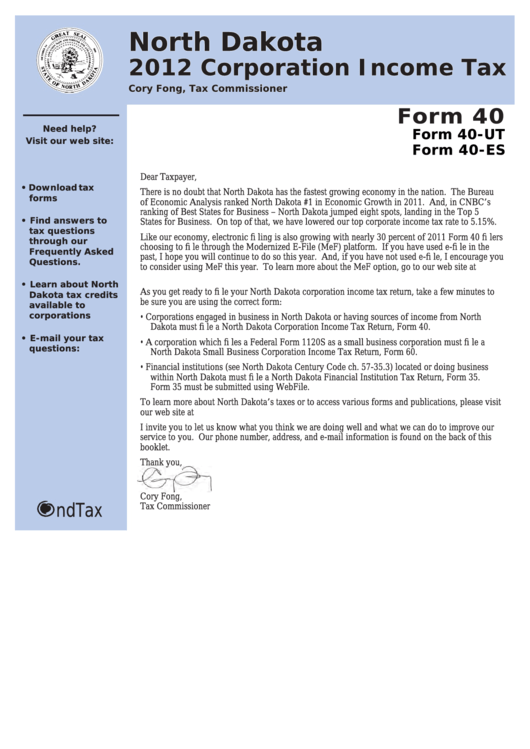

North Dakota Form 40 Instructions 2021

North Dakota Form 40 Instructions 2021 - Make sure the software supports the forms you need to. The return is due on april 15 of each year. Web north dakota disclosure form 40 instructions 2020. A corporation terminating as a subchapter s corporation during the year, or a corporation changing its annual accounting period, must annualize its north dakota taxable income and prorate its state tax liability in the same manner as Web the pdf file format allows you to safely print, fill in, and mail in your 2022 north dakota tax forms. For example, a north dakota form 40 must be filed by: Decide on the format you want to save the incorporate in north dakota form 40 instructions 2020 (pdf or docx) and click download to obtain it. Federal net operating loss deduction (federal form 1120, line 29a) 2. Web we last updated the corporation income tax return in february 2023, so this is the latest version of form 40, fully updated for tax year 2022. Web north dakota sources must file a north dakota corporation income tax return, form 40.

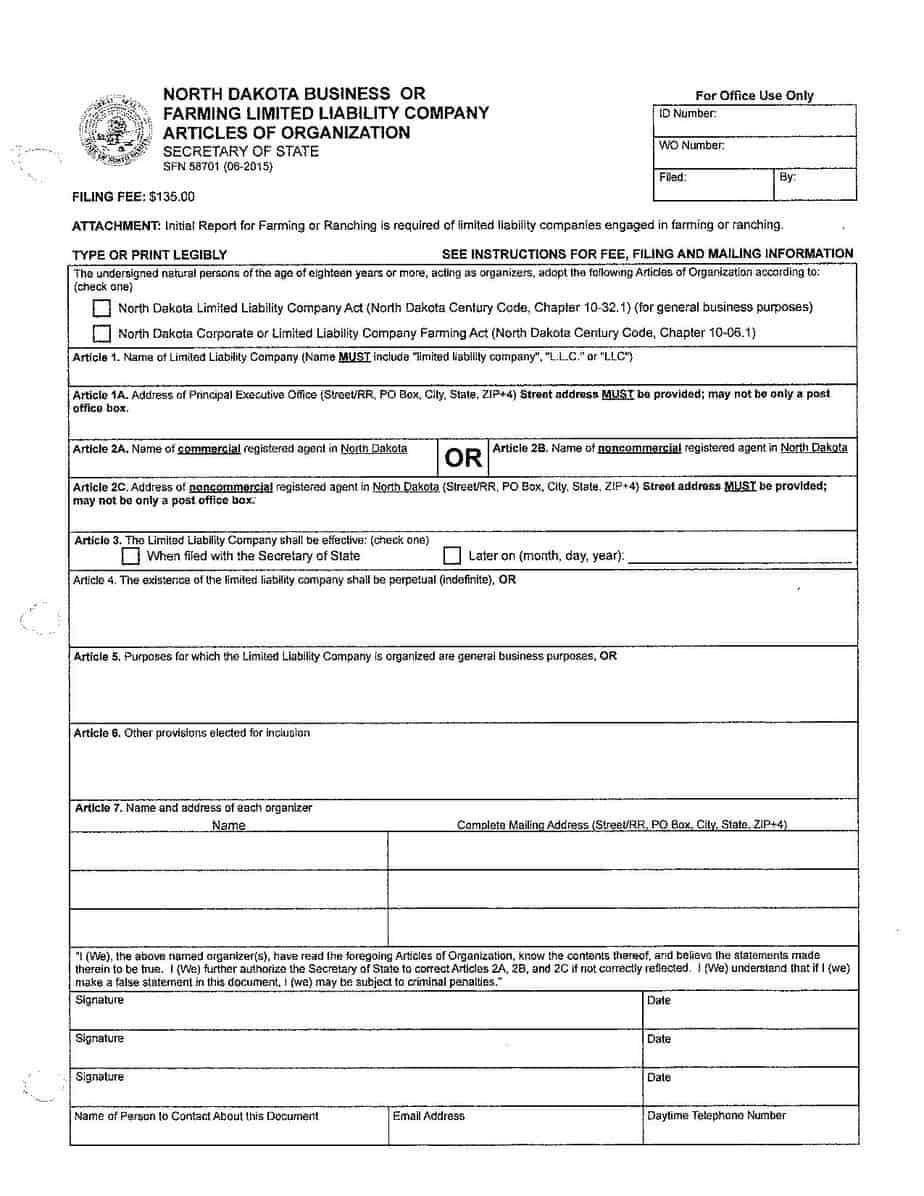

Web on the form prescribed by the secretary of state.the prescribed form is an online form found on firststop (firststop.sos.nd.gov). Decide on the format you want to save the incorporate in north dakota form 40 instructions 2020 (pdf or docx) and click download to obtain it. Wait until north dakota form 40 instructions is appeared. To get started, seek the “get form” button and press it. (fill in only one) b. Engaged parties names, addresses and phone numbers etc. • cooperative corporations distributing their net income through patronage dividends; Web a signed form 40 is required along with a minimum of the first 6 pages of the federal 1120 and any relevant schedules. All income taxes, franchise or privilege taxes measured by income 4. The return is due on april 15 of each year.

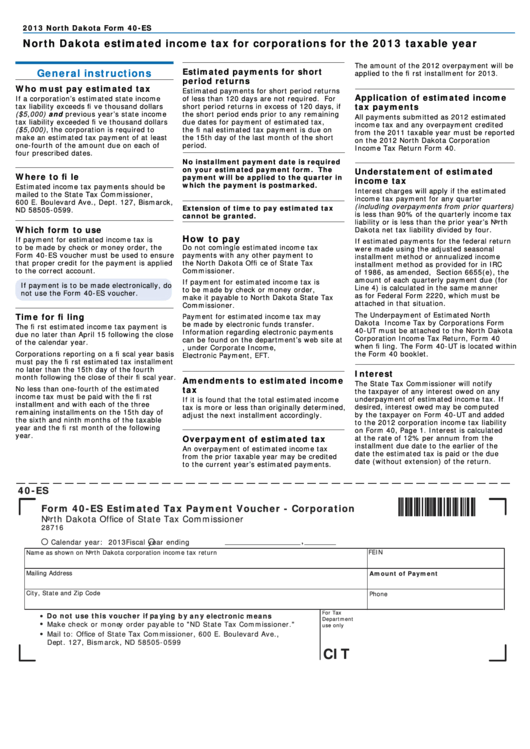

The return is due on april 15 of each year. Customize the blanks with unique fillable fields. Special deductions (federal form 1120, line 29b) 3. All income taxes, franchise or privilege taxes measured by income 4. Federal net operating loss deduction (federal form 1120, line 29a) 2. • cooperative corporations distributing their net income through patronage dividends; D enter in columns a through d the installment dates that correspond to the 15th day of the 4th, 6th and 9th months of the taxable year, and the first month of the following year 5. Interest on state and local obligations (excluding north dakota obligations) 5. Web on the form prescribed by the secretary of state.the prescribed form is an online form found on firststop (firststop.sos.nd.gov). Web north dakota disclosure form 40 instructions 2020.

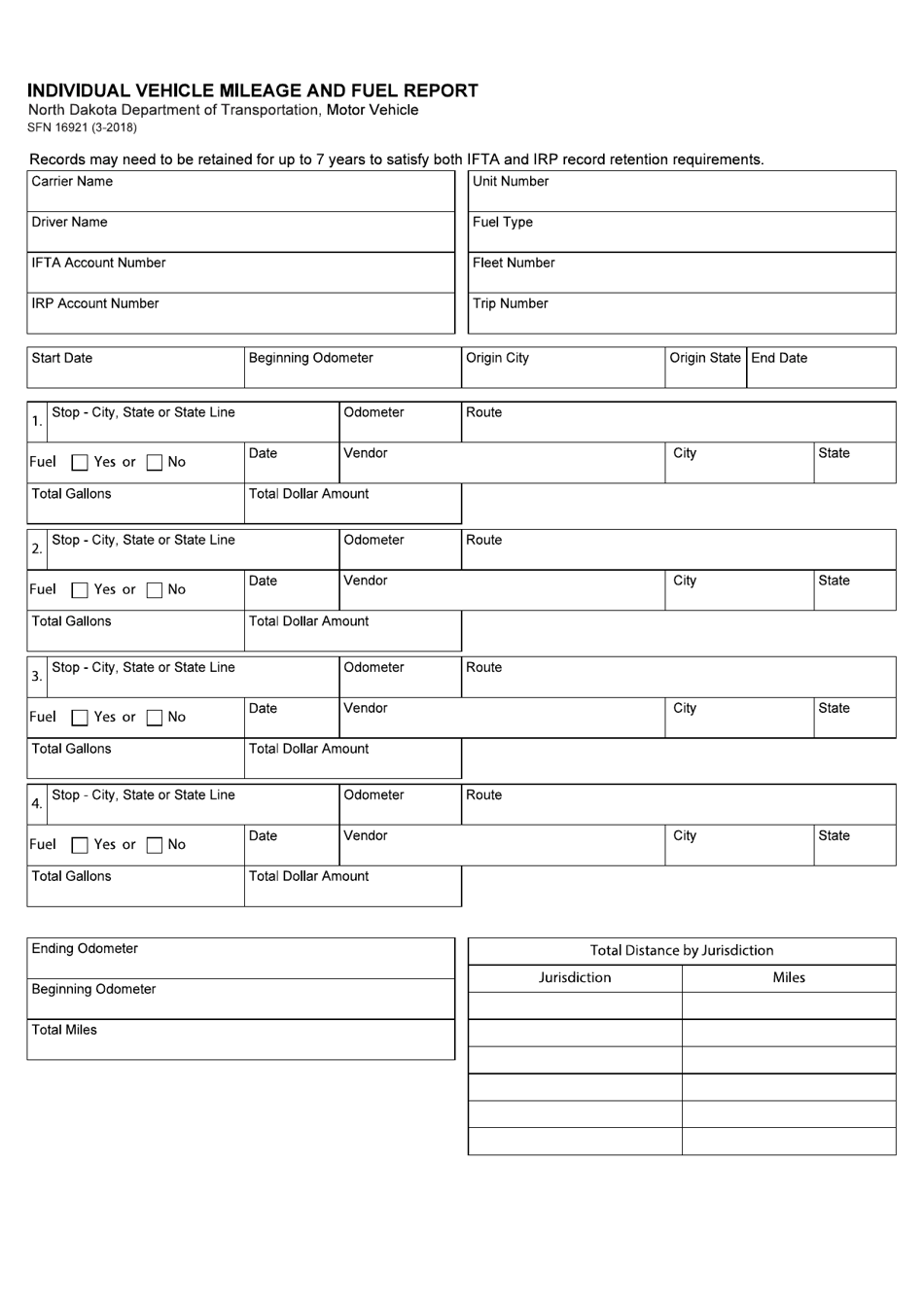

Form SFN16921 Download Fillable PDF or Fill Online Individual Vehicle

Engaged parties names, addresses and phone numbers etc. • cooperative corporations distributing their net income through patronage dividends; 2022 north dakota corporate income tax form 40 instructions photo credit: Web we last updated the corporation income tax return in february 2023, so this is the latest version of form 40, fully updated for tax year 2022. Interest on state and.

