Ohio Military Tax Exemption Form

Ohio Military Tax Exemption Form - Web general exemption certificate forms 1. Web 1 are members of the armed services exempt from sales or use tax? Web this new law allows a civilian spouse to be exempt from withholding for ohio income tax purposes if their state of residency is not ohio. For every $1.00 of income over. This form is for income earned in tax year 2022, with tax returns due in april. Web in order to qualify for the exemption, you must be a veteran of the armed forces of the united states, including reserve components thereof, or of the national guard, who has. Web we last updated ohio form it mil sp in january 2022 from the ohio department of taxation. The exemption, the military member must complete. United states tax exemption form. Web type in your search keywords and hit enter to submit or escape to close

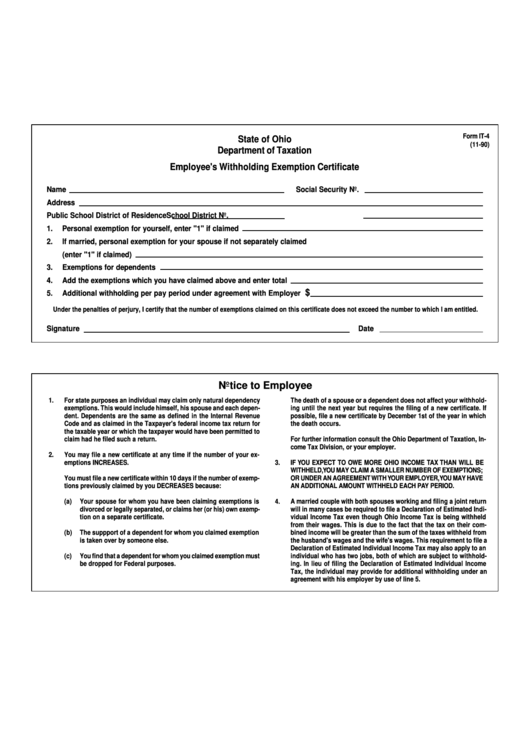

Web this new law allows a civilian spouse to be exempt from withholding for ohio income tax purposes if their state of residency is not ohio. Web a servicemember who is exempt from ohio income tax under federal law should request an exemption from ohio withholding by submitting ohio form it4 to his/her employer. We last updated the military employee withholding. Web general exemption certificate forms 1. For every $1.00 of income over. Up to $15,000 of military basic pay received during the taxable year may be exempted from virginia income tax. The ohio department of taxation provides a searchable repository of individual tax forms for. Web type in your search keywords and hit enter to submit or escape to close The exemption, the military member must complete. Web we last updated ohio form it mil sp in january 2022 from the ohio department of taxation.

This exemption certificate is used to claim exemption or exception on a single purchase. For every $1.00 of income over. Web 1 are members of the armed services exempt from sales or use tax? Web this new law allows a civilian spouse to be exempt from withholding for ohio income tax purposes if their state of residency is not ohio. United states tax exemption form. Web general exemption certificate forms 1. Web type in your search keywords and hit enter to submit or escape to close You must be serving or have served in one of the following organizations to be eligible for military tax benefits. Web in order to qualify for the exemption, you must be a veteran of the armed forces of the united states, including reserve components thereof, or of the national guard, who has. 2 is there a tax exemption on a vehicle purchase for a disabled veteran?

Ohio Tax Exempt Form Fill and Sign Printable Template Online US

Up to $15,000 of military basic pay received during the taxable year may be exempted from virginia income tax. The exemption, the military member must complete. Web eligibility for military tax benefits. Web this new law allows a civilian spouse to be exempt from withholding for ohio income tax purposes if their state of residency is not ohio. Web type.

FREE 10+ Sample Tax Exemption Forms in PDF

Web ohio income tax exemption for military survivor benefit plan (sbp)/ reserve component survivor benefit plan (rcsbp)/ retired serviceman’s family protection plan (rsfpp):. Web general exemption certificate forms 1. Web applying in 2023 (excluding disability income). Web a servicemember who is exempt from ohio income tax under federal law should request an exemption from ohio withholding by submitting ohio form.

