Notice Of Trust Florida Form

Notice Of Trust Florida Form - 736.0813 duty to inform and account.—. Web florida law requires a notice of trust to contain the following information: Web trust administration in florida refers to the duties and procedures by which a successor trustee a living trust carries going the footing of the trust document. Web 1) give notice to the qualified beneficiaries [3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the. (1) upon the death of a settlor of a trust described in s. Web this notice of trust is found in florida trust code 736.05055. (1) upon the death of a settlor of a trust described in s. Web (3) a trustee of any trust described in section 733.707(3), florida statutes, and each qualified beneficiary of the trust as defined in section 736.0103(16), florida statutes, if. You see, when one has a revocable trust, and they die, that revocable trust may have to pay: The trustee shall keep the qualified beneficiaries of the trust reasonably informed of the.

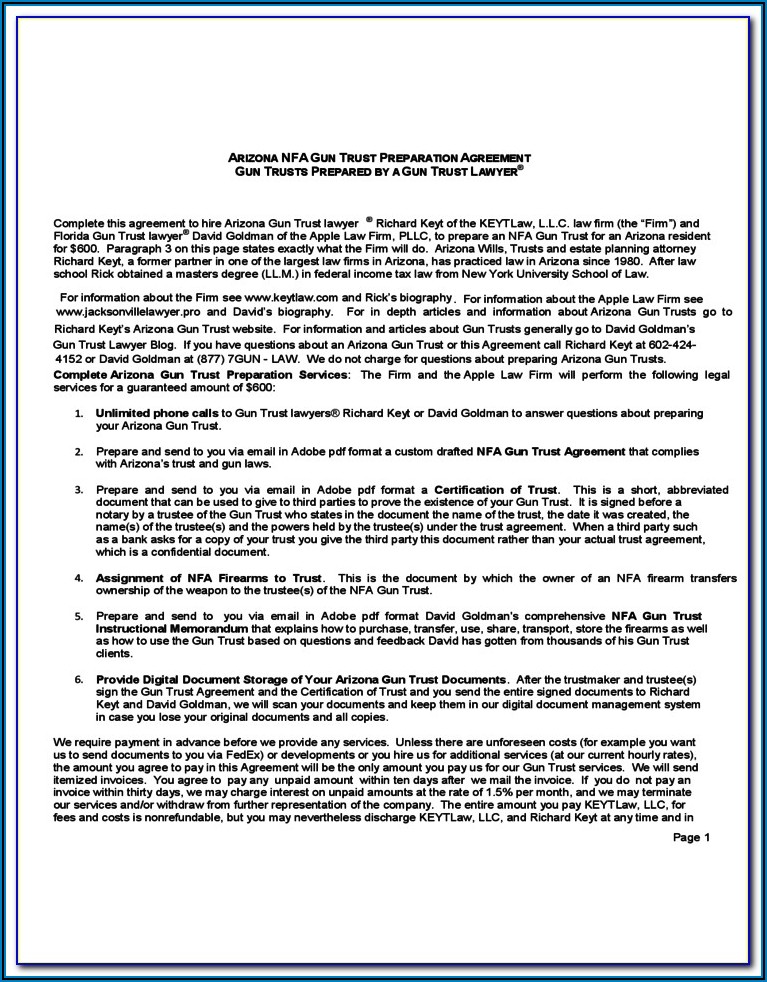

Web florida law requires a notice of trust to contain the following information: You see, when one has a revocable trust, and they die, that revocable trust may have to pay: Web updated june 01, 2022 a florida living trust allows a person (the grantor) to legally define the recipient (s) of their assets after they die. Web a notice of trust in florida must include the following information: Web 736.05055 notice of trust.—. Ad answer simple questions to make your legal documents. Web (3) a trustee of any trust described in section 733.707(3), florida statutes, and each qualified beneficiary of the trust as defined in section 736.0103(16), florida statutes, if. Get access to the largest online library of legal forms for any state. Web florida trust code view entire chapter 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. The trustee shall keep the qualified beneficiaries of the trust reasonably informed of the.