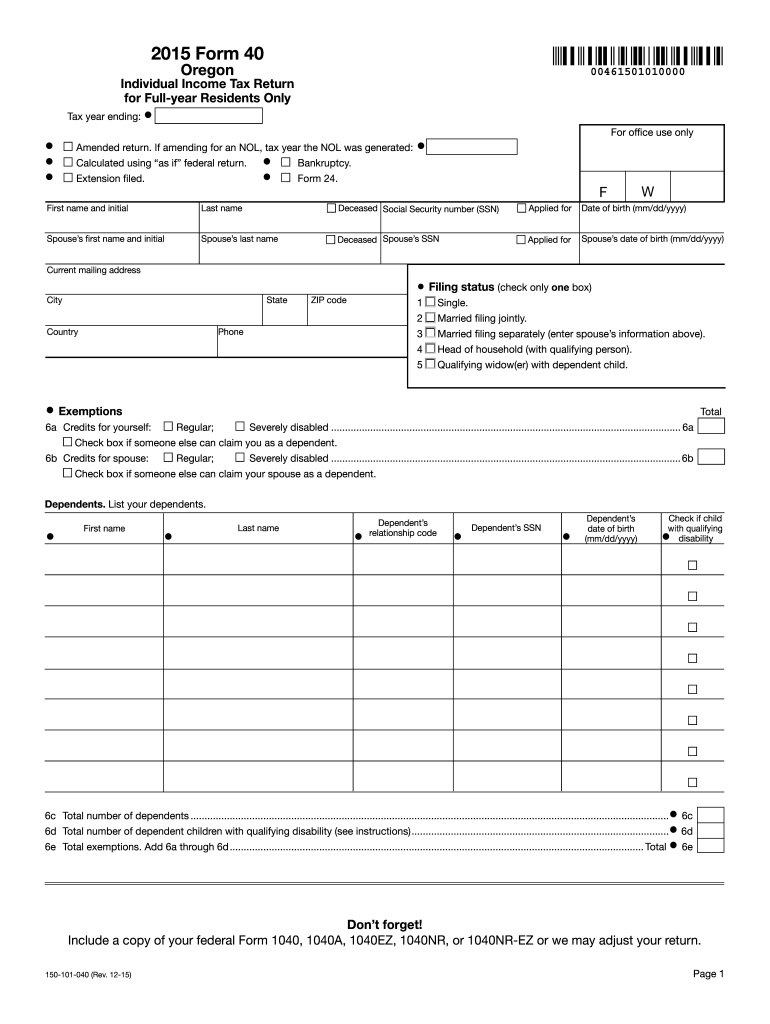

Oregon Form 40 Instructions 2017 slidesharedocs

2022 north dakota corporate income tax form 40 instructions photo credit: Web a signed form 40 is required along with a minimum of the first 6 pages of the federal 1120 and any relevant schedules. Federal net operating loss deduction (federal form 1120, line 29a) 2. Us legal forms is a great solution for everyone. Web north dakota sources must.

Stumped? How to Form a North Dakota LLC the Easy Way

Web how to edit and sign north dakota form 40 instructions online. Date for fiscal filers is on or before the 15th day of the 4th month following the end of the tax year. 2022 north dakota corporate income tax form 40 instructions photo credit: D enter in columns a through d the installment dates that correspond to the 15th.

Fill Free fillable forms State of North Dakota

Fill in the empty fields; Then, open adobe acrobat reader on your desktop or laptop computer. Us legal forms is a great solution for everyone. Download past year versions of this tax form as pdfs here: Web we last updated the corporation income tax return in february 2023, so this is the latest version of form 40, fully updated for.

