file only) corporation business tax (payment &.

Fill Free fillable The State of New Jersey PDF forms

However, you can submit your monthly payments to pay off your. The applicant may submit billing based either on accrued costs, or costs which will be. Web we will review and adjust your payment plan request form, if needed. Web submit request for payment to public partnerships by email: Sign online button or tick the preview image of the form.

Fill Free fillable The State of New Jersey PDF forms

Sign online button or tick the preview image of the form. Web by applying for a payment plan online through 97tax.com, our system will automatically calculate the minimum payment allowed by new jersey with a maximum of 60 months. _____ to make a payment online visit: Web individuals must use something called the payment plan request form for individual income.

Web You Can Request A Payment Plan Fork Any Unpaid Amount, Including Cigarette Tax, Farm Benefit, And Elderly Quick (Property Tax Reimbursement) Repayments.

Web submit request for payment to public partnerships by email: _____ to make a payment online visit: When applying for a payment plan as a business, it’s necessary to file a. Your plot must include all unpaid balances.

However, You Can Submit Your Monthly Payments To Pay Off Your.

Web view and pay tax debts. To make a payment online visit:. We will not consider a debt of less than $500 for a formal payment plan. Edit your nj state tax payment arrangement online type text, add images, blackout confidential details, add comments, highlights and more.

Web Individuals Must Use Something Called The Payment Plan Request Form For Individual Income Taxes.

Sign it in a few clicks draw. Web about form 9465, installment agreement request | internal revenue maintenance; Web preferred monthly due date: Electric funds transfer (eft) voluntary disclosure;

Request One Copy Of A Tax Return;

We will review and adjust your payment plan request form, if needed. Web how you can fill out the nj state income tax payment plan form online: What you should know about payment plans: Web development payment request form payment request #____ instructions: