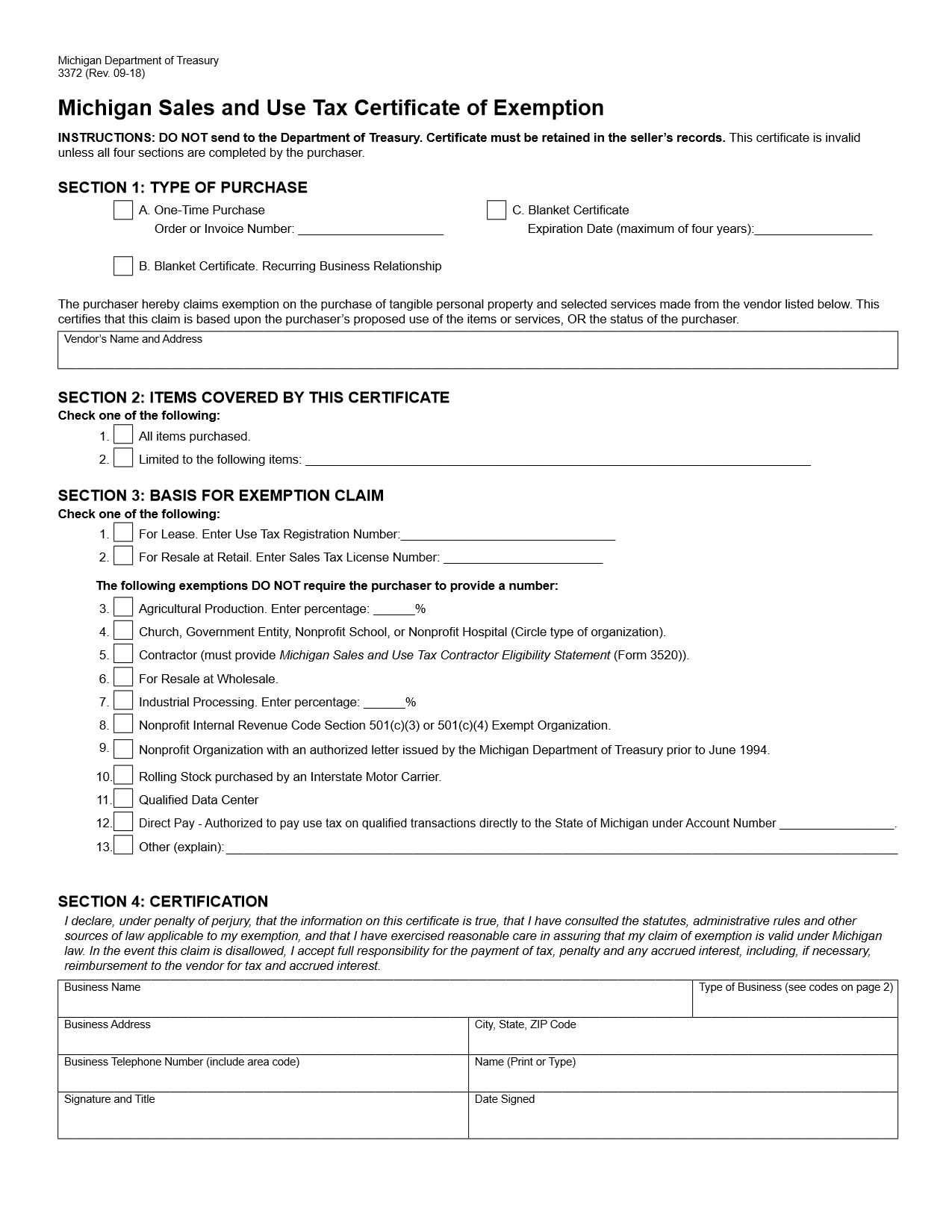

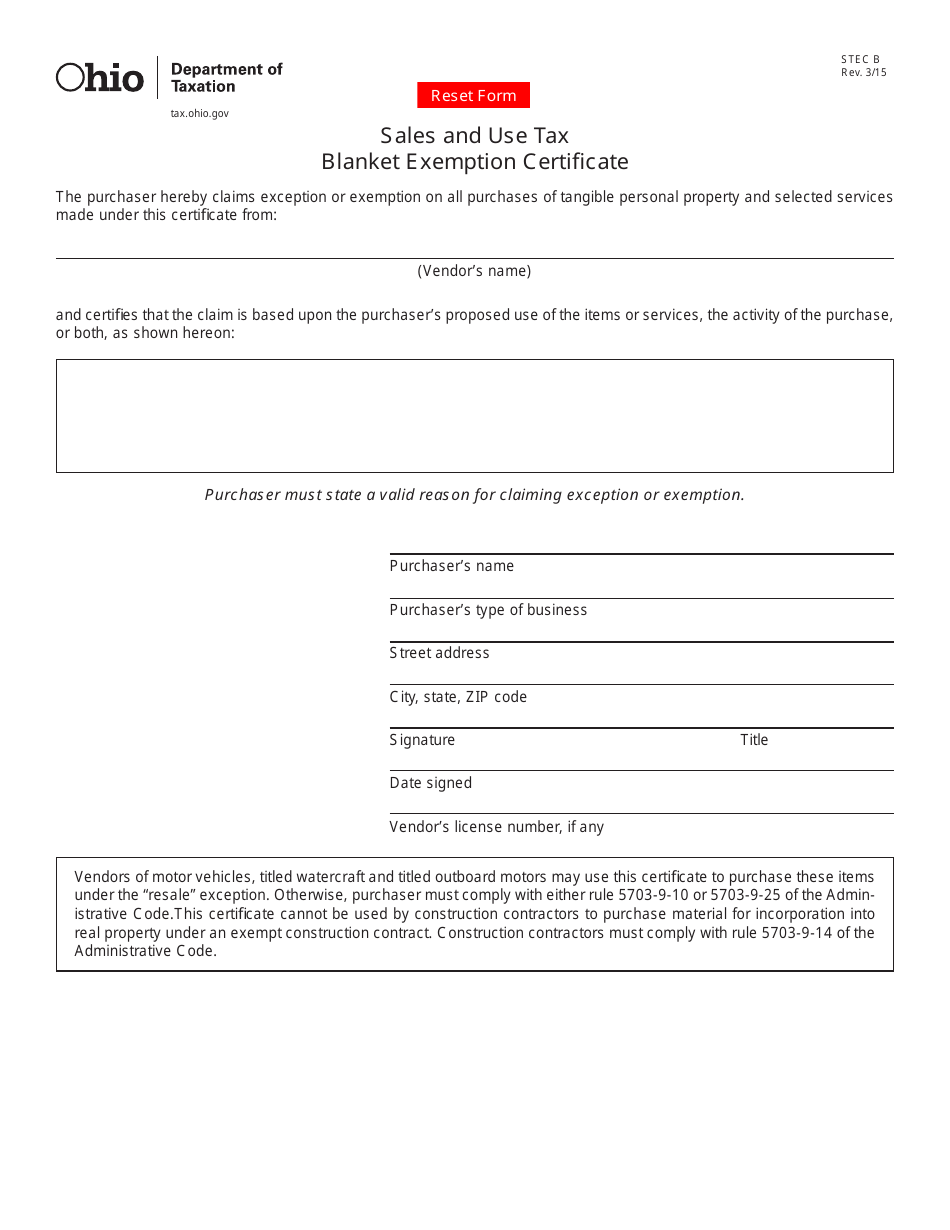

Ohio Blanket Tax Exemption Form

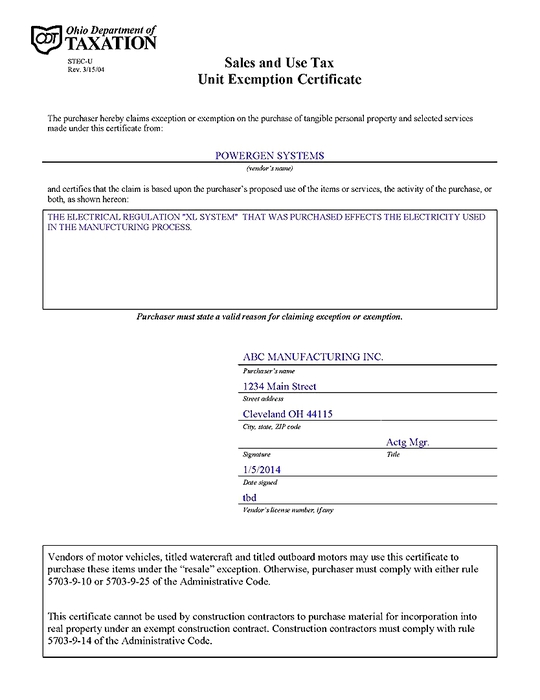

Ohio Blanket Tax Exemption Form - Complete the form as follows: Can help confirm the transaction is not subject to sales tax in a time where the vendor may be. Enter the related invoice/purchase order # a.purchaser's name 5. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web ncaa ohio state buckeyes 46''x60'' leadership micro throw blanket. This exemption certificate is used to claim exemption or exception on a single purchase. Web blanket tax exemption form. Use the yellow download button to access. Web ohio adds exemptions for child and baby products effective october 1, 2023. Web ohio blanket tax exempt and unit exemption certificates the contractor may use a blanket exemption certificate, which covers all purchases from that vendor unless.