733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s. 736.0813 duty to inform and account.—. Web 1) give notice to the qualified beneficiaries [3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the. Web (3) a trustee of any trust described in section 733.707(3), florida statutes, and each qualified beneficiary of the trust as defined in section 736.0103(16), florida statutes, if. Web florida trust code view entire chapter 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. Ad answer simple questions to make your legal documents. Get access to the largest online library of legal forms for any state. Web trust administration in florida refers to the duties and procedures by which a successor trustee a living trust carries going the footing of the trust document. Web 736.05055 notice of trust.—. You see, when one has a revocable trust, and they die, that revocable trust may have to pay:

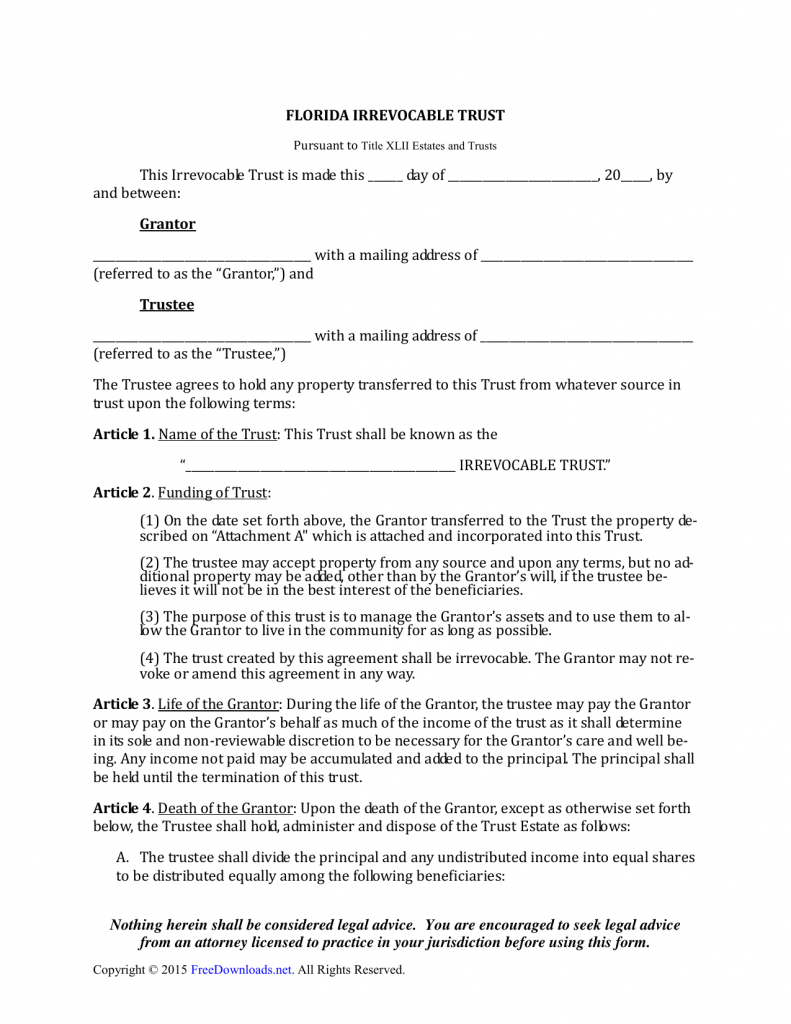

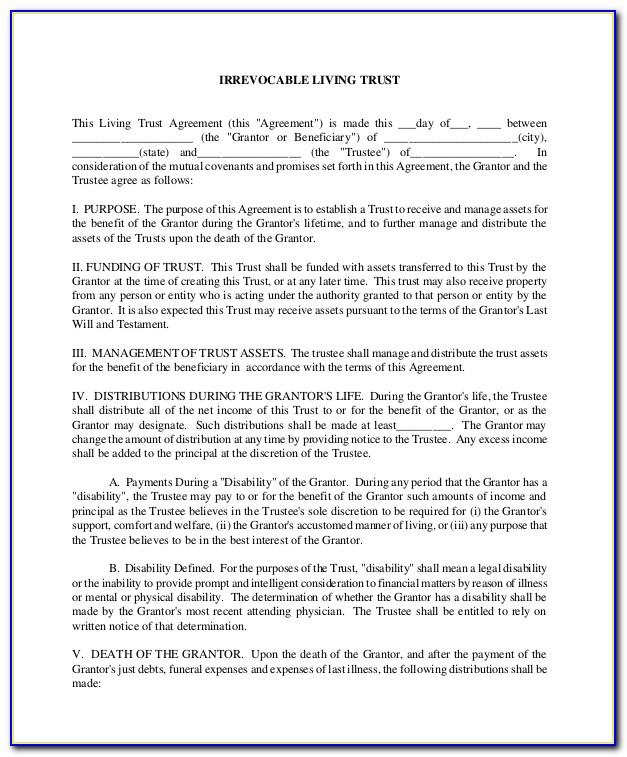

Download Florida Irrevocable Living Trust Form PDF RTF Word

The name of the trustor the trustor’s date of death the title of the trust in question the date of the. 736.0813 duty to inform and account.—. While operating similarly to a. Web florida trust code view entire chapter 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. 733.707 (3), the trustee.