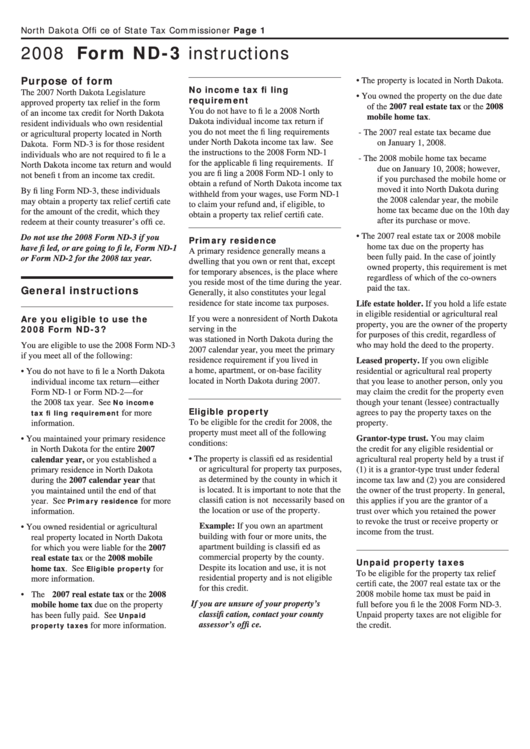

Form Nd3 Instructions North Dakota Offi Ce Of State Tax Commissioner

Details on how to only prepare and print a current tax year north dakota tax return. Wait until north dakota form 40 instructions is appeared. 2020 overpayment credited to 2021 tax b. A corporation terminating as a subchapter s corporation during the year, or a corporation changing its annual accounting period, must annualize its north dakota taxable income and prorate.