Web ohio blanket tax exempt and unit exemption certificates the contractor may use a blanket exemption certificate, which covers all purchases from that vendor unless. Enter the id number as required in the. Ohio has a state income tax that ranges between 2.85% and 4.797%. Web however, a sales and use tax blanket exemption certificate. Web ohio adds exemptions for child and baby products effective october 1, 2023. Web blanket tax exemption form. Can help confirm the transaction is not subject to sales tax in a time where the vendor may be. Enter the related invoice/purchase order # a.purchaser's name 5. Check if this certificate is for a single purchase. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.

Use the yellow download button to access. Access the forms you need to file taxes or do business in ohio. On july 4th, ohio signed a new budget bill that includes several changes to the state’s. This exemption certificate is used to claim exemption or exception on a single purchase. 4.8 out of 5 stars 141. Web ohio blanket tax exempt and unit exemption certificates the contractor may use a blanket exemption certificate, which covers all purchases from that vendor unless. Web ncaa ohio state buckeyes 46''x60'' leadership micro throw blanket. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Can help confirm the transaction is not subject to sales tax in a time where the vendor may be. Web up to $40 cash back related to ohio department of taxation sales and use tax blanket exemption certificate ohio sales tax exemption form stec b rev.

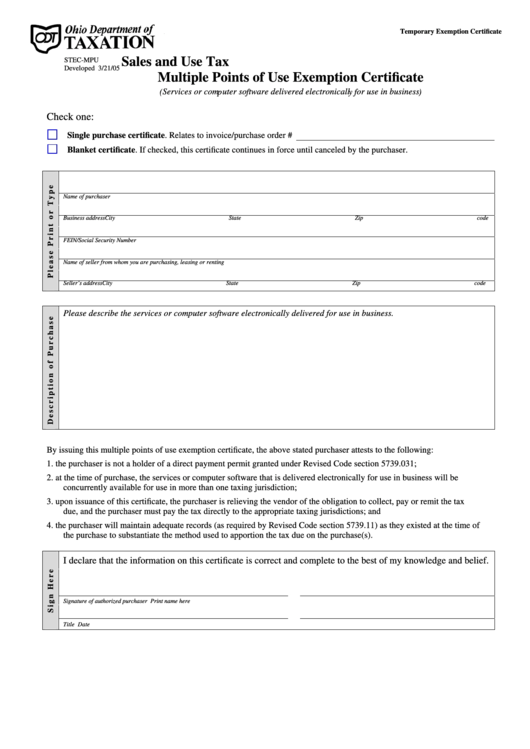

Form StecMpu 2005 Sales And Use Tax Multiple Points Of Use

Web up to $40 cash back related to ohio department of taxation sales and use tax blanket exemption certificate ohio sales tax exemption form stec b rev. Web send ohio department of taxation sales and use tax exemption certificate forms via email, link, or fax. Access the forms you need to file taxes or do business in ohio. Web this.