Revocable Trust Form Florida

Web a revocable trust is a document (the “trust agreement”) created by you to manage your assets during your lifetime and distribute the remaining assets after your death. The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the. Web trust administration in florida refers to the duties.

What is a notice of trust in Florida? Richert Quarles

Web (3) a trustee of any trust described in section 733.707(3), florida statutes, and each qualified beneficiary of the trust as defined in section 736.0103(16), florida statutes, if. Web a revocable trust is a document (the “trust agreement”) created by you to manage your assets during your lifetime and distribute the remaining assets after your death. 736.0813 duty to inform.

Successor Trustee Form Florida Universal Network

(1) a trustee may resign in accordance with the. Web updated june 01, 2022 a florida living trust allows a person (the grantor) to legally define the recipient (s) of their assets after they die. Web florida trust code view entire chapter 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. Ad.

Free Revocable Living Trust Form Florida

736.0813 duty to inform and account.—. Get access to the largest online library of legal forms for any state. Web florida trust code view entire chapter 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. “an action for breach of trust based on matters disclosed in a trust accounting or other written.

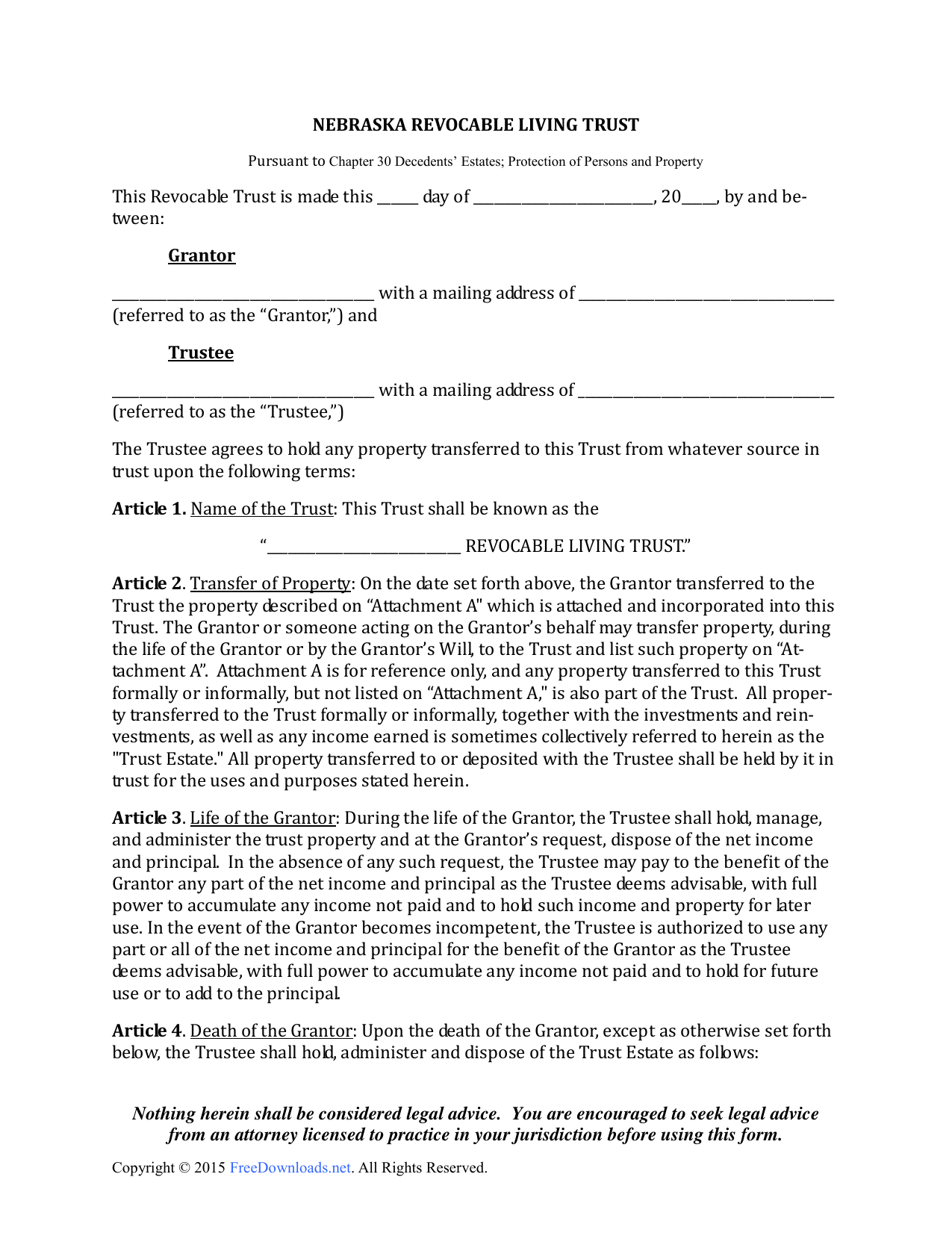

Download Nebraska Revocable Living Trust Form PDF RTF Word

Get access to the largest online library of legal forms for any state. The name of the trustor the trustor’s date of death the title of the trust in question the date of the. 733.707 (3), the trustee must file a notice of trust with. 733.707 (3), the trustee must file a notice of trust with the court of the.

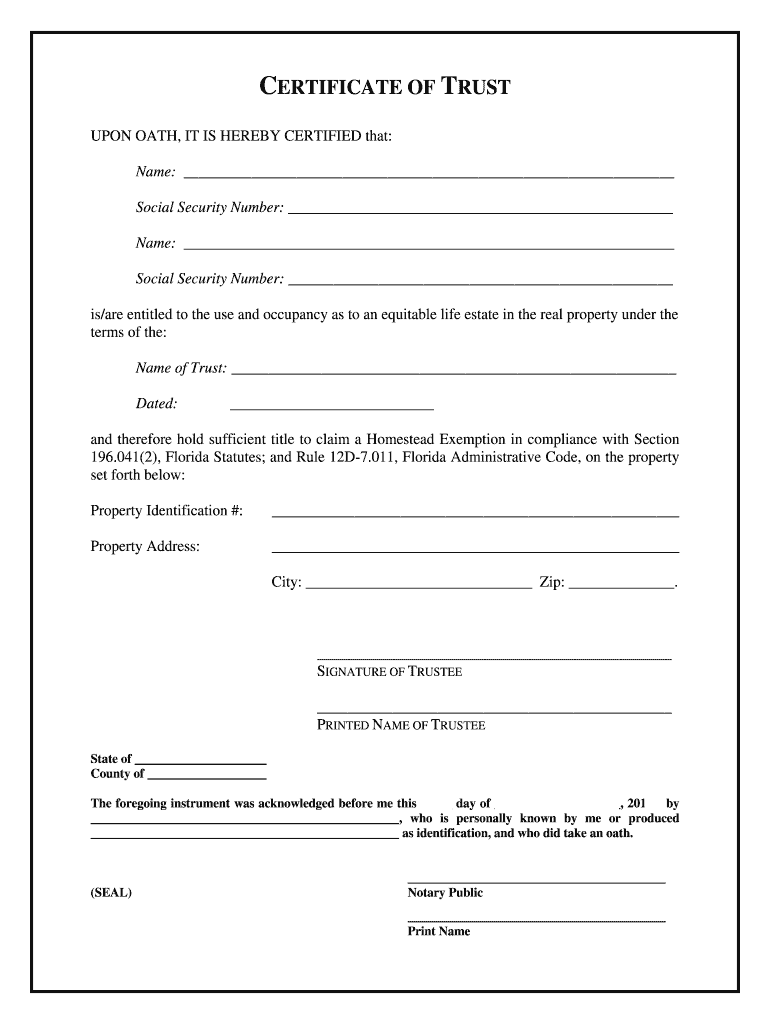

Certificate of Trust Form Fill Out and Sign Printable PDF Template

Web this form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to. (1) the name of the decedent, the file number of the estate, the designation and address of the court in which the proceedings are pending,. Ad answer simple.