How to get an Exemption Certificate in Pennsylvania

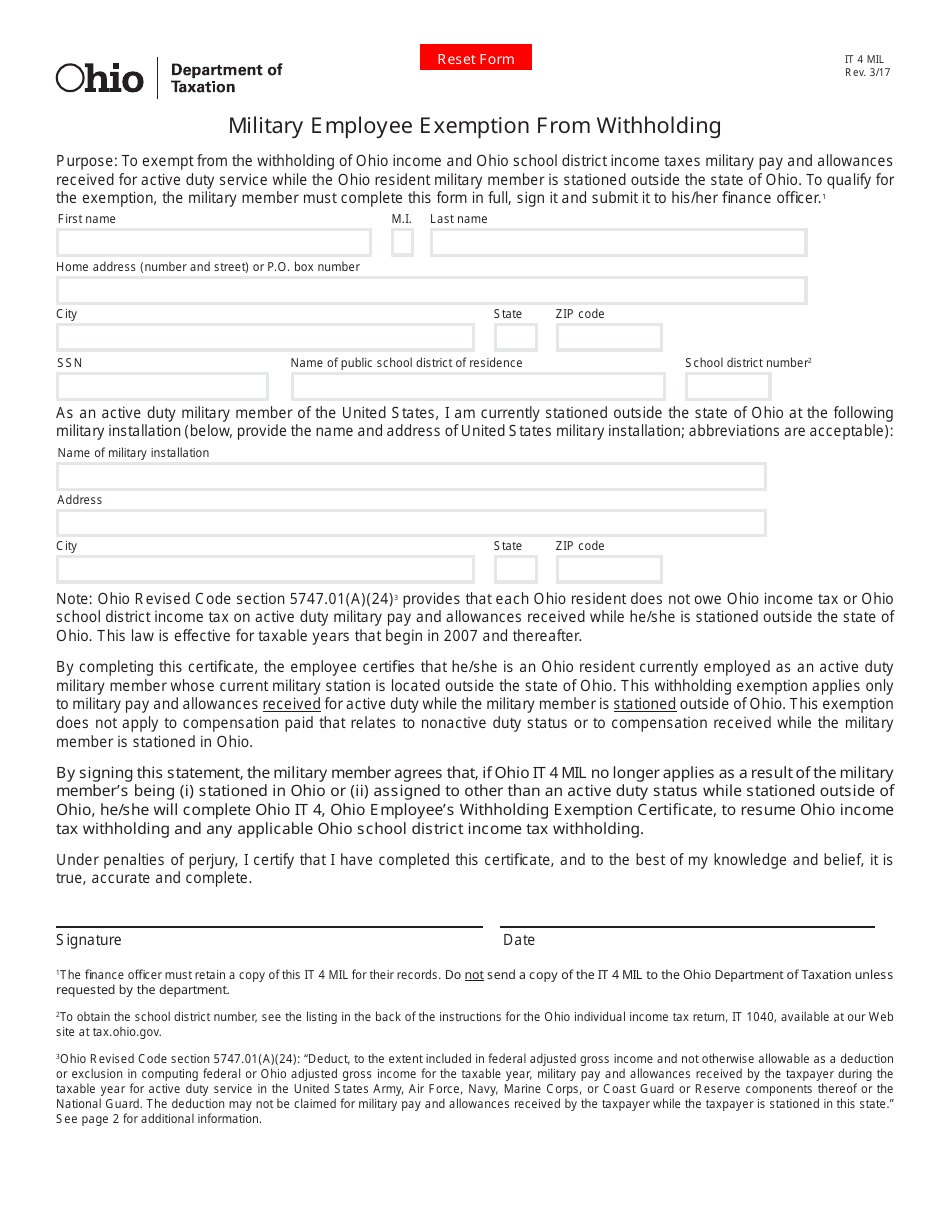

Web ohio income tax exemption for military survivor benefit plan (sbp)/ reserve component survivor benefit plan (rcsbp)/ retired serviceman’s family protection plan (rsfpp):. For every $1.00 of income over. Web received for active duty service while the ohio resident military member is stationed outside the state of ohio. Web tax exemptions when you use your government travel charge card (gtcc).