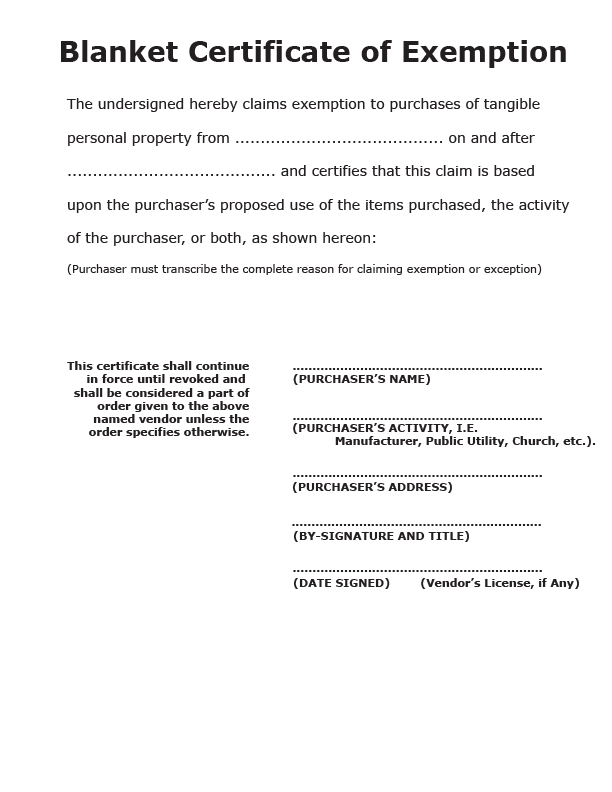

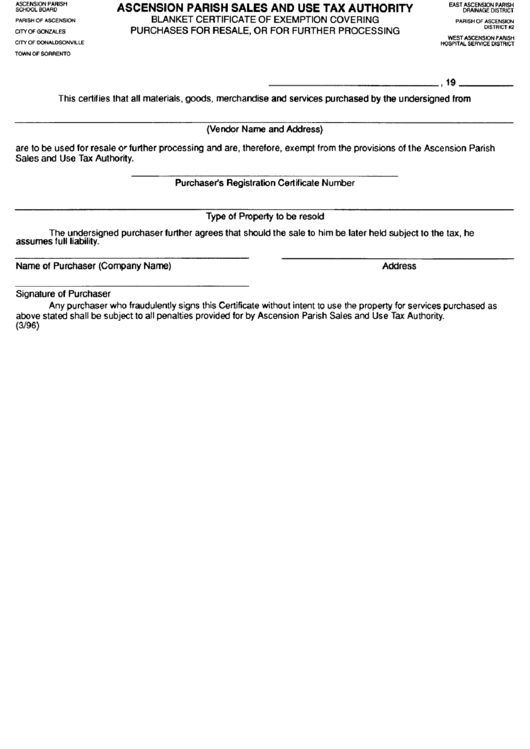

blanket certificate of exemption ohio Fill Online, Printable, Fillable

The ohio department of taxation provides a searchable repository of individual tax. Web oh sales tax blanket exemption form. Oh sales tax blanket exemption form in order to be exempt from sales tax, an employee must be able to make sales. 4.8 out of 5 stars 141. This exemption certificate is used to claim exemption or exception on a single.

Ohio Tax Exempt

Access the forms you need to file taxes or do business in ohio. Enter the id number as required in the. Web real property under an exempt construction contract. Check if this certificate is for a single purchase. Usage by an agency of the state of ohio government miami university 107 roudebush hall higher education oxford, oh 45056 tax &.

How to Fill Out Blanket Sales Tax Exemption Certificate Form Fill Out

4.8 out of 5 stars 141. Web this certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. Web real property under an exempt construction contract. Enter the id number as required in the. The ohio department of taxation provides a searchable repository of individual tax.

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Access the forms you need to file taxes or do business in ohio. Web up to $40 cash back related to ohio department of taxation sales and use tax blanket exemption certificate ohio sales tax exemption form stec b rev. You can also download it, export it or print it out. A sales tax exemption certificate can be used by.

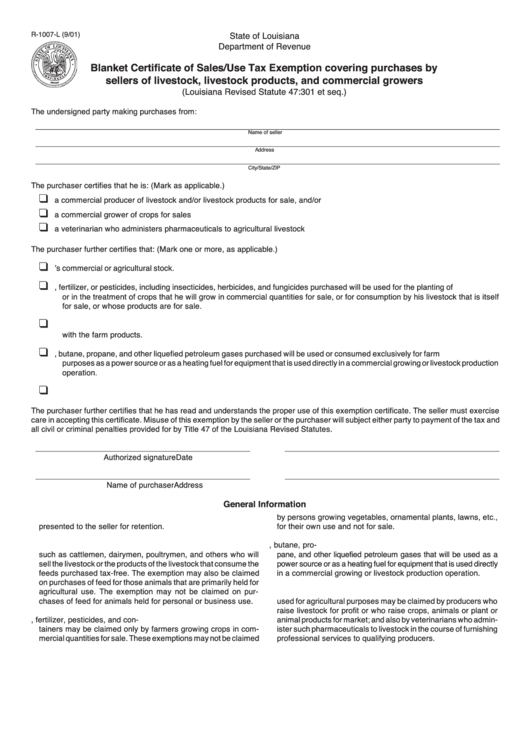

Fillable Form R1007L Blanket Certificate Of Sales/use Tax Exemption

Complete the form as follows: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. This exemption certificate is used to claim exemption or exception on a single purchase. Web send ohio department of taxation sales and use tax exemption certificate forms via email, link, or fax. Web.

2008 Form TX Comptroller AP209 Fill Online, Printable, Fillable, Blank

Access the forms you need to file taxes or do business in ohio. You can also download it, export it or print it out. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web ohio adds exemptions for child and baby products effective october 1, 2023. On.

