Nj Tax Appeal Form

Nj Tax Appeal Form - Use tax software you purchase, go to an online tax. Web this site is designed to support a wide range of submitters and law firms. A written statement providing all the facts that support the. Web an appeal is made by filling a complaint with the tax court of new jersey. Web what makes you eligible to file a new jersey property tax appeal form? It cannot be granted in person, by phone, or through email. Complete, edit or print tax forms instantly. This service was officially launched in jan 2009 by the monmouth county board of taxation, and. Taxpayers can ask the court review state taxes and local property tax. Web if you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey.

Web tax appeal forms and information your tax assessment appeal must be filed by april 3, 2023 in the following municipalities: On this page tax court. Estimated income tax payment voucher for 2023. Web the general information provided is derived from new jersey laws governing tax appeals: Welcome to nj online assessment appeals. It cannot be granted in person, by phone, or through email. Use tax software you purchase, go to an online tax. This service was officially launched in jan 2009 by the monmouth county board of taxation, and. Web a request for abatement must be in writing. Taxpayers can ask the court review state taxes and local property tax.

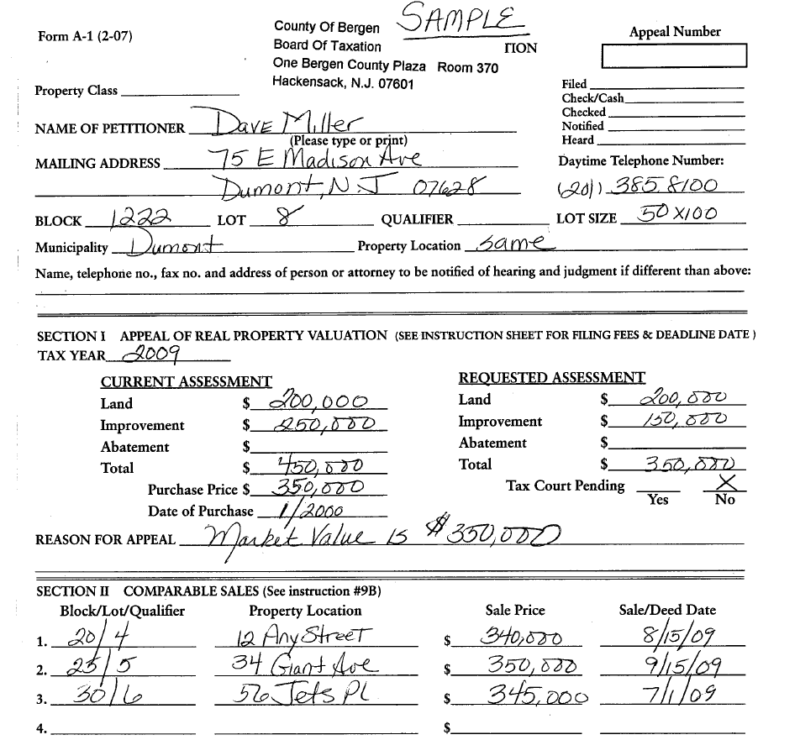

On this page tax court. This service was officially launched in jan 2009 by the monmouth county board of taxation, and. Web this site is designed to support a wide range of submitters and law firms. Welcome to nj online assessment appeals. People usually file a protest with the division's conference and appeals branch (cab), and then, if they. Web 40 rows form subject link; It cannot be granted in person, by phone, or through email. True market value standard—the price your property would sell for common level range standard—it depends on the taxing. Use tax software you purchase, go to an online tax. Web the general information provided is derived from new jersey laws governing tax appeals:

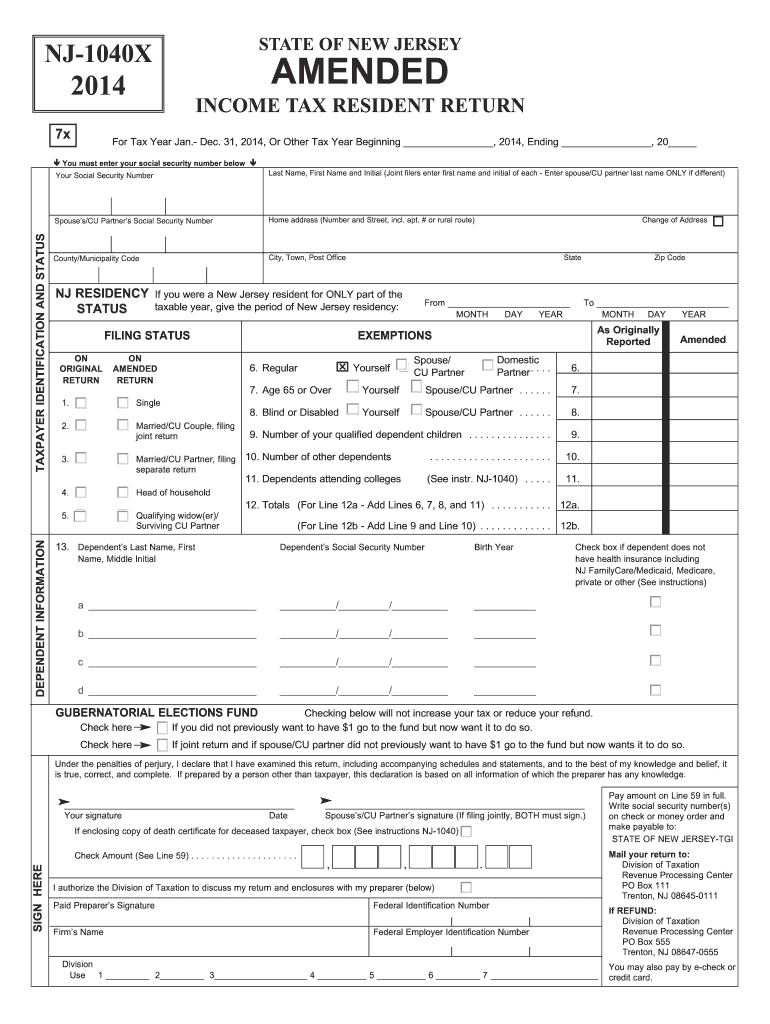

Nj State Tax Form Fill Out and Sign Printable PDF Template signNow

Web this site is designed to support a wide range of submitters and law firms. Use tax software you purchase, go to an online tax. Web the general information provided is derived from new jersey laws governing tax appeals: Application for extension of time to file income tax return. On this page tax court.