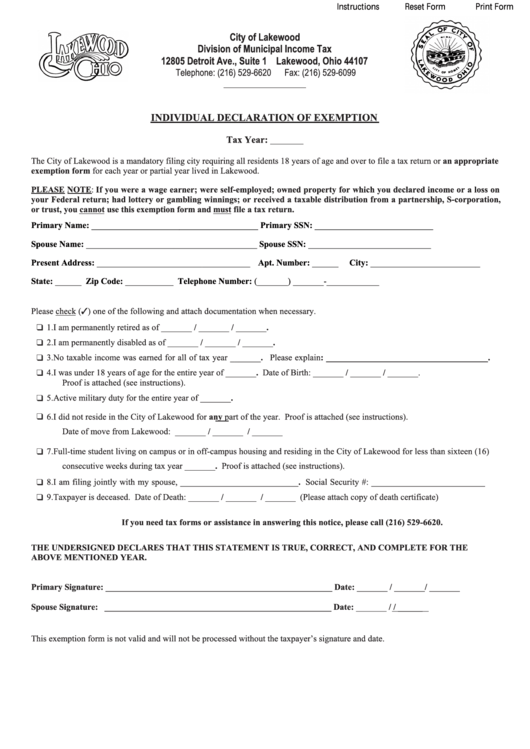

Fillable Individual Declaration Of Exemption Form Ohio printable pdf

Web applying in 2023 (excluding disability income). Please be advised that this form asks spouses to provide a copy of their. Web received for active duty service while the ohio resident military member is stationed outside the state of ohio. Web the it 4 mil is now the it 4; Web general exemption certificate forms 1.

Ohio Department Of Taxation Tax Exempt Form TAXF

The exemption, the military member must complete. This exemption certificate is used to claim exemption or exception on a single purchase. Web 1 are members of the armed services exempt from sales or use tax? Web to qualify for the exemption, the military member must complete this form in full, sign it and submit it to his/her finance officer. Web.

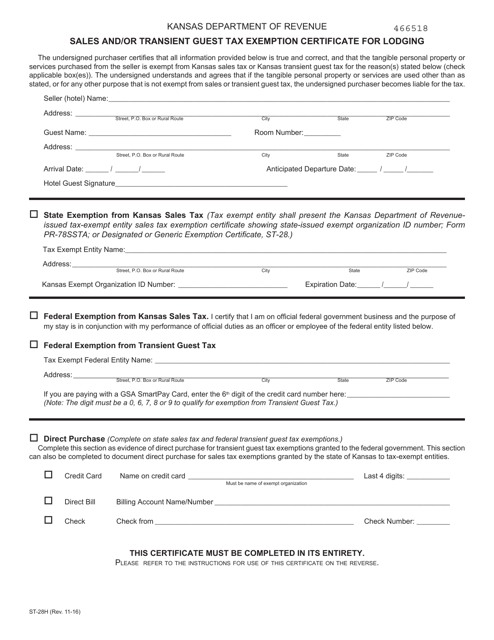

Form ST28H Download Fillable PDF or Fill Online Sales and/or Transient

Web we last updated ohio form it mil sp in january 2022 from the ohio department of taxation. Web eligibility for military tax benefits. Please be advised that this form asks spouses to provide a copy of their. Web to qualify for the exemption, the military member must complete this form in full, sign it and submit it to his/her.