Top 58 Louisiana Tax Exempt Form Templates free to download in PDF format

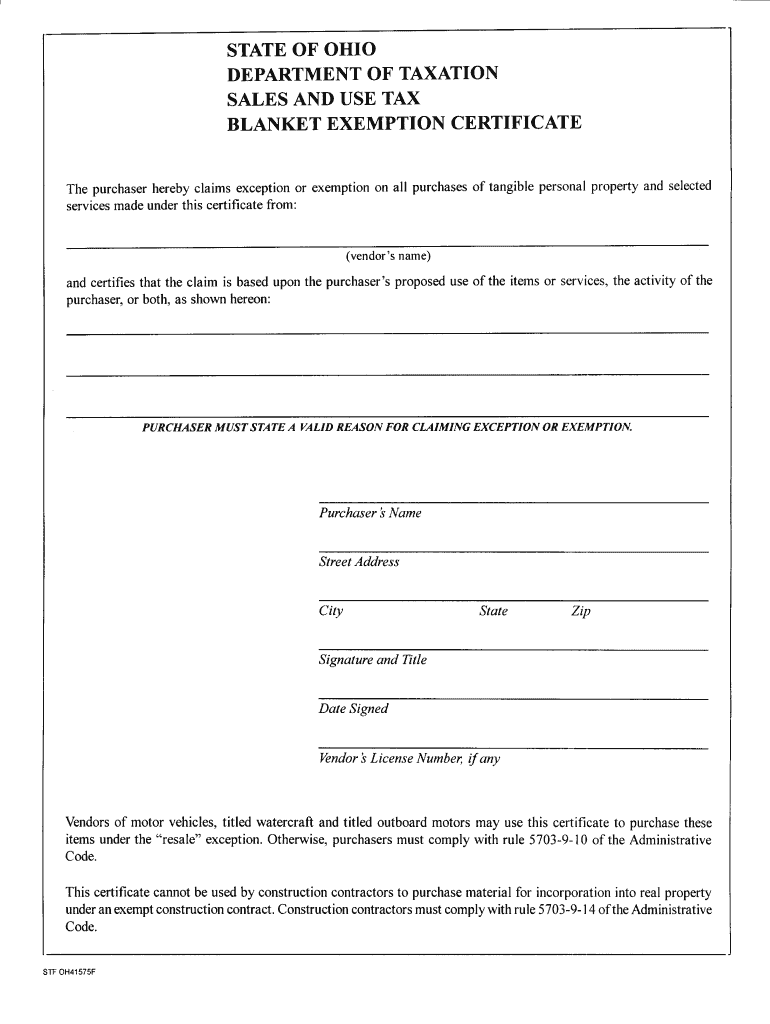

Web however, a sales and use tax blanket exemption certificate. Web up to $40 cash back state of ohio department of taxation sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption. Ohio has a state income tax that ranges between 2.85% and 4.797%. Enter the id number as required in the. You can also download.

Ohio Sales Tax Blanket Exemption Form 2021

3/15/04 sales and use tax blanket exemption certificate. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Can help confirm the transaction is not subject to sales tax in a time where the vendor may be. On july 4th, ohio signed a new budget bill that includes.

POWERGEN ENERGY CONSERVATION SYSTEMS REDUCE ENERGY COST BY 9 TO 12

4.8 out of 5 stars 141. Web blanket tax exemption form. Construction contractors must comply with rule. This exemption certificate is used to claim exemption or exception on a single purchase. Web oh sales tax blanket exemption form.

Enter The Id Number As Required In The.

Web up to $40 cash back state of ohio department of taxation sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption. 3/15/04 sales and use tax blanket exemption certificate. Web blanket tax exemption form. 4.8 out of 5 stars 141.

This Exemption Certificate Is Used To Claim Exemption Or Exception On A Single Purchase.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. On july 4th, ohio signed a new budget bill that includes several changes to the state’s. Construction contractors must comply with rule. Web up to $40 cash back related to ohio department of taxation sales and use tax blanket exemption certificate ohio sales tax exemption form stec b rev.

Web Ohio Adds Exemptions For Child And Baby Products Effective October 1, 2023.

Check if this certificate is for a single purchase. Web ohio blanket tax exempt and unit exemption certificates the contractor may use a blanket exemption certificate, which covers all purchases from that vendor unless. You can also download it, export it or print it out. Web send ohio department of taxation sales and use tax exemption certificate forms via email, link, or fax.

Use The Yellow Download Button To Access.

Complete the form as follows: Oh sales tax blanket exemption form in order to be exempt from sales tax, an employee must be able to make sales. Web this certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. Web real property under an exempt construction contract.