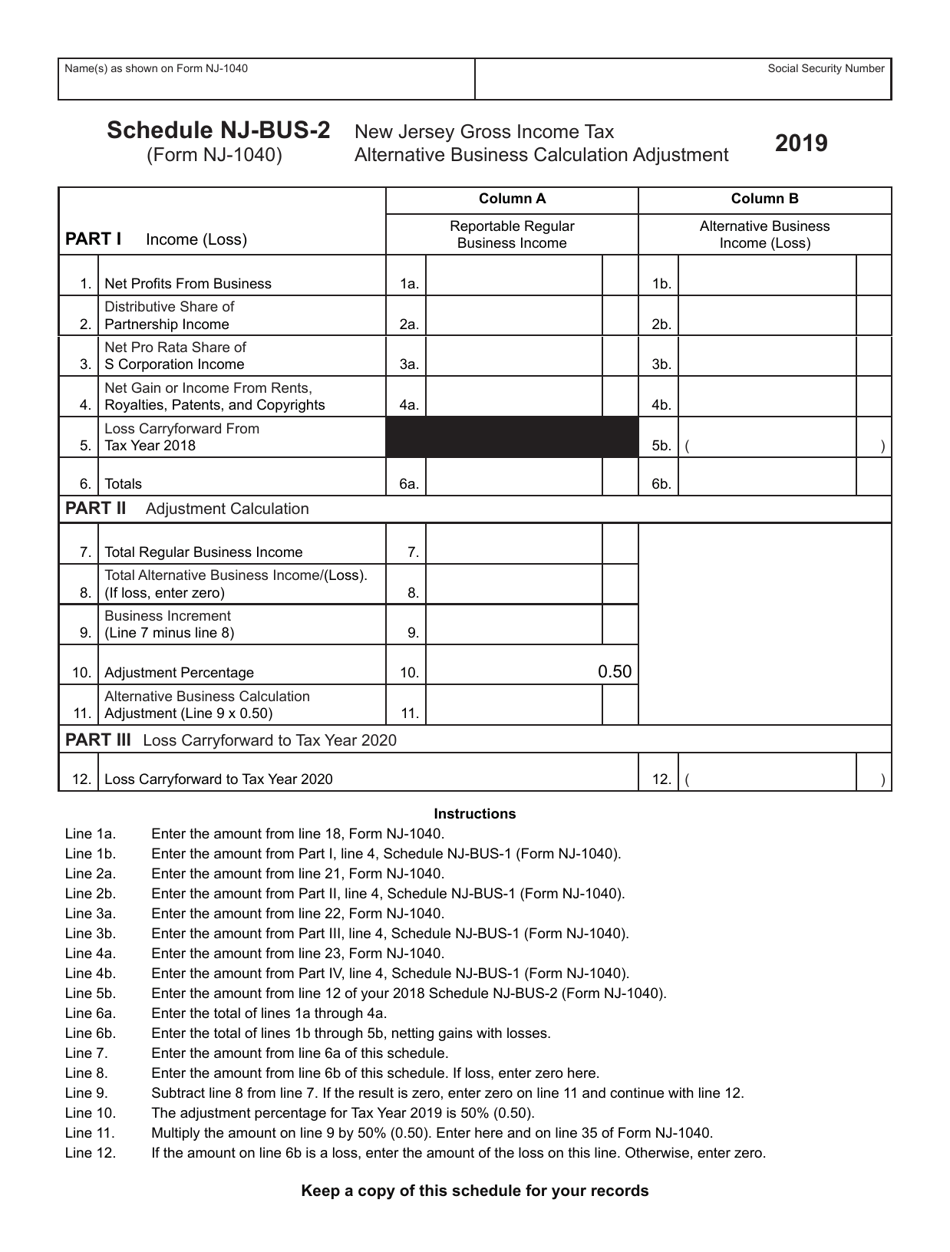

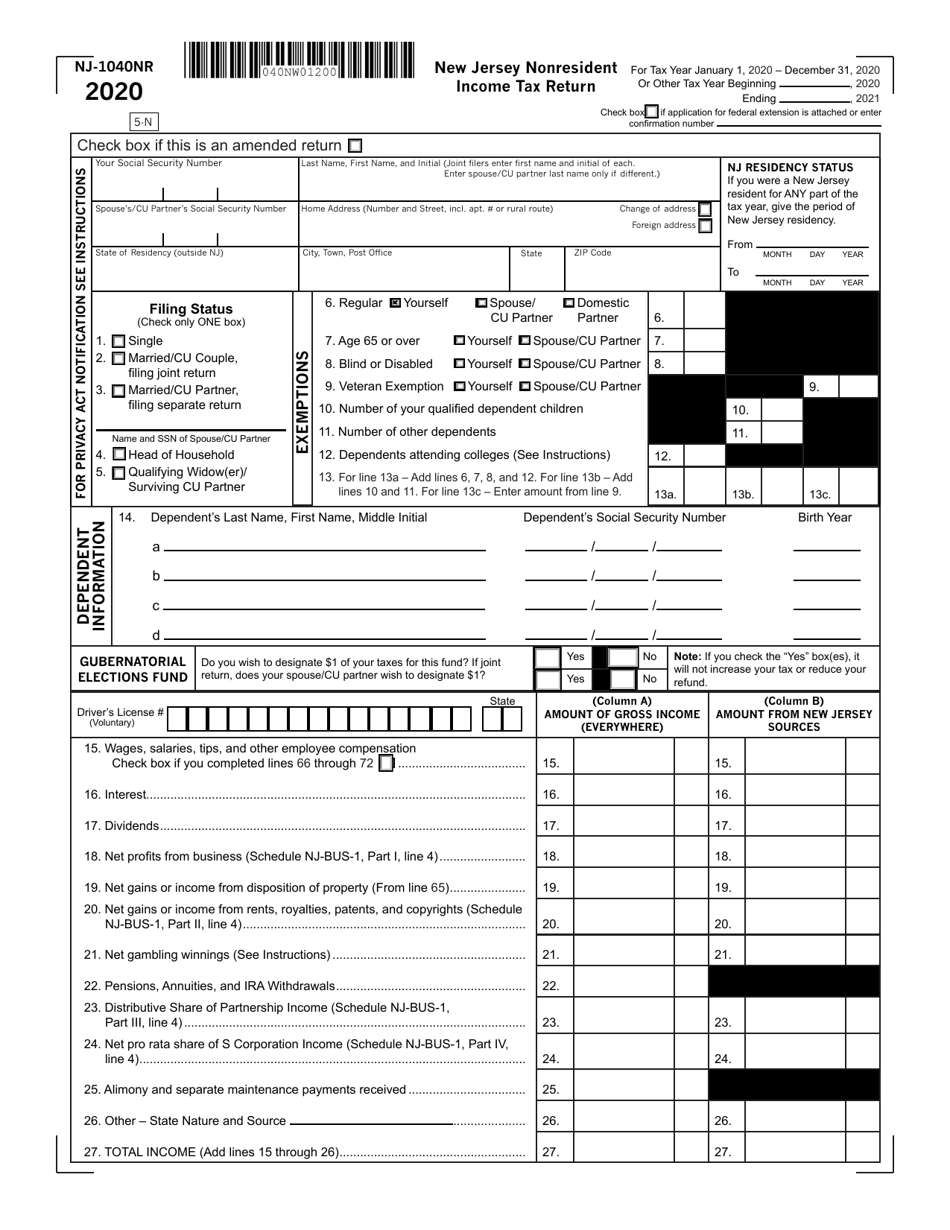

Form NJ1040 Schedule NJBUS2 Download Fillable PDF or Fill Online New

Web you may do so by presenting one of the following: True market value standard—the price your property would sell for common level range standard—it depends on the taxing. People usually file a protest with the division's conference and appeals branch (cab), and then, if they. Use tax software you purchase, go to an online tax. Web this site is.

Henry County Homestead Exemption 2020 Fill and Sign Printable

Taxpayers can ask the court review state taxes and local property tax. Web this site is designed to support a wide range of submitters and law firms. This service was officially launched in jan 2009 by the monmouth county board of taxation, and. Our mission is to facilitate secured and efficient electronic filing and management of property. People usually file.