Revocable Trust Form California

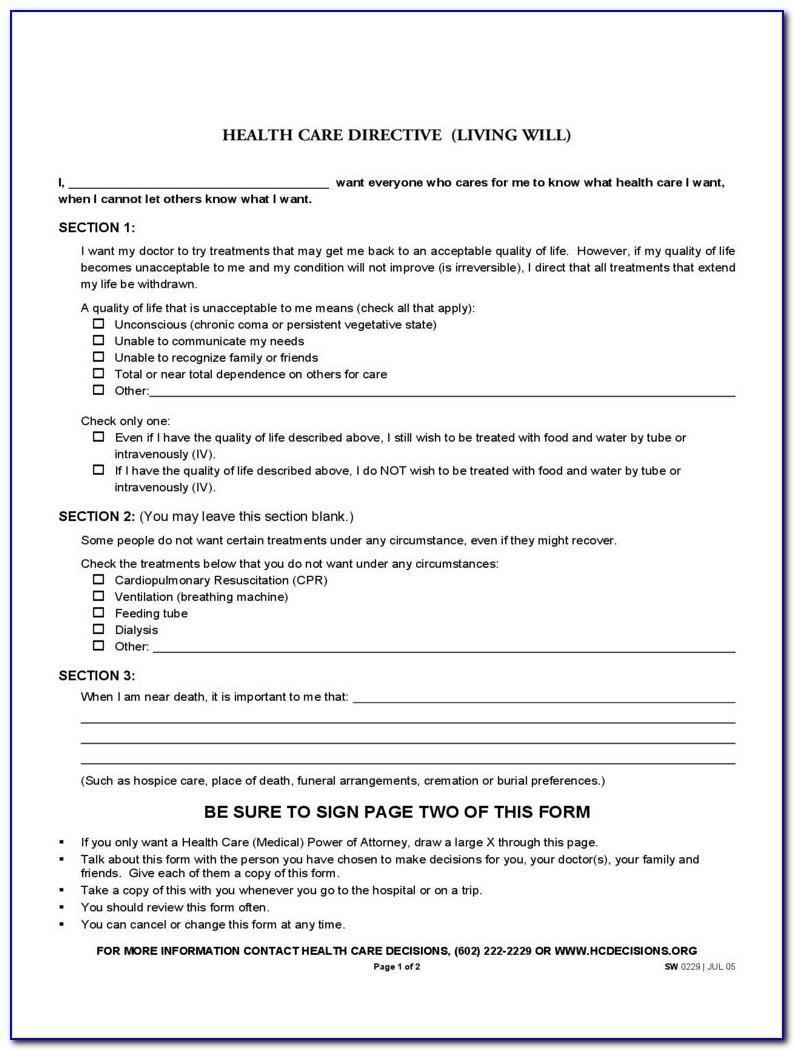

Web updated june 01, 2022 a florida living trust allows a person (the grantor) to legally define the recipient (s) of their assets after they die. Web trust administration in florida refers to the duties and procedures by which a successor trustee a living trust carries going the footing of the trust document. (1) upon the death of a settlor.

Qdot Trust Form Form Resume Examples MW9p0pM9AJ

(1) the name of the decedent, the file number of the estate, the designation and address of the court in which the proceedings are pending,. (1) upon the death of a settlor of a trust described in s. “an action for breach of trust based on matters disclosed in a trust accounting or other written report of the. Web a.

(1) A Trustee May Resign In Accordance With The.

Web a notice of trust in florida must include the following information: 733.707 (3), the trustee must file a notice of. Web the notice shall state: The name of the trustor the trustor’s date of death the title of the trust in question the date of the.

(1) The Name Of The Decedent, The File Number Of The Estate, The Designation And Address Of The Court In Which The Proceedings Are Pending,.

Web this form serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to. You see, when one has a revocable trust, and they die, that revocable trust may have to pay: Web florida law requires a notice of trust to contain the following information: 733.707 (3), the trustee must file a notice of trust with.

733.707 (3), The Trustee Must File A Notice Of Trust With The Court Of The County Of The Settlor’s.

Web a limitation notice may but is not required to be in the following form: Web trust administration in florida refers to the duties and procedures by which a successor trustee a living trust carries going the footing of the trust document. While operating similarly to a. Ad answer simple questions to make your legal documents.

(1) Upon The Death Of A Settlor Of A Trust Described In S.

The trustee shall keep the qualified beneficiaries of the trust reasonably informed of the. Web (3) a trustee of any trust described in section 733.707(3), florida statutes, and each qualified beneficiary of the trust as defined in section 736.0103(16), florida statutes, if. Web this notice of trust is found in florida trust code 736.05055. “an action for breach of trust based on matters disclosed in a trust accounting or other written report of the.