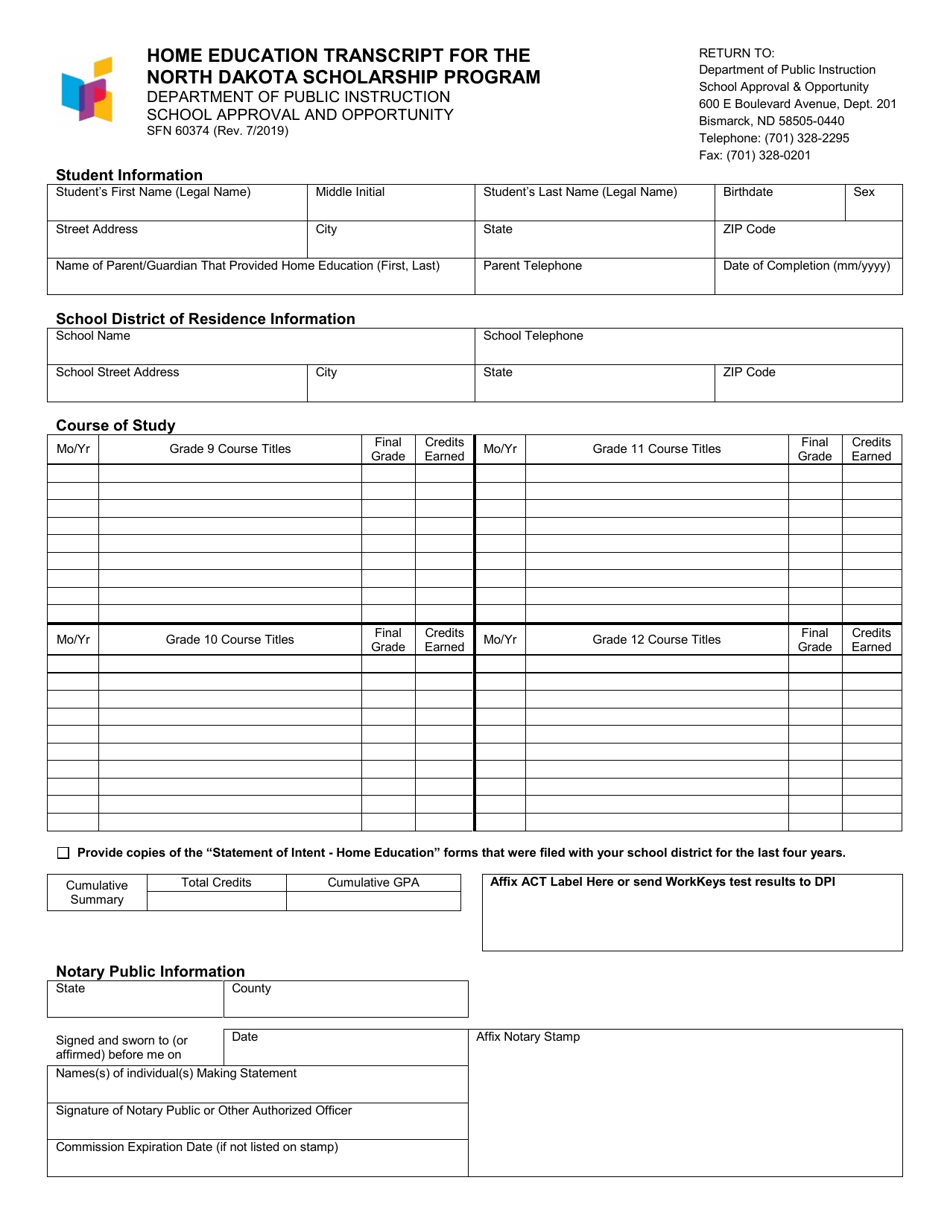

Form SFN60374 Download Fillable PDF or Fill Online Home Education

Special deductions (federal form 1120, line 29b) 3. Nd tourism tax forms, guidelines, and more are available at www.tax.nd.gov. To get started, download the forms and instructions files you need to prepare your 2022 north dakota income tax return. Make sure the software supports the forms you need to. Web a signed form 40 is required along with a minimum.

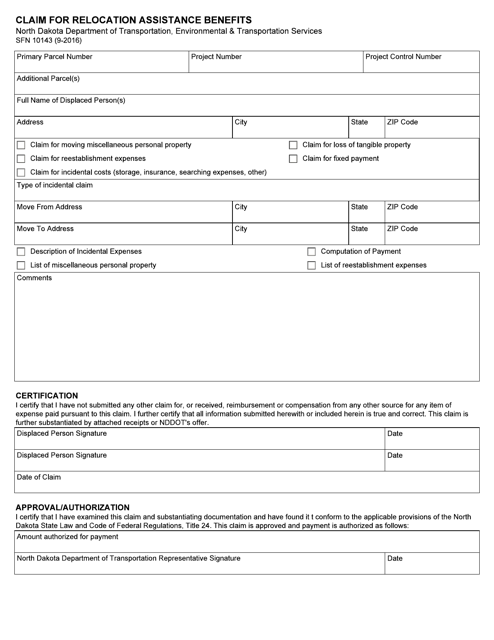

Form SFN10143 Download Fillable PDF or Fill Online Claim for Relocation

You can print other north dakota tax forms here. Web if the employee is single and married filing separately, or the employee is head of household and has claimed exemptions, apply the taxable income computed in step 5 to the following tables to determine the annual north dakota income tax withholding: D enter in columns a through d the installment.

Form 40 North Dakota Corporation Tax Booklet 2012 printable

Special deductions (federal form 1120, line 29b) 3. All income taxes, franchise or privilege taxes measured by income 4. Web north dakota disclosure form 40 instructions 2020. Interest on state and local obligations (excluding north dakota obligations) 5. Customize your document by using the toolbar on the top.

Fillable Form 40Es Estimated Tax Payment VoucherCorporation North

2020 overpayment credited to 2021 tax b. Interest on state and local obligations (excluding north dakota obligations) 5. Then, open adobe acrobat reader on your desktop or laptop computer. D enter in columns a through d the installment dates that correspond to the 15th day of the 4th, 6th and 9th months of the taxable year, and the first month.