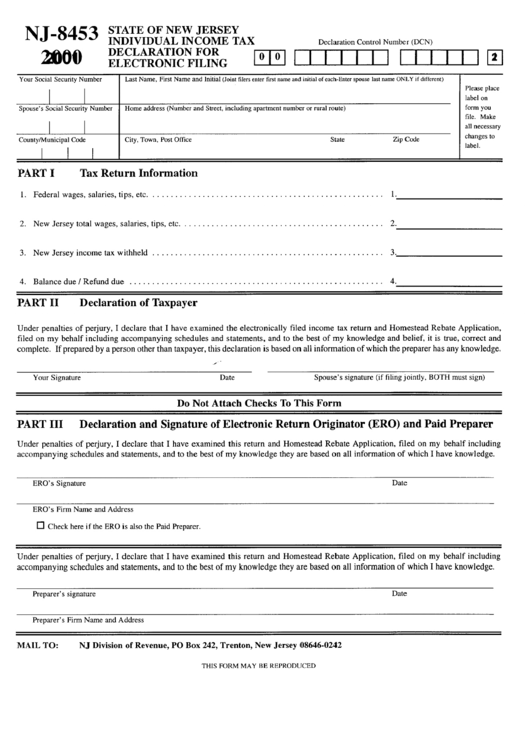

Form Nj8453 Individual Tax Declaration For Electronic Filing

This service was officially launched in jan 2009 by the monmouth county board of taxation, and. True market value standard—the price your property would sell for common level range standard—it depends on the taxing. Our mission is to facilitate secured and efficient electronic filing and management of property. A written statement providing all the facts that support the. Web section.

Struggling to find a NJ Tax Appeal?

People usually file a protest with the division's conference and appeals branch (cab), and then, if they. Web the general information provided is derived from new jersey laws governing tax appeals: Our mission is to facilitate secured and efficient electronic filing and management of property. Estimated income tax payment voucher for 2023. Web tax appeal forms and information your tax.

