Nys Tax Exempt Form Hotel

Nys Tax Exempt Form Hotel - This form must be completed and submitted to the appropriate authorities. Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york. Web hotel or motel rooms in new york state exempt from sales tax using. Web local government and school district employees are exempt from paying state and local sales or use taxes on hotel occupancy purchased within new york state while on official. Web tax exempt form new york hotel anita march 31, 2022 exempt form no comments what does tax exempt mean? Fillable pdf for nys fillable pdf for cuny: Web exempt from hotel room occupancy tax. Web yes do i need a form? Web hotels motels inns bed and breakfast establishments ski lodges apartment hotels certain bungalows, condos, cottages, and cabins (see bungalow rentals below). Web new york state department of taxation and finance.

Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york. Web how to apply. This form must be completed and submitted to the appropriate authorities. Submit the required documentation described in the instructions for form st. Web • tax law sections that provide the exemption; Web yes do i need a form? Web new york state department of taxation and finance. It should be printed and given to the company if needed. Web hotels motels inns bed and breakfast establishments ski lodges apartment hotels certain bungalows, condos, cottages, and cabins (see bungalow rentals below). Web if you are on official new york state or federal government business and staying in a hotel or motel:

The room remarketer will still be responsible for collecting and remitting the hotel room occupancy tax on the sale to the occupant. Web this form can be used to show your tax exempt status for car rentals or anything else, except for hotels. Web new york state department of taxation and finance. Web yes do i need a form? Exemption certificate for the purchase of a racehorse:. Complete all information requested in the box above. Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york. Web hotel or motel rooms in new york state exempt from sales tax using. Prior year social security and medicare tax refund certification: Submit the required documentation described in the instructions for form st.

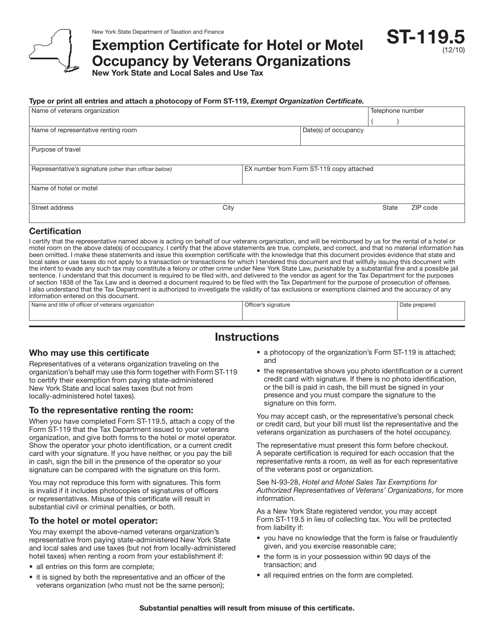

Form ST119.5 Download Fillable PDF or Fill Online Exemption

We specialize in travel, government. Prior year social security and medicare tax refund certification: Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york. Web hotels motels inns bed and breakfast establishments ski lodges apartment hotels certain bungalows, condos, cottages, and cabins (see bungalow rentals below). Web.

Gallery of Nys Tax Exempt form Hotel Inspirational News In Our City the

Web local government and school district employees are exempt from paying state and local sales or use taxes on hotel occupancy purchased within new york state while on official. Web • tax law sections that provide the exemption; Complete all information requested in the box above. The room remarketer will still be responsible for collecting and remitting the hotel room.

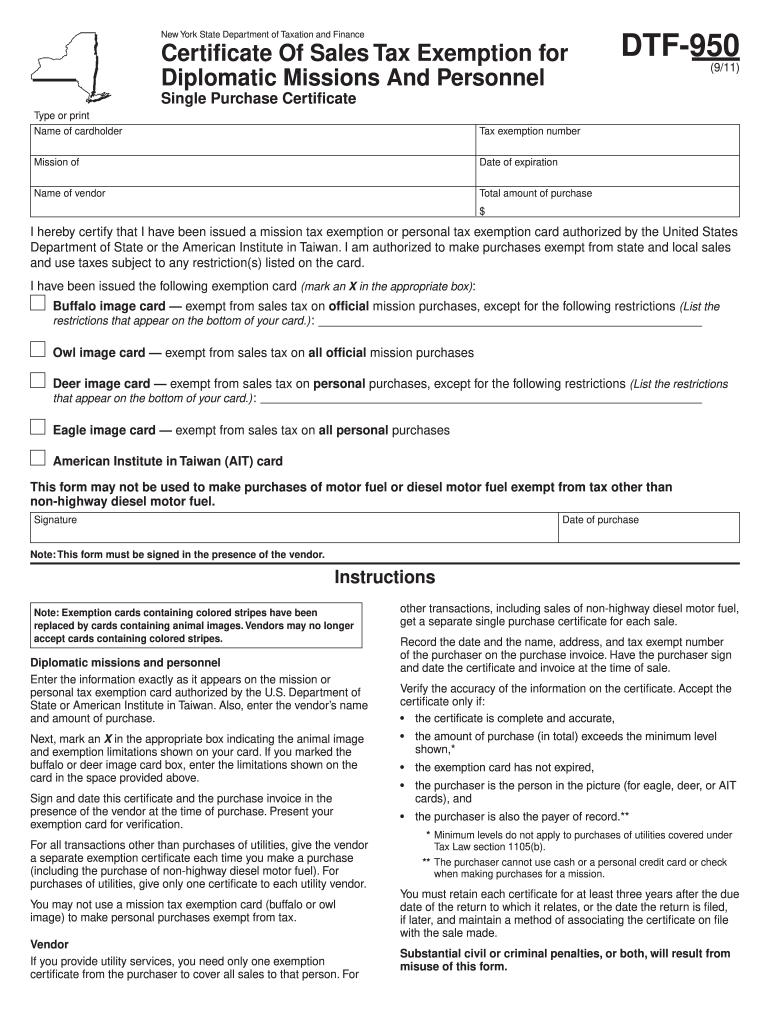

NY DTF950 20112022 Fill out Tax Template Online US Legal Forms

Submit the required documentation described in the instructions for form st. Fillable pdf for nys fillable pdf for cuny: Web • tax law sections that provide the exemption; Complete all information requested in the box above. Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york.

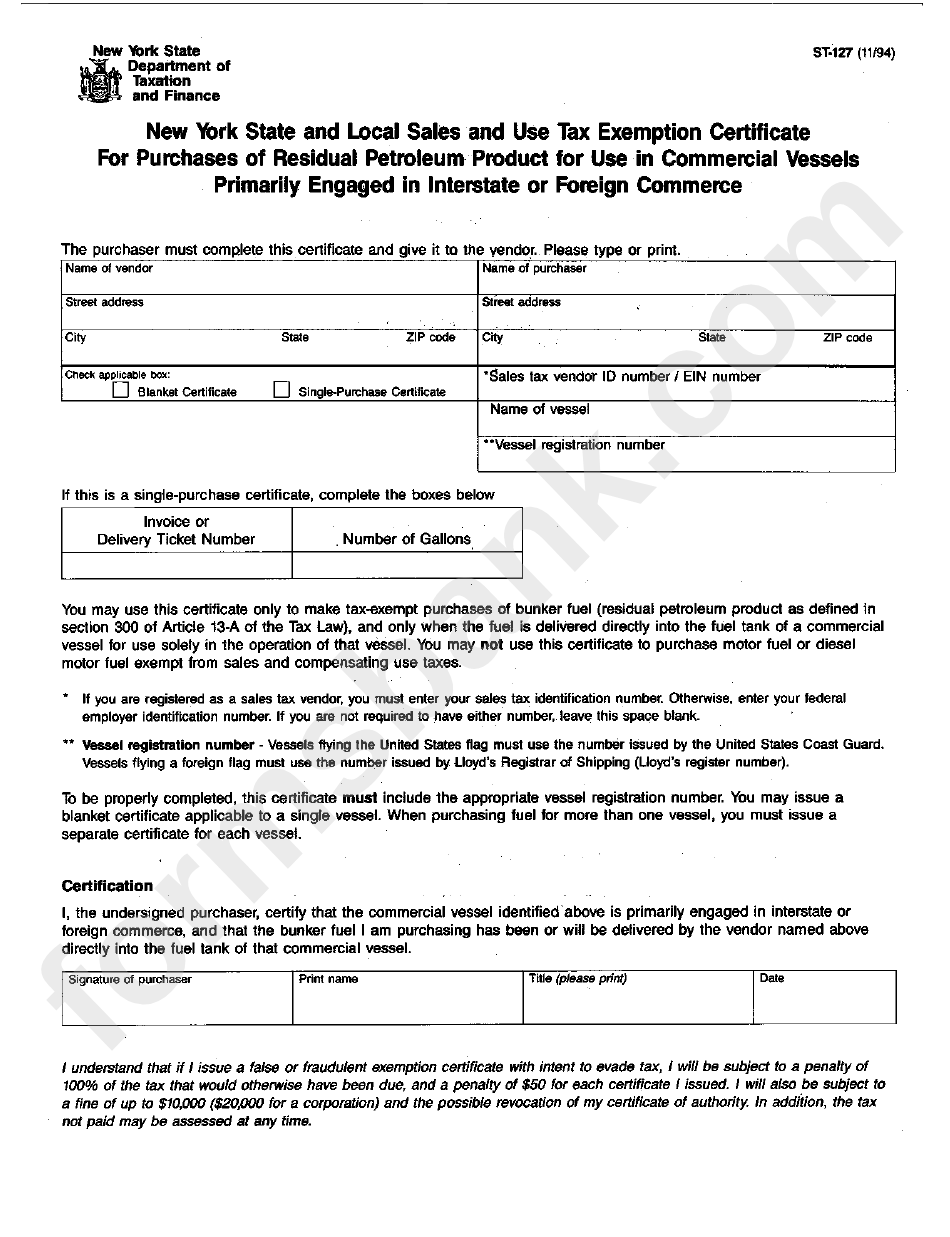

Form St127 New York State And Local Sales And Use Tax Exemption

Submit the required documentation described in the instructions for form st. Web yes do i need a form? Web how to apply. Web • tax law sections that provide the exemption; It should be printed and given to the company if needed.

St 119 1 new york state blank form Fill out & sign online DocHub

Submit the required documentation described in the instructions for form st. Web hotel or motel rooms in new york state exempt from sales tax using. Prior year social security and medicare tax refund certification: We specialize in travel, government. Web hotels motels inns bed and breakfast establishments ski lodges apartment hotels certain bungalows, condos, cottages, and cabins (see bungalow rentals.

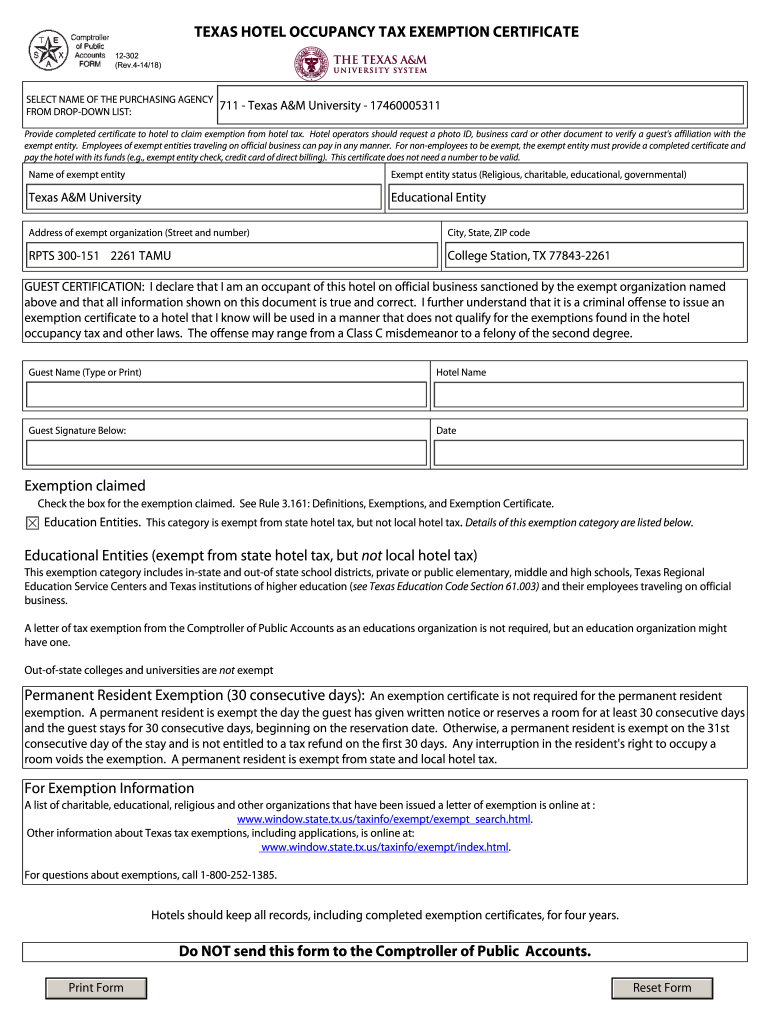

Texas hotel tax exempt form 2014 Fill out & sign online DocHub

New york state and local sales and use tax. We specialize in travel, government. Web new york state department of taxation and finance. The room remarketer will still be responsible for collecting and remitting the hotel room occupancy tax on the sale to the occupant. Web • tax law sections that provide the exemption;

