Nj Solar Tax Credit Form

Nj Solar Tax Credit Form - Web 1 division of taxation new jersey division of taxation assessing renewable energy systems james leblon 2 division of taxation presentation renewable energy systems. Web the nj solar tax credit, also known as the solar investment tax credit (itc), is a federal tax incentive that allows you to deduct 26 percent of the cost of. The federal tax credit falls to 26% starting in 2033. Nj solar power strives to produce the best results and can. In july 2012, the dep installed a 184 kilowatt (kw) solar photovoltaic (pv) array on the roof of its headquarters at 401 east state street in. Web 2022 solar tax credit. Drug deaths nationwide hit a record. Take control of home energy costs & produce your own solar energy. Web form 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web new jersey solar programs.

Nj solar power strives to produce the best results and can. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Web new jersey solar programs. Web the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2033. Web 2022 solar tax credit. Web these incentives could be tax credits, rebates, and more. Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. The federal tax credit falls to 26% starting in 2033. This page has been updated to include 2023 new jersey solar incentives, rebates, and tax credits. Web new jersey residents are eligible for the federal solar tax credit and receive a rebate of 30% applied to their next federal tax return.

Web the hearing was particularly timely, because the u.s. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system. Web new jersey solar programs. Web 1 division of taxation new jersey division of taxation assessing renewable energy systems james leblon 2 division of taxation presentation renewable energy systems. Nj solar power strives to produce the best results and can. Web federal solar tax credit. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. This page has been updated to include 2023 new jersey solar incentives, rebates, and tax credits. One of the biggest questions potential customers have for us is whether they will qualify for a solar tax credit.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. Web njdep solar array. Drug deaths nationwide hit a record. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system..

Understanding How Solar Tax Credits Work

Web 2022 solar tax credit. Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the calculation of the community solar energy pilot program bill credit. Web federal solar tax credit. Web 1 division of taxation new jersey division of taxation assessing renewable energy systems james leblon 2 division of taxation presentation renewable energy systems..

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. Drug deaths nationwide hit a record. Web 2023 new jersey solar incentives, tax credits, rebates & grants. Nj solar power strives to produce the best results and can. Web new jersey residents are eligible for.

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ

Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. This page has been updated to include 2023 new jersey solar incentives, rebates, and tax credits. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total.

How to Claim Your Solar Tax Credit A.M. Sun Solar

Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the calculation of the community solar energy pilot program bill credit. Web form 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web the nj solar tax credit, also known as the solar investment.

How Does the Federal Solar Tax Credit Work?

Web these incentives could be tax credits, rebates, and more. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Nj solar power strives to produce the best results and can. One of the biggest questions potential customers have for us is whether they will qualify.

How Does The Solar Tax Credit Work Solar Pricing NJ Solar Power

Web get quote new jersey solar tax credits and rebates new jersey solar incentives support clean energy growth by encouraging homeowners to convert to solar power. Is facing intensifying urgency to stop the worsening fentanyl epidemic. In july 2012, the dep installed a 184 kilowatt (kw) solar photovoltaic (pv) array on the roof of its headquarters at 401 east state.

Solar Tax Credit Extension

The successor solar incentive (susi) program is the current solar program which allows. Web the hearing was particularly timely, because the u.s. Take control of home energy costs & produce your own solar energy. Web these incentives could be tax credits, rebates, and more. Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the.

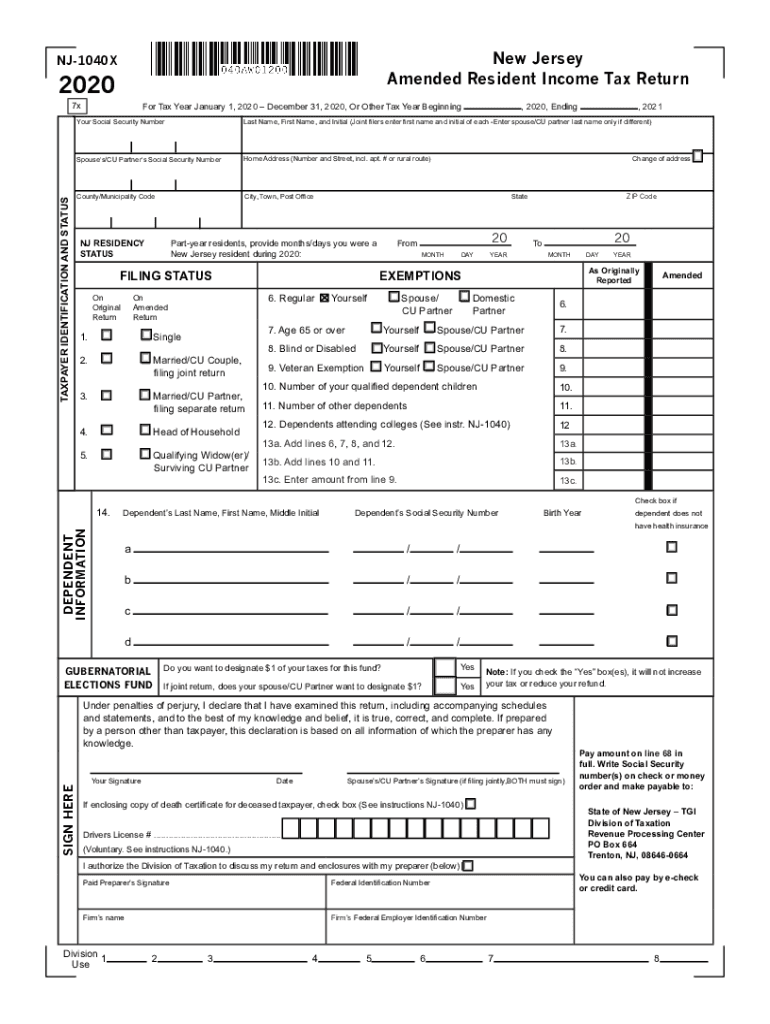

Nj Tax Return Form Fill Out and Sign Printable PDF Template signNow

Web the hearing was particularly timely, because the u.s. Web form 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system. Web these incentives could.

Here’s How To Claim The Solar Tax Credits On Your Tax Return Southern

Take control of home energy costs & produce your own solar energy. Web new jersey residents are eligible for the federal solar tax credit and receive a rebate of 30% applied to their next federal tax return. Web the hearing was particularly timely, because the u.s. Drug deaths nationwide hit a record. Web 1 division of taxation new jersey division.

Web New Jersey Residents Who Purchased Or Leased An Eligible Electric Vehicle After July 25, 2022 May Apply For An Incentive Of Up To $4,000.

All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system. Web the hearing was particularly timely, because the u.s. Nj solar power strives to produce the best results and can. Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the calculation of the community solar energy pilot program bill credit.

Web These Incentives Could Be Tax Credits, Rebates, And More.

Web form 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web sustainable jersey drive green nj federal incentives: In july 2012, the dep installed a 184 kilowatt (kw) solar photovoltaic (pv) array on the roof of its headquarters at 401 east state street in. The successor solar incentive (susi) program is the current solar program which allows.

Is Facing Intensifying Urgency To Stop The Worsening Fentanyl Epidemic.

Drug deaths nationwide hit a record. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Web 2022 solar tax credit. Web njdep solar array.

One Of The Biggest Questions Potential Customers Have For Us Is Whether They Will Qualify For A Solar Tax Credit.

Take control of home energy costs & produce your own solar energy. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. The federal tax credit falls to 26% starting in 2033. Web the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2033.