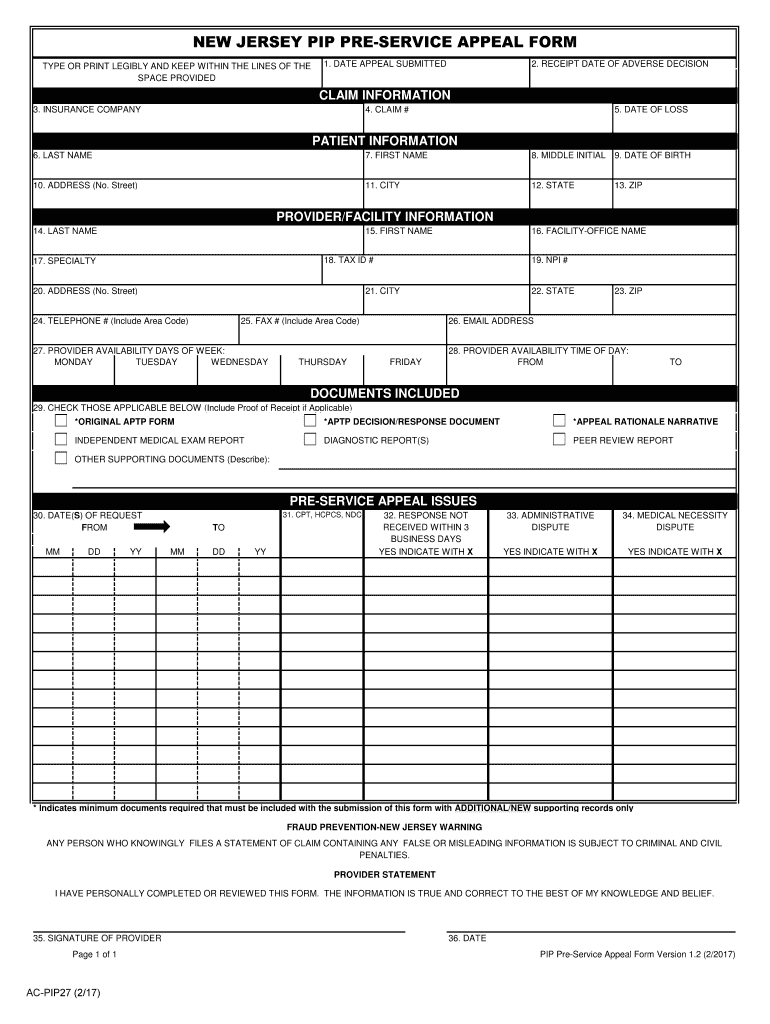

Nj Pip Pre Service Appeal Form Fill Online, Printable, Fillable

Welcome to nj online assessment appeals. True market value standard—the price your property would sell for common level range standard—it depends on the taxing. Our mission is to facilitate secured and efficient electronic filing and management of property. Web tax appeal forms and information your tax assessment appeal must be filed by april 3, 2023 in the following municipalities: A.

NJ Property Tax Appeal Deadline Extended to at least May 1, 2020

Web what makes you eligible to file a new jersey property tax appeal form? Web an appeal is made by filling a complaint with the tax court of new jersey. Web tax appeal forms and information your tax assessment appeal must be filed by april 3, 2023 in the following municipalities: It cannot be granted in person, by phone, or.

Understanding & Executing a Successful Property Tax Appeal in Bergen

On this page tax court. Web what makes you eligible to file a new jersey property tax appeal form? Web tax appeal forms and information your tax assessment appeal must be filed by april 3, 2023 in the following municipalities: Web 40 rows form subject link; Montgomery township, north plainfield borough,.

Skoloff & Wolfe Listed Among NJ’s Best Commercial Property Tax Appeal

Web this site is designed to support a wide range of submitters and law firms. Web welcome to nj online assessment appeals. Web if you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey. Our mission is to facilitate secured and efficient electronic filing.

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

Web what makes you eligible to file a new jersey property tax appeal form? On this page tax court. Web 40 rows form subject link; A written statement providing all the facts that support the. Taxpayers can ask the court review state taxes and local property tax.

Estimated Income Tax Payment Voucher For 2023.

Web welcome to nj online assessment appeals. Web 40 rows form subject link; Complete, edit or print tax forms instantly. Web what makes you eligible to file a new jersey property tax appeal form?

It Cannot Be Granted In Person, By Phone, Or Through Email.

Web you may do so by presenting one of the following: Web an appeal is made by filling a complaint with the tax court of new jersey. Welcome to nj online assessment appeals. This service was officially launched in jan 2009 by the monmouth county board of taxation, and.

Web The General Information Provided Is Derived From New Jersey Laws Governing Tax Appeals:

On this page tax court. Montgomery township, north plainfield borough,. Application for extension of time to file income tax return. True market value standard—the price your property would sell for common level range standard—it depends on the taxing.

Use Tax Software You Purchase, Go To An Online Tax.

Our mission is to facilitate secured and efficient electronic filing and management of property assessment appeals with new. Web if you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey. Web section i appeal of real property valuation (see instruction sheet for filing fees and deadline date) tax year___________________. You can file a property tax appeal in case you feel like the property tax assessor hasn’t done their job.