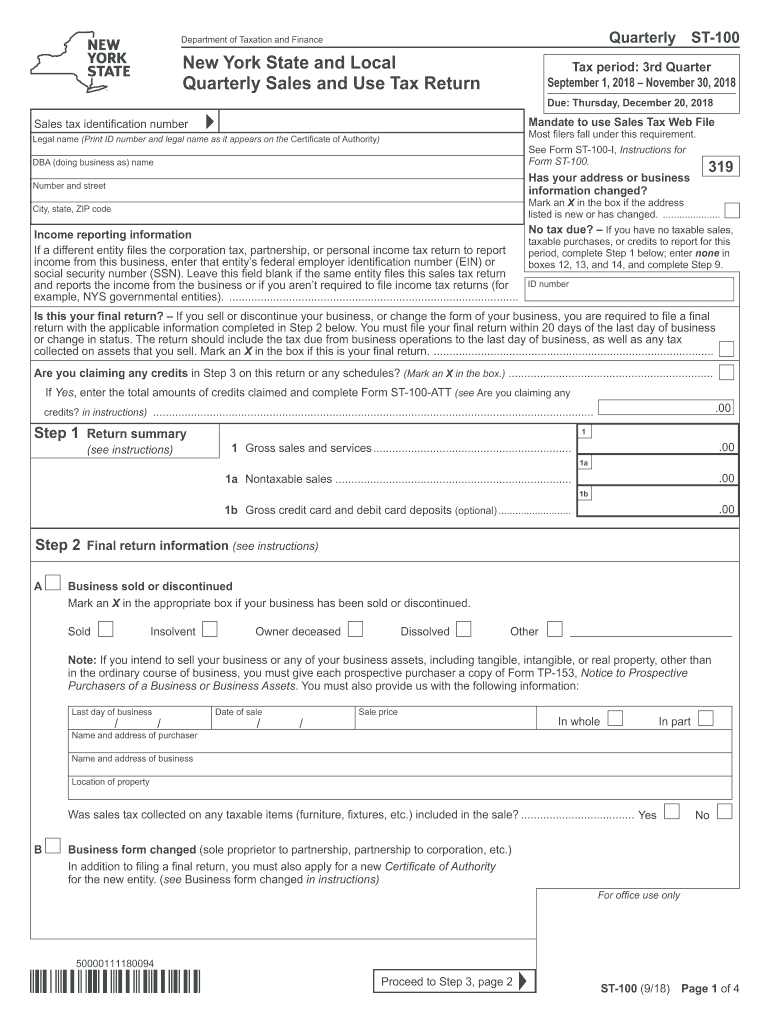

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

Web how to apply. Web new york state department of taxation and finance. Web • tax law sections that provide the exemption; Fillable pdf for nys fillable pdf for cuny: Web tax exempt form new york hotel anita march 31, 2022 exempt form no comments what does tax exempt mean?

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

Web tax exempt form new york hotel anita march 31, 2022 exempt form no comments what does tax exempt mean? Web yes do i need a form? Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york. Web hotel or motel rooms in new york state exempt.

Chicago Hotel Tax Exempt 26 Creative Wedding Ideas & Wedding

This form must be completed and submitted to the appropriate authorities. Web exempt from hotel room occupancy tax. New york state and local sales and use tax. Web hotel or motel rooms in new york state exempt from sales tax using. Fillable pdf for nys fillable pdf for cuny:

Nys tax exempt form hotel Fill out & sign online DocHub

New york state and local sales and use tax. Submit the required documentation described in the instructions for form st. Web hotels motels inns bed and breakfast establishments ski lodges apartment hotels certain bungalows, condos, cottages, and cabins (see bungalow rentals below). Web • tax law sections that provide the exemption; Web if you are on official new york state.

Web Hotels Motels Inns Bed And Breakfast Establishments Ski Lodges Apartment Hotels Certain Bungalows, Condos, Cottages, And Cabins (See Bungalow Rentals Below).

Web • tax law sections that provide the exemption; New york state and local sales and use tax. Submit the required documentation described in the instructions for form st. Web hotel or motel rooms in new york state exempt from sales tax using.

Web Local Government And School District Employees Are Exempt From Paying State And Local Sales Or Use Taxes On Hotel Occupancy Purchased Within New York State While On Official.

Web new york state department of taxation and finance. Prior year social security and medicare tax refund certification: It should be printed and given to the company if needed. Fillable pdf for nys fillable pdf for cuny:

We Specialize In Travel, Government.

Web the new york hotel tax exempt form is used to apply for a hotel tax exemption in the state of new york. Exemption certificate for the purchase of a racehorse:. Web 25 rows instructions on form: Web yes do i need a form?

This Form Must Be Completed And Submitted To The Appropriate Authorities.

Web exempt from hotel room occupancy tax. Web if you are on official new york state or federal government business and staying in a hotel or motel: Web this form can be used to show your tax exempt status for car rentals or anything else, except for hotels. The room remarketer will still be responsible for collecting and remitting the hotel room occupancy tax on the sale to the occupant.