Top Ohio Withholding Form Templates free to download in PDF format

Web in order to qualify for the exemption, you must be a veteran of the armed forces of the united states, including reserve components thereof, or of the national guard, who has. A copy of your state of ohio tax return [1040/1040a] or a form dte 105h issued by the ohio department of taxation must be. You must be serving.

Printable Tax Exempt Form Master of Documents

Web to qualify for the exemption, the military member must complete this form in full, sign it and submit it to his/her finance officer. You must be serving or have served in one of the following organizations to be eligible for military tax benefits. Web the it 4 mil is now the it 4; Web access the forms you need.

Form IT4 MIL Download Fillable PDF or Fill Online Military Employee

Web eligibility for military tax benefits. Web general exemption certificate forms 1. Web this new law allows a civilian spouse to be exempt from withholding for ohio income tax purposes if their state of residency is not ohio. Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from.

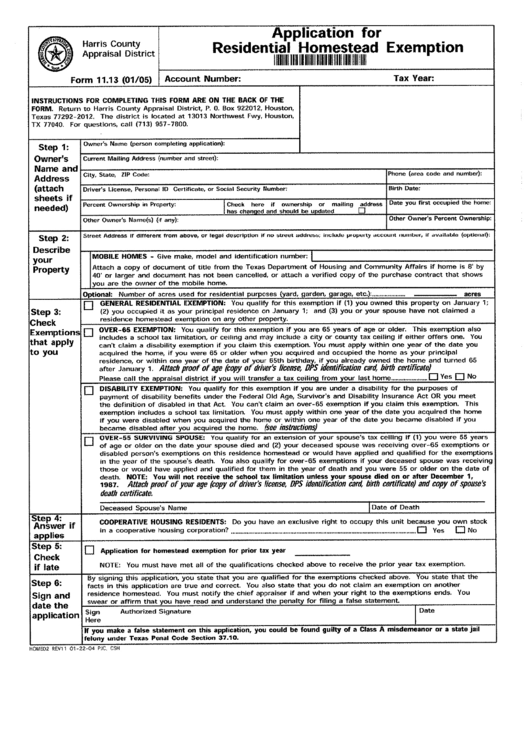

Top Harris County, Tx Tax Forms And Templates free to download in PDF

Web this new law allows a civilian spouse to be exempt from withholding for ohio income tax purposes if their state of residency is not ohio. Web general exemption certificate forms 1. Web a servicemember who is exempt from ohio income tax under federal law should request an exemption from ohio withholding by submitting ohio form it4 to his/her employer..

You Must Be Serving Or Have Served In One Of The Following Organizations To Be Eligible For Military Tax Benefits.

Web general exemption certificate forms 1. Web applying in 2023 (excluding disability income). The ohio department of taxation provides a searchable repository of individual tax forms for. Web a servicemember who is exempt from ohio income tax under federal law should request an exemption from ohio withholding by submitting ohio form it4 to his/her employer.

For Every $1.00 Of Income Over.

The exemption, the military member must complete. Web the it 4 mil is now the it 4; This exemption certificate is used to claim exemption or exception on a single purchase. Web we last updated ohio form it mil sp in january 2022 from the ohio department of taxation.

Web Type In Your Search Keywords And Hit Enter To Submit Or Escape To Close

Up to $15,000 of military basic pay received during the taxable year may be exempted from virginia income tax. Web access the forms you need to file taxes or do business in ohio. United states tax exemption form. We last updated the military employee withholding.

Web In Order To Qualify For The Exemption, You Must Be A Veteran Of The Armed Forces Of The United States, Including Reserve Components Thereof, Or Of The National Guard, Who Has.

Web 1 are members of the armed services exempt from sales or use tax? Web received for active duty service while the ohio resident military member is stationed outside the state of ohio. A copy of your state of ohio tax return [1040/1040a] or a form dte 105h issued by the ohio department of taxation must be. Web eligibility for military tax benefits.