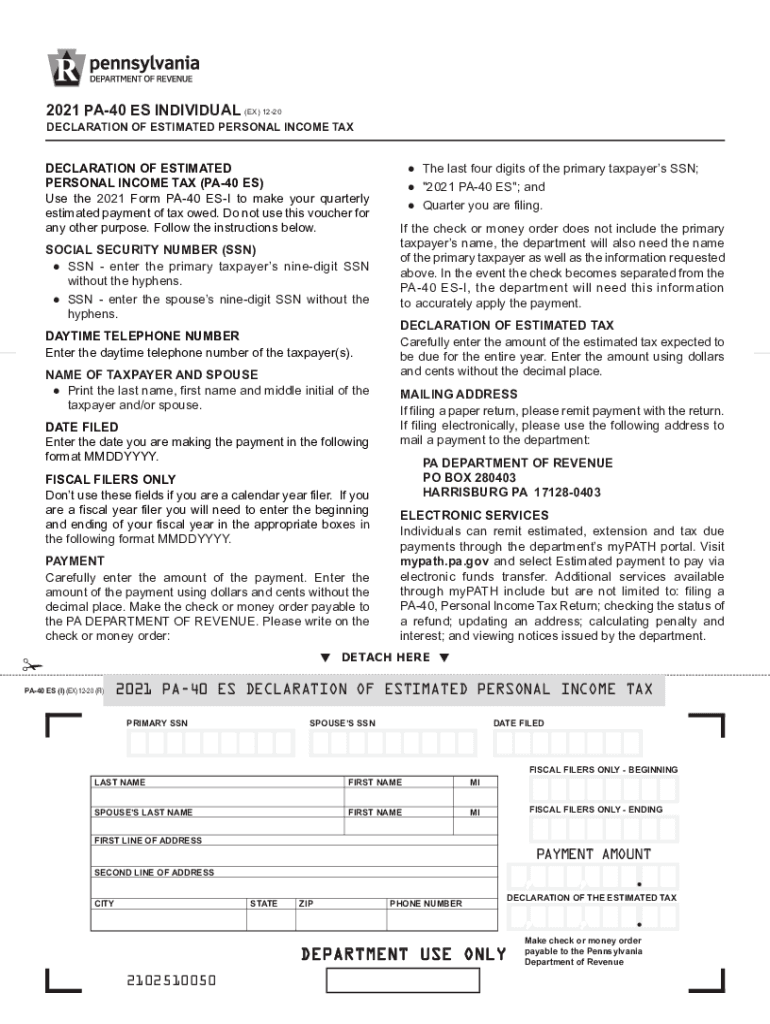

PA Form PA40 ES (I) 20212022 Fill out Tax Template Online US

Web north dakota disclosure form 40 instructions 2020. Web north dakota sources must file a north dakota corporation income tax return, form 40. Wait until north dakota form 40 instructions is appeared. To get started, download the forms and instructions files you need to prepare your 2022 north dakota income tax return. Web a signed form 40 is required along.

Download Past Year Versions Of This Tax Form As Pdfs Here:

An annual report must be completed on firststop and may be filed online with a credit card payment or it may be printed and mailed with a check, cashier's check, or money order payable to secretary of state. Web on the form prescribed by the secretary of state.the prescribed form is an online form found on firststop (firststop.sos.nd.gov). Web a signed form 40 is required along with a minimum of the first 6 pages of the federal 1120 and any relevant schedules. Customize the blanks with unique fillable fields.

You Can Print Other North Dakota Tax Forms Here.

Web how to edit and sign north dakota form 40 instructions online. Special deductions (federal form 1120, line 29b) 3. All income taxes, franchise or privilege taxes measured by income 4. Then, open adobe acrobat reader on your desktop or laptop computer.

A Corporation Terminating As A Subchapter S Corporation During The Year, Or A Corporation Changing Its Annual Accounting Period, Must Annualize Its North Dakota Taxable Income And Prorate Its State Tax Liability In The Same Manner As

Interest on state and local obligations (excluding north dakota obligations) 5. Engaged parties names, addresses and phone numbers etc. 2022 north dakota corporate income tax form 40 instructions photo credit: The return is due on april 15 of each year.

Fill In The Empty Fields;

Single or married filing separately tax withholding table Customize your document by using the toolbar on the top. Nd tourism tax forms, guidelines, and more are available at www.tax.nd.gov. D enter in columns a through d the installment dates that correspond to the 15th day of the 4th, 6th and 9th months of the taxable year, and the first month of the following year 5.